Answered step by step

Verified Expert Solution

Question

1 Approved Answer

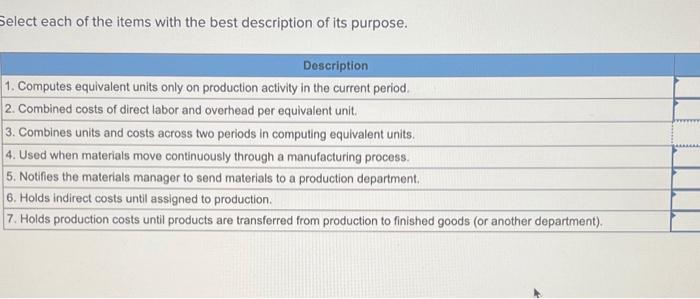

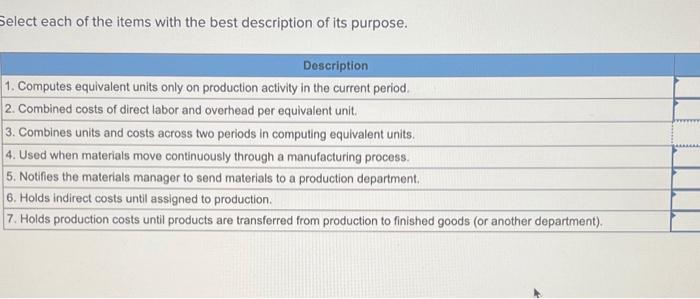

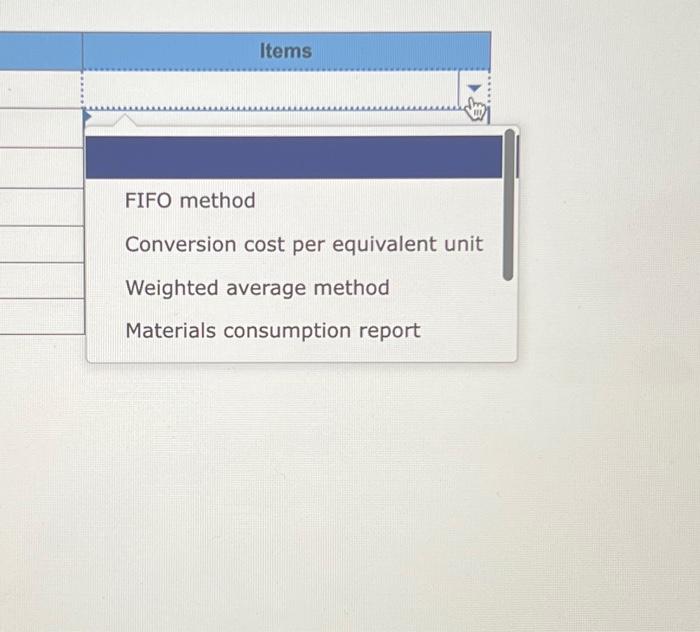

Answer all Parts Part 1 Part 2 part 3 Select each of the items with the best description of its purpose. FIFO method Conversion cost

Answer all Parts

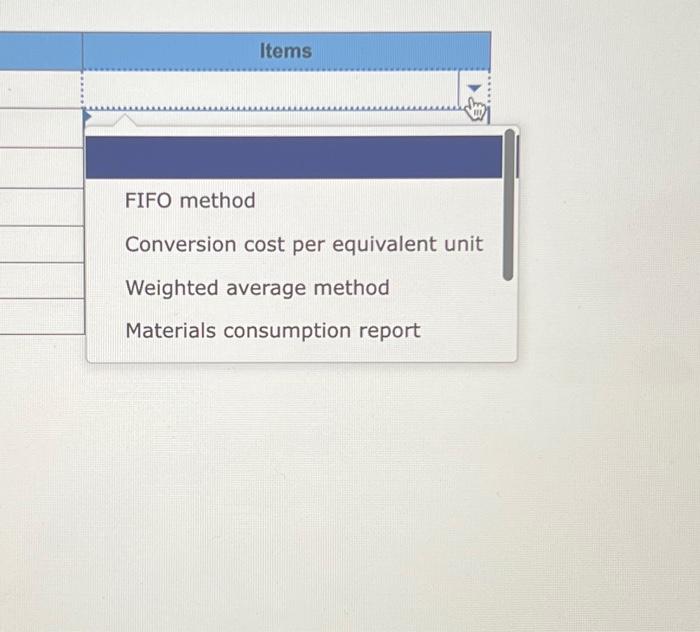

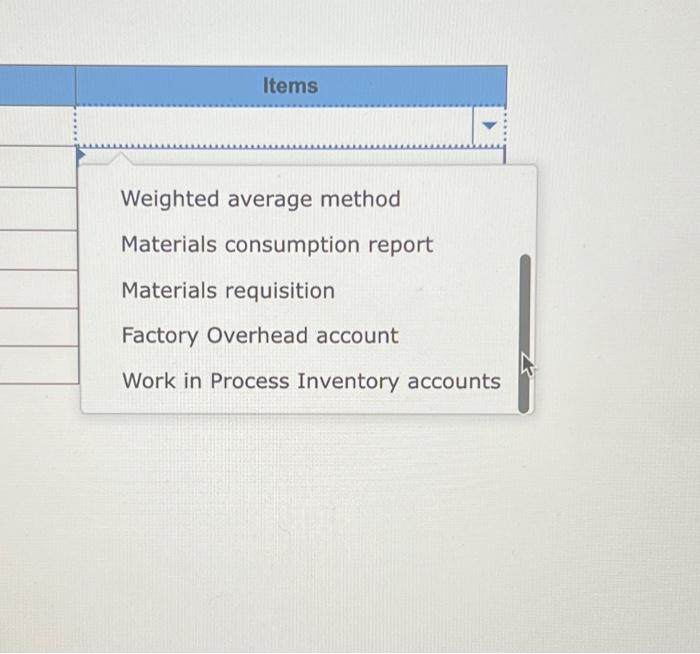

Select each of the items with the best description of its purpose. FIFO method Conversion cost per equivalent unit Weighted average method Materials consumption report Weighted average method Materials consumption report Materials requisition Factory Overhead account Work in Process Inventory accounts Process and job order manufacturing operations both combine materials, labor, and overhead items in the process of producing products. True or False Conversion costs consist of direct materials and factory overhead. True or False Equivalent units of production is the number of whole units that could have been started and completed given the costs incurred in a period. True or False Conversion costs consist of direct labor and factory overhead. True or False Process costing is applied to operations that use customized processes to make unique products. True or False The weighted-average method of process costing excludes the beginning work in process inventory costs in computing the cost per equivalent unit for the current period. True or False Part 1

Part 2

part 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started