Answered step by step

Verified Expert Solution

Question

1 Approved Answer

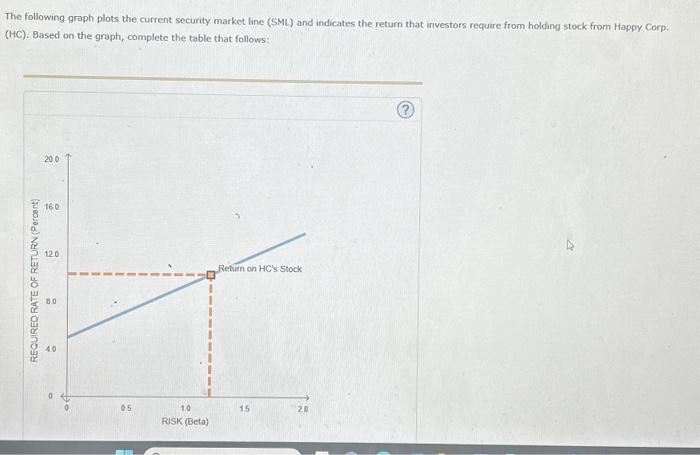

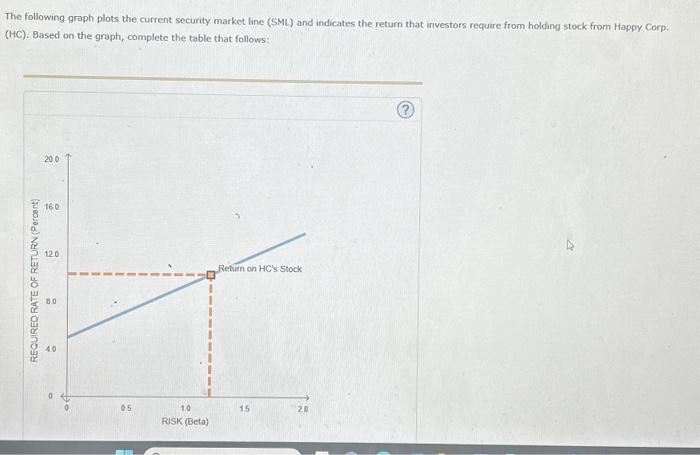

answer all parts please ill thumbs up The following graph plots the current security market line (SML) and indicates the return that investors require from

answer all parts please ill thumbs up

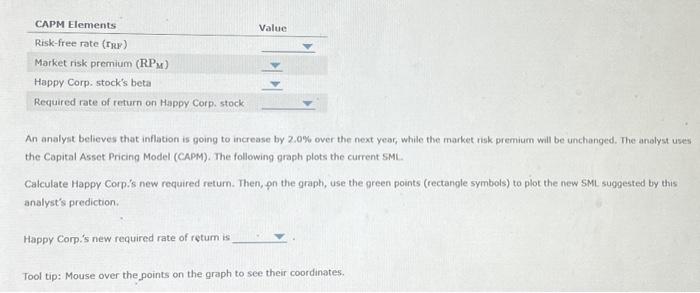

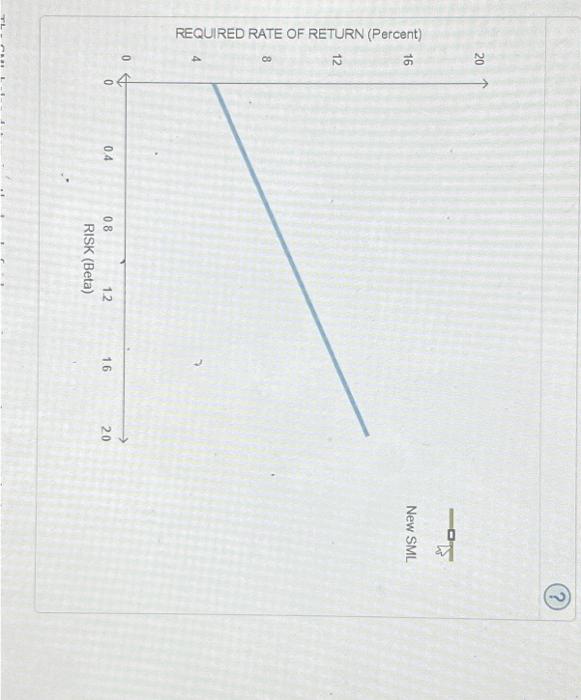

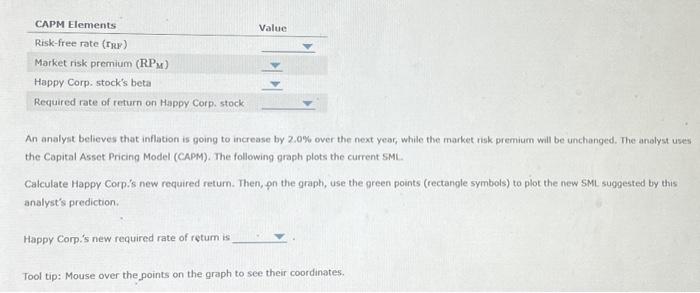

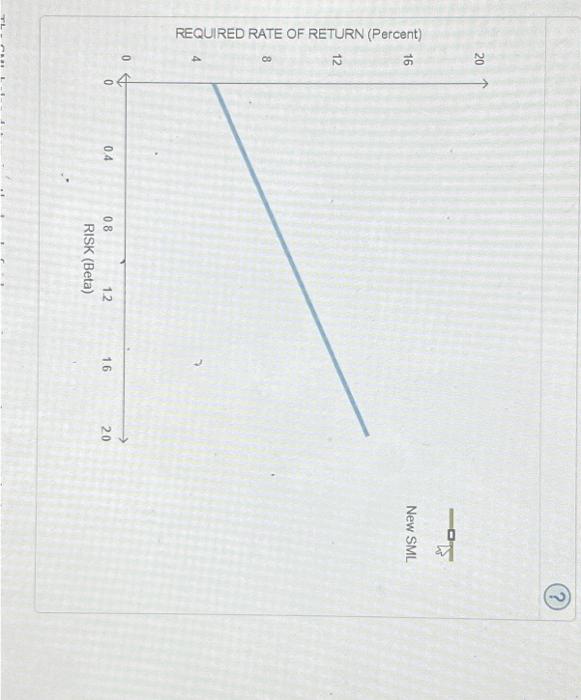

The following graph plots the current security market line (SML) and indicates the return that investors require from holding stock from Happy Corp. (HC). Based on the graph, complete the table that follows: An analyst believes that inflation is going to increase by 2.0% over the next year, while the market risk premium will be unchanged. The anolyst uses the Copitat Asset Pricing Modet (CAPM). The following grapt ptots the current SMt. Calculate Happy Corpiss new required return. Then, pn the graph, use the preen points (rectangle symbols) to plot the new SML suggested by this analyst's prediction. Happy Corp.'s new required rate of return is Tool tip: Mouse over the points on the graph to see their coordinates. REQUIRED RATE OF RETURN (Percent) The SML helps determine the level of risk aversion among investors. The higher the level of risk aversion, the the slope of the SML. Which kind of stock is most affected by changes in risk aversion? (In other words, which stocks see the biggest change in their required returns?) All stocks affected the same, regardless of beta Medium beta stocks Low beta stocks High-beta stocks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started