Answered step by step

Verified Expert Solution

Question

1 Approved Answer

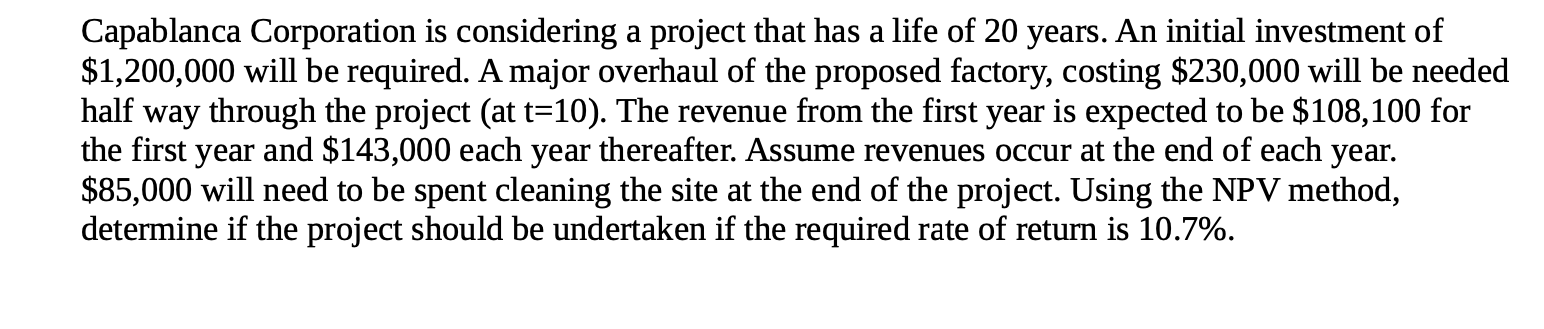

answer all parts please Capablanca Corporation is considering a project that has a life of 20 years. An initial investment of $1,200,000 will be required.

answer all parts please

answer all parts please

Capablanca Corporation is considering a project that has a life of 20 years. An initial investment of $1,200,000 will be required. A major overhaul of the proposed factory, costing $230,000 will be needed half way through the project (at t=10). The revenue from the first year is expected to be $108,100 for the first year and $143,000 each year thereafter. Assume revenues occur at the end of each year. $85,000 will need to be spent cleaning the site at the end of the project. Using the NPV method, determine if the project should be undertaken if the required rate of return is 10.7%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started