Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer all part of the question. it is just one question. The following is the unadjusted trial balance for Rainbow Lodge Ltd. at its year

answer all part of the question. it is just one question.

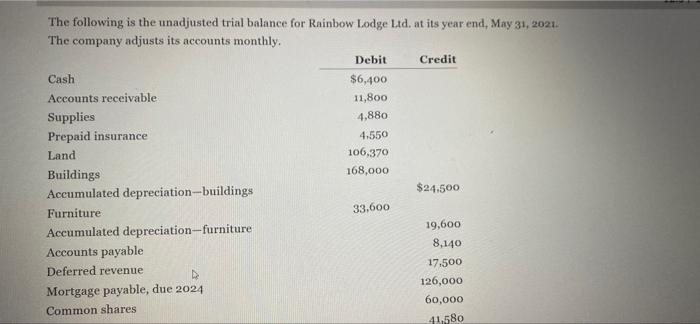

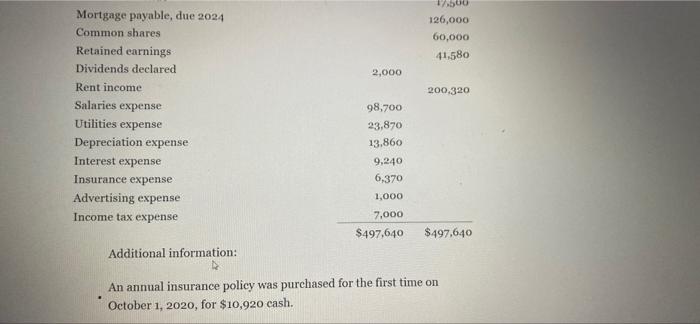

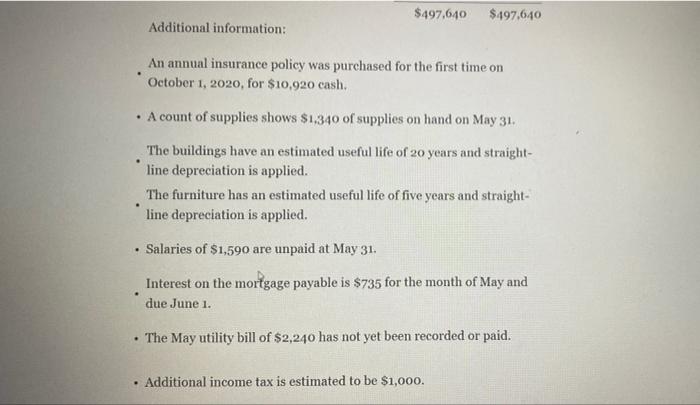

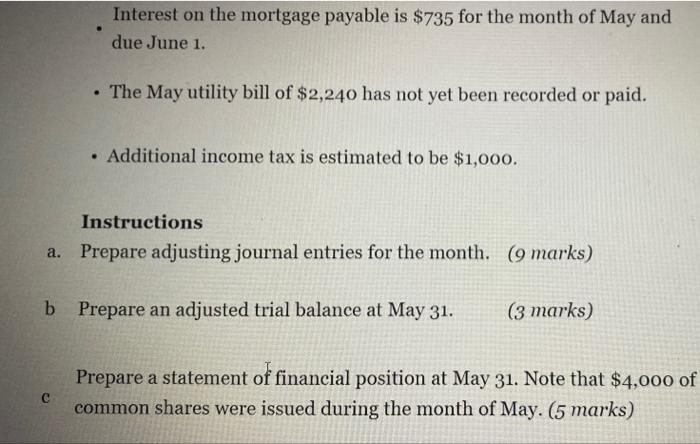

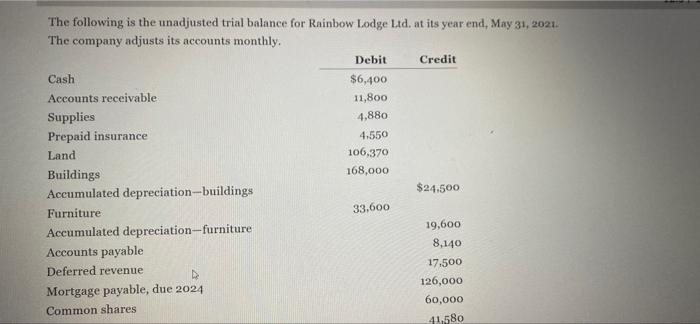

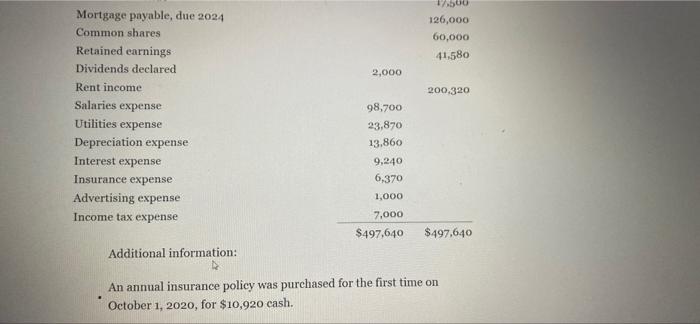

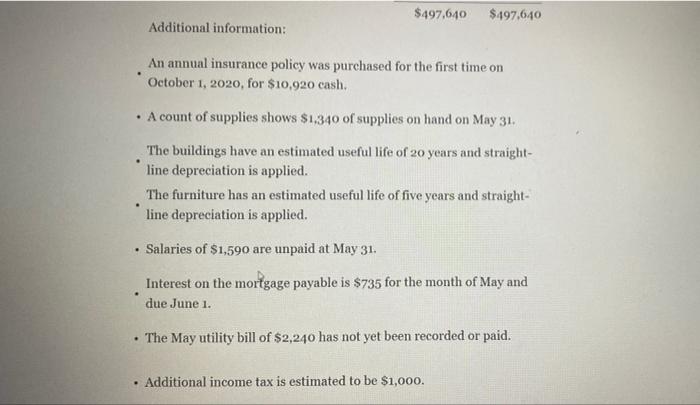

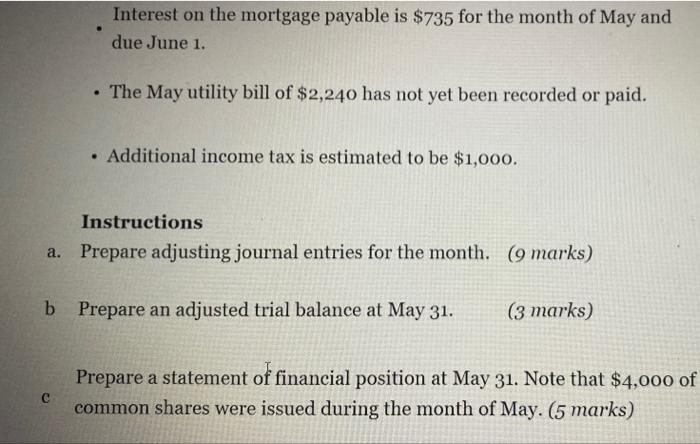

The following is the unadjusted trial balance for Rainbow Lodge Ltd. at its year end, May 31, 2021. The company adjusts its accounts monthly. Debit Credit Cash $6,400. Accounts receivable 11,800. Supplies 4,880 Prepaid insurance 4.550 Land 106,370 Buildings 168,000 Accumulated depreciation-buildings $24.500 Furniture 33,600 Accumulated depreciation-furniture 19,600 Accounts payable 8,140 Deferred revenue 17,500 Mortgage payable, due 2024 126,000 Common shares 60,000 41,580 Mortgage payable, due 2024 Common shares. Retained earnings Dividends declared Rent income Salaries expense Utilities expense Depreciation expense Interest expense Insurance expense Advertising expense Income tax expense 17,500 126,000 60,000 41,580 200,320 $497,640 2,000 98,700 23,870 13,860 9,240 6,370 1,000 7,000 $497,640 Additional information: An annual insurance policy was purchased for the first time on October 1, 2020, for $10,920 cash. $497,640 $497,640 Additional information: . An annual insurance policy was purchased for the first time on October 1, 2020, for $10,920 cash. A count of supplies shows $1,340 of supplies on hand on May 31. The buildings have an estimated useful life of 20 years and straight- line depreciation is applied. The furniture has an estimated useful life of five years and straight- line depreciation is applied. . Salaries of $1,590 are unpaid at May 31. Interest on the mortgage payable is $735 for the month of May and due June 1. The May utility bill of $2,240 has not yet been recorded or paid. . Additional income tax is estimated to be $1,000. Interest on the mortgage payable is $735 for the month of May and due June 1. The May utility bill of $2,240 has not yet been recorded or paid. . Additional income tax is estimated to be $1,000. Instructions a. Prepare adjusting journal entries for the month. (9 marks) Prepare an adjusted trial balance at May 31. (3 marks) Prepare a statement of financial position at May 31. Note that $4,000 of common shares were issued during the month of May. (5 marks) C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started