Answered step by step

Verified Expert Solution

Question

1 Approved Answer

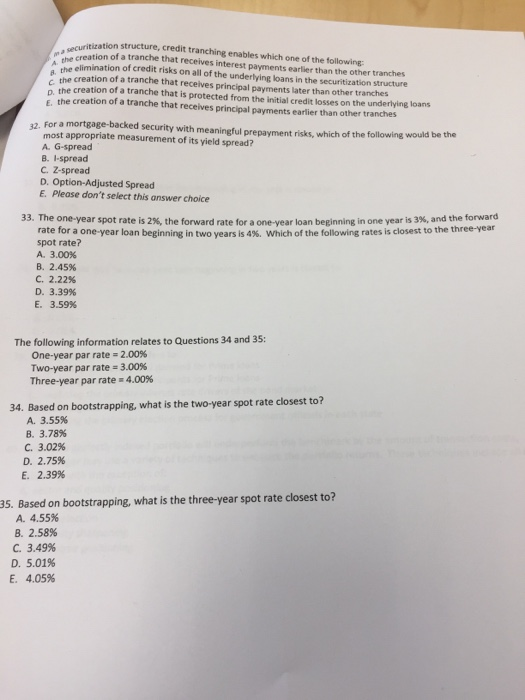

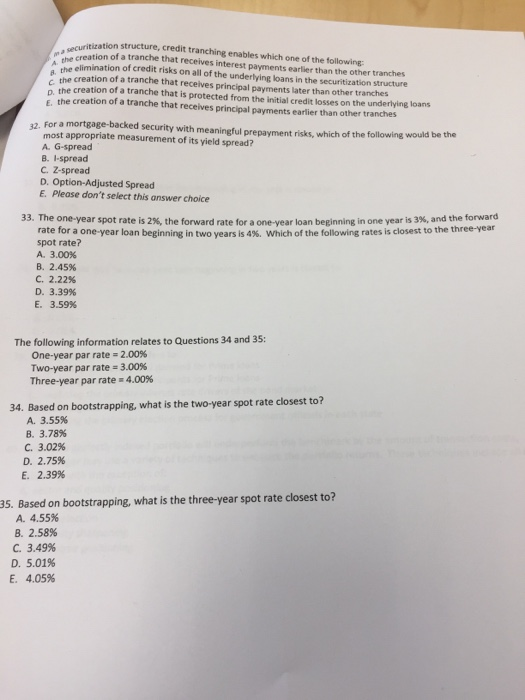

answer all ation structure, credit tranching enables which one of the following: n of a tranche that receives interest payments earlier than the other tranches

answer all

ation structure, credit tranching enables which one of the following: n of a tranche that receives interest payments earlier than the other tranches tion of credit risks on all of the underlying loans in the securitization 8. the elimina the creation of a tranche that receives principal payments later than other tranches receives structure o. the creation of a tranche that is protected from the initial credit losses on the underlying loans E. the creation of a tranche that receives principal payments earlier than other tranches for a mortgage-backed security with meaningful prepayment risks, which of the following would be most appropriate measurement of its yield spread? A. G-spread B. I-spread C. Z-spread D. Option-Adjusted Spread E. Please don't select this answer choice 32. the 33 The one-year spot rate is 2%, the forward rate for a one-year loan beginning in one year is 3%, and the forward rate for a one-year loan beginning in two years is 4%, spot rate? A. 3.00% B. 2.45% C. 2.22% Which of the following rates is closest to the three-year D. 3.39% E. 3.59% The following information relates to Questions 34 and 35: One-year par rate-2.00% Two-year par rate-3.00% Three-year par rate-4.00% 34. Based on bootstrapping, what is the two-year spot rate closest to? A. 3.55% B. 3.78% . 3.02% D. 2.75% E. 2.39% 35. Based on bootstrapping, what is the three-year spot rate closest to? A. 4.55% B. 2.58% C. 3.49% D. 5.01% E. 4.05% ation structure, credit tranching enables which one of the following: n of a tranche that receives interest payments earlier than the other tranches tion of credit risks on all of the underlying loans in the securitization 8. the elimina the creation of a tranche that receives principal payments later than other tranches receives structure o. the creation of a tranche that is protected from the initial credit losses on the underlying loans E. the creation of a tranche that receives principal payments earlier than other tranches for a mortgage-backed security with meaningful prepayment risks, which of the following would be most appropriate measurement of its yield spread? A. G-spread B. I-spread C. Z-spread D. Option-Adjusted Spread E. Please don't select this answer choice 32. the 33 The one-year spot rate is 2%, the forward rate for a one-year loan beginning in one year is 3%, and the forward rate for a one-year loan beginning in two years is 4%, spot rate? A. 3.00% B. 2.45% C. 2.22% Which of the following rates is closest to the three-year D. 3.39% E. 3.59% The following information relates to Questions 34 and 35: One-year par rate-2.00% Two-year par rate-3.00% Three-year par rate-4.00% 34. Based on bootstrapping, what is the two-year spot rate closest to? A. 3.55% B. 3.78% . 3.02% D. 2.75% E. 2.39% 35. Based on bootstrapping, what is the three-year spot rate closest to? A. 4.55% B. 2.58% C. 3.49% D. 5.01% E. 4.05%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started