answer all parts

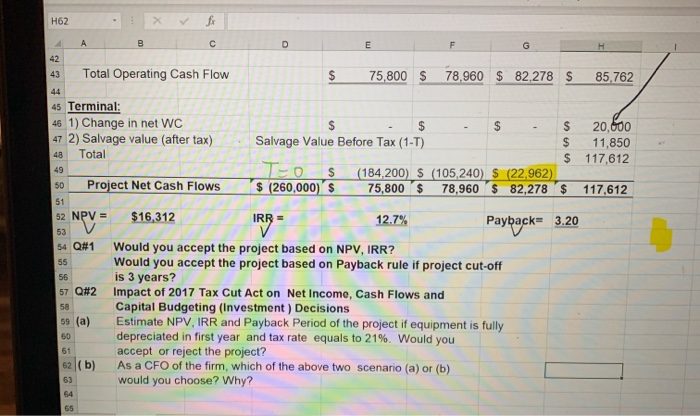

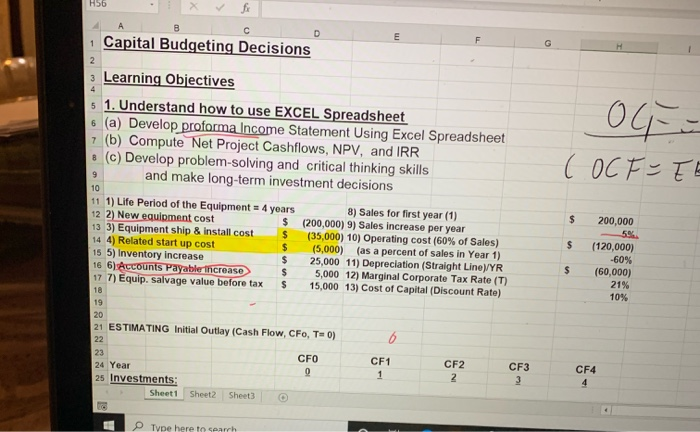

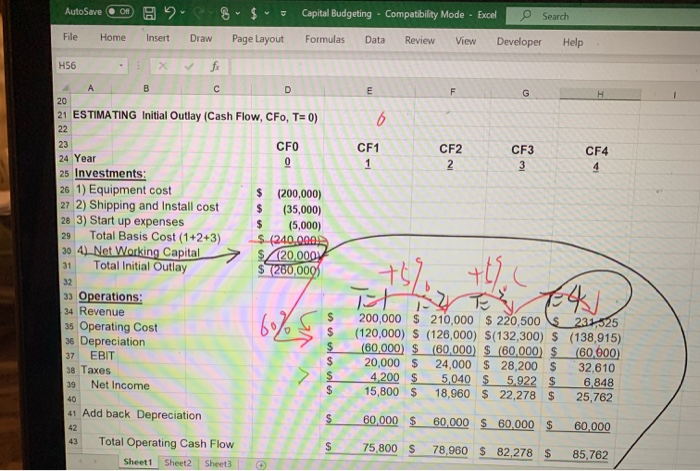

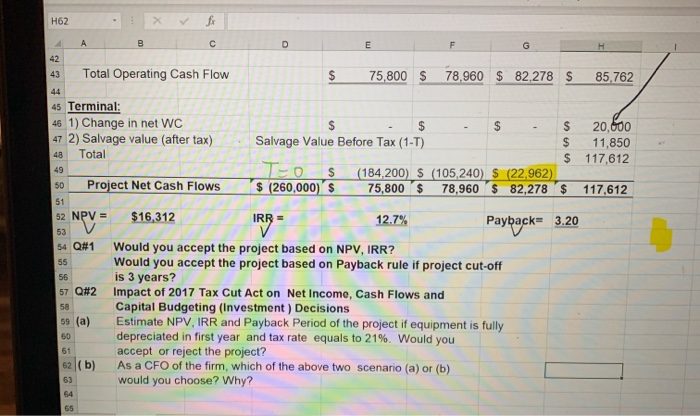

H56 A B D H 4 E 1 Capital Budgeting Decisions 2 3 Learning Objectives 5 1. Understand how to use EXCEL Spreadsheet 6 (a) Develop proforma Income Statement Using Excel Spreadsheet 7 (b) Compute Net Project Cashflows, NPV, and IRR . (c) Develop problem-solving and critical thinking skills and make long-term investment decisions 11 1) Life Period of the Equipment = 4 years 8) Sales for first year (1) 12 2) New equipment cost $ (200,000) 9) Sales increase per year 13 3) Equipment ship & Install cost $ (35,000) 10) Operating cost (60% of Sales) 14 4) Related start up cost (5,000) (as a percent of sales in Year 1) 15 5) Inventory Increase 25,000 11) Depreciation (Straight Line)/YR 16 6) Accounts Payable increase 5,000 12) Marginal Corporate Tax Rate (T) 177) Equip. salvage value before tax 15,000 13) Cost of Capital (Discount Rate) OG (OCF=TE 9 10 $ $ $ $ $ $ 200,000 5% (120,000) -60% (60,000) 21% 10% $ 18 19 20 21 ESTIMATING Initial Outlay (Cash Flow, CFO, T-0) 22 6 23 24 Year 25 Investments: Sheet1 CFO 9 CF1 1 CF3 CF2 2 CF4 Sheet2 Sheet3 Type here to search AutoSave of 28- $ - Capital Budgeting - Compatibility Mode - Excel e Search File Home Insert Draw Page Layout Formulas Data Review View Developer Help H56 fi E F G 6 CF2 CF1 1 2 CF3 3 CF4 4 29 A B D 20 21 ESTIMATING Initial Outlay (Cash Flow, CFO, T=0) 22 23 CFO 24 Year 0 25 Investments: 26 1) Equipment cost $ (200,000) 27 2) Shipping and Install cost $ (35,000) 28 3) Start up expenses $ (5,000) Total Basis Cost (1+2+3) $ (240.000) 304) Net Working Capital $120,000 31 Total Initial Outlay $ 260,000 32 33 Operations: 34 Revenue 35 Operating Cost 36 Depreciation EBIT 38 Taxes Net Income 40 41 Add back Depreciation +the TH 60% 37 200,000 $ 210,000 $ 220,500 237,325 (120,000) S (126,000) $(132,300) $ (138,915) (60,000) $ (60,000) $ (60,000) $ (60.000) 20,000 $ 24,000 $ 28,200 $ 32,610 4,200 $ 5,040 $ 5.922 $ 6.848 15,800 $ 18,960 $ 22,278 $ 25,762 39 $ 60.000 $ 60,000 $60,000 $ 42 60,000 $ Total Operating Cash Flow Sheet1 Sheet2 Sheet3 75 800 $ 78,960 $ 82,278 $ 85,762 H62 fx B E F G H 42 43 Total Operating Cash Flow $ 75,800 $ 78.960 $ 82.278 S 85,762 48 49 50 45 Terminal: 46 1) Change in net WC $ $ $ $ 20,600 47 2) Salvage value (after tax) Salvage Value Before Tax (1-T) $ 11,850 Total $ 117,612 $ (184,200) S (105,240) $ (22,962) Project Net Cash Flows $ (260,000) $ 75,800 $ 78,960 $ 82,278 '$ 117,612 51 52 NPV = $16,312 IRR = 12.7% Payback= 3.20 53 54 Q#1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off is 3 years? 57 Q#2 Impact of 2017 Tax Cut Act on Net Income, Cash Flows and Capital Budgeting (Investment ) Decisions 59 (a) Estimate NPV, IRR and Payback Period of the project if equipment is fully depreciated in first year and tax rate equals to 21%. Would you accept or reject the project? 62 (b) As a CFO of the firm, which of the above two scenario (a) or (b) would you choose? Why? 55 56 58 50 61 63 64 65

answer all parts

answer all parts