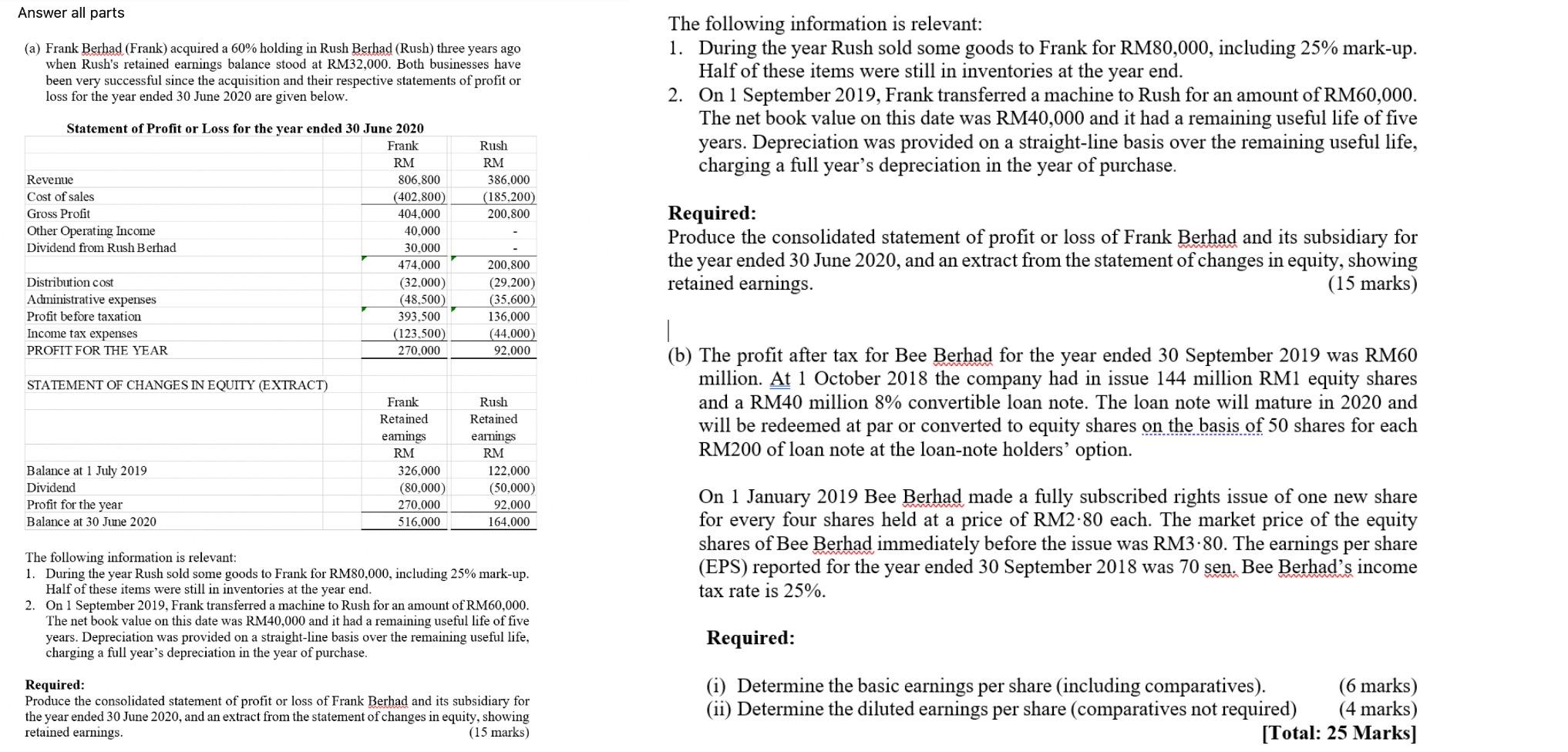

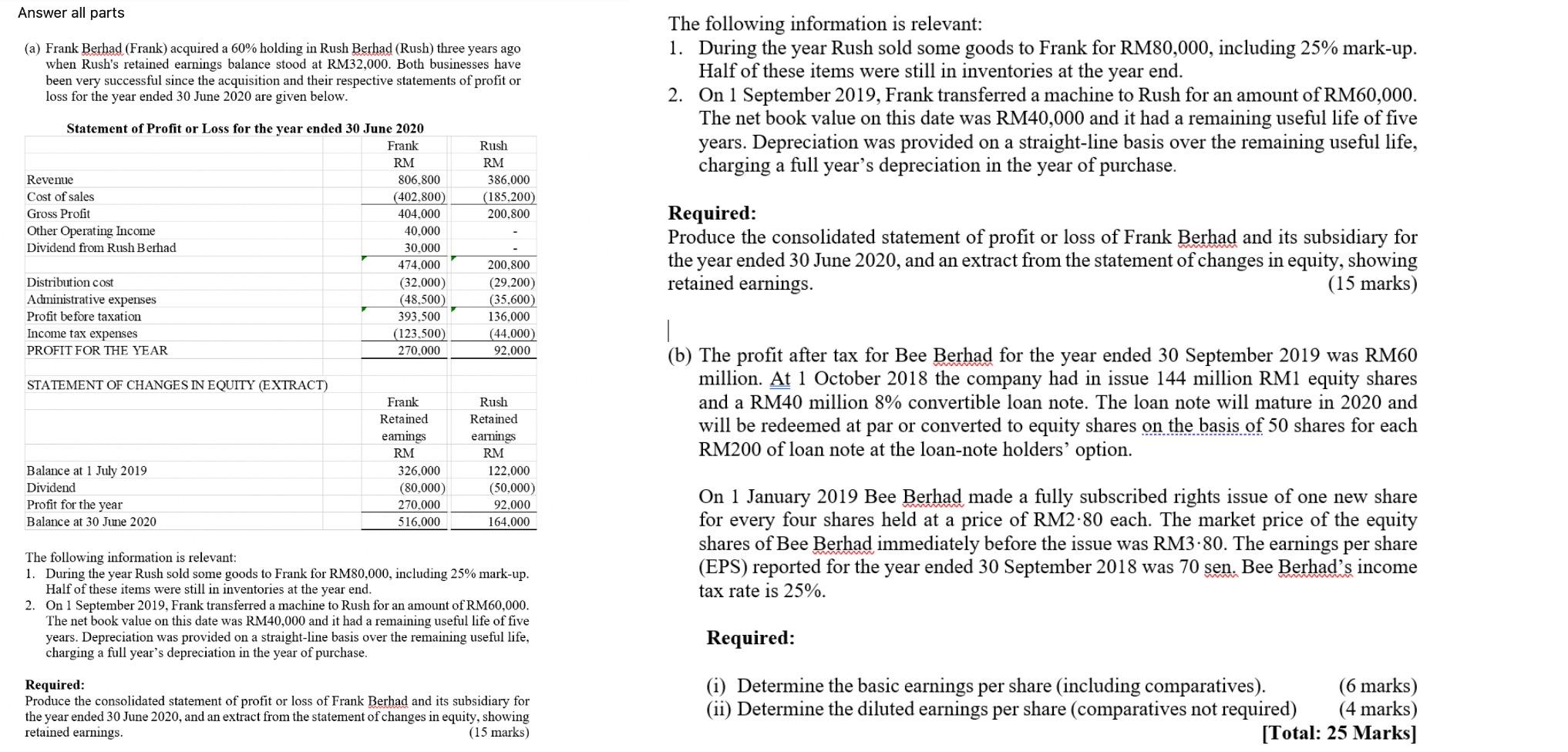

Answer all parts (a) Frank Berhad (Frank) acquired a 60% holding in Rush Berhad (Rush) three years ago when Rush's retained earnings balance stood at RM32,000. Both businesses have been very successful since the acquisition and their respective statements of profit or loss for the year ended 30 June 2020 are given below. The following information is relevant: 1. During the year Rush sold some goods to Frank for RM80,000, including 25% mark-up. Half of these items were still in inventories at the year end. 2. On 1 September 2019, Frank transferred a machine to Rush for an amount of RM60,000. The net book value on this date was RM40,000 and it had a remaining useful life of five years. Depreciation was provided on a straight-line basis over the remaining useful life, charging a full year's depreciation in the year of purchase. Rush RM 386.000 (185.200) 200.800 Statement of Profit or Loss for the year ended 30 June 2020 Frank RM Revenue 806.800 Cost of sales (402,800) Gross Profit 404.000 Other Operating Income 40.000 Dividend from Rush Berhad 30.000 474.000 Distribution cost (32,000) Adininistrative expenses (48,500) Profit before taxation 393.500 Income tax expenses (123,500) PROFIT FOR THE YEAR 270,000 Required: Produce the consolidated statement of profit or loss of Frank Berhad and its subsidiary for the year ended 30 June 2020, and an extract from the statement of changes in equity, showing retained earnings. (15 marks) 200.800 (29,200) (35,600 136.000 (44.000 92.000 1 STATEMENT OF CHANGES IN EQUITY (EXTRACT) Frank Retained earnings RM 326,000 (80,000) 270,000 516.000 Rush Retained earnings RM 122.000 (50,000) 92.000 164.000 The profit after tax for Bee Berhad for the year ended 30 September 2019 w RM60 million. At 1 October 2018 the company had in issue 144 million RM1 equity shares and a RM40 million 8% convertible loan note. The loan note will mature in 2020 and will be redeemed at par or converted to equity shares on the basis of 50 shares for each RM200 of loan note at the loan-note holders' option. Balance at 1 July 2019 Dividend Profit for the year Balance at 30 June 2020 On 1 January 2019 Bee Berhad made a fully subscribed rights issue of one new share for every four shares held at a price of RM2-80 each. The market price of the equity shares of Bee Berhad immediately before the issue was RM3.80. The earnings per share (EPS) reported for the year ended 30 September 2018 was 70 sen. Bee Berhad's income tax rate is 25%. The following information is relevant: 1. During the year Rush sold some goods to Frank for RM80,000, including 25% mark-up. Half of these items were still in inventories at the year end. 2. On 1 September 2019, Frank transferred a machine to Rush for an amount of RM60,000. The net book value on this date was RM40,000 and it had a remaining useful life of five years. Depreciation was provided on a straight-line basis over the remaining useful life, charging a full year's depreciation in the year of purchase. Required: Required: Produce the consolidated statement of profit or loss of Frank Berhad and its subsidiary for the year ended 30 June 2020, and an extract from the statement of changes in equity, showing retained earnings. (15 marks) (i) Determine the basic earnings per share (including comparatives). (6 marks) (ii) Determine the diluted earnings per share (comparatives not required) (4 marks) [Total: 25 Marks]