Answer all MCQ questions and no need to explain the answers

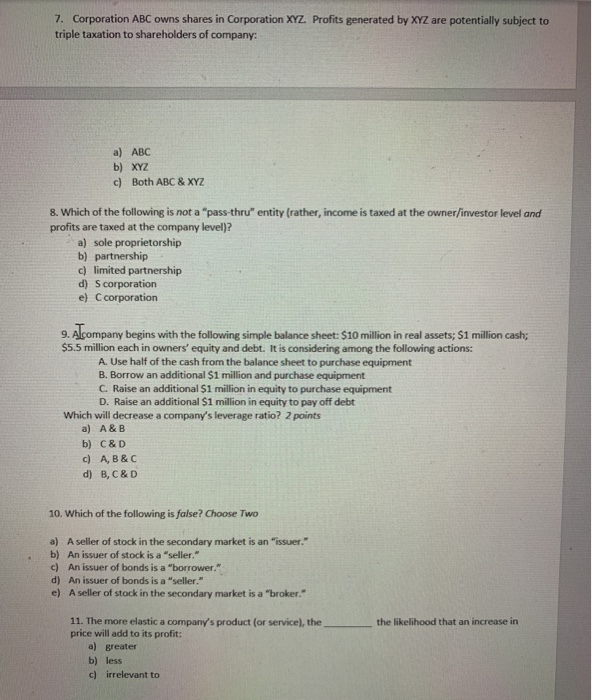

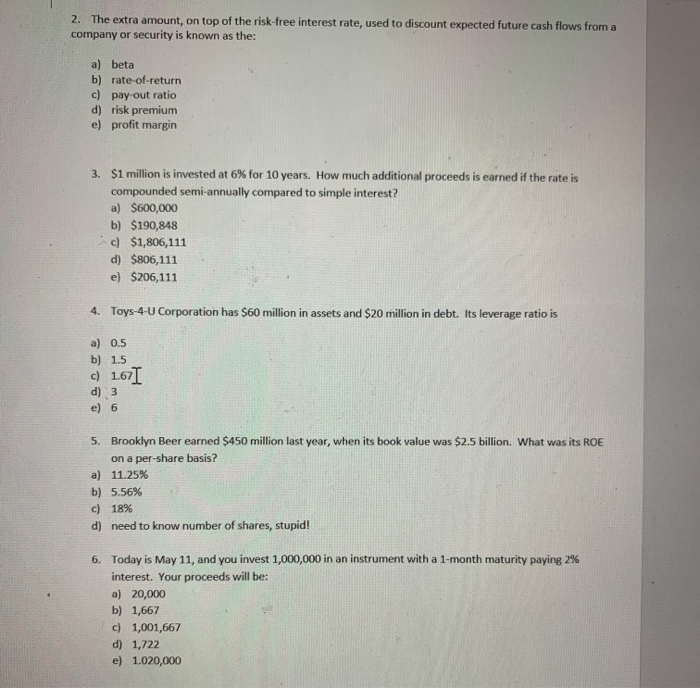

2. The extra amount, on top of the risk-free interest rate, used to discount expected future cash flows from a company or security is known as the: a) beta b) rate-of-return c) pay-out ratio d) risk premium e) profit margin 3. $1 million is invested at 6% for 10 years. How much additional proceeds is earned if the rate is compounded semi-annually compared to simple interest? a) $600,000 b) $190,848 c) $1,806,111 d) $806,111 e) $206,111 4. Toys-4-U Corporation has $60 million in assets and $20 million in debt. Its leverage ratio is a) 0.5 b) 1.5 c) 1.67) d) 3 e) 6 5. Brooklyn Beer earned $450 million last year, when its book value was $2.5 billion. What was its ROE on a per-share basis? a) 11.25% b) 5.56% c) 18% d) need to know number of shares, stupid! 6. Today is May 11, and you invest 1,000,000 in an instrument with a 1-month maturity paying 2% interest. Your proceeds will be: a) 20,000 b) 1,667 c) 1,001,667 d) 1,722 e) 1.020,000 7. Corporation ABC owns shares in Corporation XYZ. Profits generated by XYZ are potentially subject to triple taxation to shareholders of company: a) ABC b) XYZ c) Both ABC & XYZ 8. Which of the following is not a "pass-thru" entity (rather, income is taxed at the owner/investor level and profits are taxed at the company level)? a) sole proprietorship b) partnership c) limited partnership d) Scorporation e) C corporation 9. Alpompany begins with the following simple balance sheet: $10 million in real assets; $1 million cash; $5.5 million each in owners' equity and debt. It is considering among the following actions: A. Use half of the cash from the balance sheet to purchase equipment B. Borrow an additional $1 million and purchase equipment C. Raise an additional $1 million in equity to purchase equipment D. Raise an additional $1 million in equity to pay off debt Which will decrease a company's leverage ratio? 2 points a) A&B b) C&D c) A,B &C d) B, C&D 10. Which of the following is false? Choose Two a) A seller of stock in the secondary market is an issuer." b) An issuer of stock is a "seller." c) An issuer of bonds is a "borrower." d) An issuer of bonds is a "seller." e) A seller of stock in the secondary market is a "broker." the likelihood that an increase in 11. The more elastic a company's product (or service), the price will add to its profit: a) greater b) less c) irrelevant to

Answer all MCQ questions and no need to explain the answers

Answer all MCQ questions and no need to explain the answers