Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer ALL and receive a like! Suppose a local government votes to impose an excise tax of $1.10 per bottle on the sales of bottled

Answer ALL and receive a like!

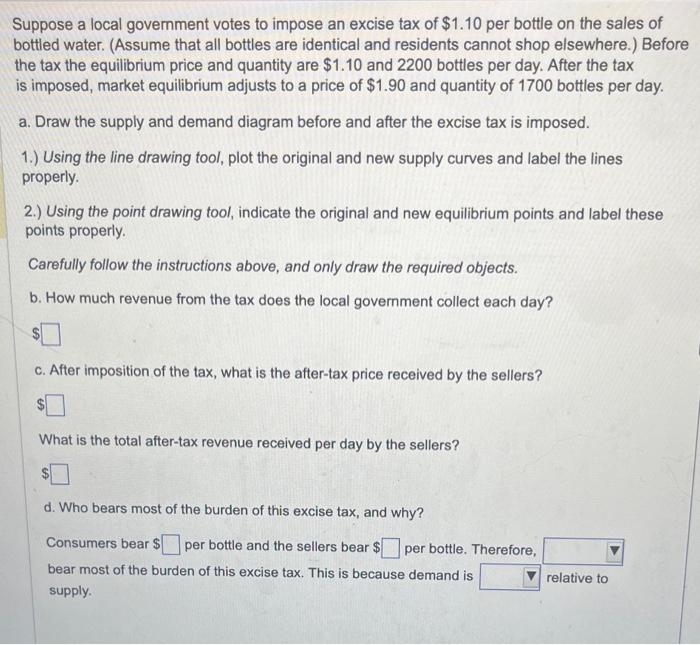

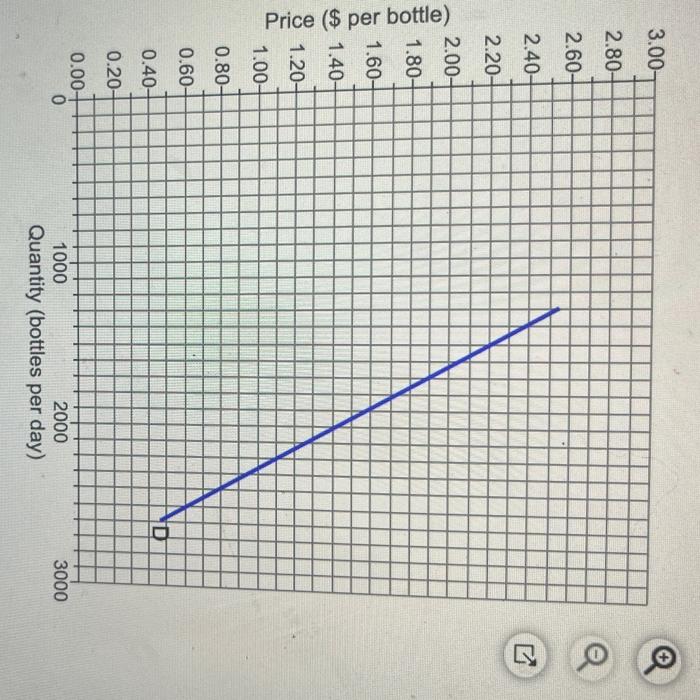

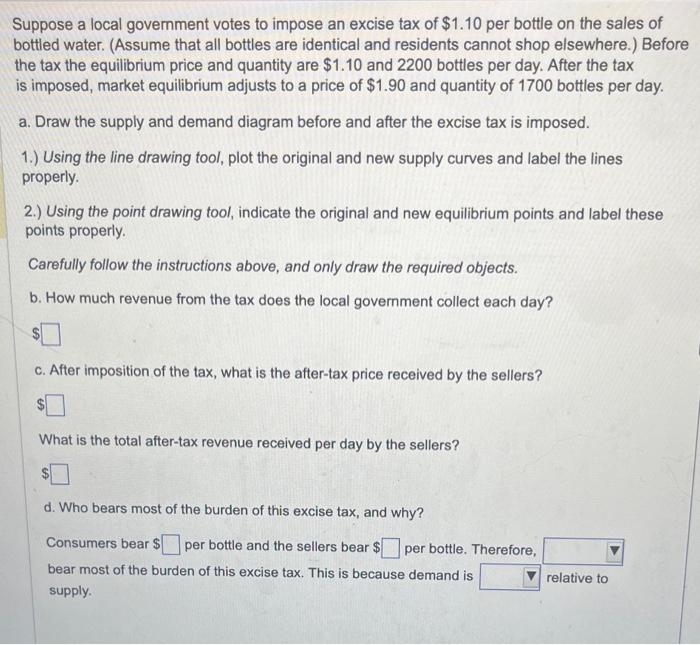

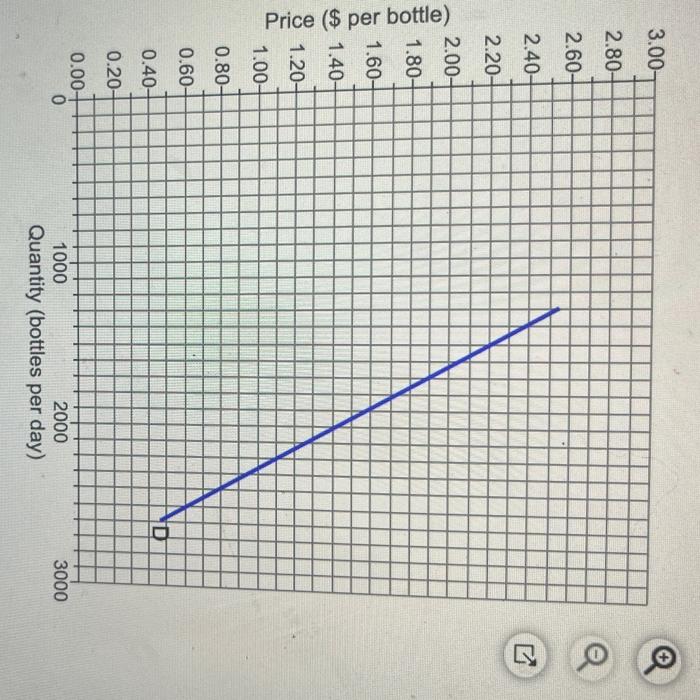

Suppose a local government votes to impose an excise tax of $1.10 per bottle on the sales of bottled water. (Assume that all bottles are identical and residents cannot shop elsewhere.) Before the tax the equilibrium price and quantity are $1.10 and 2200 bottles per day. After the tax is imposed, market equilibrium adjusts to a price of $1.90 and quantity of 1700 bottles per day. a. Draw the supply and demand diagram before and after the excise tax is imposed. 1.) Using the line drawing tool, plot the original and new supply curves and label the lines properly. 2.) Using the point drawing tool, indicate the original and new equilibrium points and label these points properly. Carefully follow the instructions above, and only draw the required objects. b. How much revenue from the tax does the local government collect each day? c. After imposition of the tax, what is the after-tax price received by the sellers? What is the total after-tax revenue received per day by the sellers? d. Who bears most of the burden of this excise tax, and why? Consumers bear $ per bottle and the sellers bear $ per bottle. Therefore, bear most of the burden of this excise tax. This is because demand is relative to supply. Price (\$ per bottle)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started