Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer all parts it is complete i just solved it with those pictures its not incomplete Suppose Alcatel-Lucent has an equity cost of capital of

answer all parts

it is complete i just solved it with those pictures

its not incomplete

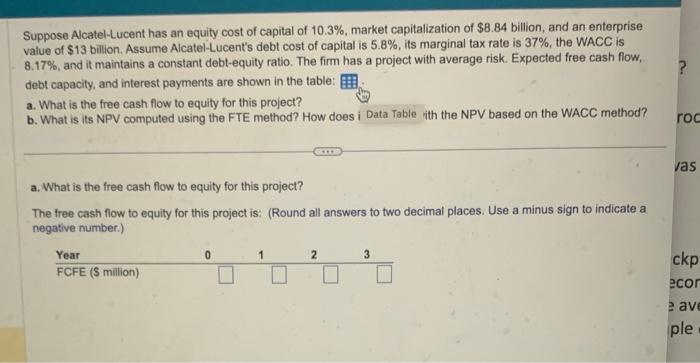

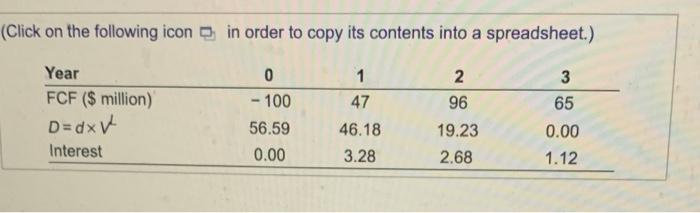

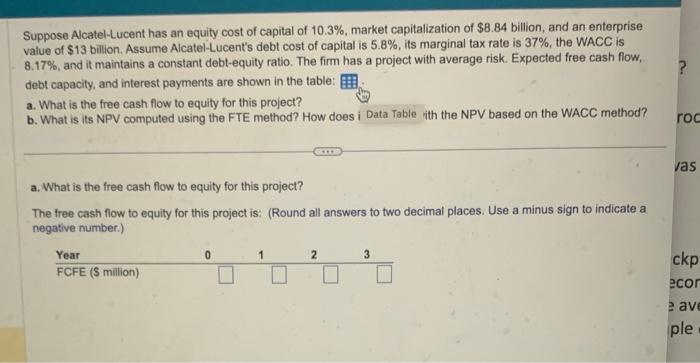

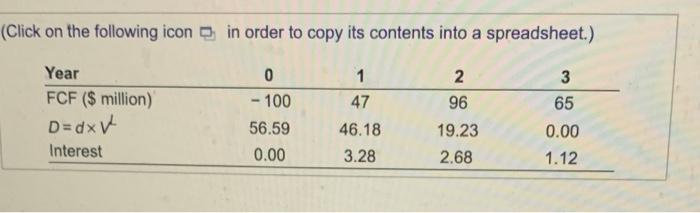

Suppose Alcatel-Lucent has an equity cost of capital of 10.3%, market capitalization of $8.84 billion, and an enterprise value of $13 billion. Assume Alcatel-Lucent's debt cost of capital is 5.8%, its marginal tax rate is 37%, the WACC is 8.17%, and it maintains a constant debt-equity ratio. The firm has a project with average risk. Expected free cash flow, debt capacity, and interest payments are shown in the table: a. What is the free cash flow to equity for this project? b. What is its NPV computed using the FTE method? How does ith the NPV based on the WACC method? a. What is the free cash flow to equity for this project? The free cash fow to equity for this project is: (Round all answers to two decimal places. Use a minus sign to indicate a negative number.) Click on the following icon in order to copy its contents into a spreadsheet.) Suppose Alcatel-Lucent has an equity cost of capital of 10.3%, market capitalization of $8.84 billion, and an enterprise value of $13 billion. Assume Alcatel-Lucent's debt cost of capital is 5.8%, its marginal tax rate is 37%, the WACC is 8.17%, and it maintains a constant debt-equity ratio. The firm has a project with average risk. Expected free cash flow, debt capacity, and interest payments are shown in the table: a. What is the free cash flow to equity for this project? b. What is its NPV computed using the FTE method? How does ith the NPV based on the WACC method? a. What is the free cash flow to equity for this project? The free cash fow to equity for this project is: (Round all answers to two decimal places. Use a minus sign to indicate a negative number.) Click on the following icon in order to copy its contents into a spreadsheet.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started