Answered step by step

Verified Expert Solution

Question

1 Approved Answer

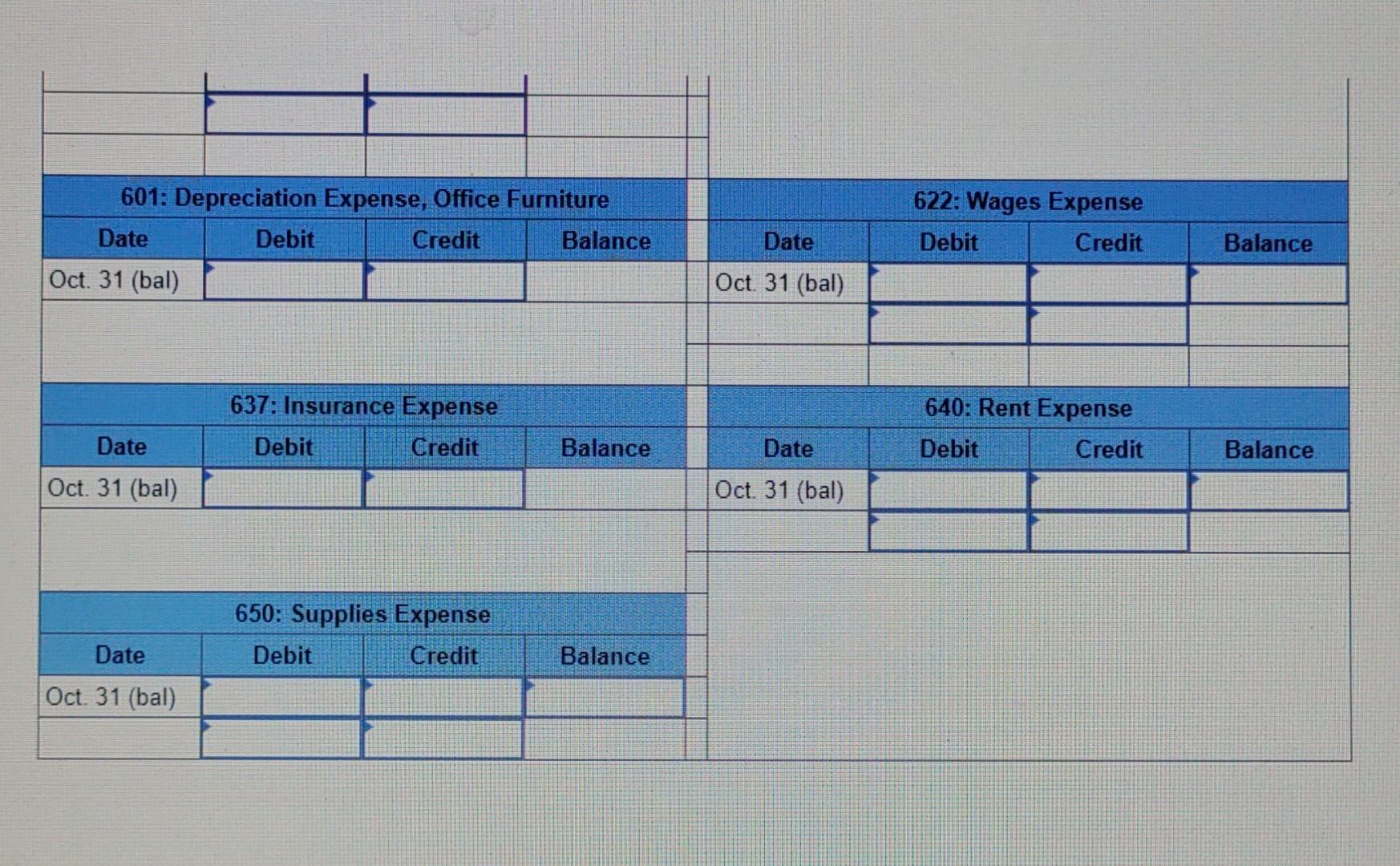

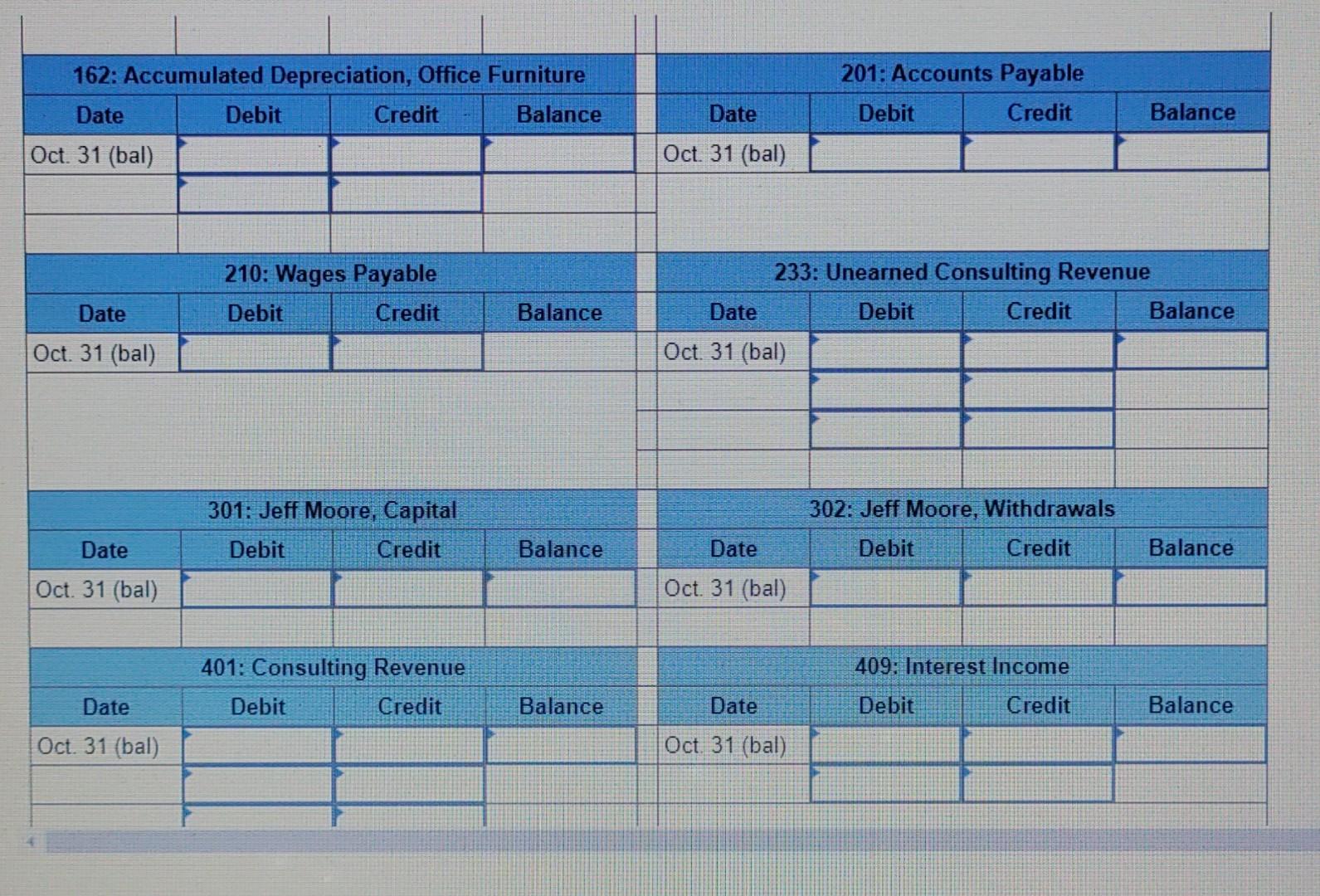

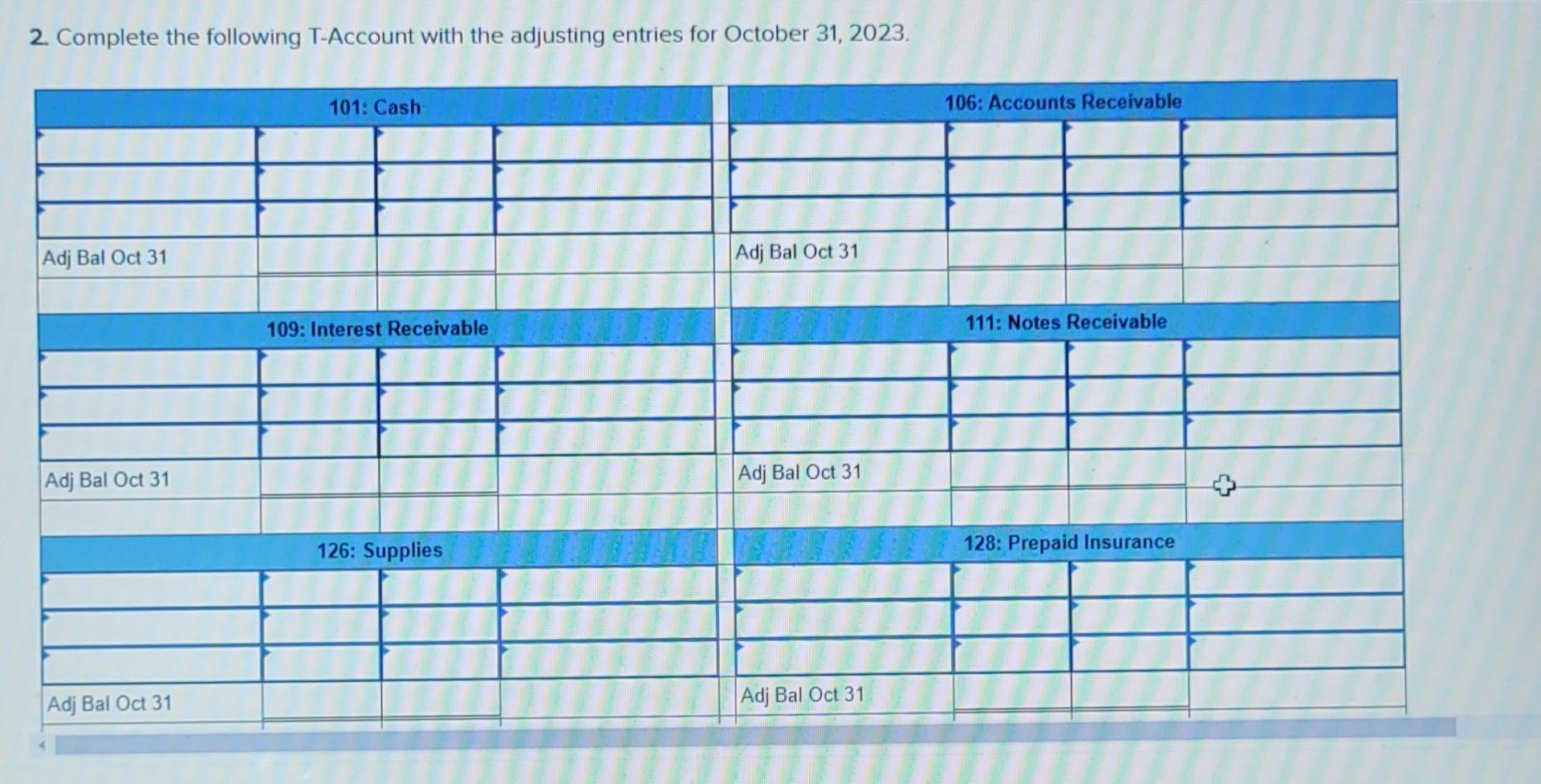

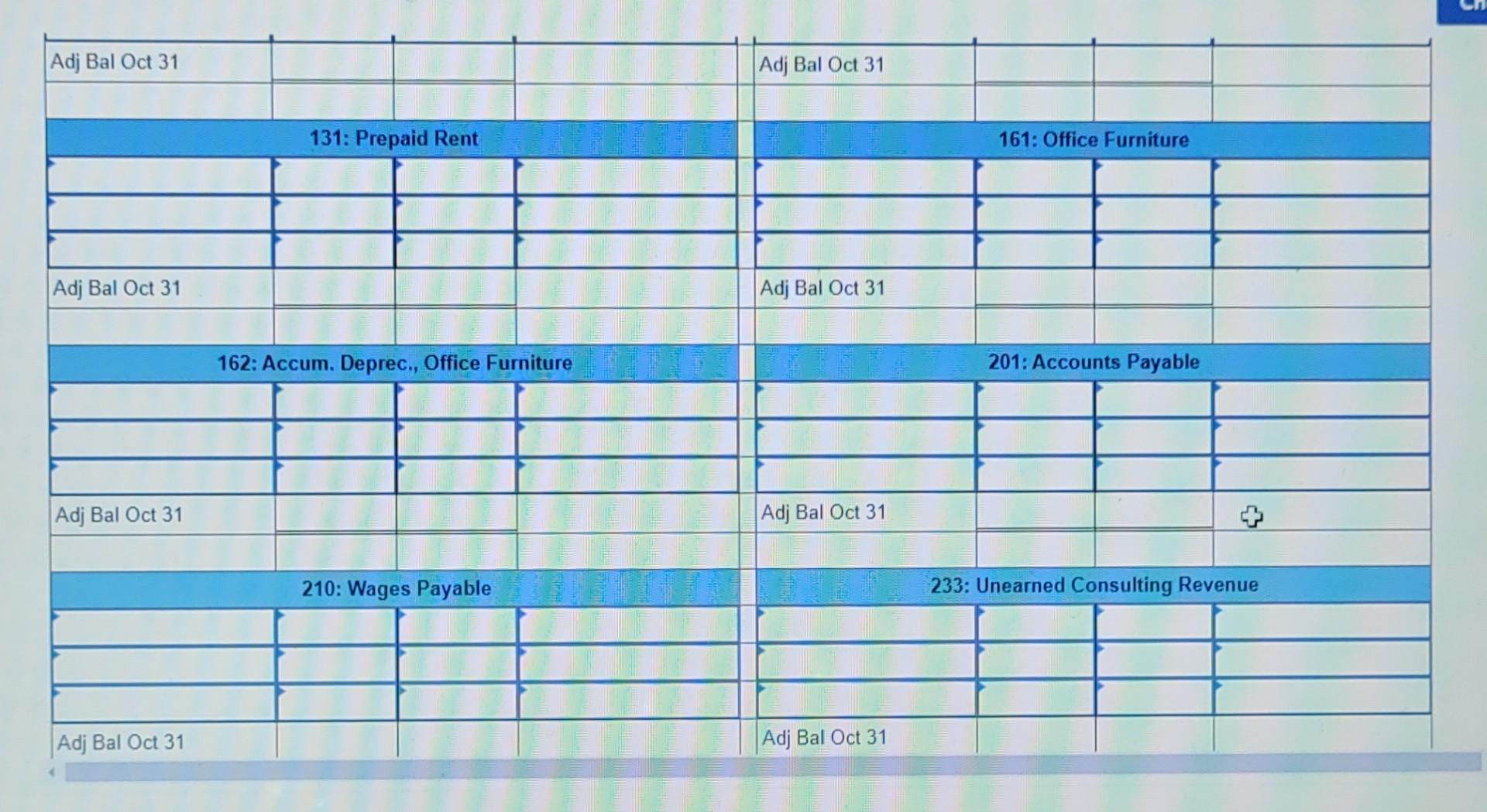

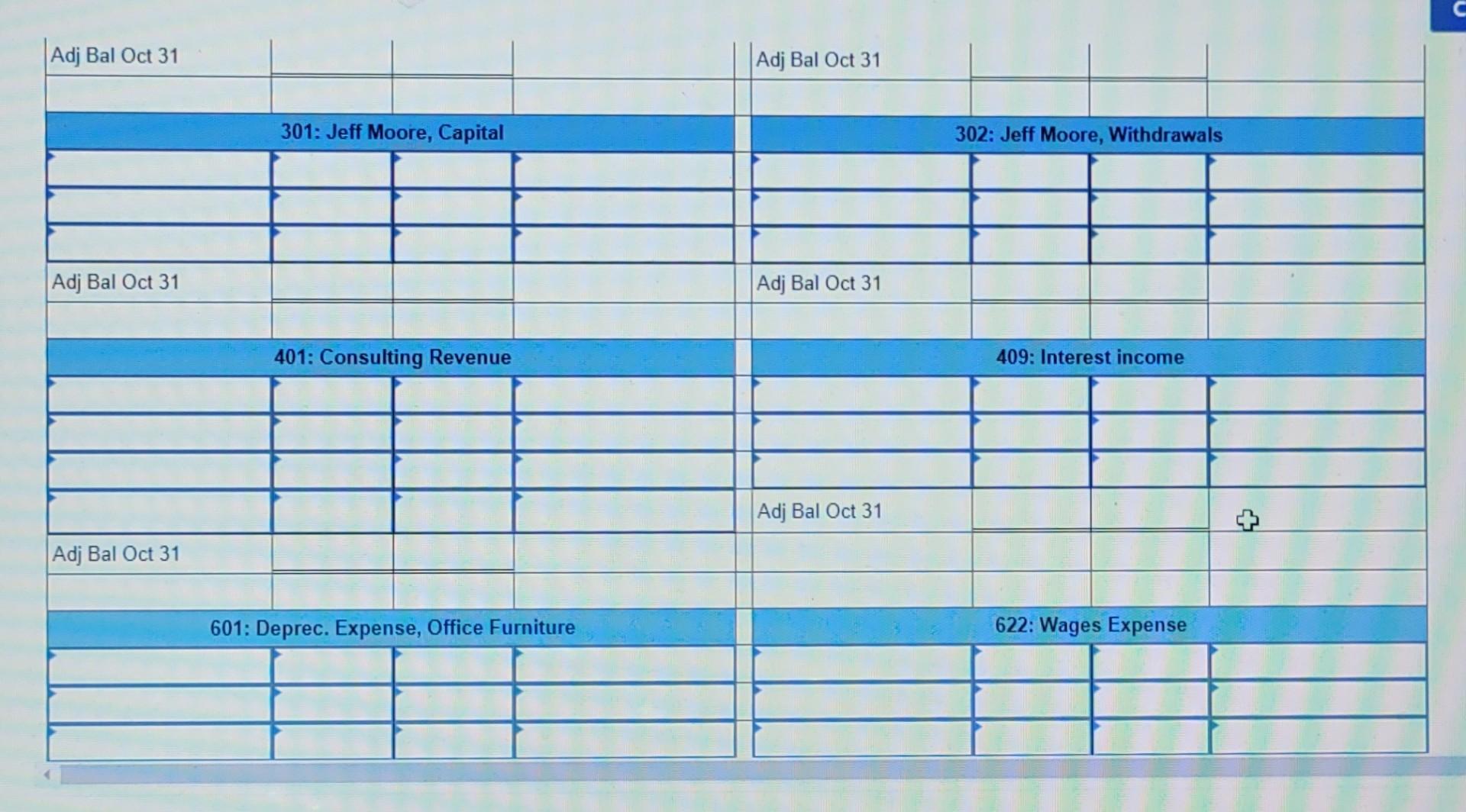

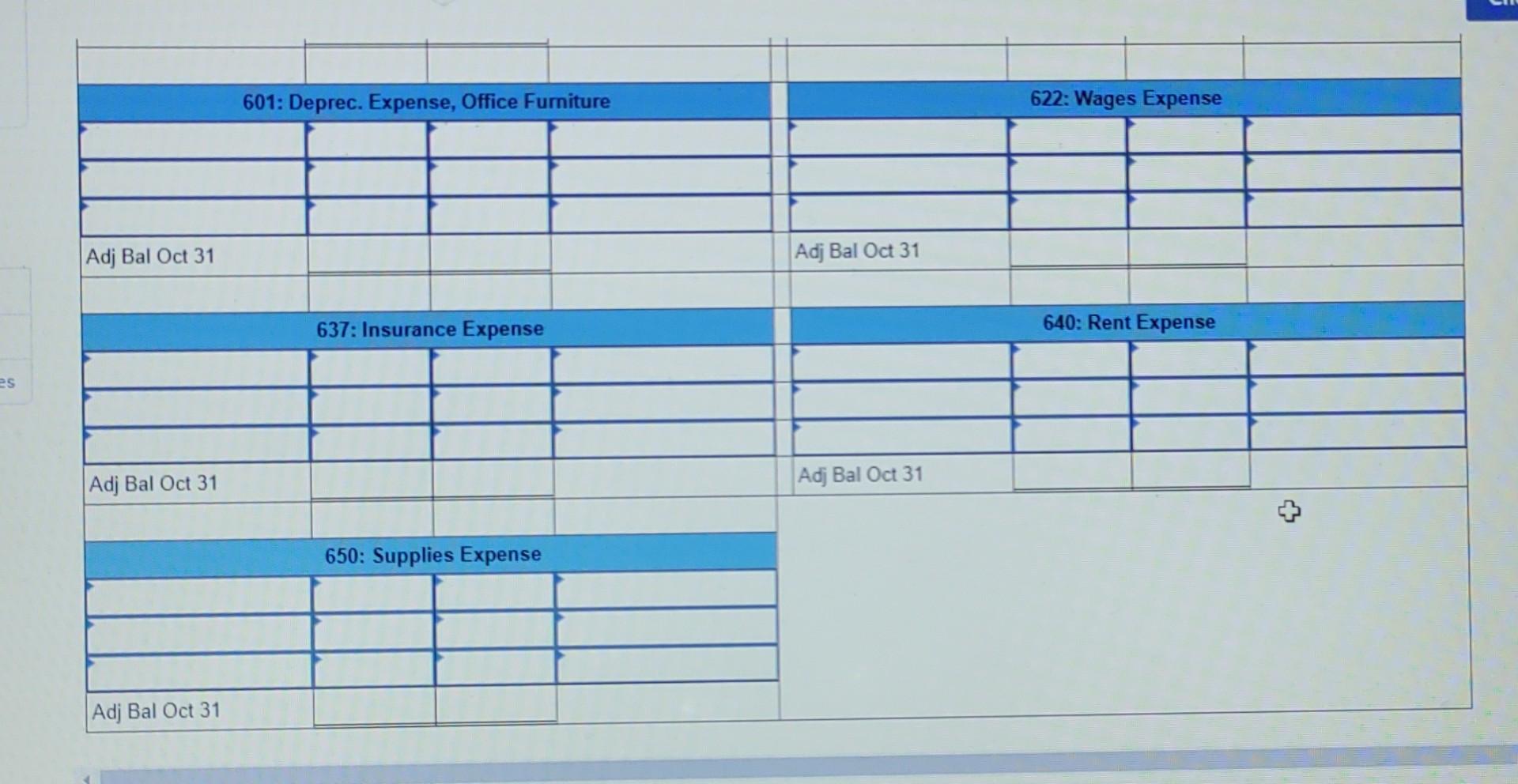

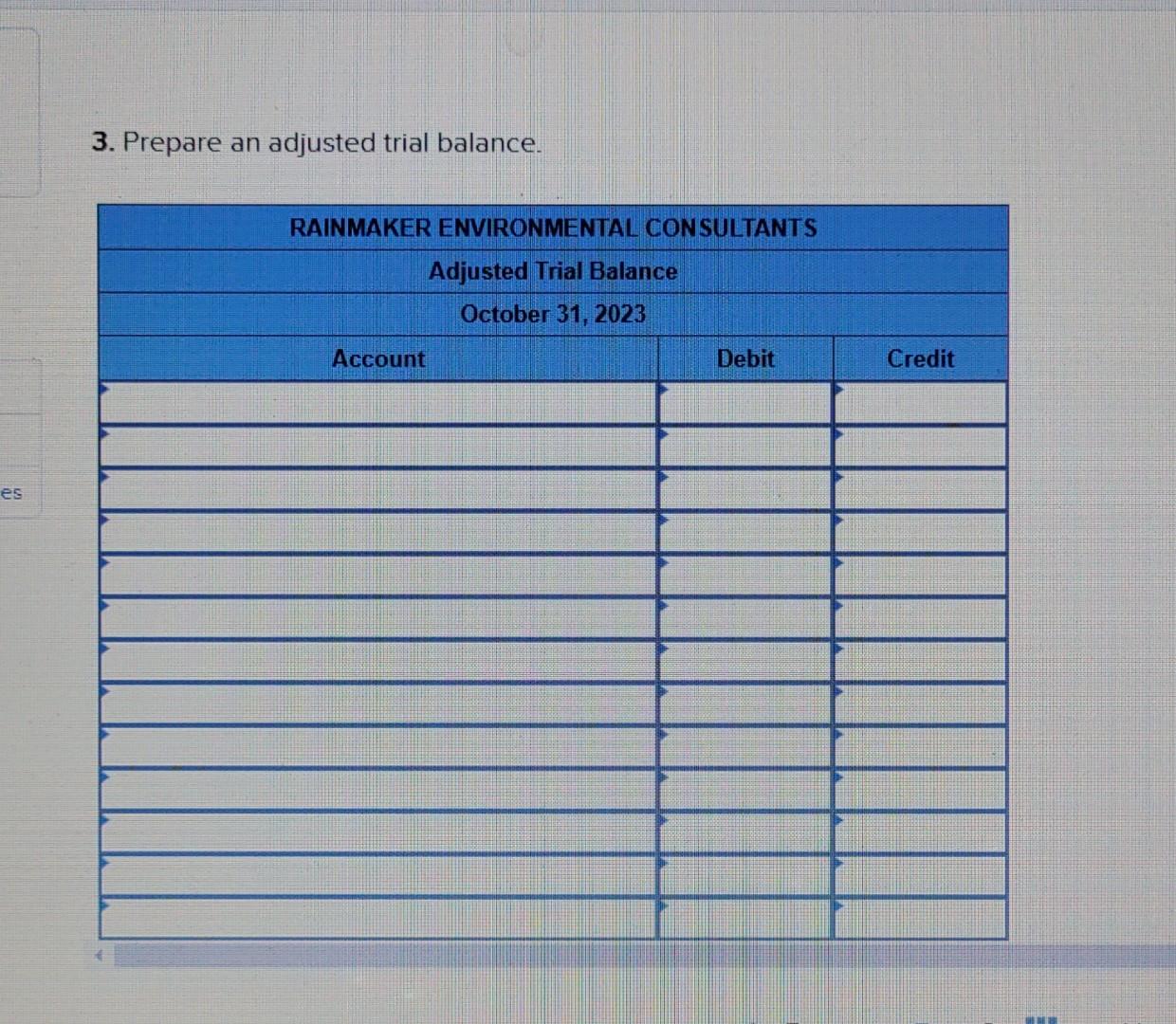

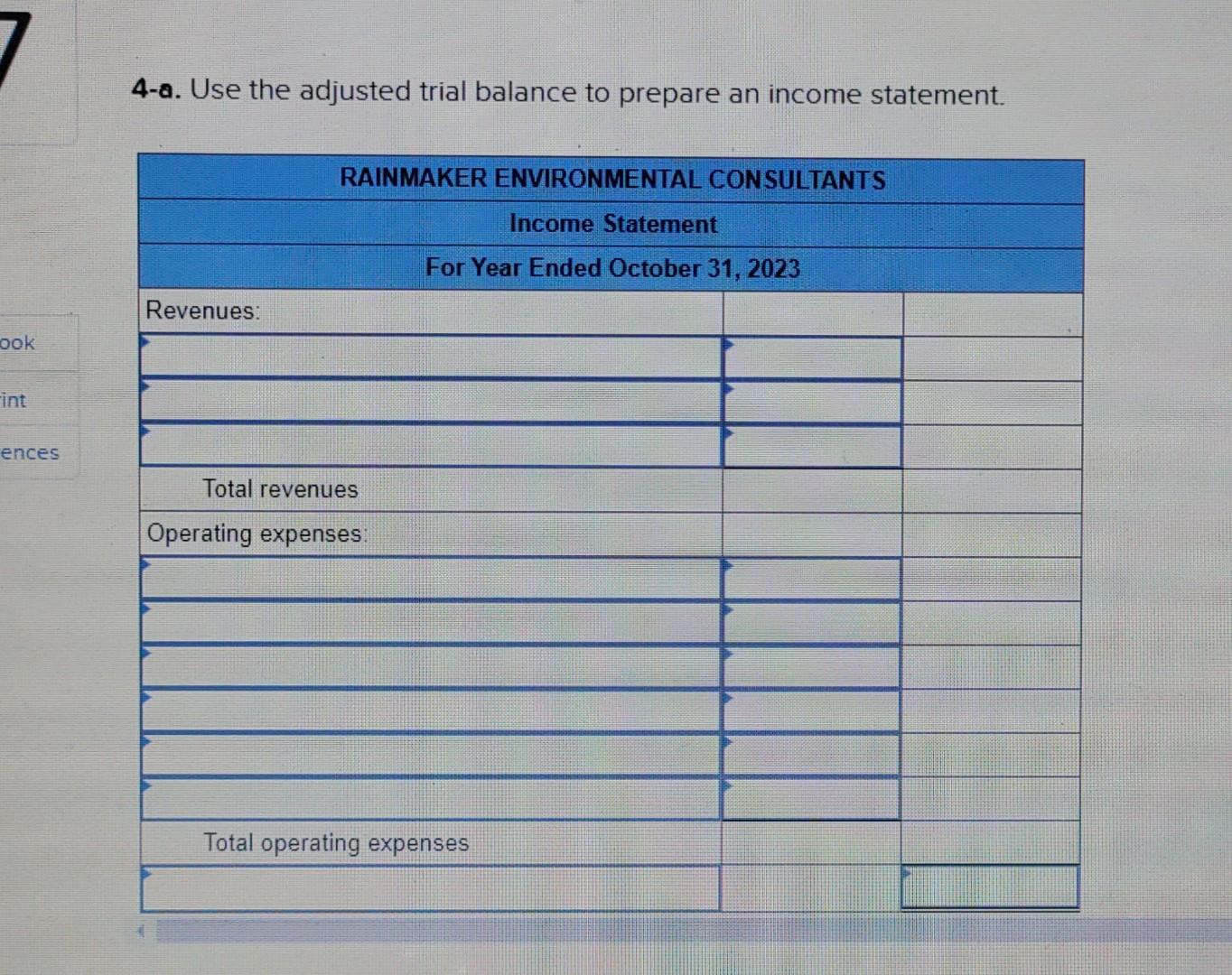

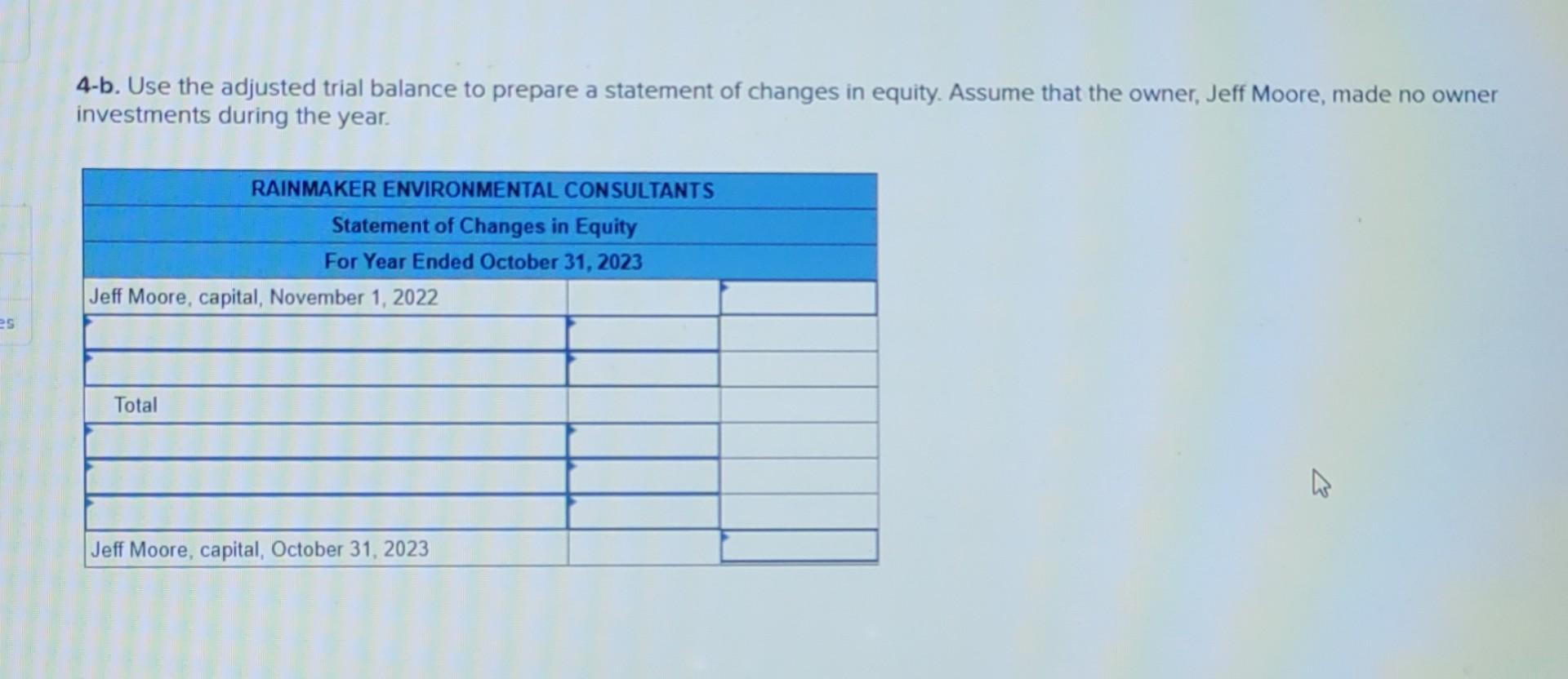

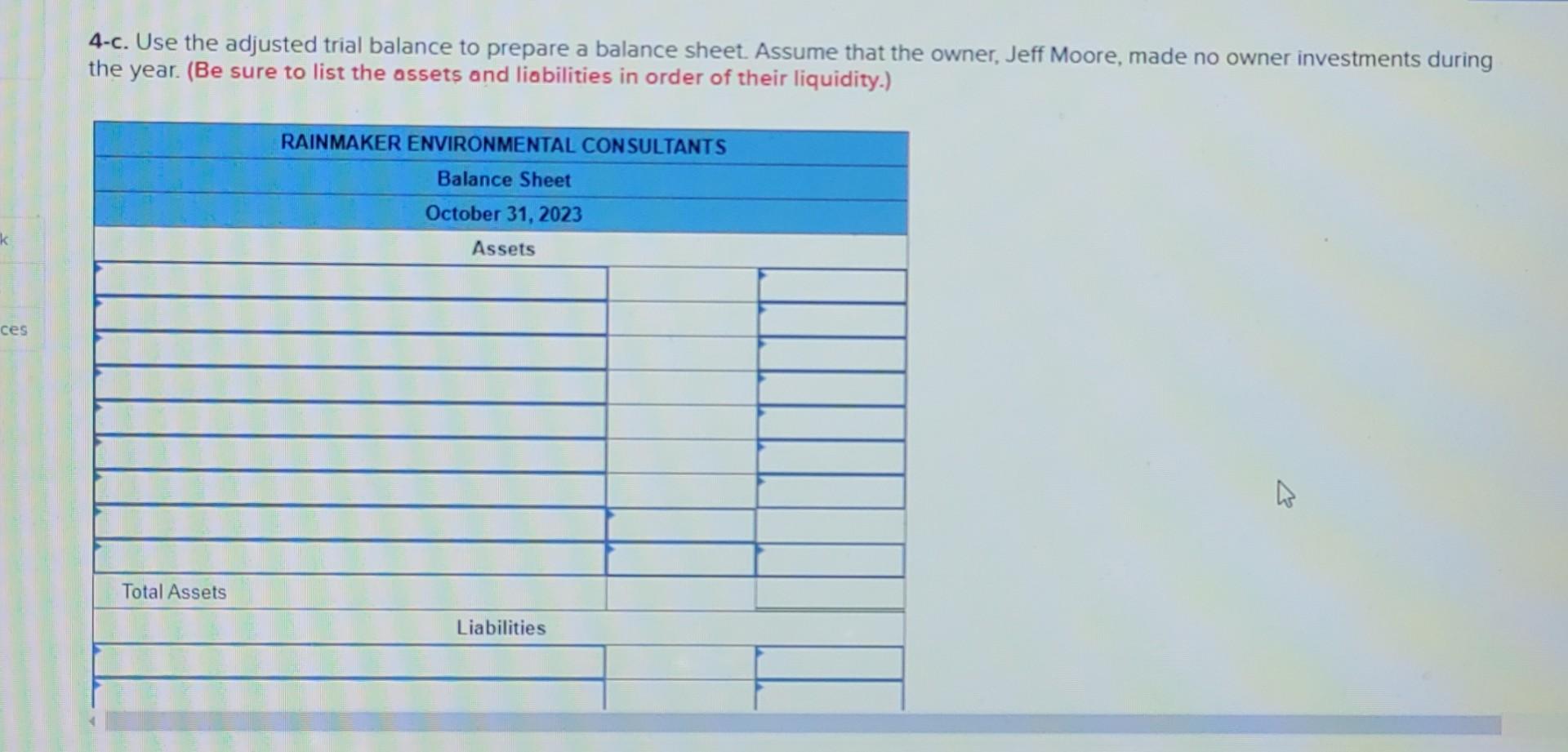

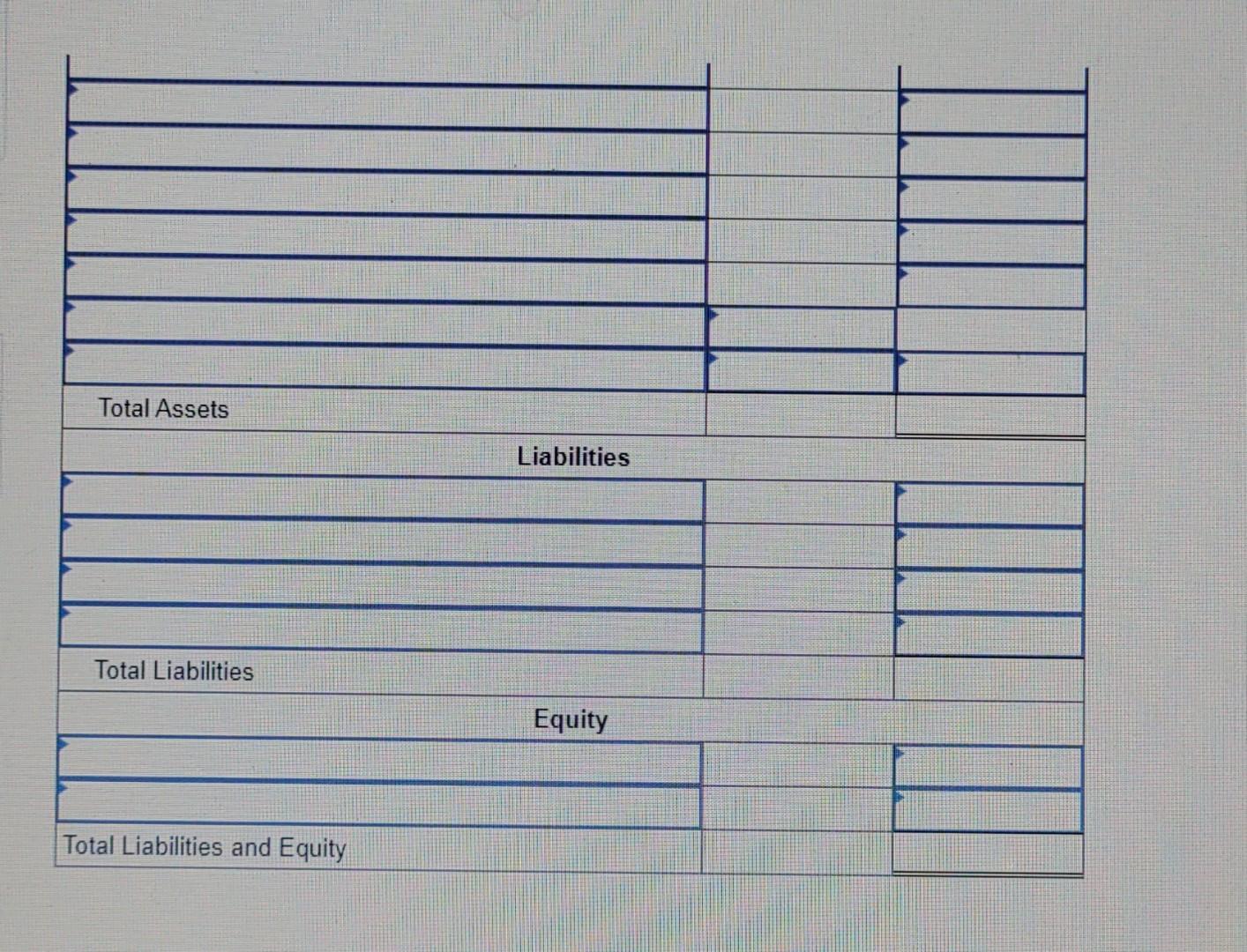

Answer all in the tables as soon as possible. 2. Complete the following T-Account with the adjusting entries for October 31, 2023. 4-a. Use the

Answer all in the tables as soon as possible.

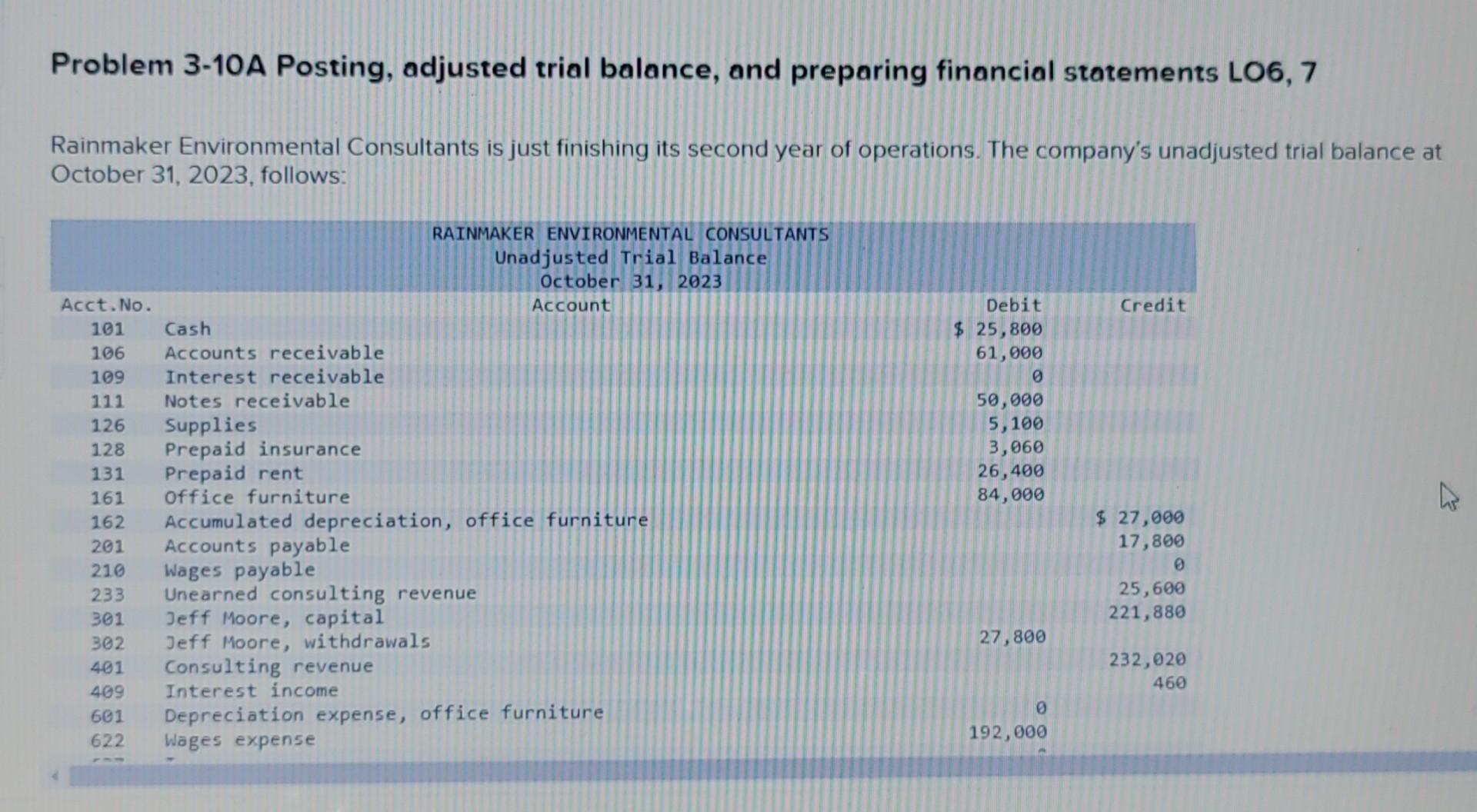

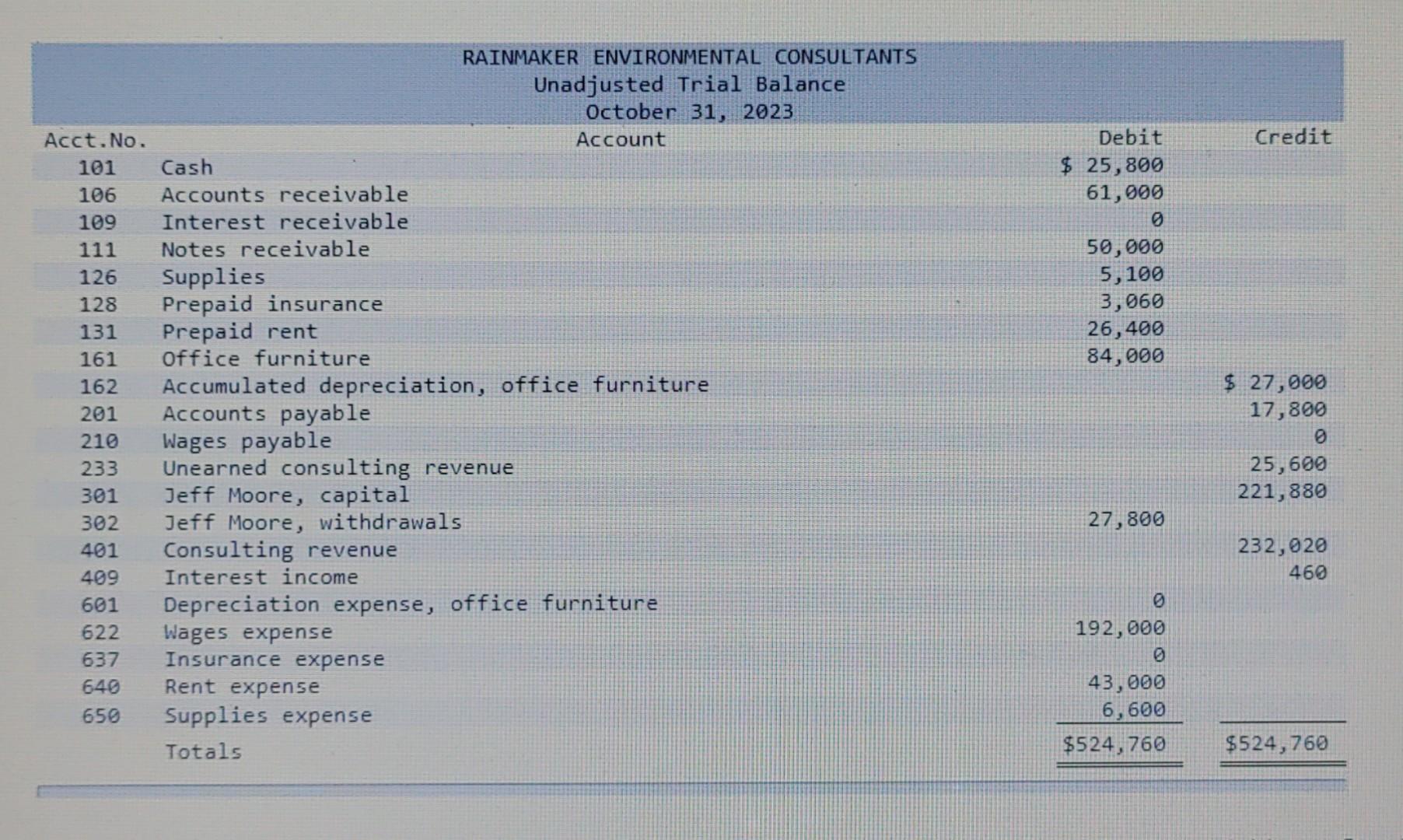

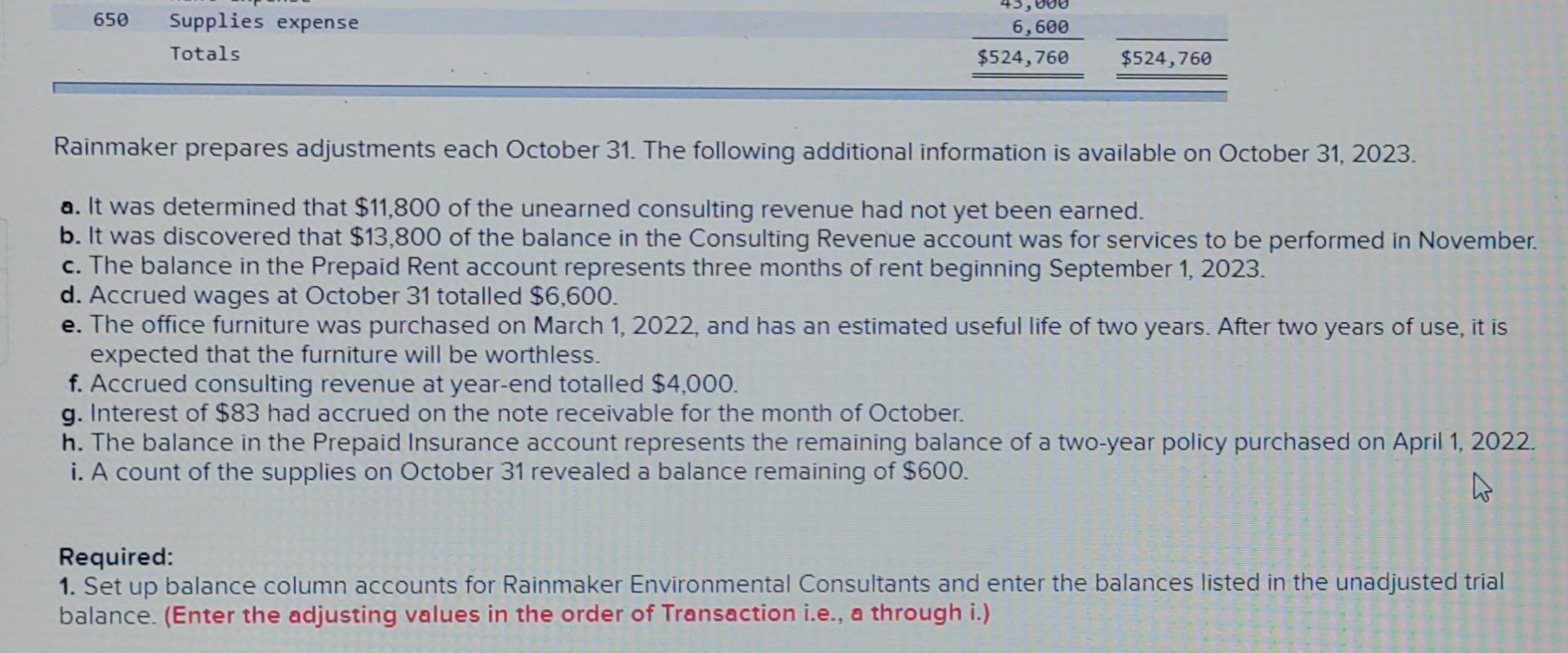

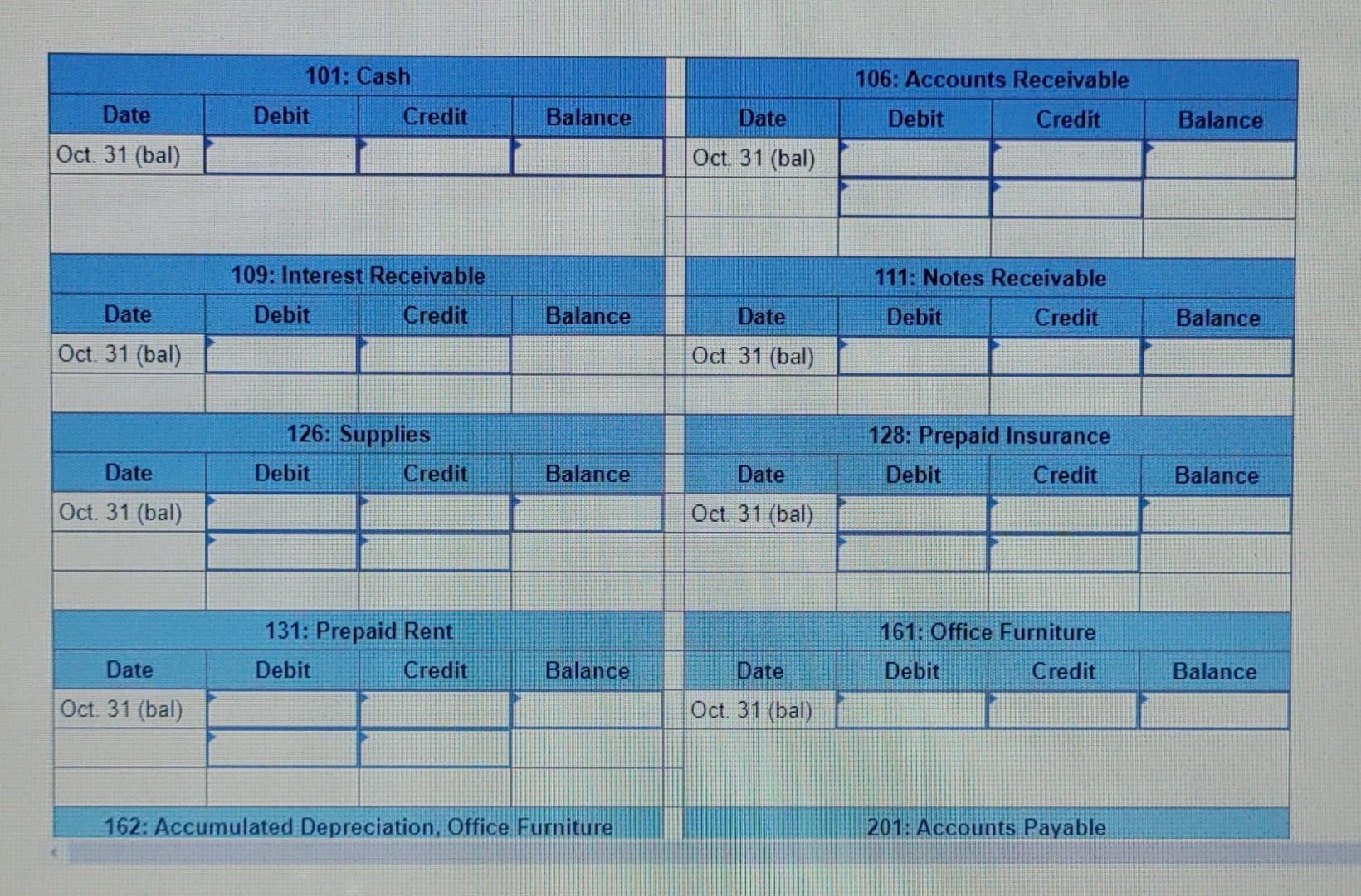

2. Complete the following T-Account with the adjusting entries for October 31, 2023. 4-a. Use the adjusted trial balance to prepare an income statement. \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ 101: Cash } & \multicolumn{4}{|c|}{ 106: Accounts Receivable } \\ \hline Date & Debit & Credit & Balance & Date & Debit & Credit & Balance \\ \hline Oct. 31 (bal) & & & & Oct 31 (bal) & & & \\ \hline & & & & & & & \\ \hline \multicolumn{4}{|c|}{ 109: Interest Receivable } & \multicolumn{4}{|c|}{ 111: Notes Receivable } \\ \hline Date & Debit & Credit & Balance & Date & Debit & Credit & Balance \\ \hline Oct. 31 (bal) & & & & Oct. 31 (bal) & & & \\ \hline \multicolumn{4}{|c|}{ 126: Supplies } & \multicolumn{4}{|c|}{ 128: Prepaid Insurance } \\ \hline Date & Debit & Credit & Balance & Date & Debit & Credit & Balance \\ \hline Oct. 31 (bal) & & & & Oct 31 (bal) & & & \\ \hline & & & & & & & \\ \hline \multicolumn{4}{|c|}{ 131: Prepaid Rent } & \multicolumn{4}{|c|}{ 161: Office Furniture } \\ \hline Date & Debit & Credit & Balance & Date & Debit & Credit & Balance \\ \hline Oct. 31 (bal) & & & & Oct. 31 (bal) & & & \\ \hline & & & & & & & \\ \hline \multicolumn{4}{|c|}{ 162: Accumulated Depreciation, Office Furniture } & \multicolumn{4}{|c|}{ 201: Accounts Payable } \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ 601: Depreciation Expense, Office Furniture } & \multicolumn{4}{|c|}{ 622: Wages Expense } \\ \hline Date & Debit & Credit & Balance & Date & Debit & Credit & Balance \\ \hline Oct. 31 (bal) & & & & Oct. 31 (bal) & & & \\ \hline \multicolumn{4}{|c|}{ 637: Insurance Expense } & \multicolumn{4}{|c|}{ 640: Rent Expense } \\ \hline Date & Debit & Credit & Balance & Date & Debit & Credit & Balance \\ \hline Oct. 31 (bal) & & & & Oct. 31 (bal) & & & \\ \hline \multicolumn{4}{|c|}{ 650: Supplies Expense } & & & & \\ \hline Date & Debit & Credit & Balance & & & & \\ \hline Oct. 31 (bal) & & & & & & & \\ \hline & & & & & & & \\ \hline \end{tabular} 3. Prepare an adjusted trial balance. 4-c. Use the adjusted trial balance to prepare a balance sheet. Assume that the owner, Jeff Moore, made no owner investments during the year. (Be sure to list the assets and liabilities in order of their liquidity.) Problem 3-10A Posting, adjusted trial balance, and preparing financial statements LO6, 7 Rainmaker Environmental Consultants is just finishing its second year of operations. The company's unadjusted trial balance at October 31,2023 , follows: \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ 162: Accumulated Depreciation, Office Furniture } & \multicolumn{4}{|c|}{ 201: Accounts Payable } \\ \hline Date & Debit & Credit & Balance & Date & Debit & Credit & Balance \\ \hline Oct. 31 (bal) & & & & Oct. 31 (bal) & & & \\ \hline \multicolumn{4}{|c|}{ 210: Wages Payable } & \multicolumn{4}{|c|}{ 233: Unearned Consulting Revenue } \\ \hline Date & Debit & Credit & Balance & Date & Debit & Credit & Balance \\ \hline Oct. 31 (bal) & & & & Oct. 31 (bal) & & & \\ \hline & & & & & & & \\ \hline \multicolumn{4}{|c|}{ 301: Jeff Moore, Capital } & \multicolumn{4}{|c|}{ 302: Jeff Moore, Withdrawals } \\ \hline Date & Debit & Credit & Balance & Date & Debit & Credit & Balance \\ \hline Oct. 31 (bal) & & & & Oct. 31 (bal) & & & \\ \hline \multicolumn{4}{|c|}{ 401: Consulting Revenue } & \multicolumn{4}{|c|}{ 409: Interest Income } \\ \hline Date & Debit & Credit & Balance & Date & Debit & Credit & Balance \\ \hline Oct. 31 (bal) & & & & Oct. 31 (bal) & & & \\ \hline & & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline & \begin{tabular}{r} RAINMAKER ENVIRONMEN \\ Unadjusted Tria \\ October 31, \end{tabular} & \begin{tabular}{l} AL CONSULTANTS \\ I Balance \\ 2023 \end{tabular} & & \\ \hline Acct. No. & Account & & Debit & Credit \\ \hline 101 & Cash & & $25,800 & \\ \hline 106 & Accounts receivable & & 61,000 & \\ \hline 109 & Interest receivable & & 0 & \\ \hline 111 & Notes receivable & & 50,000 & \\ \hline 126 & Supplies & & 5,100 & \\ \hline 128 & Prepaid insurance & & 3,060 & \\ \hline 131 & Prepaid rent & & 26,400 & \\ \hline 161 & office furniture & & 84,000 & \\ \hline 162 & Accumulated depreciation, office furniture & & & $27,000 \\ \hline 201 & Accounts payable & & & 17,800 \\ \hline 210 & Wages payable & & & \\ \hline 233 & Unearned consulting revenue & & & 25,600 \\ \hline 301 & Jeff Moore, capital & & & 221,880 \\ \hline 302 & Jeff Moore, withdrawals & & 27,800 & \\ \hline 401 & Consulting revenue & & & 232,020 \\ \hline 409 & Interest income & & & 460 \\ \hline 601 & Depreciation expense, office furniture & & 0 & \\ \hline 622 & Wages expense & & 192,000 & \\ \hline 637 & Insurance expense & & & \\ \hline 640 & Rent expense & & 43,000 & \\ \hline \multirow[t]{2}{*}{650} & Supplies expense & & 6,600 & \\ \hline & Totals & & $524,760 & $524,760 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Rainmaker prepares adjustments each October 31. The following additional information is available on October 31, 2023. a. It was determined that $11,800 of the unearned consulting revenue had not yet been earned. b. It was discovered that $13,800 of the balance in the Consulting Revenue account was for services to be performed in November. c. The balance in the Prepaid Rent account represents three months of rent beginning September 1, 2023. d. Accrued wages at October 31 totalled $6,600. e. The office furniture was purchased on March 1, 2022, and has an estimated useful life of two years. After two years of use, it is expected that the furniture will be worthless. f. Accrued consulting revenue at year-end totalled $4,000. g. Interest of $83 had accrued on the note receivable for the month of October. h. The balance in the Prepaid Insurance account represents the remaining balance of a two-year policy purchased on April 1, 2022. i. A count of the supplies on October 31 revealed a balance remaining of $600. Required: 1. Set up balance column accounts for Rainmaker Environmental Consultants and enter the balances listed in the unadjusted trial 4-b. Use the adjusted trial balance to prepare a statement of changes in equity. Assume that the owner, Jeff Moore, made no owner investments during the year. 2. Complete the following T-Account with the adjusting entries for October 31, 2023. 4-a. Use the adjusted trial balance to prepare an income statement. \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ 101: Cash } & \multicolumn{4}{|c|}{ 106: Accounts Receivable } \\ \hline Date & Debit & Credit & Balance & Date & Debit & Credit & Balance \\ \hline Oct. 31 (bal) & & & & Oct 31 (bal) & & & \\ \hline & & & & & & & \\ \hline \multicolumn{4}{|c|}{ 109: Interest Receivable } & \multicolumn{4}{|c|}{ 111: Notes Receivable } \\ \hline Date & Debit & Credit & Balance & Date & Debit & Credit & Balance \\ \hline Oct. 31 (bal) & & & & Oct. 31 (bal) & & & \\ \hline \multicolumn{4}{|c|}{ 126: Supplies } & \multicolumn{4}{|c|}{ 128: Prepaid Insurance } \\ \hline Date & Debit & Credit & Balance & Date & Debit & Credit & Balance \\ \hline Oct. 31 (bal) & & & & Oct 31 (bal) & & & \\ \hline & & & & & & & \\ \hline \multicolumn{4}{|c|}{ 131: Prepaid Rent } & \multicolumn{4}{|c|}{ 161: Office Furniture } \\ \hline Date & Debit & Credit & Balance & Date & Debit & Credit & Balance \\ \hline Oct. 31 (bal) & & & & Oct. 31 (bal) & & & \\ \hline & & & & & & & \\ \hline \multicolumn{4}{|c|}{ 162: Accumulated Depreciation, Office Furniture } & \multicolumn{4}{|c|}{ 201: Accounts Payable } \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ 601: Depreciation Expense, Office Furniture } & \multicolumn{4}{|c|}{ 622: Wages Expense } \\ \hline Date & Debit & Credit & Balance & Date & Debit & Credit & Balance \\ \hline Oct. 31 (bal) & & & & Oct. 31 (bal) & & & \\ \hline \multicolumn{4}{|c|}{ 637: Insurance Expense } & \multicolumn{4}{|c|}{ 640: Rent Expense } \\ \hline Date & Debit & Credit & Balance & Date & Debit & Credit & Balance \\ \hline Oct. 31 (bal) & & & & Oct. 31 (bal) & & & \\ \hline \multicolumn{4}{|c|}{ 650: Supplies Expense } & & & & \\ \hline Date & Debit & Credit & Balance & & & & \\ \hline Oct. 31 (bal) & & & & & & & \\ \hline & & & & & & & \\ \hline \end{tabular} 3. Prepare an adjusted trial balance. 4-c. Use the adjusted trial balance to prepare a balance sheet. Assume that the owner, Jeff Moore, made no owner investments during the year. (Be sure to list the assets and liabilities in order of their liquidity.) Problem 3-10A Posting, adjusted trial balance, and preparing financial statements LO6, 7 Rainmaker Environmental Consultants is just finishing its second year of operations. The company's unadjusted trial balance at October 31,2023 , follows: \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ 162: Accumulated Depreciation, Office Furniture } & \multicolumn{4}{|c|}{ 201: Accounts Payable } \\ \hline Date & Debit & Credit & Balance & Date & Debit & Credit & Balance \\ \hline Oct. 31 (bal) & & & & Oct. 31 (bal) & & & \\ \hline \multicolumn{4}{|c|}{ 210: Wages Payable } & \multicolumn{4}{|c|}{ 233: Unearned Consulting Revenue } \\ \hline Date & Debit & Credit & Balance & Date & Debit & Credit & Balance \\ \hline Oct. 31 (bal) & & & & Oct. 31 (bal) & & & \\ \hline & & & & & & & \\ \hline \multicolumn{4}{|c|}{ 301: Jeff Moore, Capital } & \multicolumn{4}{|c|}{ 302: Jeff Moore, Withdrawals } \\ \hline Date & Debit & Credit & Balance & Date & Debit & Credit & Balance \\ \hline Oct. 31 (bal) & & & & Oct. 31 (bal) & & & \\ \hline \multicolumn{4}{|c|}{ 401: Consulting Revenue } & \multicolumn{4}{|c|}{ 409: Interest Income } \\ \hline Date & Debit & Credit & Balance & Date & Debit & Credit & Balance \\ \hline Oct. 31 (bal) & & & & Oct. 31 (bal) & & & \\ \hline & & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline & \begin{tabular}{r} RAINMAKER ENVIRONMEN \\ Unadjusted Tria \\ October 31, \end{tabular} & \begin{tabular}{l} AL CONSULTANTS \\ I Balance \\ 2023 \end{tabular} & & \\ \hline Acct. No. & Account & & Debit & Credit \\ \hline 101 & Cash & & $25,800 & \\ \hline 106 & Accounts receivable & & 61,000 & \\ \hline 109 & Interest receivable & & 0 & \\ \hline 111 & Notes receivable & & 50,000 & \\ \hline 126 & Supplies & & 5,100 & \\ \hline 128 & Prepaid insurance & & 3,060 & \\ \hline 131 & Prepaid rent & & 26,400 & \\ \hline 161 & office furniture & & 84,000 & \\ \hline 162 & Accumulated depreciation, office furniture & & & $27,000 \\ \hline 201 & Accounts payable & & & 17,800 \\ \hline 210 & Wages payable & & & \\ \hline 233 & Unearned consulting revenue & & & 25,600 \\ \hline 301 & Jeff Moore, capital & & & 221,880 \\ \hline 302 & Jeff Moore, withdrawals & & 27,800 & \\ \hline 401 & Consulting revenue & & & 232,020 \\ \hline 409 & Interest income & & & 460 \\ \hline 601 & Depreciation expense, office furniture & & 0 & \\ \hline 622 & Wages expense & & 192,000 & \\ \hline 637 & Insurance expense & & & \\ \hline 640 & Rent expense & & 43,000 & \\ \hline \multirow[t]{2}{*}{650} & Supplies expense & & 6,600 & \\ \hline & Totals & & $524,760 & $524,760 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Rainmaker prepares adjustments each October 31. The following additional information is available on October 31, 2023. a. It was determined that $11,800 of the unearned consulting revenue had not yet been earned. b. It was discovered that $13,800 of the balance in the Consulting Revenue account was for services to be performed in November. c. The balance in the Prepaid Rent account represents three months of rent beginning September 1, 2023. d. Accrued wages at October 31 totalled $6,600. e. The office furniture was purchased on March 1, 2022, and has an estimated useful life of two years. After two years of use, it is expected that the furniture will be worthless. f. Accrued consulting revenue at year-end totalled $4,000. g. Interest of $83 had accrued on the note receivable for the month of October. h. The balance in the Prepaid Insurance account represents the remaining balance of a two-year policy purchased on April 1, 2022. i. A count of the supplies on October 31 revealed a balance remaining of $600. Required: 1. Set up balance column accounts for Rainmaker Environmental Consultants and enter the balances listed in the unadjusted trial 4-b. Use the adjusted trial balance to prepare a statement of changes in equity. Assume that the owner, Jeff Moore, made no owner investments during the yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started