Answered step by step

Verified Expert Solution

Question

1 Approved Answer

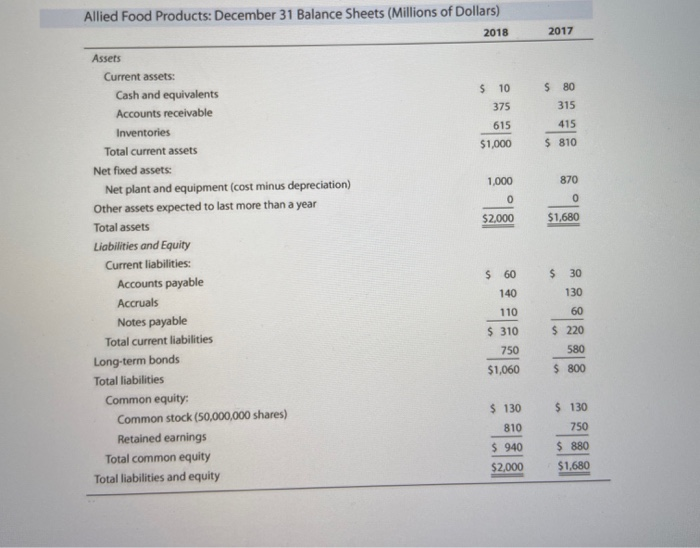

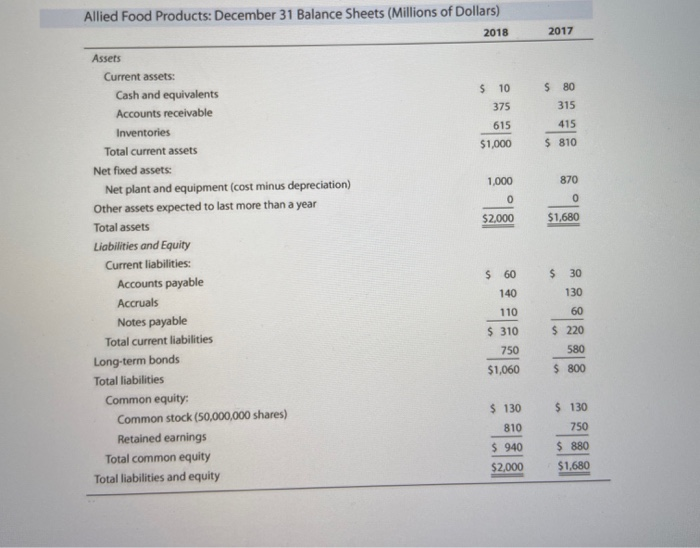

answer all parts and lable them clearly. thank you! 2017 $ 80 375 $1,000 $2.000 0 $1,680 Allied Food Products: December 31 Balance Sheets (Millions

answer all parts and lable them clearly. thank you!

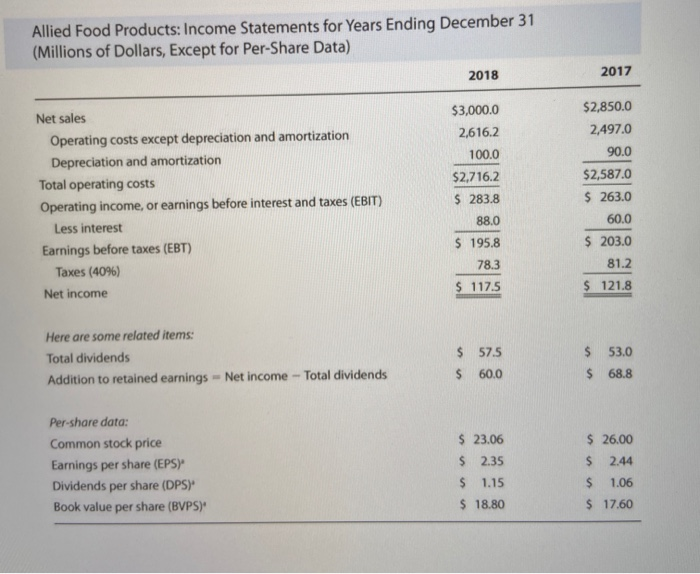

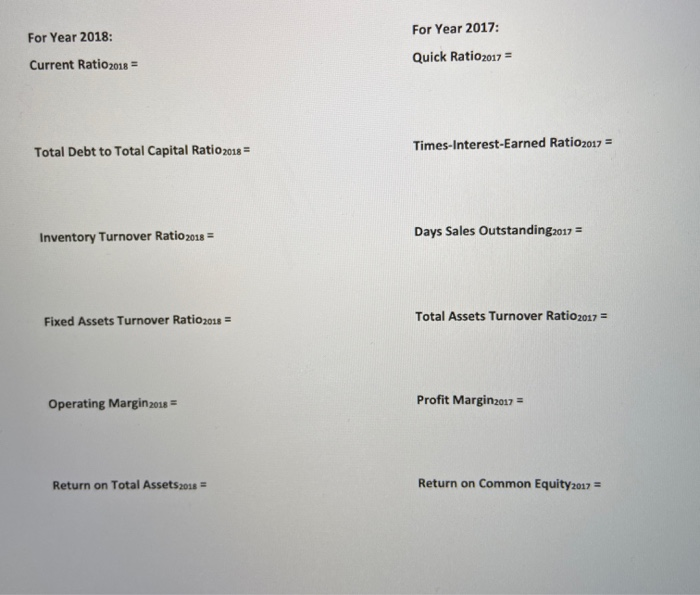

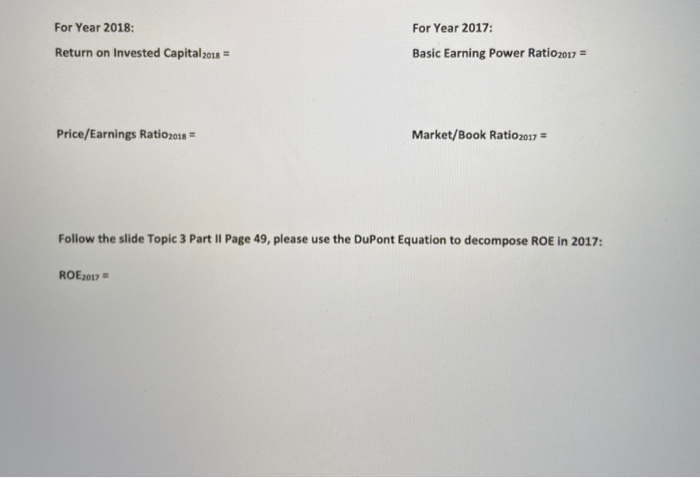

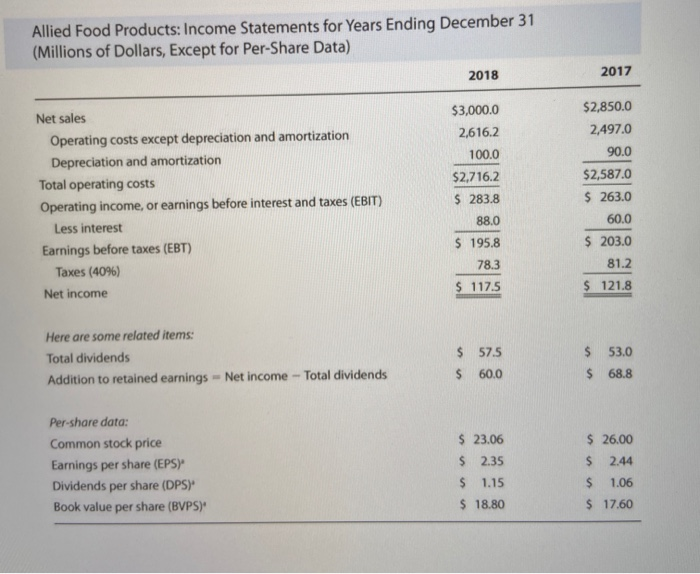

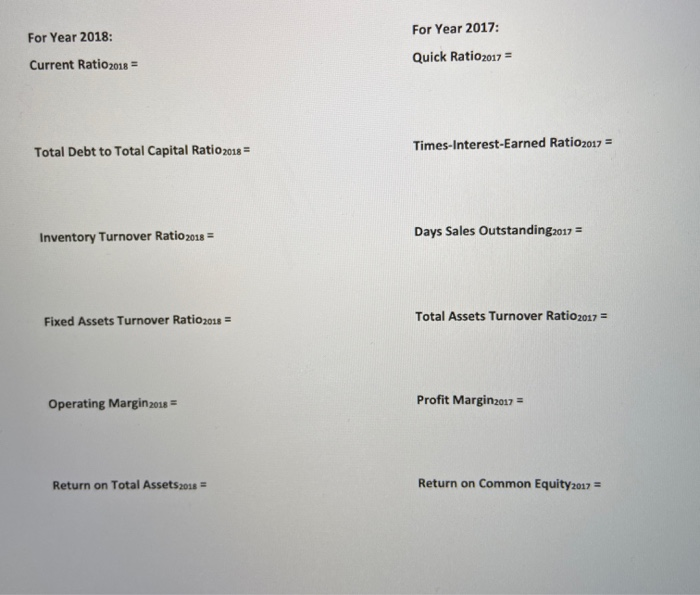

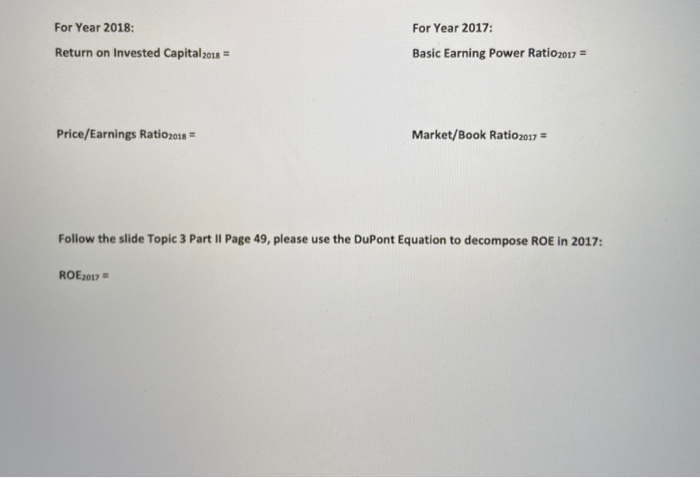

2017 $ 80 375 $1,000 $2.000 0 $1,680 Allied Food Products: December 31 Balance Sheets (Millions of Dollars) 2018 Assets Current assets: Cash and equivalents 5 10 Accounts receivable Inventories 615 Total current assets Net fixed assets: Net plant and equipment (cost minus depreciation) 1.000 Other assets expected to last more than a year Total assets Liabilities and Equity Current liabilities: Accounts payable $ 60 Accruals 140 Notes payable 110 Total current liabilities $ 310 Long-term bonds Total liabilities $1,060 Common equity Common stock (50,000,000 shares) $ 130 Retained earnings Total common equity Total liabilities and equity $ 30 130 60 $ 220 750 $ 800 $ 130 750 $ 880 $1,680 Allied Food Products: Income Statements for Years Ending December 31 (Millions of Dollars, Except for Per-Share Data) 2018 2017 Net sales Operating costs except depreciation and amortization Depreciation and amortization Total operating costs Operating income, or earnings before interest and taxes (EBIT) Less interest Earnings before taxes (EBT) Taxes (40%) Net income $3,000.0 2,616.2 100.0 $2.716.2 $ 283.8 88.0 $ 195.8 78.3 $ 1175 $2,850.0 2,497.0 90.0 $2,587.0 $ 263.0 60.0 $ 203.0 81.2 $ 121.8 Here are some related items: Total dividends Addition to retained earnings - Net income - Total dividends $ 575 $ 60.0 $ 53.0 $ 68.8 Per-share data: Common stock price Earnings per share (EPS) Dividends per share (DPS) Book value per share (BVPS)" $ 23.06 $ 2.35 $ 1.15 $18.80 $ 26.00 $ 2.44 $ 1.06 $17.60 For Year 2018: For Year 2017: Quick Ratio 2017= Current Ratio2018 = Total Debt to Total Capital Ratio 2018 = Times-Interest-Earned Ratio 2017= Inventory Turnover Ratio 2018 = Days Sales Outstanding 2017= Fixed Assets Turnover Ratio 2018 = Total Assets Turnover Ratio 2017= Operating Margin 2018 = Profit Margin 2017= Return on Total Assets2018 = Return on Common Equity 2017= For Year 2018: Return on invested Capital2018 = For Year 2017: Basic Earning Power Ratio 2017 - Price/Earnings Ratio 2018 - Market/Book Ratio 2017 - Follow the slide Topic 3 Part II Page 49, please use the DuPont Equation to decompose ROE in 2017: ROE2017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started