Answered step by step

Verified Expert Solution

Question

1 Approved Answer

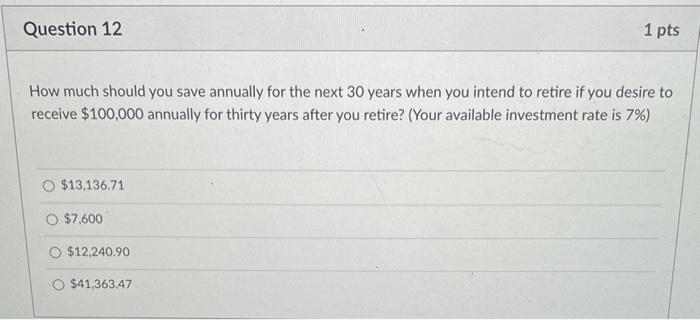

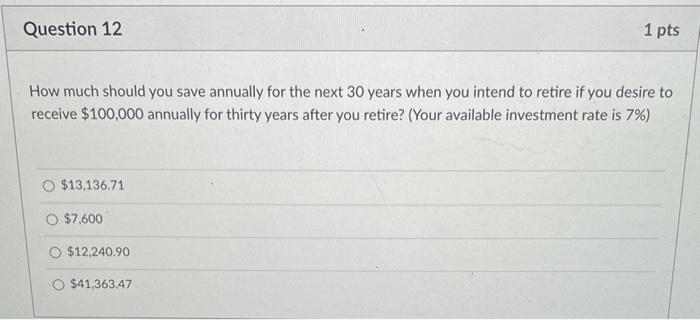

answer all or none Question 12 1 pts How much should you save annually for the next 30 years when you intend to retire if

answer all or none

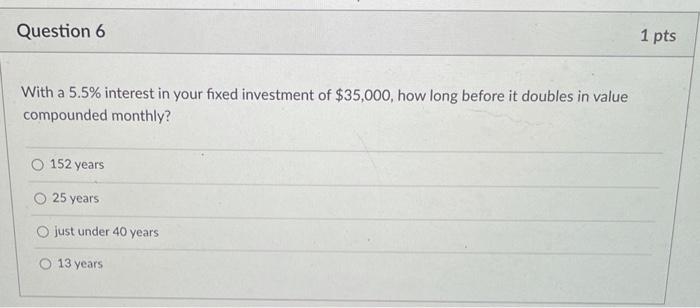

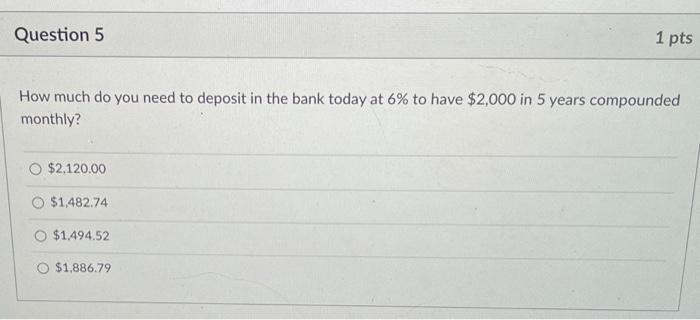

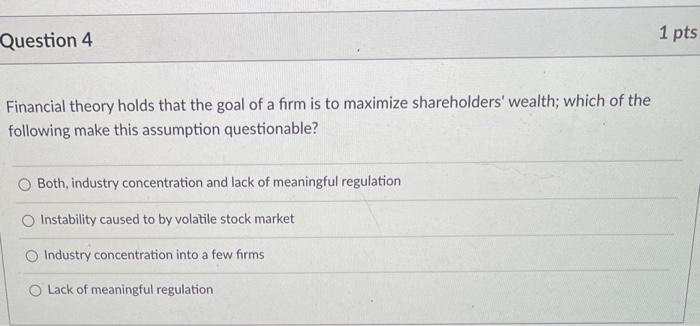

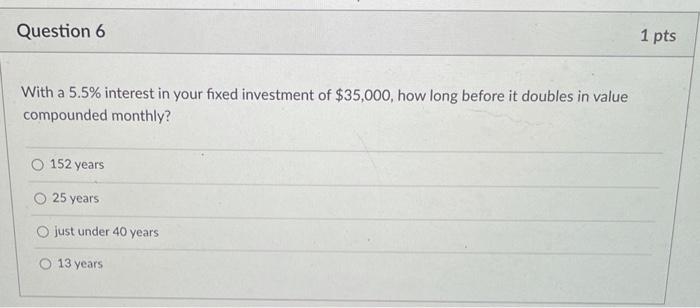

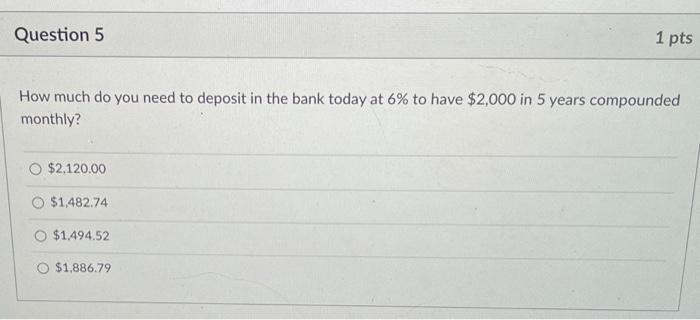

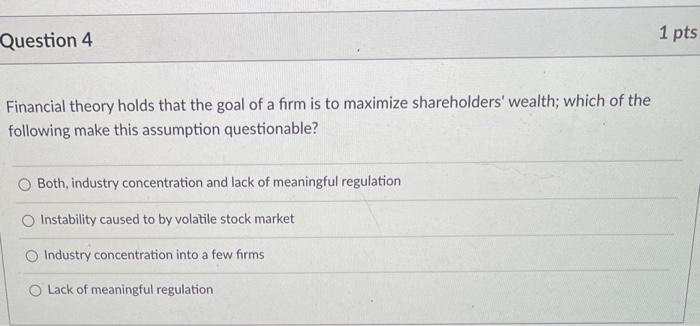

Question 12 1 pts How much should you save annually for the next 30 years when you intend to retire if you desire to receive $100,000 annually for thirty years after you retire? (Your available investment rate is 7%) $13,136.71 $7.600 O $12,240.90 O $41,363.47 Question 6 1 pts With a 5.5% interest in your fixed investment of $35,000, how long before it doubles in value compounded monthly? 152 years 25 years just under 40 years O 13 years Question 5 1 pts How much do you need to deposit in the bank today at 6% to have $2,000 in 5 years compounded monthly? $2,120.00 $1,482.74 O $1.494.52 O $1,886.79 Question 4 1 pts Financial theory holds that the goal of a firm is to maximize shareholders' wealth; which of the following make this assumption questionable? Both, industry concentration and lack of meaningful regulation Instability caused to by volatile stock market Industry concentration into a few firms Lack of meaningful regulation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started