Answered step by step

Verified Expert Solution

Question

1 Approved Answer

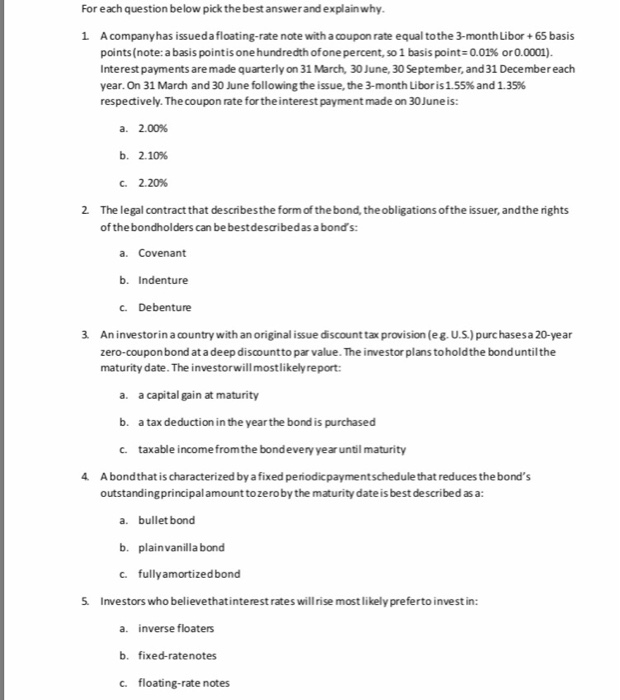

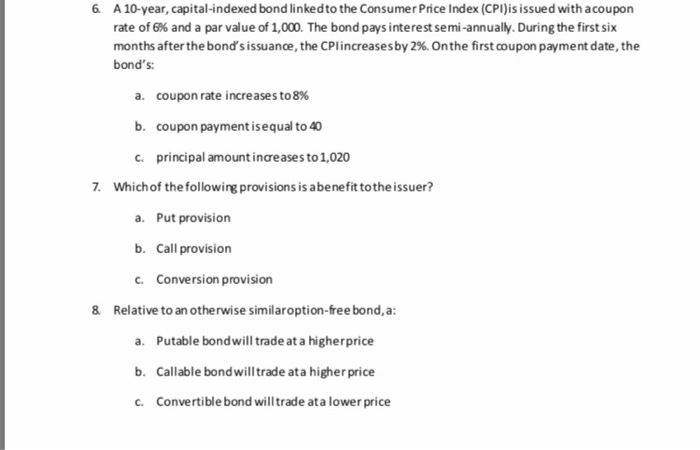

answer all of them and explain please For each question below pick the best answer and explain why. 1. A company has issuedafloating-rate note with

answer all of them and explain please

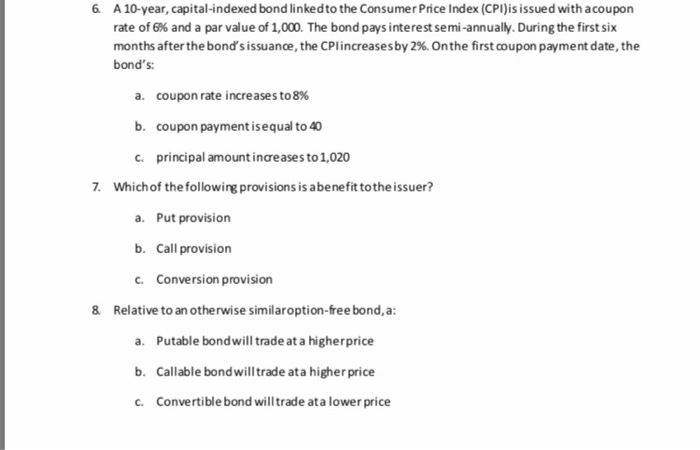

For each question below pick the best answer and explain why. 1. A company has issuedafloating-rate note with a coupon rate equal to the 3-month Libor +65 basis points(note: a basis point is one hundredth ofone percent, so 1 basis point=0.01% or 0.0001). Interest payments are made quarterly on 31 March, 30 June, 30 September, and 31 December each year. On 31 March and 30 June following the issue, the 3-month Libor is 1.55% and 1.35% respectively. The coupon rate for the interest payment made on 30 June is: a. 2.00% b. 2.10% c.2.20% 2 The legal contract that describesthe form of the bond, the obligations of the issuer, and the rights of the bondholders can be best describedas a bond's: a. Covenant b. Indenture c. Debenture 3. An investorin a country with an original issue discount tax provision (eg. U.S.) purchases a 20-year zero-couponbond at a deep discount to par value. The investor plans to hold the bond until the maturity date. The investor will mostlikely report: a. a capital gain at maturity b. a tax deduction in the year the bond is purchased c. taxable income from the bond every year until maturity 4 A bond that is characterized by a fixed periodicpaymentschedule that reduces the bond's outstanding principal amount to zeroby the maturity date is best described as a a. bullet bond b. plain vanilla bond c. fully amortizedbond 5. Investors who believethatinterest rates will rise most likely preferto invest in: a. inverse floaters b. fixed-ratenotes c. floating-rate notes 6 A 10-year, capital-indexed bond linked to the Consumer Price Index (CPI)is issued with a coupon rate of 6% and a par value of 1,000. The bond pays interest semi-annually. During the first six months after the bond's issuance, the CPlincreases by 2%. Onthe first coupon payment date, the bond's: a. coupon rate increases to 8% b. coupon payment is equal to 40 c. principal amount increases to 1,020 7. Which of the following provisions is abenefit to the issuer? a. Put provision b. Call provision c. Conversion provision 8 Relative to an otherwise similaroption-free bond, a: a. Putable bond will trade at a higherprice b. Callable bond will trade ata higher price c. Convertible bond will trade ata lower price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started