Question: ANSWER ALL FOR THUMBS IF ONLY ONE IS ANSWERED I WILL GIVE THUMBS DOWN 1.1 1.2 1.3 (Yield to maturity) Fitzgerald's 15-year bonds pay 11

ANSWER ALL FOR THUMBS

IF ONLY ONE IS ANSWERED I WILL GIVE THUMBS DOWN

1.1

1.2

1.3

1.3

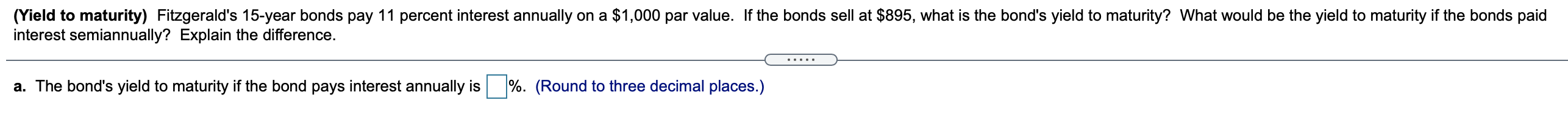

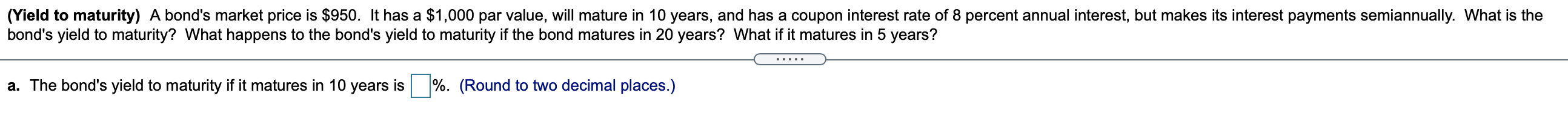

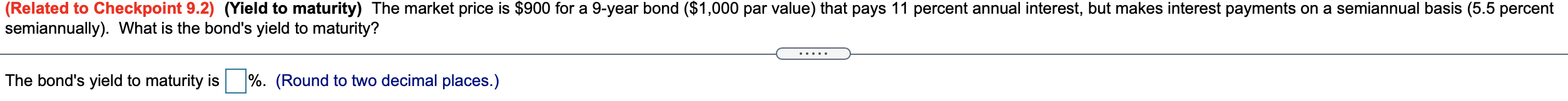

(Yield to maturity) Fitzgerald's 15-year bonds pay 11 percent interest annually on a $1,000 par value. If the bonds sell at $895, what is the bond's yield to maturity? What would be the yield to maturity if the bonds paid interest semiannually? Explain the difference. a. The bond's yield to maturity if the bond pays interest annually is %. (Round to three decimal places.) (Yield to maturity) A bond's market price is $950. It has a $1,000 par value, will mature in 10 years, and has a coupon interest rate of 8 percent annual interest, but makes its interest payments semiannually. What is the bond's yield to maturity? What happens to the bond's yield to maturity if the bond matures in 20 years? What if it matures in 5 years? a. The bond's yield to maturity if it matures in 10 years is %. (Round to two decimal places.) (Related to Checkpoint 9.2) (Yield to maturity) The market price is $900 for a 9-year bond ($1,000 par value) that pays 11 percent annual interest, but makes interest payments on a semiannual basis (5.5 percent semiannually). What is the bond's yield to maturity? The bond's yield to maturity is %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts