Answer all in Excel.

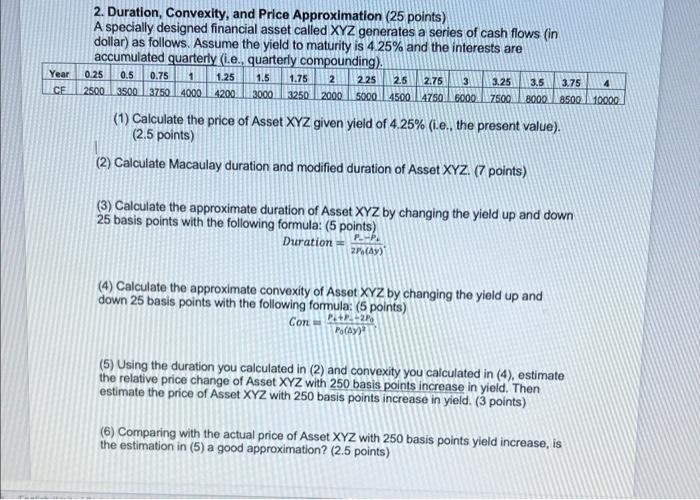

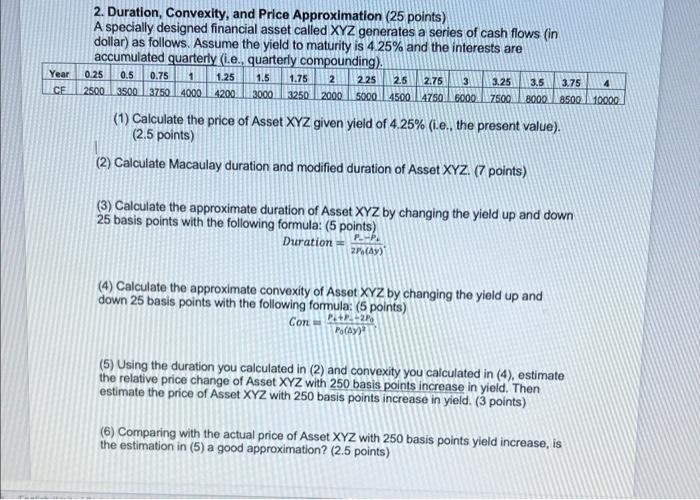

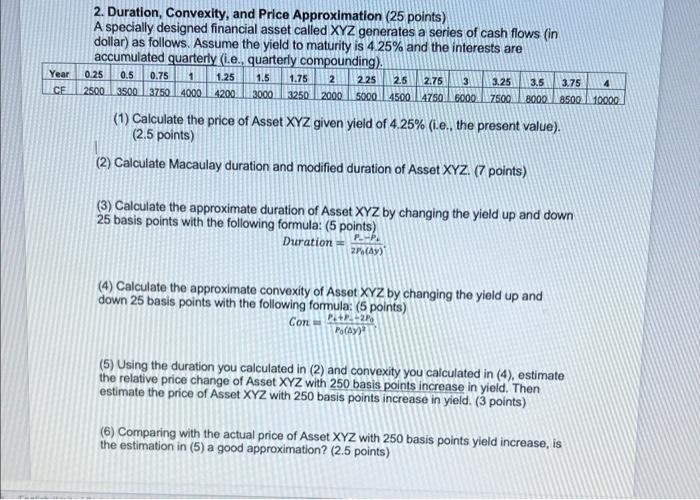

2. Duration, Convexity, and Price Approximation (25 points) A specially designed financial asset called XYZ generates a series of cash flows (in dollar) as follows. Assume the yield to maturity is 4.25% and the interests are accumulated quarterly (i.e., quarterly compoundina). (1) Calculate the price of Asset XYZ given yield of 4.25% (i.e., the present value). ( 2.5 points) (2) Calculate Macaulay duration and modified duration of Asset XYZ. (7 points) (3) Calculate the approximate duration of Asset XYZ by changing the yield up and down 25 basis points with the following formula: ( 5 points) Duration=2p0(y)re (4) Calculate the approximate convexity of Asset XYZ by changing the yield up and down 25 basis points with the following formula: ( 5 points) Con=p0(y)2p0+p22p0 (5) Using the duration you calculated in (2) and convexity you calculated in (4), estimate the relative price change of Asset XYZ with 250 basis points increase in yield. Then estimate the price of Asset XYZ with 250 basis points increase in yield. (3 points) (6) Comparing with the actual price of Asset XYZ with 250 basis points yield increase, is the estimation in (5) a good approximation? (2.5 points) 2. Duration, Convexity, and Price Approximation (25 points) A specially designed financial asset called XYZ generates a series of cash flows (in dollar) as follows. Assume the yield to maturity is 4.25% and the interests are accumulated quarterly (i.e., quarterly compoundina). (1) Calculate the price of Asset XYZ given yield of 4.25% (i.e., the present value). ( 2.5 points) (2) Calculate Macaulay duration and modified duration of Asset XYZ. (7 points) (3) Calculate the approximate duration of Asset XYZ by changing the yield up and down 25 basis points with the following formula: ( 5 points) Duration=2p0(y)re (4) Calculate the approximate convexity of Asset XYZ by changing the yield up and down 25 basis points with the following formula: ( 5 points) Con=p0(y)2p0+p22p0 (5) Using the duration you calculated in (2) and convexity you calculated in (4), estimate the relative price change of Asset XYZ with 250 basis points increase in yield. Then estimate the price of Asset XYZ with 250 basis points increase in yield. (3 points) (6) Comparing with the actual price of Asset XYZ with 250 basis points yield increase, is the estimation in (5) a good approximation? (2.5 points)