Answered step by step

Verified Expert Solution

Question

1 Approved Answer

*Answer all parts and show process Assume the M&M model with corporate taxes and financial distress holds and that the CAPM is true. Protec Corporations

*Answer all parts and show process

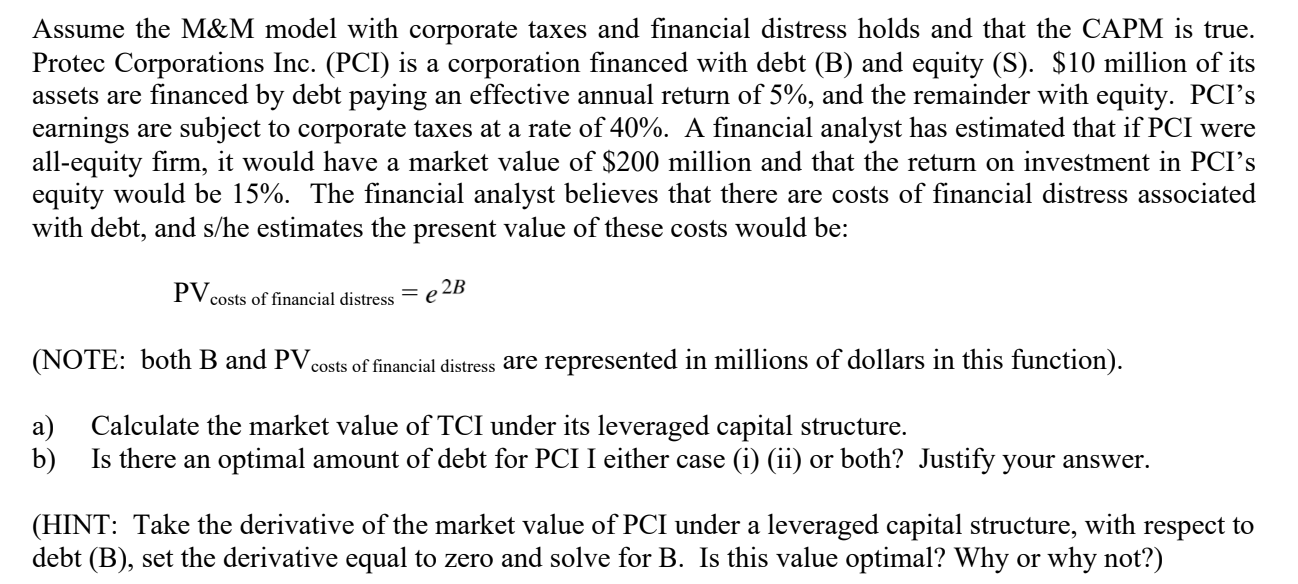

Assume the M&M model with corporate taxes and financial distress holds and that the CAPM is true. Protec Corporations Inc. (PCI) is a corporation financed with debt (B) and equity (S). $10 million of its assets are financed by debt paying an effective annual return of 5%, and the remainder with equity. PCI's earnings are subject to corporate taxes at a rate of 40%. A financial analyst has estimated that if PCI were all-equity firm, it would have a market value of $200 million and that the return on investment in PCI's equity would be 15%. The financial analyst believes that there are costs of financial distress associated with debt, and s/he estimates the present value of these costs would be: 2B PV costs of financial distress (NOTE: both B and PV costs of financial distress are represented in millions of dollars in this function). a) b) Calculate the market value of TCI under its leveraged capital structure. Is there an optimal amount of debt for PCI I either case (i) (ii) or both? Justify your answer. (HINT: Take the derivative of the market value of PCI under a leveraged capital structure, with respect to debt (B), set the derivative equal to zero and solve for B. Is this value optimal? Why or why not?) Assume the M&M model with corporate taxes and financial distress holds and that the CAPM is true. Protec Corporations Inc. (PCI) is a corporation financed with debt (B) and equity (S). $10 million of its assets are financed by debt paying an effective annual return of 5%, and the remainder with equity. PCI's earnings are subject to corporate taxes at a rate of 40%. A financial analyst has estimated that if PCI were all-equity firm, it would have a market value of $200 million and that the return on investment in PCI's equity would be 15%. The financial analyst believes that there are costs of financial distress associated with debt, and s/he estimates the present value of these costs would be: 2B PV costs of financial distress (NOTE: both B and PV costs of financial distress are represented in millions of dollars in this function). a) b) Calculate the market value of TCI under its leveraged capital structure. Is there an optimal amount of debt for PCI I either case (i) (ii) or both? Justify your answer. (HINT: Take the derivative of the market value of PCI under a leveraged capital structure, with respect to debt (B), set the derivative equal to zero and solve for B. Is this value optimal? Why or why not?)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started