Answer all of these, please

Answer correctly, this is second time I posted!!!!!!!

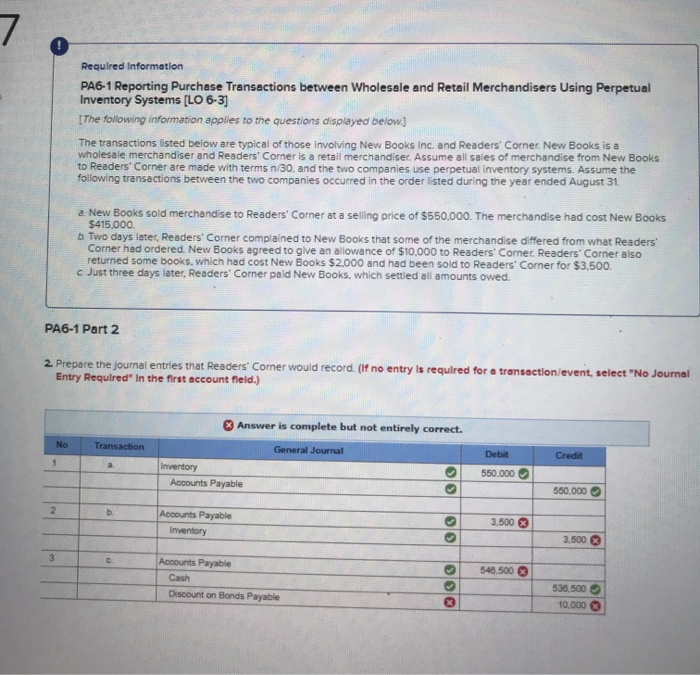

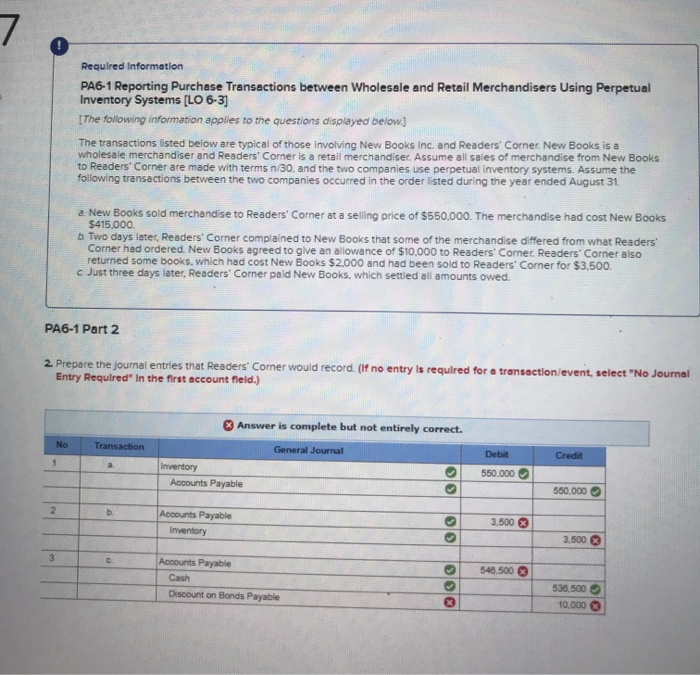

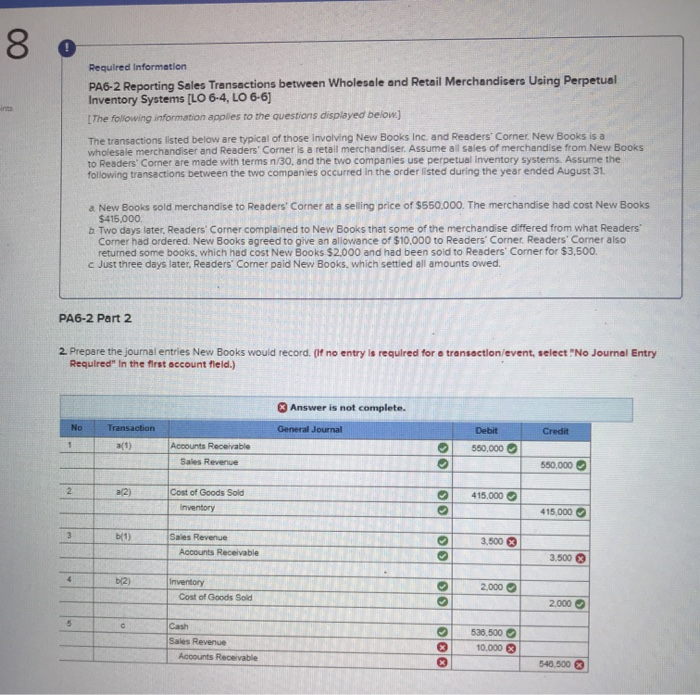

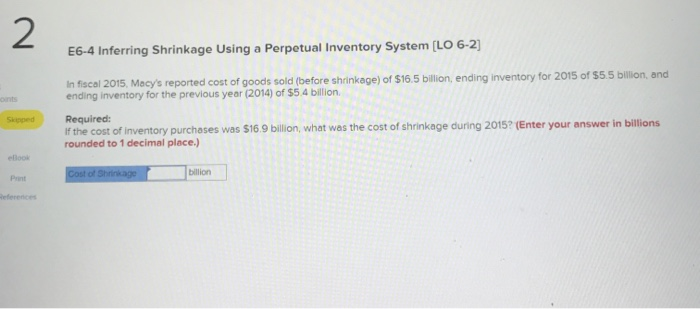

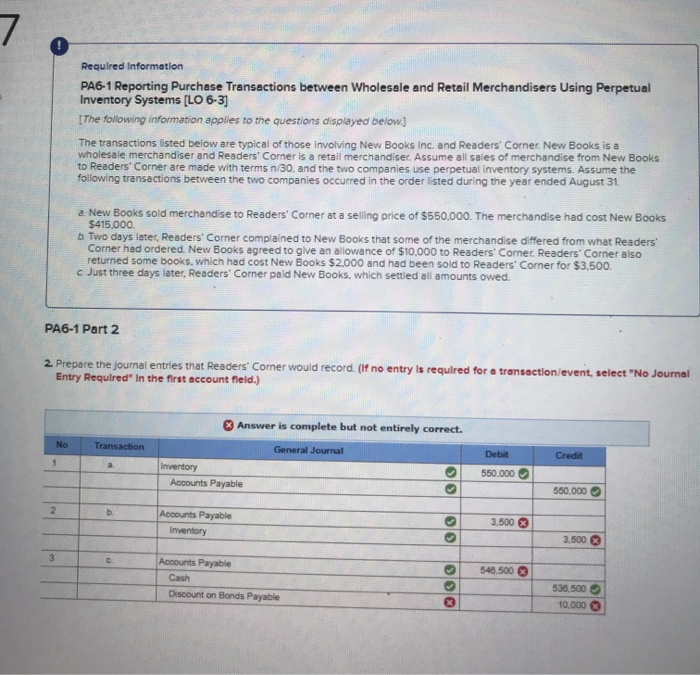

7 Required Information PA6-1 Reporting Purchase Transactions between Wholesale and Retail Merchandisers Using Perpetual Inventory Systems (LO 6-3] [The following information applies to the questions displayed below] The transactions listed below are typical of those involving New Books Inc. and Readers' Corner. New Books is a wholesale merchandiser and Readers Corner is a retail merchandiser. Assume all sales of merchandise from New Books to Readers' Corner are made with terms n/30, and the two companies use perpetual inventory systems. Assume the following transactions between the two companies occurred in the order listed during the year ended August 31 a New Books sold merchandise to Readers' Corner at a selling price of $550,000. The merchandise had cost New Books $415,000. b Two days later, Readers' Corner complained to New Books that some of the merchandise differed from what Readers Corner had ordered. New Books agreed to give an allovance of $10,000 to Readers' Corner. Readers' Corner also returned some books, which had cost New Books $2,000 and had been sold to Readers' Corner for $3,500. c Just three days later, Readers' Corner paid New Books, which settled all amounts owed PA6-1 Part 2 2 Prepare the journal entries that Readers' Corner would record. (If no entry Is required for a transaction/event, select "No Journal Entry Required" In the first account fleld.) Answer is complete but not entirely correct. No Transaction General Journal Debit Credit Inventory 550,000 550,000 Accounts Payable Accounts Payable 2 b 3,500 Inventory 3,500 Accounts Payable 3 546,500 C. Cash 536.500 Discount on Bonds Payable 10.000 Required Information PA6-2 Reporting Sales Transactions between Wholesale and Retail Merchandisers Using Perpetual Inventory Systems [LO 6-4, LO 6-6 ints [The following information applies to the questions displayed below. The transactions listed below are typical of those involving New Books Inc. and Readers' Corner New Bookks is a wholesale merchandiser and Readers' Corner is a retail merchandiser. ASsume al sales of merchandise from New Books to Readers' Corner are made with terms n/30, and the two companies use perpetual inventory systems. Assume the following transactions between the two companies occurred in the order listed during the year ended August 31 a New Books sold merchandise to Readers' Corner at a selling price of $550,000. The merchandise had cost New Books $415,000 b Two days later, Readers' Corner complained to New Books that some of the merchandise differed from what Readers Corner had ordered. New Books agreed to give an allowance of $10,000 to Readers Corner, Readers' Corner also returned some books, which had cost New Books $2.000 and had been sold to Readers' Corner for $3,500. c Just three days later, Readers' Corner paid New Books, which settled all amounts owed PA6-2 Part 2 2 Prepare the journal entries New Books would record. (If no entry is required for a transaction/event, select"No Journal Entry Required" In the first account fleld.) Answer is not complete. No Transaction General Journal Debit Credit Accounts Receivable 1 a(1) 550,000 Sales Revenue 550,000 6 2 Cost of Goods Sold a(2) 415,000 Inventory 415,000 3 Sales Revenue b(1) 3.500 Accounts Receivable 3,500 b2) Inventory 2000 Cost of Goods Sold 2.000 5 Cash 536.500 Sales Revenue 10,000 Accounts Receivable 540.500 00 2 E6-4 Inferring Shrinkage Using a Perpetual Inventory System (LO 6-2] In fiscal 2015, Macy's reported cost of goods sold (before shrinkage) of $16.5 billion, ending inventory for 2015 of $5.5 billion, and ending inventory for the previous year (2014) of $5.4 billion onts Required: If the cost of inventory purchases was $16.9 billion, what was the cost of shrinkage during 2015? (Enter your answer in billions rounded to 1 decimal place.) Skpped elook billion Cost of Shrinkage Print References