Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Elizabeth, age 30, is thinking about investing for retirement. She plans to retire when she turns age 65 . She will need $3.15 million in

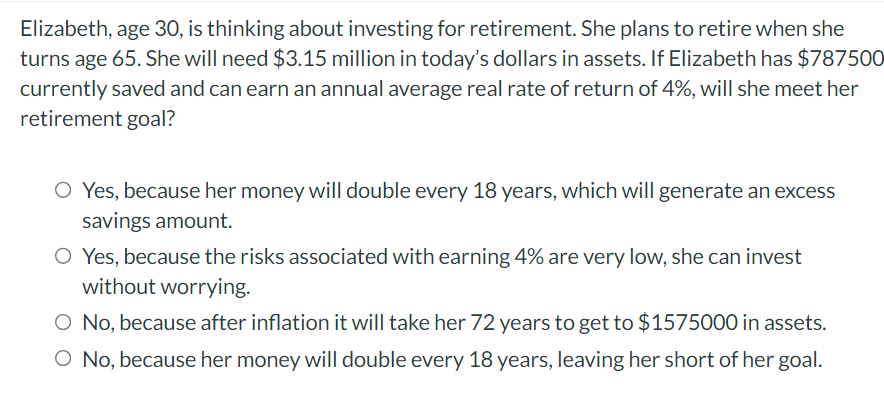

Elizabeth, age 30, is thinking about investing for retirement. She plans to retire when she turns age 65 . She will need $3.15 million in today's dollars in assets. If Elizabeth has $787500 currently saved and can earn an annual average real rate of return of 4%, will she meet her retirement goal? Yes, because her money will double every 18 years, which will generate an excess savings amount. Yes, because the risks associated with earning 4% are very low, she can invest without worrying. No, because after inflation it will take her 72 years to get to $1575000 in assets. No, because her money will double every 18 years, leaving her short of her goal. Elizabeth, age 30, is thinking about investing for retirement. She plans to retire when she turns age 65 . She will need $3.15 million in today's dollars in assets. If Elizabeth has $787500 currently saved and can earn an annual average real rate of return of 4%, will she meet her retirement goal? Yes, because her money will double every 18 years, which will generate an excess savings amount. Yes, because the risks associated with earning 4% are very low, she can invest without worrying. No, because after inflation it will take her 72 years to get to $1575000 in assets. No, because her money will double every 18 years, leaving her short of her goal

Elizabeth, age 30, is thinking about investing for retirement. She plans to retire when she turns age 65 . She will need $3.15 million in today's dollars in assets. If Elizabeth has $787500 currently saved and can earn an annual average real rate of return of 4%, will she meet her retirement goal? Yes, because her money will double every 18 years, which will generate an excess savings amount. Yes, because the risks associated with earning 4% are very low, she can invest without worrying. No, because after inflation it will take her 72 years to get to $1575000 in assets. No, because her money will double every 18 years, leaving her short of her goal. Elizabeth, age 30, is thinking about investing for retirement. She plans to retire when she turns age 65 . She will need $3.15 million in today's dollars in assets. If Elizabeth has $787500 currently saved and can earn an annual average real rate of return of 4%, will she meet her retirement goal? Yes, because her money will double every 18 years, which will generate an excess savings amount. Yes, because the risks associated with earning 4% are very low, she can invest without worrying. No, because after inflation it will take her 72 years to get to $1575000 in assets. No, because her money will double every 18 years, leaving her short of her goal Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started