Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer all 4 questions with explanation please Which of the following is not true? A. In the event of bankruptcy, bondholders are paid before shareholders

answer all 4 questions with explanation please

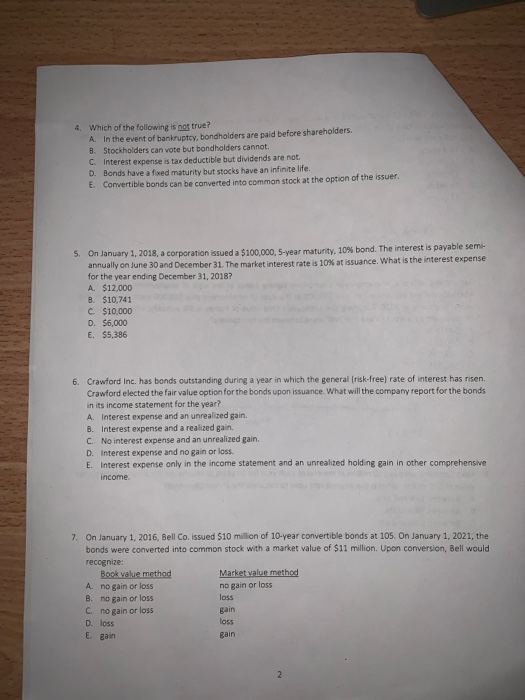

Which of the following is not true? A. In the event of bankruptcy, bondholders are paid before shareholders 8. Stockholders can vote but bondholders cannot C. Interest expense is tax deductible but dividends are not. D. Bonds have a fixed maturity but stocks have an infinite life. E. 4. Convertible bonds can be converted into common stock at the option of the issuer. On January 1, 2018, a corporation issued a $100,000, 5-year maturity, 10% bond. The interest is payable em- annually on June 30 and December 31, The market interest rate is 10% at issuance, what is the nterest expense for the year ending December 31, 2018? A. $12,000 8. $10,741 $10,000 D. $6,000 E, $5,386 5. 6. Crawford Inc. has bonds outstanding during a year in which the general [risk-free) rate of interest has risen. Crawford elected the fair value option for the bonds upon issuance. What will the company report for the bonds in its income statement for the year? A. Interest expense and an unrealized gain. B. Interest expense and a realized gain. C. No interest expense and an unrealized gain. D. Interest expense and no gain or loss. E. Interest expense only in the income statement and an unrealized holding gain in other comprehensive income 7. On January 1, 2016, Bell Co. issued $10 million of 10-year convertible bonds at 105. On January 1, 2021, the bonds were converted into common stock with a market value of $11 million. Upon conversion, Bell would recognize A no gain or loss B. no gain or loss c. no gain or loss D. loss E. gain no gain or loss loss gain oss gain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started