Answer all of these, please

It is the third time I posted!!!!!

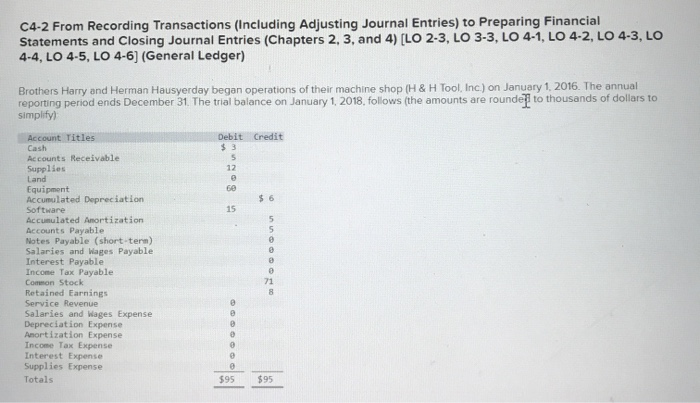

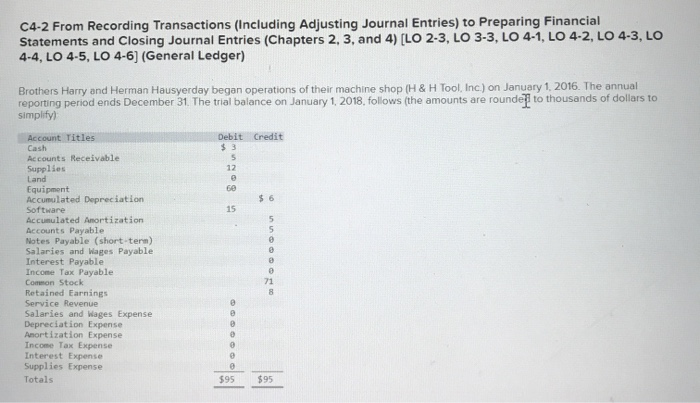

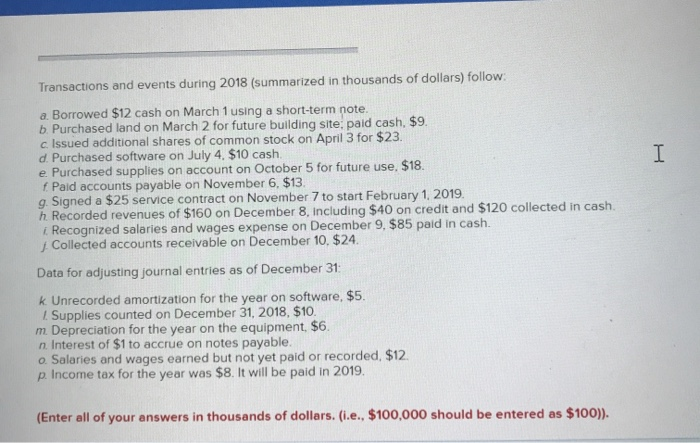

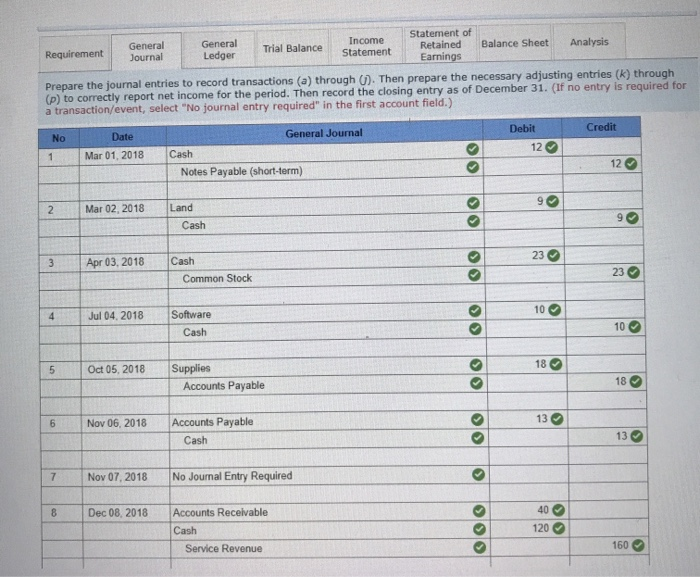

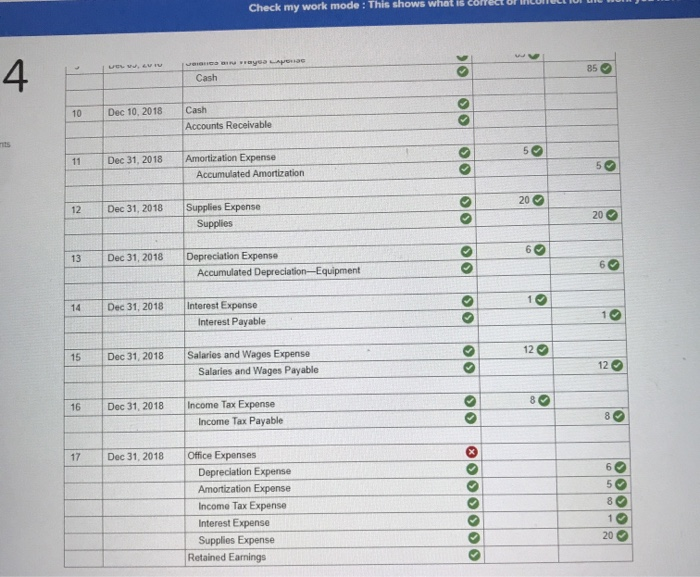

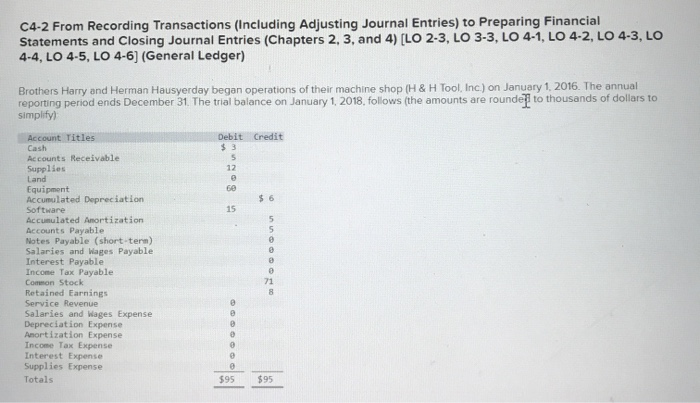

C4-2 From Recording Transactions (Including Adjusting Journal Entries) to Preparing Financial Statements and Closing Journal Entries (Chapters 2, 3, and 4) [LO 2-3, LO 3-3, LO 4-1, LO 4-2, LO 4-3, LO 4-4, LO 4-5, LO 4-6] (General Ledger) Brothers Harry and Herman Hausyerday began operations of their machine shop (H & H Tool, Inc.) on January 1, 2016. The annual reporting period ends December 31. The trial balance on January 1, 2018, follows (the amounts are rounde simplify) to thousands of dollars to Debit Credit $3 Account Titles Cash Accounts Receivable Supplies 12 Land 60 Equipment Accumulated Depreciation Software $ 6 15 Accumulated Anortization Accounts Payable Notes Payable (short-term) Salaries and Wages Payable Interest Payable Income Tax Payable Common Stock Retained Earnings Service Revenue Salaries and Wages Expense Depreciation Expense Anortization Expense Income Tax Expense Interest Expense Supplies Expense $95 $95 Totals Statement of Retained Earnings Income Statement Analysis Balance Sheet General General Journal Trial Balance Requirement Ledger Prepare the journal entries to record transactions (a) through (). Then prepare the necessary adjusting entries (k) through (p) to correctly report net income for the period. Then record the closing entry as of December 31. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Credit Debit General Journal Date No 12 Cash Mar 01, 2018 12 Notes Payable (short-term) Mar 02, 2018 Land 2 Cash 23 Apr 03, 2018 Cash 3 23 Common Stock 10 Software 4 Jul 04, 2018 10 Cash 18 Supplies Oct 05, 2018 5 18 Accounts Payable 13 Accounts Payable Nov 06, 2018 13 Cash No Journal Entry Required Nov 07, 2018 7 40 Accounts Receivable Dec 08, 2018 120 Cash 160 Service Revenue en Check my work mode : This shows what is 4 ayea LApoae veiaues au 85 Cash Cash Dec 10, 2018 Accounts Receivable ts 5 Amortization Expense Dec 31, 2018 11 Accumulated Amortization 20 Supplies Expense Dec 31, 2018 20 C Supplies Depreciation Expense Dec 31, 2018 60 Accumulated Depreciation-Equipment Interest Expense Dec 31, 2018 14 Interest Payable 12 Salaries and Wages Expense Dec 31, 2018 15 12 Salaries and Wages Payable 8 Income Tax Expense Dec 31, 2018 16 8 Income Tax Payable Office Expenses Dec 31, 2018 17 6 Depreciation Expense 5 C Amortization Expense 8 Income Tax Expense 1 C Interest Expense 20 Supplies Expense Retained Earnings 10 12 13