Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer all of the following questions Which statement about the cost of capital is false? If a company's tax rate increases then, all else equal,

answer all of the following questions

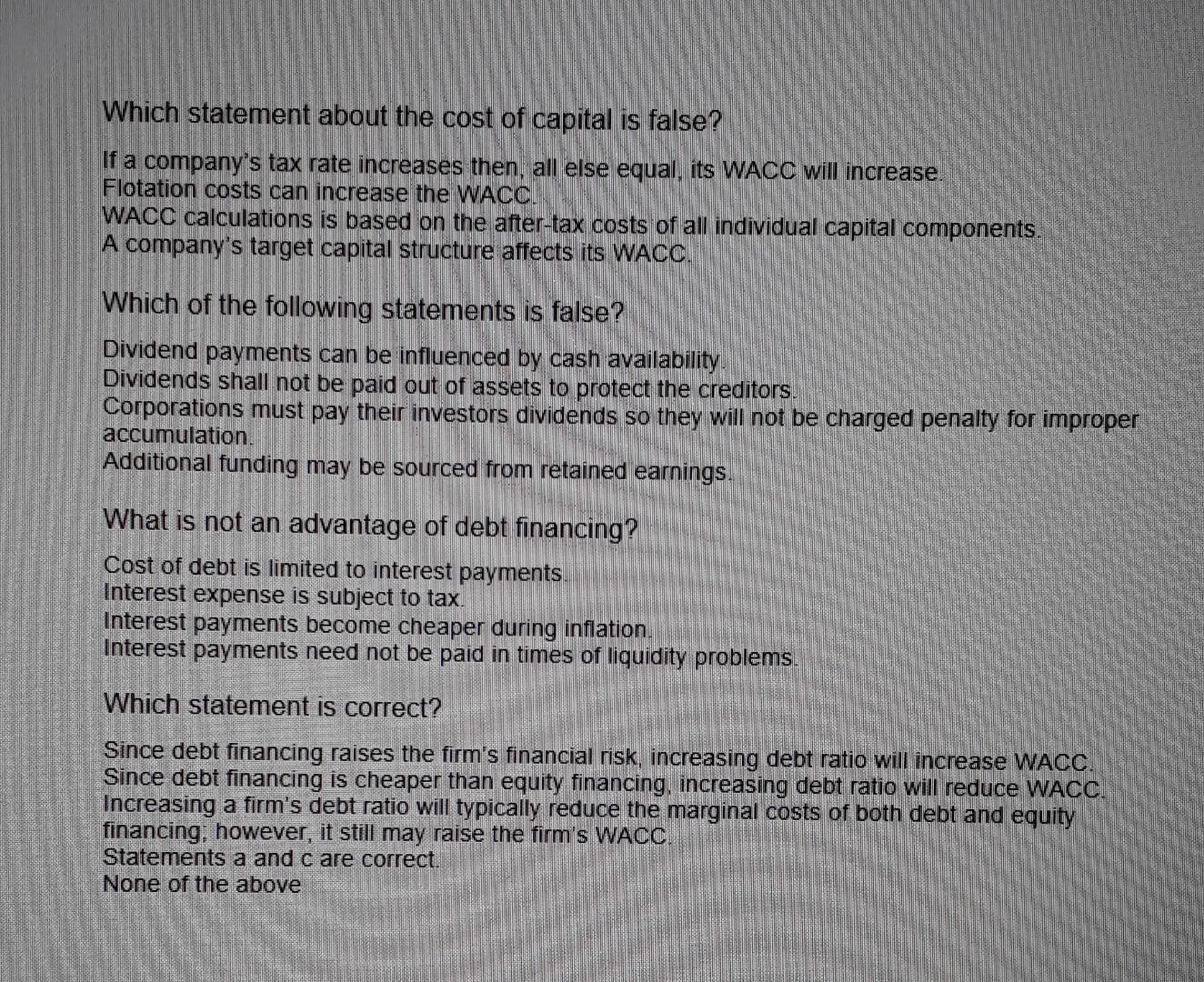

Which statement about the cost of capital is false? If a company's tax rate increases then, all else equal, its WACC will increase. Flotation costs can increase the WACC. WACC calculations is based on the after-tax costs of all individual capital components. A company's target capital structure affects its WACC. Which of the following statements is false? Dividend payments can be influenced by cash availability. Dividends shall not be paid out of assets to protect the creditors. Corporations must pay their investors dividends so they will not be charged penalty for improper accumulation. Additional funding may be sourced from retained earnings. What is not an advantage of debt financing? Cost of debt is limited to interest payments Interest expense is subject to tax. Interest payments become cheaper during inflation. Interest payments need not be paid in times of liquidity problems. Which statement is correct? Since debt financing raises the firm's financial risk, increasing debt ratio will increase WACC. Since debt financing is cheaper than equity financing, increasing debt ratio will reduce WACC. Increasing a firm's debt ratio will typically reduce the marginal costs of both debt and equity financing, however, it still may raise the firm's WACC. Statements a and care correct. None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started