answer all 3 for an upvote

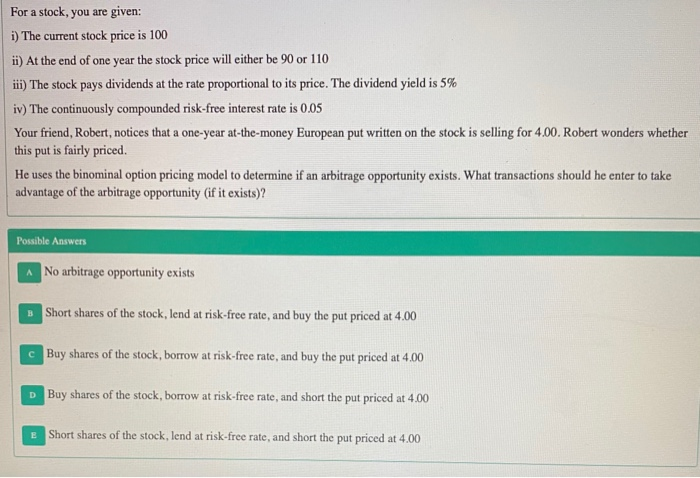

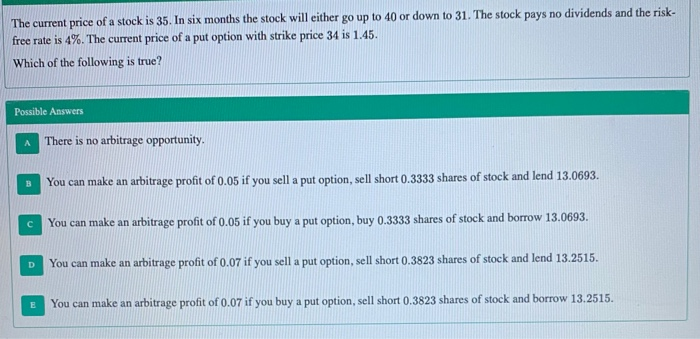

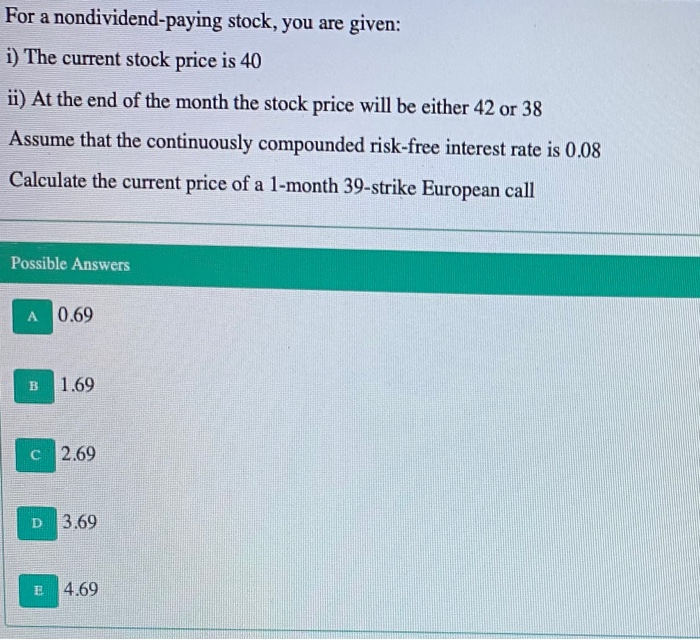

For a stock, you are given: i) The current stock price is 100 ii) At the end of one year the stock price will either be 90 or 110 iii) The stock pays dividends at the rate proportional to its price. The dividend yield is 5% iv) The continuously compounded risk-free interest rate is 0.05 Your friend, Robert, notices that a one-year at-the-money European put written on the stock is selling for 4.00. Robert wonders whether this put is fairly priced. He uses the binominal option pricing model to determine if an arbitrage opportunity exists. What transactions should he enter to take advantage of the arbitrage opportunity (if it exists)? Possible Answers * No arbitrage opportunity exists B Short shares of the stock, lend at risk-free rate, and buy the put priced at 4.00 Buy shares of the stock, borrow at risk-free rate, and buy the put priced at 4.00 D Buy shares of the stock, borrow at risk-free rate, and short the put priced at 4.00 E Short shares of the stock, lend at risk-free rate, and short the put priced at 4.00 The current price of a stock is 35. In six months the stock will either go up to 40 or down to 31. The stock pays no dividends and the risk- free rate is 4%. The current price of a put option with strike price 34 is 1.45. Which of the following is true? Possible Answers There is no arbitrage opportunity. You can make an arbitrage profit of 0.05 if you sell a put option, sell short 0.3333 shares of stock and lend 13.0693. You can make an arbitrage profit of 0.05 if you buy a put option, buy 0.3333 shares of stock and borrow 13.0693. D You can make an arbitrage profit of 0.07 if you sell a put option, sell short 0.3823 shares of stock and lend 13.2515. You can make an arbitrage profit of 0.07 if you buy a put option, sell short 0.3823 shares of stock and borrow 13.2515. For a nondividend-paying stock, you are given: i) The current stock price is 40 ii) At the end of the month the stock price will be either 42 or 38 Assume that the continuously compounded risk-free interest rate is 0.08 Calculate the current price of a 1-month 39-strike European call Possible Answers A 0.69 B 1.69 C 2.69 D 3.69 E 4.69