Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer all 4 for a thumbs up please i added instructions There was an order for a retirement party for 147 dozen vanilla cupcakes with

answer all 4 for a thumbs up please

i added instructions

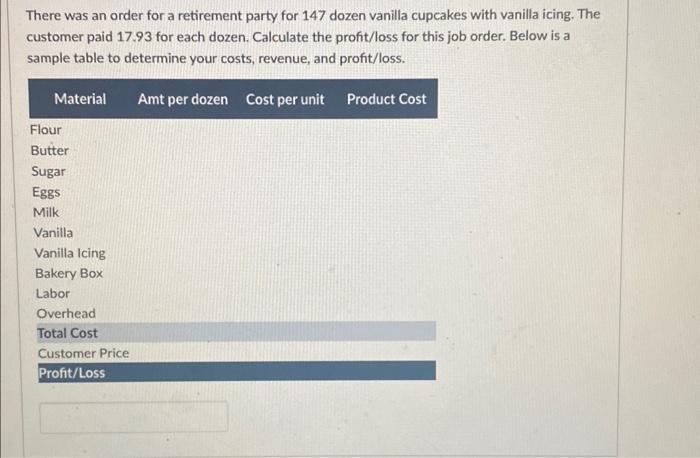

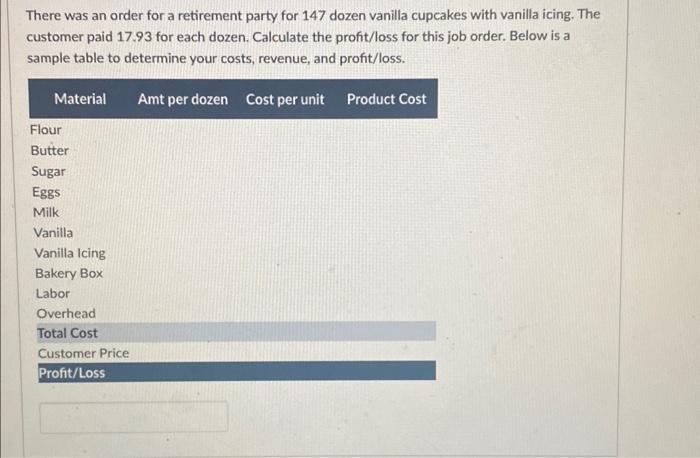

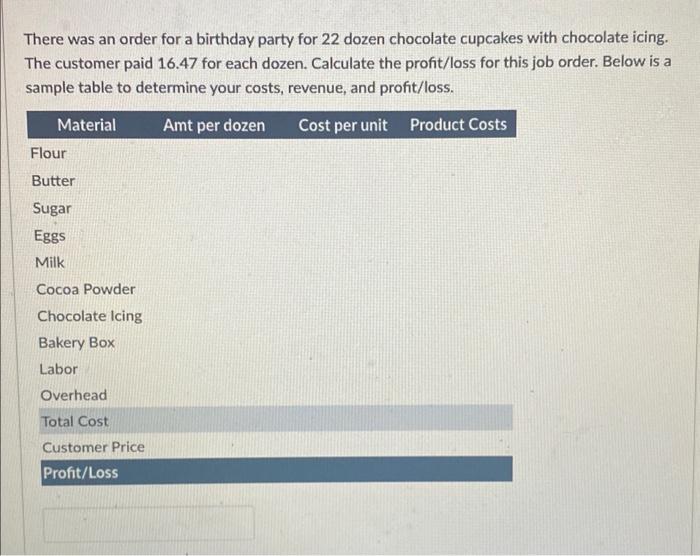

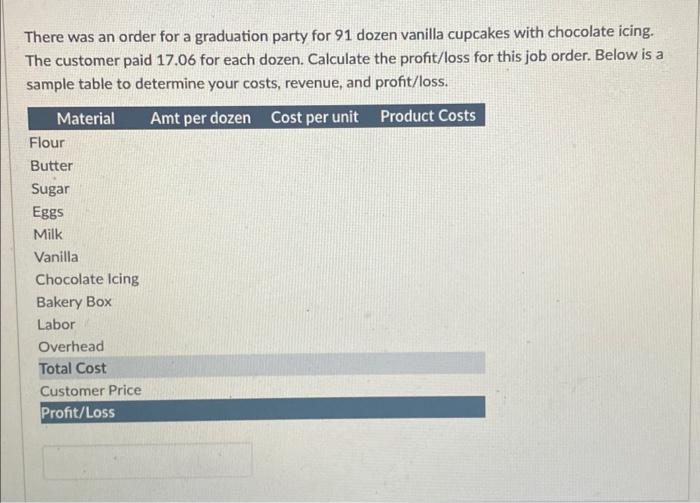

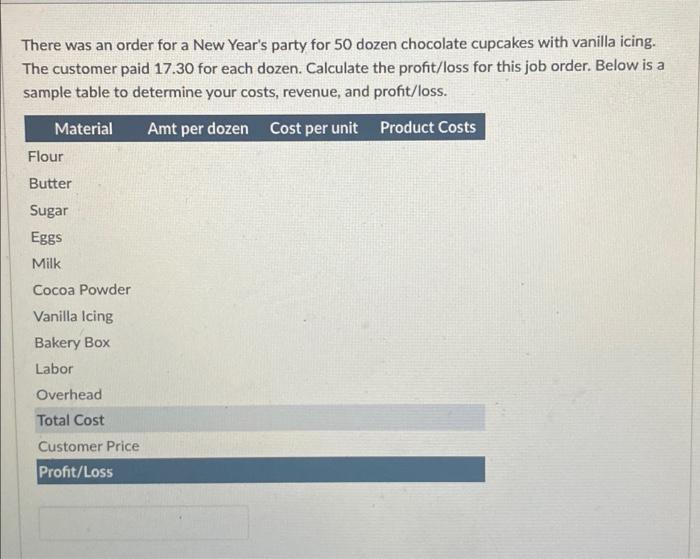

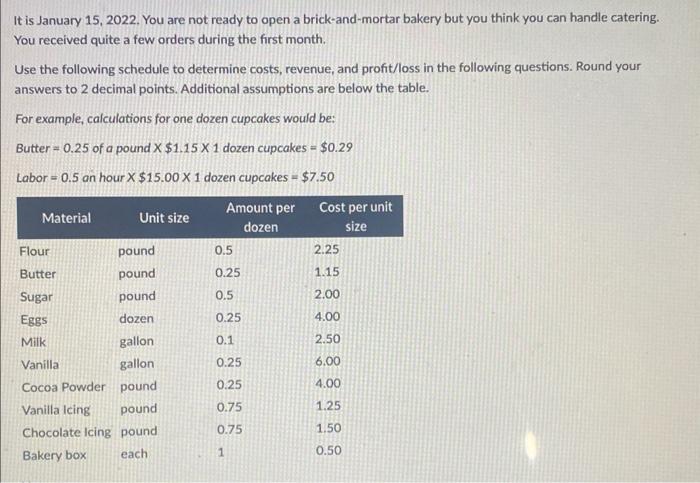

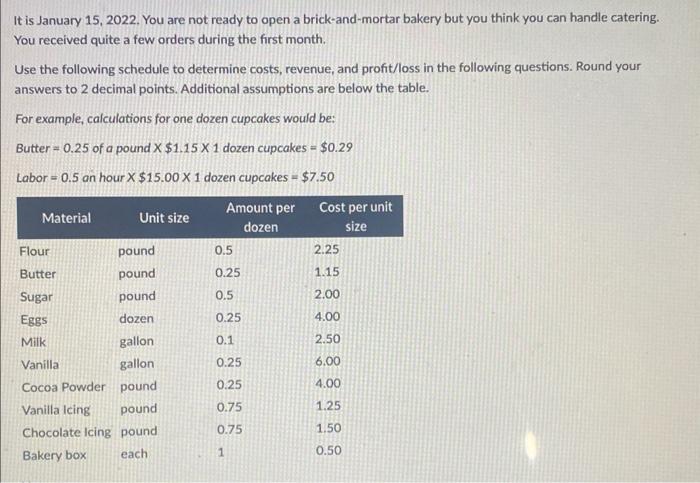

There was an order for a retirement party for 147 dozen vanilla cupcakes with vanilla icing. The customer paid 17.93 for each dozen. Calculate the profit/loss for this job order. Below is a sample table to determine your costs, revenue, and profit/loss. There was an order for a birthday party for 22 dozen chocolate cupcakes with chocolate icing. The customer paid 16.47 for each dozen. Calculate the profit/loss for this job order. Below is a sample table to determine your costs, revenue, and profit/loss. There was an order for a graduation party for 91 dozen vanilla cupcakes with chocolate icing. The customer paid 17.06 for each dozen. Calculate the profit/loss for this job order. Below is a sample table to determine your costs, revenue, and profit/loss. There was an order for a New Year's party for 50 dozen chocolate cupcakes with vanilla icing. The customer paid 17.30 for each dozen. Calculate the profit/loss for this job order. Below is a sample table to determine your costs, revenue, and profit/loss. It is January 15,2022 , You are not ready to open a brick-and-mortar bakery but you think you can handle catering. You received quite a few orders during the first month. Use the following schedule to determine costs, revenue, and profit/loss in the following questions. Round your answers to 2 decimal points. Additional assumptions are below the table. For example, calculations for one dozen cupcakes would be: Butter =0.25 of a pound $1.151 dozen cupcakes =$0.29 Labor =0.5 an hour $15.001 dozen cupcakes =$7.50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started