Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ANSWER ALL FILL IN THE BLANKS & THE MULTIPLE CHOICE Q. TIA 4. Analysis of a replacement project Aa Aa At times firms will need

ANSWER ALL FILL IN THE BLANKS & THE MULTIPLE CHOICE Q. TIA

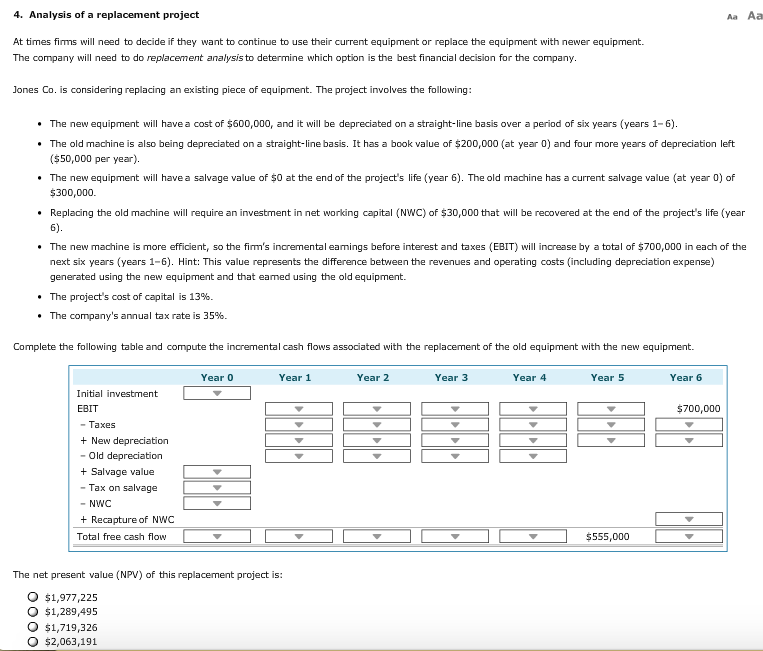

4. Analysis of a replacement project Aa Aa At times firms will need to decide if they want to continue to use their current equipment or replace the equipment with newer equipment. The company will need to do replacement analysis to determine which option is the best financial decision for the company Jones Co. is considering replacing an existing piece of equipment. The project involves the following The new equipment will have a cost of $600,000, and it will be depreciated on a straight-line basis over a period of six years (years 1-6) . The old machine is also being depreciated on a straight-line basis. It has a book value of $200,000 (at year 0) and four more years of depreciation left ($50,000 per year). The new equipment will have a salvage value of $0 at the end of the project's life (year 6). The old machine has a current salvage value (at year 0) of $300,000 . Replacing the old machine wil require an investment in net working capital (NWC) of $30,000 that will be recovered at the end of the project's life (year The new machine is more efficient, so the firm's incremental eamings before interest and taxes (EBIT) will increase by a total of $700,000 in each ofthe next six years (years 1-6). Hint: This value represents the difference between the revenues and operating costs (including depreciation expense) generated using the new equipment and that eamed using the old equipment. The project's cost of capital is 13%. The company's annual tax rate is 35%. * * Complete the following table and compute the incremental cash flows associated with the replacement of the old equipment with the new equipment. Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Initial investment EBIT $700,000 axes + New depreciation + Salvage value - Tax on salvage - NWC + Recapture of NWC Total free cash flow $555,000 The net present value (NPV) of this replacement project is $1,977,225 O $1,289,495 o $1,719,326 O $2,063,191

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started