ANSWER ALL FULLY OR DONT ANSWER AT ALL

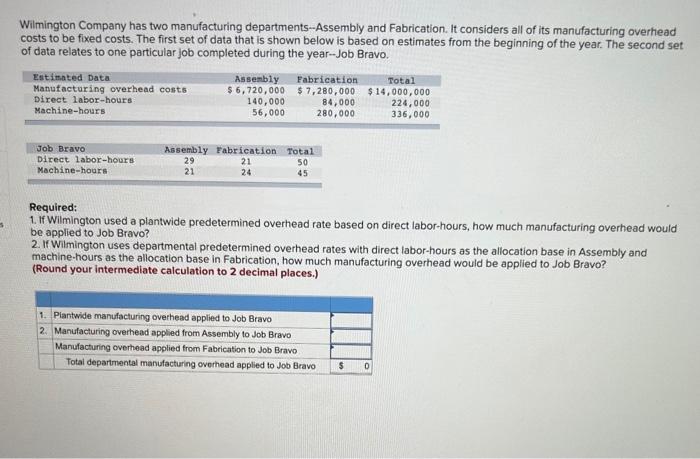

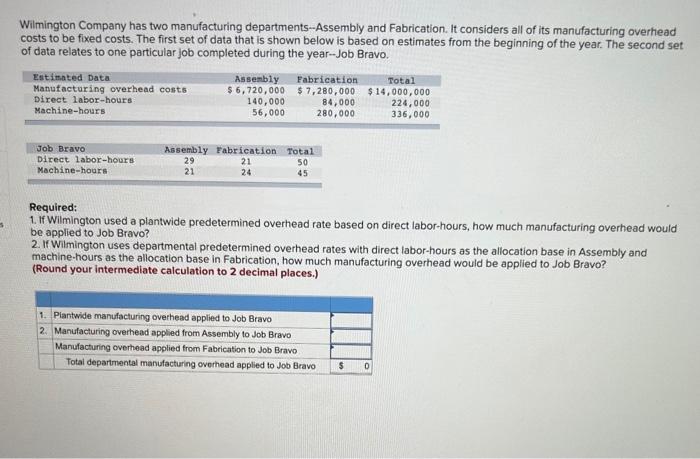

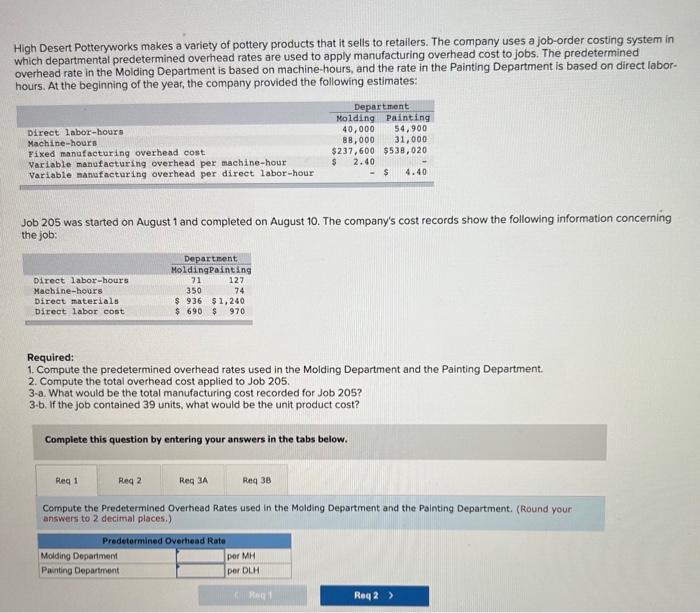

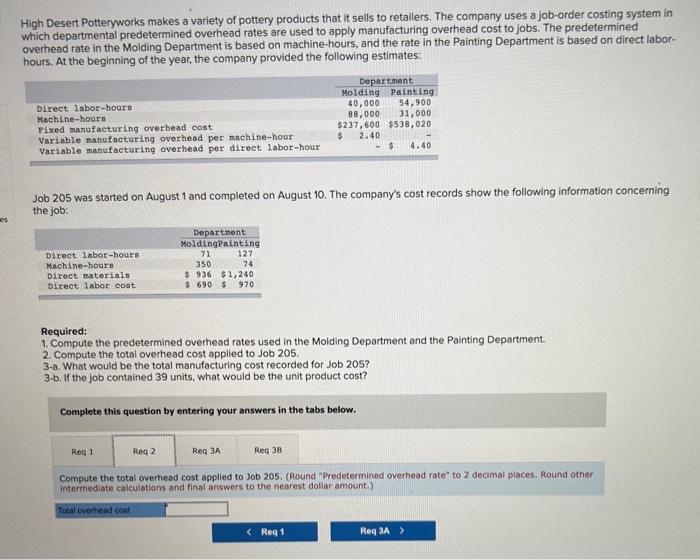

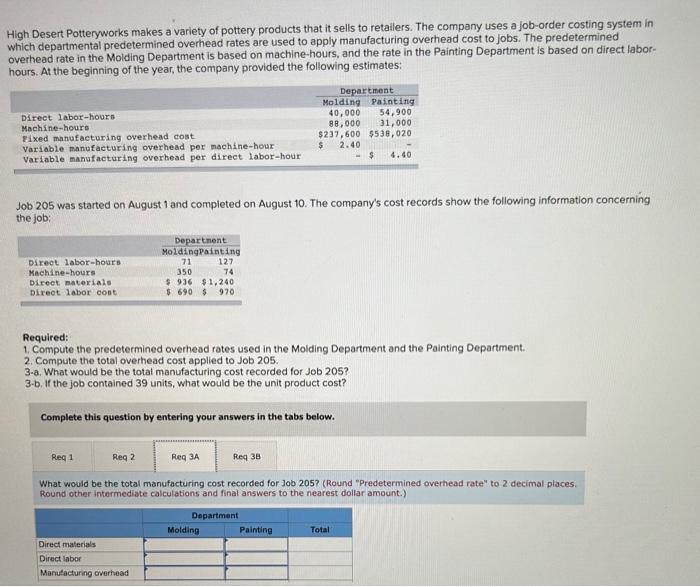

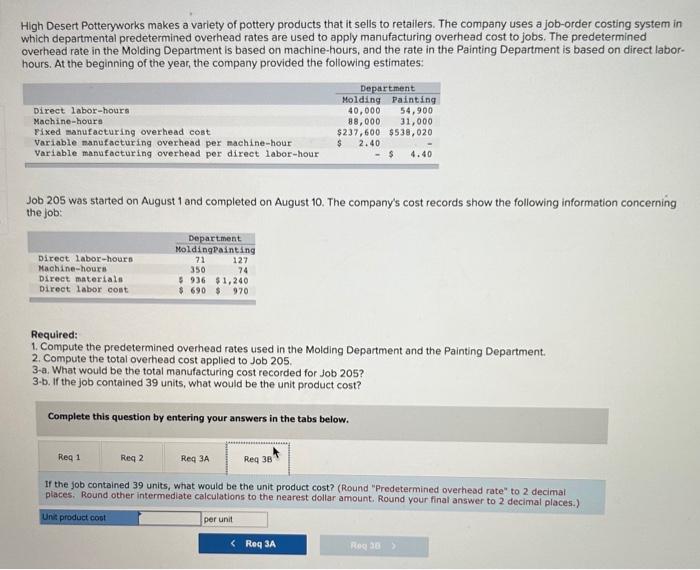

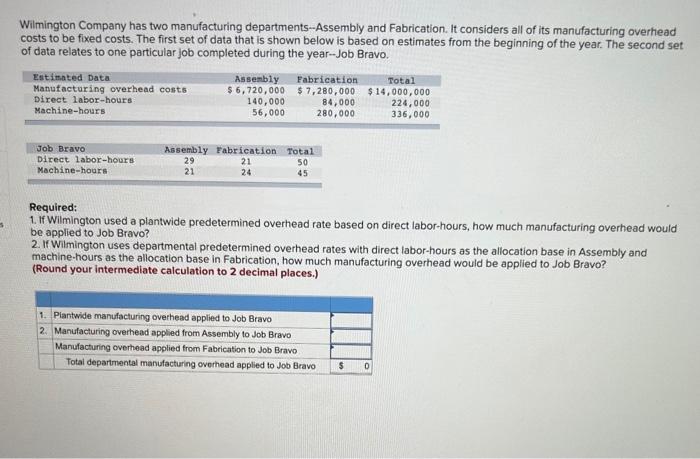

Wilmington Company has two manufacturing departments-Assembly and Fabrication. It considers all of its manufacturing overhead costs to be fixed costs. The first set of data that is shown below is based on estimates from the beginning of the year. The second set of data relates to one particular job completed during the year-Job Bravo. Required: 1. If Wilmington used a plantwide predetermined overhead rate based on direct labor-hours, how much manufacturing overhead would be applied to Job Bravo? 2. If Wilmington uses departmental predetermined overhead rates with direct labor-hours as the allocation base in Assembly and machine-hours as the allocation base in Fabrication, how much manufacturing overhead would be applied to Job Bravo? (Round your intermediate calculation to 2 decimal places.) High Desert Potteryworks makes a variety of pottery products that it sells to retallers. The company uses a job-order costing system in which departmental predetermined overhead rates are used to apply manufacturing overhead cost to jobs. The predetermined overhead rate in the Molding Department is based on machine-hours, and the rate in the Painting Department is based on direct laborhours. At the beginning of the year, the company provided the following estimates: Job 205 was started on August 1 and completed on August 10. The company's cost records show the following information concerning the job: Required: 1. Compute the predetermined overhead rates used in the Molding Department and the Painting Department. 2. Compute the total overhead cost applied to Job 205. 3-a. What would be the total manufacturing cost recorded for Job 205? 3-b. If the job contained 39 units, what would be the unit product cost? Complete this question by entering your answers in the tabs below. Compute the Predetermined Overhead Rates used in the Molding Department and the Painting Department. (Round your answers to 2 decimal places.) High Desert Potteryworks makes a variety of pottery products that it sells to retailers. The company uses a job-order costing system in which departmental predetermined overhead rates are used to apply manufacturing overhead cost to jobs. The predetermined overhead rate in the Molding Department is based on machine-hours, and the rate in the Painting Department is based on direct laborhours. At the beginning of the year, the company provided the following estimates: Job 205 was started on August 1 and completed on August 10. The company's cost records show the following information concerning the job: Required: 1. Compute the predetermined overhead rates used in the Molding Department and the Painting Department. 2. Compute the total overhead cost applied to Job 205. 3-a. What would be the total manufacturing cost recorded for Job 205? 3-b. If the job contained 39 units, what would be the unit product cost? Complete this question by entering your answers in the tabs below. Compute the total overhead cost applied to Job 205. (Round "Predetermined overhead rate" to 2 decimal places. Round other intermediate calculations and final answers to the nearest dollar amount.) High Desert Potteryworks makes a variety of pottery products that it sells to retailers. The company uses a job-order costing system in which departmental predetermined overhead rates are used to apply manufacturing overhead cost to jobs. The predetermined overhead rate in the Molding Department is based on machine-hours, and the rate in the Painting Department is based on direct laborhours. At the beginning of the year, the company provided the following estimates: Job 205 was started on August 1 and completed on August 10. The company's cost records show the following information concerning the job: Required: 1. Compute the predetermined overhead rates used in the Molding Department and the Painting Department. 2. Compute the total overhead cost applied to Job 205. 3-a. What would be the total manufacturing cost recorded for Job 205? 3-b. If the job contained 39 units, what would be the unit product cost? Complete this question by entering your answers in the tabs below. What would be the total manufacturing cost recorded for Job 205 ? (Round "Predetermined overhead rate" to 2 decimal places. Round other intermediate calculations and final answers to the nearest dollar amount.) High Desert Potteryworks makes a variety of pottery products that it sells to retailers. The company uses a job-order costing system in which departmental predetermined overhead rates are used to apply manufacturing overhead cost to jobs. The predetermined overhead rate in the Molding Department is based on machine-hours, and the rate in the Painting Department is based on direct laborhours. At the beginning of the year, the company provided the following estimates: Job 205 was started on August 1 and completed on August 10. The company's cost records show the following information concerning the job: Required: 1. Compute the predetermined overhead rates used in the Molding Department and the Painting Department. 2. Compute the total overhead cost applied to Job 205. 3-a. What would be the total manufacturing cost recorded for Job 205? 3-b. If the job contained 39 units, what would be the unit product cost? Complete this question by entering your answers in the tabs below. If the job contained 39 units, what would be the unit product cost? (Round "Predetermined overhead rate" to 2 decimal places. Round other intermediate calculations to the nearest dollar amount. Round your final answer to 2 decimal places.)