Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ANSWER ALL OF THEM OR DO NOT ANSWER ANY OF THEM! WILL GIVE THUMBS UP IF ALL ARE ANSWERED. Suppose you bought ten call contracts

ANSWER ALL OF THEM OR DO NOT ANSWER ANY OF THEM! WILL GIVE THUMBS UP IF ALL ARE ANSWERED.

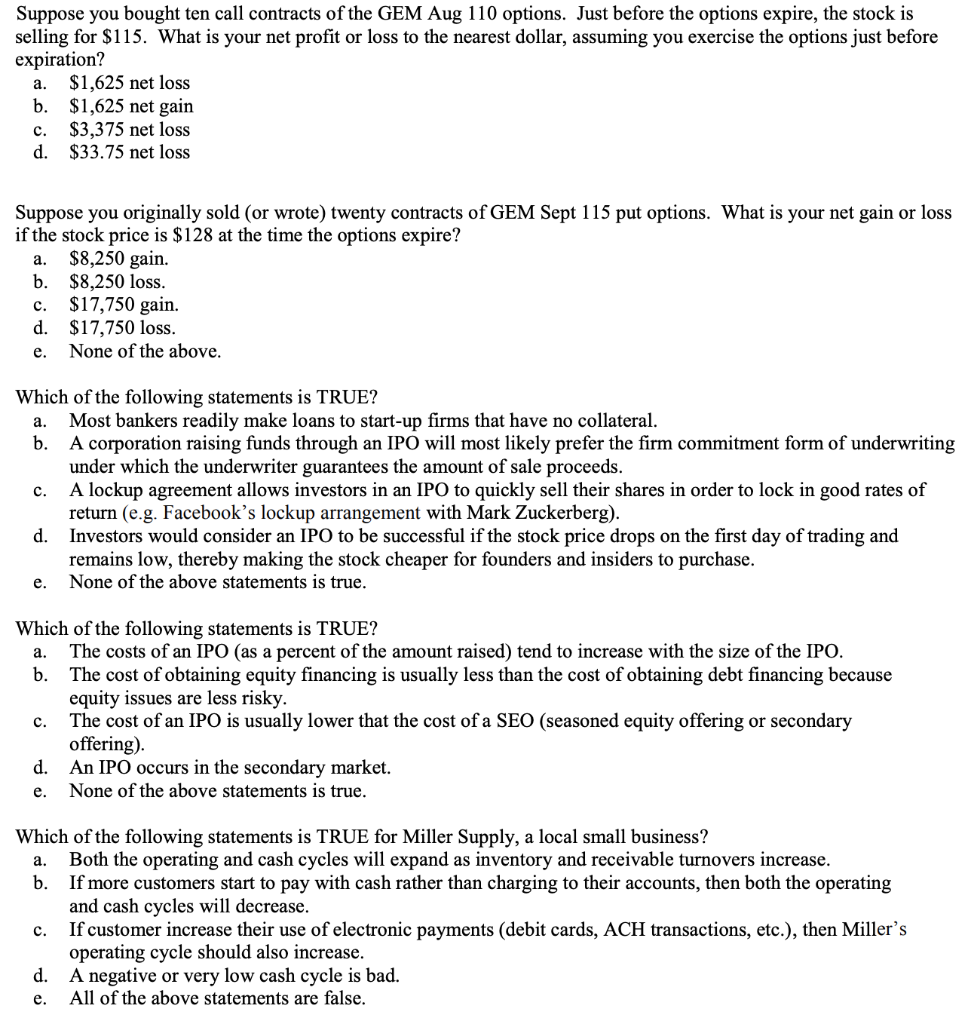

Suppose you bought ten call contracts of the GEM Aug 110 options. Just before the options expire, the stock is selling for $115. What is your net profit or loss to the nearest dollar, assuming you exercise the options just before expiration? $1,625 net loss b. $1,625 net gain c. $3,375 net loss d. $33.75 net loss a. a. Suppose you originally sold (or wrote) twenty contracts of GEM Sept 115 put options. What is your net gain or loss if the stock price is $128 at the time the options expire? $8,250 gain. b. $8,250 loss. c. $17,750 gain. d. $17,750 loss. e. None of the above. a. Which of the following statements is TRUE? Most bankers readily make loans to start-up firms that have no collateral. b. A corporation raising funds through an IPO will most likely prefer the firm commitment form of underwriting under which the underwriter guarantees the amount of sale proceeds. A lockup agreement allows investors in an IPO quickly sell their shares in order to lock in good rates of return (e.g. Facebook's lockup arrangement with Mark Zuckerberg). d. Investors would consider an IPO to be successful if the stock price drops on the first day of trading and remains low, thereby making the stock cheaper for founders and insiders to purchase. None of the above statements is true. c. e. a. Which of the following statements is TRUE? The costs of an IPO (as a percent of the amount raised) tend to increase with the size of the IPO. b. The cost of obtaining equity financing is usually less than the cost of obtaining debt financing because equity issues are less risky. The cost of an IPO is usually lower that the cost of a SEO (seasoned equity offering or secondary offering) d. An IPO occurs in the secondary market. None of the above statements is true. c. e. a. Which of the following statements is TRUE for Miller Supply, a local small business? Both the operating and cash cycles will expand as inventory and receivable turnovers increase. b. If more customers start to pay with cash rather than charging to their accounts, then both the operating and cash cycles will decrease. If customer increase their use of electronic payments (debit cards, ACH transactions, etc.), then Miller's operating cycle should also increase. d. A negative or very low cash cycle is bad. All of the above statements are false. c. e. Suppose you bought ten call contracts of the GEM Aug 110 options. Just before the options expire, the stock is selling for $115. What is your net profit or loss to the nearest dollar, assuming you exercise the options just before expiration? $1,625 net loss b. $1,625 net gain c. $3,375 net loss d. $33.75 net loss a. a. Suppose you originally sold (or wrote) twenty contracts of GEM Sept 115 put options. What is your net gain or loss if the stock price is $128 at the time the options expire? $8,250 gain. b. $8,250 loss. c. $17,750 gain. d. $17,750 loss. e. None of the above. a. Which of the following statements is TRUE? Most bankers readily make loans to start-up firms that have no collateral. b. A corporation raising funds through an IPO will most likely prefer the firm commitment form of underwriting under which the underwriter guarantees the amount of sale proceeds. A lockup agreement allows investors in an IPO quickly sell their shares in order to lock in good rates of return (e.g. Facebook's lockup arrangement with Mark Zuckerberg). d. Investors would consider an IPO to be successful if the stock price drops on the first day of trading and remains low, thereby making the stock cheaper for founders and insiders to purchase. None of the above statements is true. c. e. a. Which of the following statements is TRUE? The costs of an IPO (as a percent of the amount raised) tend to increase with the size of the IPO. b. The cost of obtaining equity financing is usually less than the cost of obtaining debt financing because equity issues are less risky. The cost of an IPO is usually lower that the cost of a SEO (seasoned equity offering or secondary offering) d. An IPO occurs in the secondary market. None of the above statements is true. c. e. a. Which of the following statements is TRUE for Miller Supply, a local small business? Both the operating and cash cycles will expand as inventory and receivable turnovers increase. b. If more customers start to pay with cash rather than charging to their accounts, then both the operating and cash cycles will decrease. If customer increase their use of electronic payments (debit cards, ACH transactions, etc.), then Miller's operating cycle should also increase. d. A negative or very low cash cycle is bad. All of the above statements are false. c. eStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started