Answered step by step

Verified Expert Solution

Question

1 Approved Answer

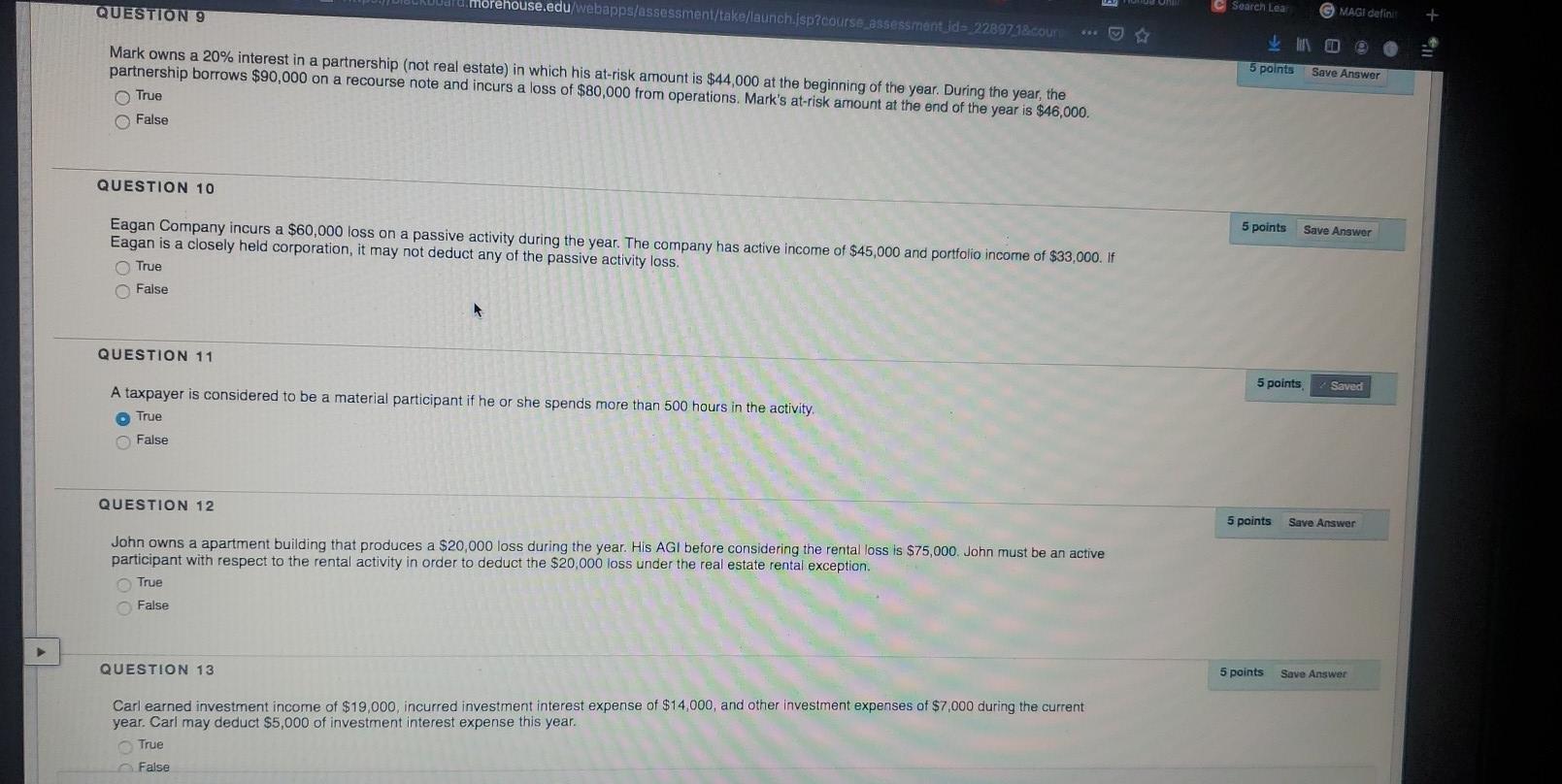

answer all and provide an explanation QUESTION 9 ..morehouse.edu/webapps/assessment/take/launch.jsp?course_assessment_id=2289718.com C Search Lea MAGI cetin 5 points Save Answer Mark owns a 20% interest in a

answer all and provide an explanation

QUESTION 9 ..morehouse.edu/webapps/assessment/take/launch.jsp?course_assessment_id=2289718.com C Search Lea MAGI cetin 5 points Save Answer Mark owns a 20% interest in a partnership (not real estate) in which his at-risk amount is $44,000 at the beginning of the year. During the year, the partnership borrows $90,000 on a recourse note and incurs a loss of $80,000 from operations. Mark's at-risk amount at the end of the year is $46,000. True False QUESTION 10 5 points Save Answer Eagan Company incurs a $60,000 loss on a passive activity during the year. The company has active income of $45,000 and portfolio income of $33,000. If Eagan is a closely held corporation, it may not deduct any of the passive activity loss. True False QUESTION 11 5 points Saved A taxpayer is considered to be a material participant if he or she spends more than 500 hours in the activity True False QUESTION 12 5 points Save Answer John owns a apartment building that produces a $20,000 loss during the year. His AGI before considering the rental loss is $75,000. John must be an active participant with respect to the rental activity in order to deduct the $20,000 loss under the real estate rental exception. True False QUESTION 13 5 points Save Answer Carl earned investment income of $19,000, incurred investment interest expense of $14,000, and other investment expenses of $7,000 during the current year. Carl may deduct $5,000 of investment interest expense this year. True False QUESTION 9 ..morehouse.edu/webapps/assessment/take/launch.jsp?course_assessment_id=2289718.com C Search Lea MAGI cetin 5 points Save Answer Mark owns a 20% interest in a partnership (not real estate) in which his at-risk amount is $44,000 at the beginning of the year. During the year, the partnership borrows $90,000 on a recourse note and incurs a loss of $80,000 from operations. Mark's at-risk amount at the end of the year is $46,000. True False QUESTION 10 5 points Save Answer Eagan Company incurs a $60,000 loss on a passive activity during the year. The company has active income of $45,000 and portfolio income of $33,000. If Eagan is a closely held corporation, it may not deduct any of the passive activity loss. True False QUESTION 11 5 points Saved A taxpayer is considered to be a material participant if he or she spends more than 500 hours in the activity True False QUESTION 12 5 points Save Answer John owns a apartment building that produces a $20,000 loss during the year. His AGI before considering the rental loss is $75,000. John must be an active participant with respect to the rental activity in order to deduct the $20,000 loss under the real estate rental exception. True False QUESTION 13 5 points Save Answer Carl earned investment income of $19,000, incurred investment interest expense of $14,000, and other investment expenses of $7,000 during the current year. Carl may deduct $5,000 of investment interest expense this year. True FalseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started