Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer all parts please. thank you! The date is January 10, 2023, and Maryton Hotels' CFO George Smith is looking with dismay at his company's

Answer all parts please. thank you!

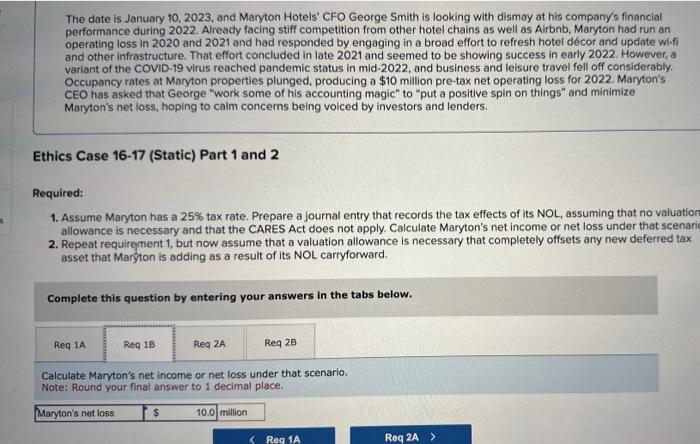

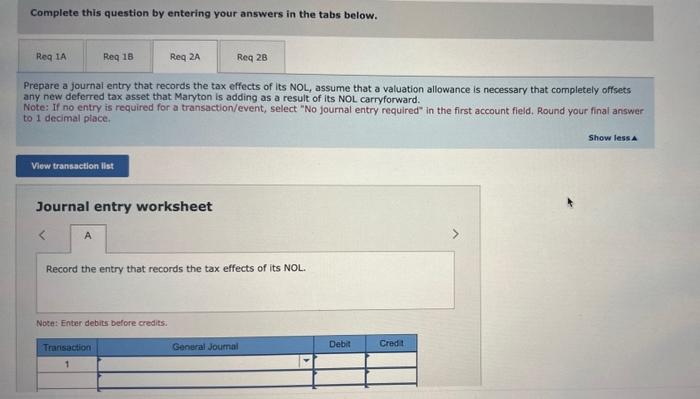

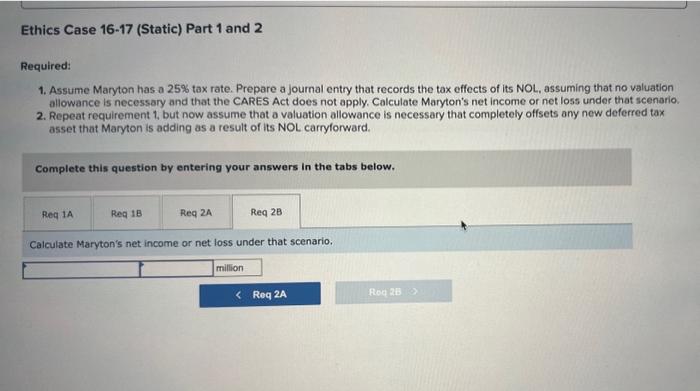

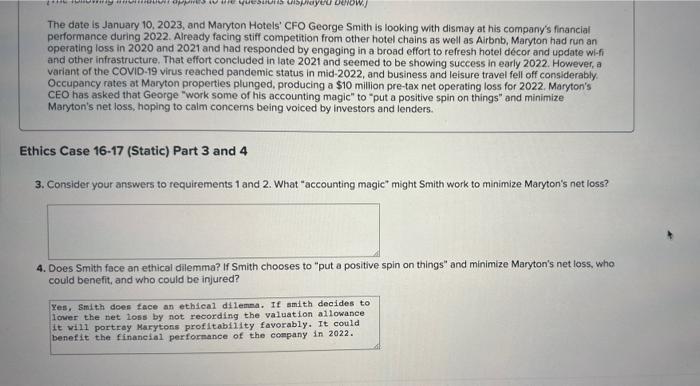

The date is January 10, 2023, and Maryton Hotels' CFO George Smith is looking with dismay at his company's financial performance during 2022. Already facing stiff competition from other hotel chains as well as Airbnb, Maryton had run an operating loss in 2020 and 2021 and had responded by engaging in a broad effort to refresh hotel decor and update wi-fi and other infrastructure. That effort concluded in late 2021 and seemed to be showing success in early 2022 . However, a variant of the COVID-19 virus reached pandemic status in mid-2022, and business and leisure travel fell off considerably. Occupancy rates at Maryton properties plunged, producing a $10 million pre-tax net operating loss for 2022. Maryton's CEO has asked that George "work some of his accounting magic" to "put a positive spin on things" and minimize Maryton's net loss, hoping to calm concerns being voiced by investors and lenders. Ethics Case 16-17 (Static) Part 1 and 2 Required: 1. Assume Maryton has a 25% tax rate. Prepare a journal entry that records the tax effects of its NOL, assuming that no valuatic allowance is necessary and that the CARES Act does not apply. Calculate Maryton's net income or net loss under that scena 2. Repeat requirement 1, but now assume that a valuation allowance is necessary that completely offsets any new deferred tax asset that Maryton is adding as a result of its NOL carryforward. Complete this question by entering your answers in the tabs below. Calculate Maryton's net income or net loss under that scenario. Note: Round your final answer to 1 decimal place. Complete this question by entering your answers in the tabs below. Prepare a journai entry that records the tax effects of its NOL, assume that a valuation allowance is necessary that completely offsets any new deferred tax asset that Maryton is adding as a result of its NOL carryforward. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answer to 1 decimal piace. Journal entry worksheet Record the entry that records the tax effects of its NOL. Note: Enter debits before credits. Required: 1. Assume Maryton has a 25% tax rate. Prepare a journal entry that records the tax effects of its NOL, assuming that no valuation allowance is necessary and that the CARES Act does not apply. Calculate Maryton's net income or net loss under that scenario. 2. Repeat requirement 1, but now assume that a valuation allowance is necessary that completely offsets any new deferred tax asset that Maryton is adding as a result of its NOL carryforward. Complete this question by entering your answers in the tabs below. Calculate Maryton's net income or net loss under that scenario. The date is January 10, 2023, and Maryton Hotels' CFO George Smith is looking with dismay at his company's financial performance during 2022. Already facing stiff competition from other hotel chains as well as Airbnb, Maryton had run an operating loss in 2020 and 2021 and had responded by engaging in a broad effort to refresh hotel dcor and update wi-fi and other infrastructure. That effort concluded in late 2021 and seemed to be showing success in early 2022. However, a variant of the COVID-19 virus reached pandemic status in mid-2022, and business and leisure travel fell off considerably. Occupancy rates at Maryton properties plunged, producing a $10 million pre-tax net operating loss for 2022 . Maryton's CEO has asked that George "work some of his accounting magic" to "put a positive spin on things" and minimize Maryton's net loss, hoping to calm concerns being voiced by investors and lenders. thics Case 16-17 (Static) Part 3 and 4 3. Consider your answers to requirements 1 and 2. What "accounting magic" might Smith work to minimize Maryton's net loss? 4. Does Smith face an ethical dilemma? If Smith chooses to "put a positive spin on things" and minimize Maryton's net Ioss, who could benefit, and who could be injured? Yes, Smitih doen tace an ethical dilemna. If amith decides to lover the bet loss by not recording the valuation allowance it will portray Marytons profitability favorably. It could benefit the finaneial performance of the company in 2022 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started