answer all parts of the question and only if you know how to, thank you

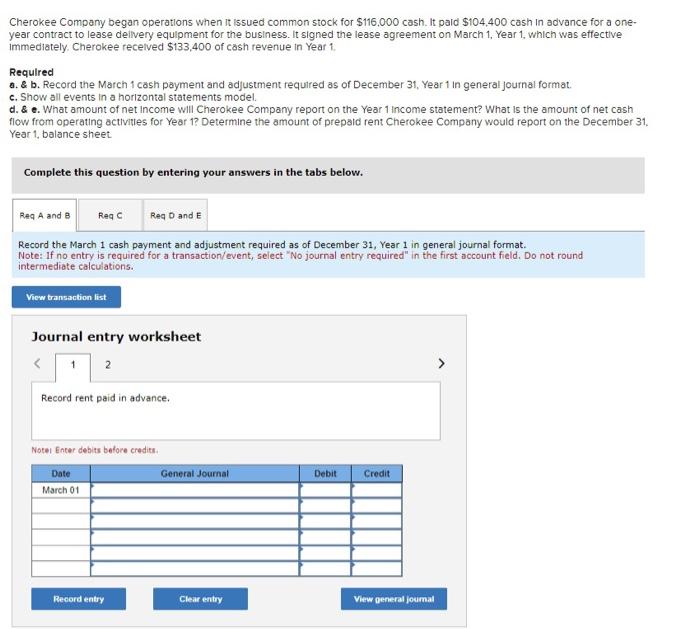

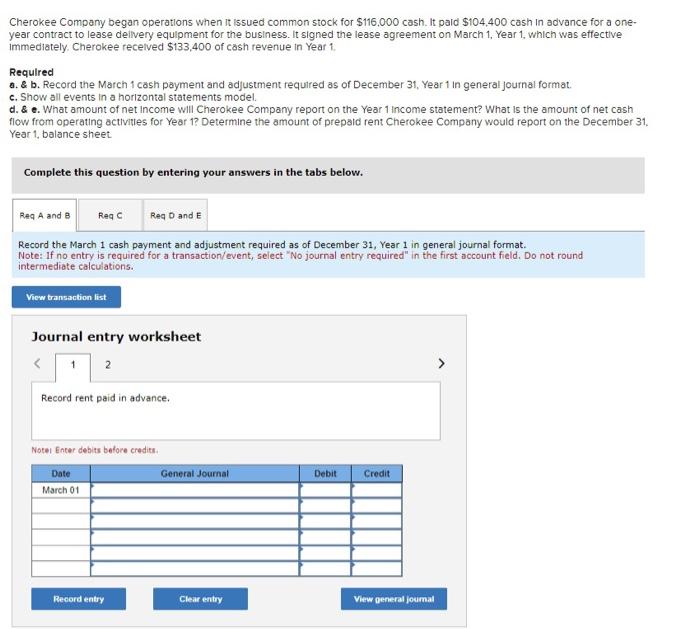

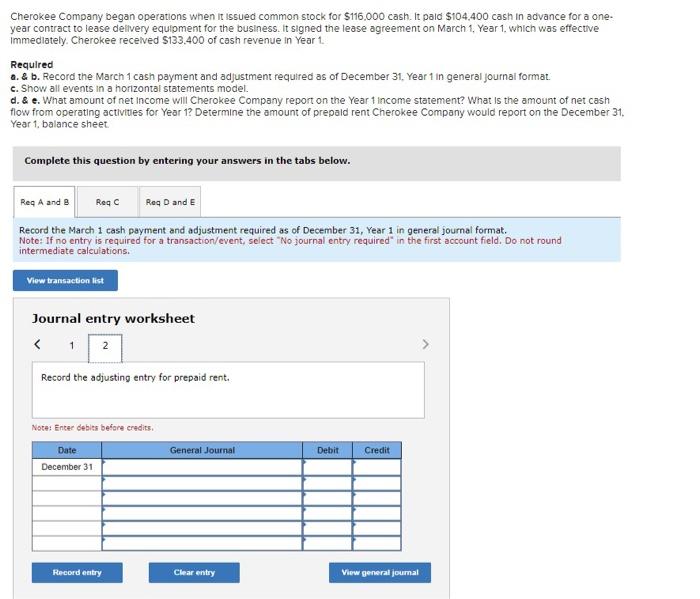

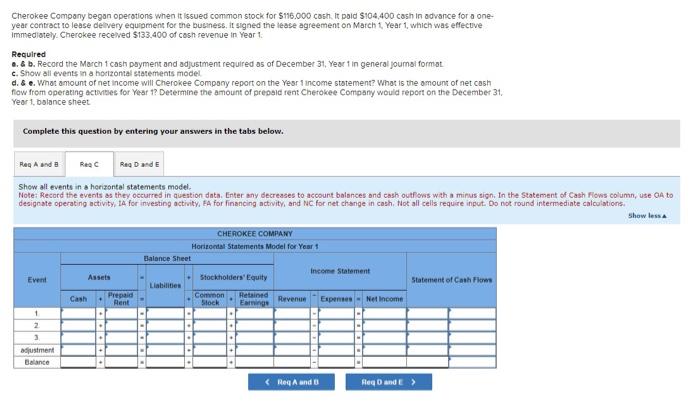

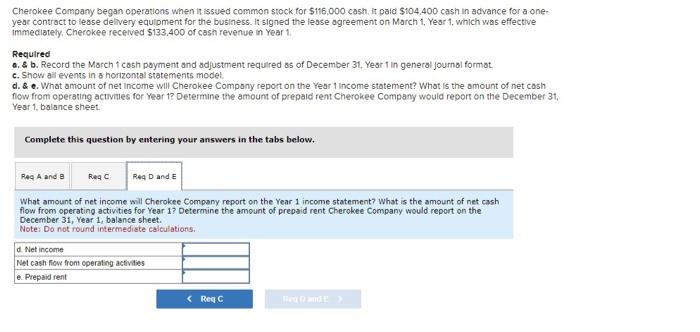

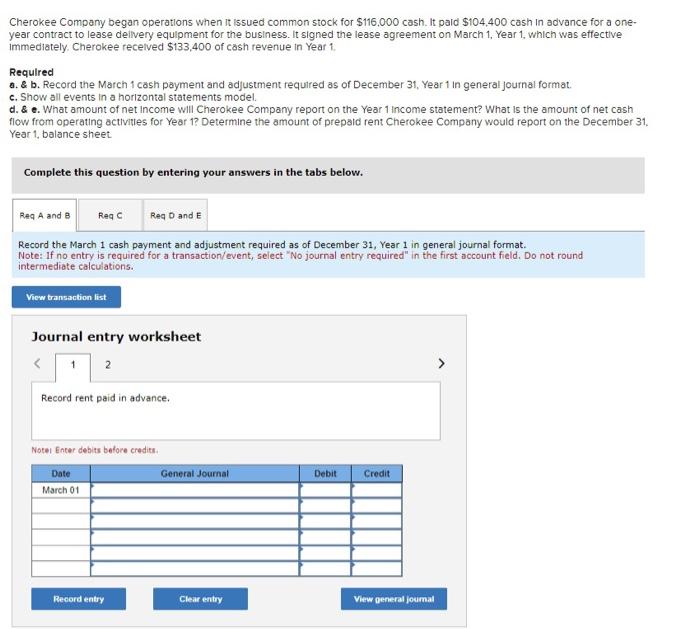

Cherokee Company began operations when it issued common stock for $116,000 cash. It paid $104,400 cash in advance for a oneyear contract to lease delivery equipment for the business. It signed the lease agreement on March 1, Year 1, which was effective immediately. Cherokee recelved $133,400 of cash revenue in Year 1. Required a. \& b. Record the March 1 cash payment and adjustment required as of December 31, Year 1 in general journal format. c. Show all events in a horizontal statements model. d. \& e. What amount of net income will Cherokee Company report on the Year 1 income statement? What is the amount of net cash flow from operating activites for Year 1 ? Determine the amount of prepaid rent Cherokee Company would report on the December 31. Year 1, balance sheet Complete this question by entering your answers in the tabs below. Record the March 1 cash payment and adjustment required as of December 31 , Year 1 in general journal format. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Journal entry worksheet 2 Notel Enter debits before credits. Cherokee Company began operations when it issued common stock for $116,000cash. It paid $104,400 cash in advance for a one. year contract to lease delivery equipment for the business. It signed the lease agreement on March 1, Year 1 , which was effective immedlately. Cherokee recelved $133.400 of cash revenue in Year 1 . Required a. \& b. Record the March 1 cash payment and adjustment required as or December 31 , Year 1 in general journal format. c. Show all events in a horizontal statements model. d. \& e. What amount of net income will Cherokee Company report on the Year 1 income statement? What Is the amount of net cash flow from operating actlvities for Year 1 ? Determine the amount of prepald rent Cherokee Company would report on the December 31 . Year 1, balance sheet. Complete this question by entering your answers in the tabs below. Record the March 1 cash payment and adjustment required as of December 31 , Year 1 in general joumal format. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Journal entry worksheet Cherokee Compsny begon operations when it issued common stock for $16.000cash. It poid $104.400 cash in odvance for a one. year contract to lease delvery equipment for the business, it agned the lease agreement on Match 1 , Year 1 , which was effectve immediotely. Cherokee recelved $133,400 of cosh revense in Yeor 1. Reculred a. \& b. Record the March 1 cash payment and adjustment required os of December 31, Year 1 in general joumsi form.ot. c. Show all events in a horizonial sqatements model. d. S e. Whot amount of net income will Cherokee Compony report on the Yesr 1 income statement? What is the omount of net cash fiow from operating actiases for Year 1? Desermine the amount of presald rent Cherokee Company would report on the December 31 . year 1, bolance sheet. Complete this question by entering your answers in the tabs below. Shew all events in a herizontal statemerts model. Note: Record the events as they occurred in question data. Enter any becreases to accourt balances ond cashoutfows wath a minus sigh, In the Statement of Cash fiows column, use OA to designate operating activity, la for investiog activity, EA for financing activity, and NC for net change in cash, Not all cells require input. Do not round intermediate calculations. Cherokee Company began operations when it issued common stock for $116,000cash, It paid $104,400cash in advance for a oneyear contract to lease delivery equipment for the business. it signed the leose agreement on March 1, Year 1, which was effective immediately, Cherokee recelved $133,400 of cash revenue in Year 1 . Required a. \& b. Record the March 1 cosh poyment and adjustment required as of December 31, Year 1 in general joumbi formot. c. Show all events in a horizontal statements model d. \& e. What amount of net income will Cherokee Company report on the Year 1 income statement? Whot is the omount of net cash fow from operating activities for Year 1 ? Determine the amount of prepaid rent Cherokee Company would report on the December 31 , Year 1 , balance sheet. Complete this question by entering your answers in the tabs below. What amount of net income will Cherokee Company report on the Year 1 income statement? What is the amount of net cash flow from operating activities for Year 1 ? Determine the amount of prepaid rent Cherokee Company would report on the December 31 , Year 1 , balance sheet. Note: Do not round intermediste calculations