Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer All parts or thumbs down. i am requesting you to answer it all MFG Company experlences the following cost behavior patterns each week: Fixed

answer All parts or thumbs down. i am requesting you to answer it all

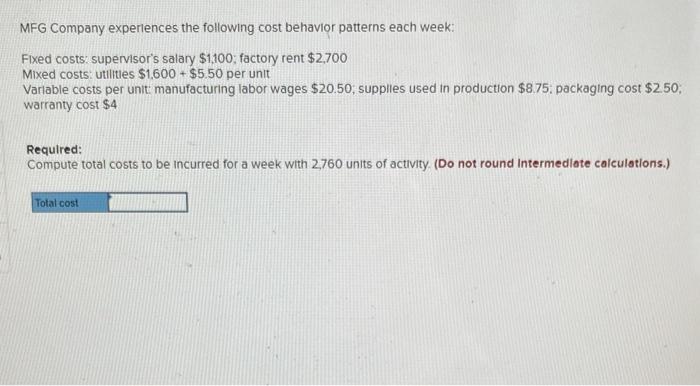

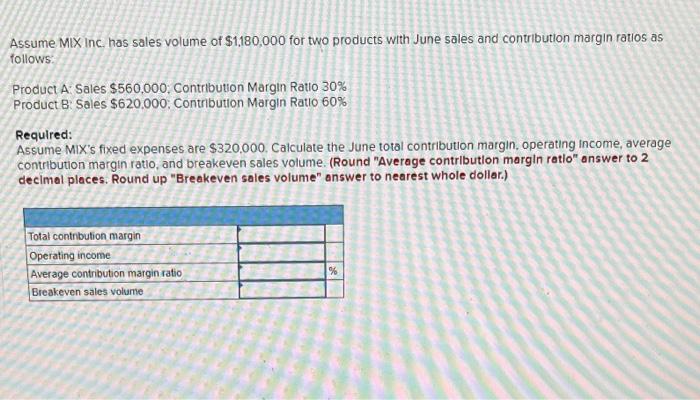

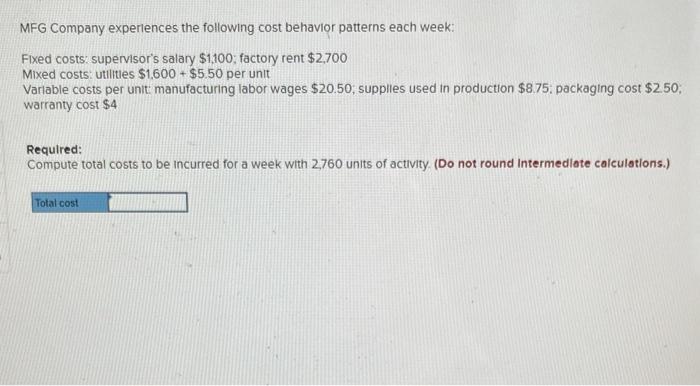

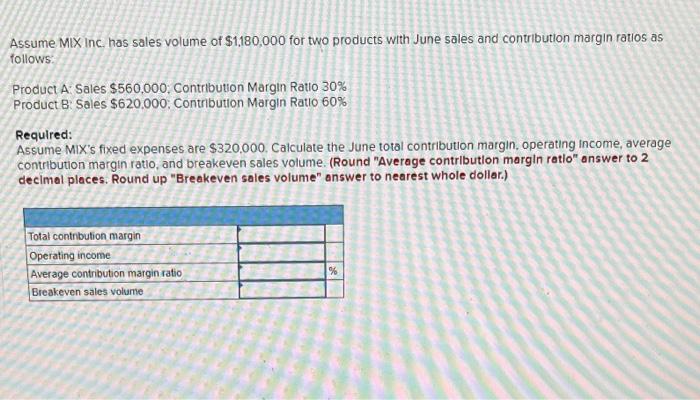

MFG Company experlences the following cost behavior patterns each week: Fixed costs: supervisor's salary $1,100; factory rent $2,700 Mixed costs: utilities $1.600+$5.50 per unit Variable costs per unit: manufacturing labor wages $20.50; supplies used in production $8.75 : packaging cost $2.50; warranty cost $4 Required: Compute total costs to be incurred for a week with 2,760 units of activity. (Do not round Intermediate caiculations.) Assume MiX inc. has sales volume of $1,180,000 for two products with June sales and contribution margin ratios as follows: Product A: Sales $560,000 : Contribution Margin Ratio 30% Product B: Sales $620,000 : Contribution Margin Ratlo 60% Required: Assume Mix's fixed expenses are $320.000. Calculate the June total contribution margin, operating income, average contribution margin ratio, and breakeven sales volume. (Round "Average contribution margin ratio" answer to 2 decimal places. Round up "Breakeven sales volume" answer to nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started