Answered step by step

Verified Expert Solution

Question

1 Approved Answer

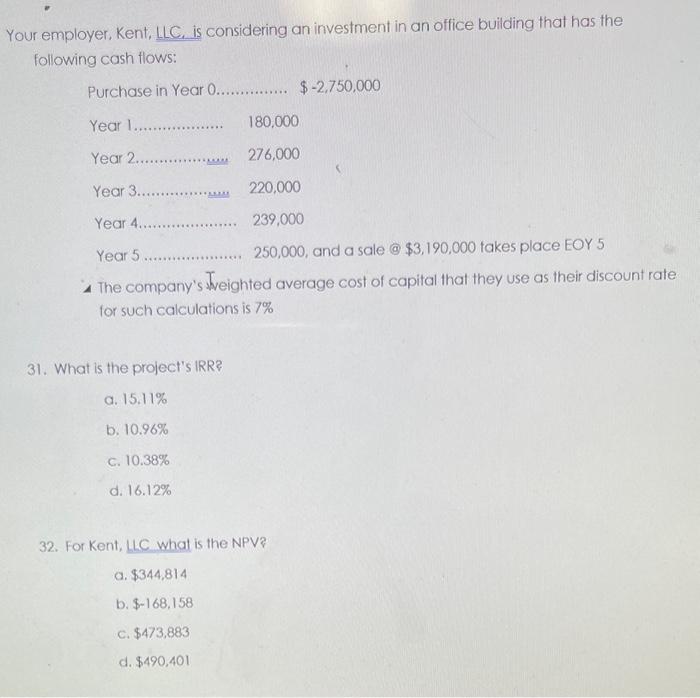

Answer all parts please, they are related. thanks in advance!! Your employer, Kent, LLC. is considering an investment in an office building that has the

Answer all parts please, they are related. thanks in advance!!

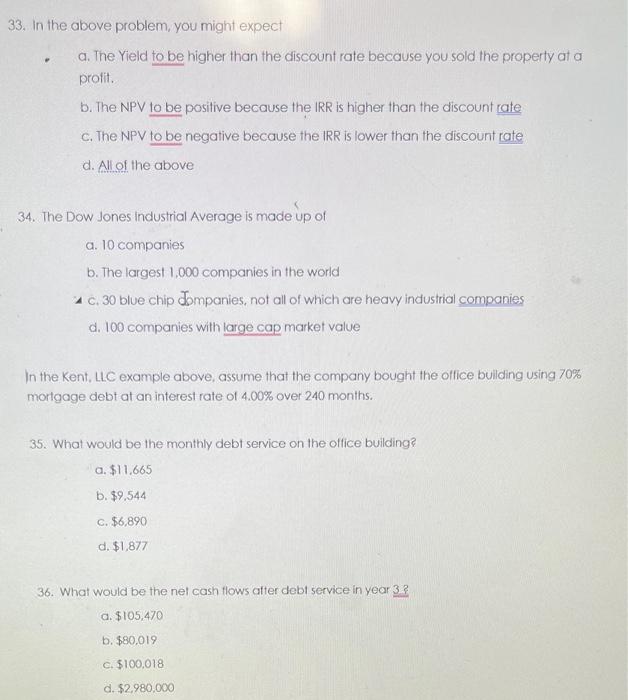

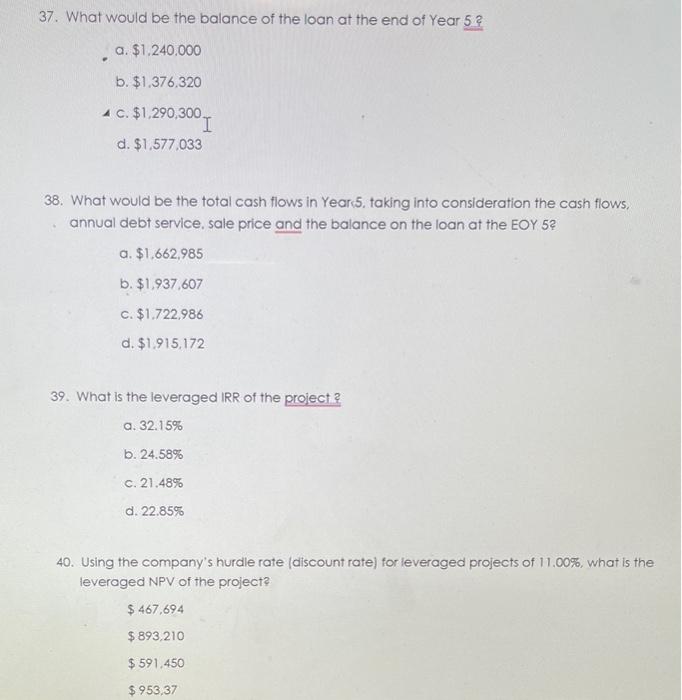

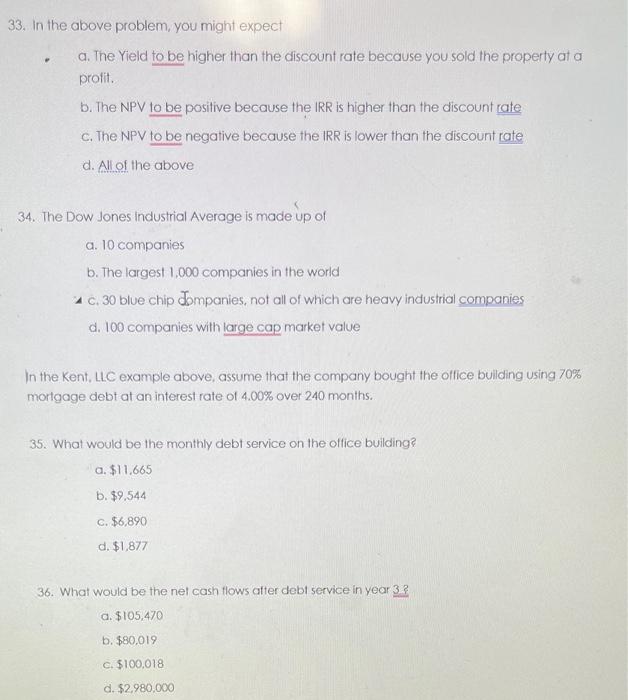

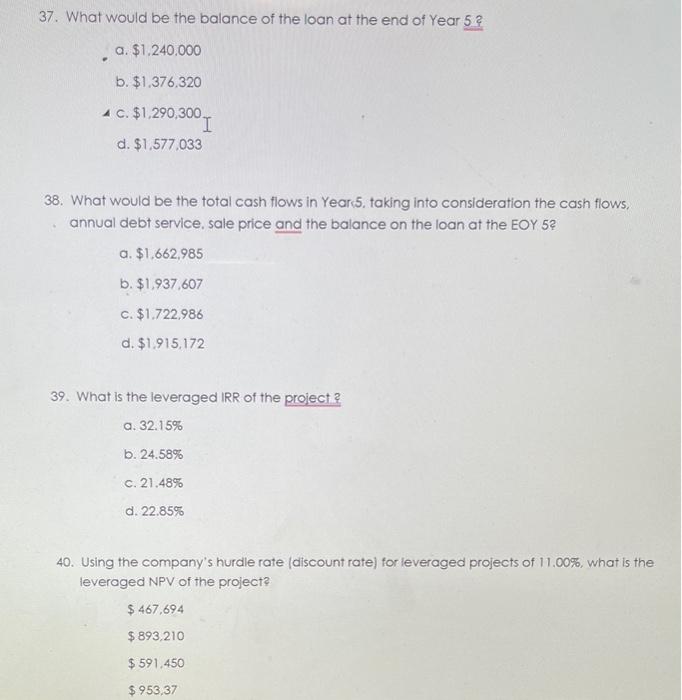

Your employer, Kent, LLC. is considering an investment in an office building that has the following cash flows: $3,190,000 takes place EOY 5 1 The company's tweighted average cost of capital that they use as their discount rate for such calculations is 7% 31. What is the project's IRR? a. 15.11% b. 10.96% c. 10.38% d. 16.12% 32. For Kent, LLC what is the NPV? a. $344.814 b. $168.158 c. $473,883 d. $490,401 33. In the above problem, you might expect a. The Yield to be higher than the discount rate because you sold the property at a profit. b. The NPV to be positive because the IRR is higher than the discount rate c. The NPV to be negative because the IRR is lower than the discount rate d. All of the above 34. The Dow Jones industrial Average is made up of a. 10 companies b. The largest 1,000 companies in the world c. 30 blue chip dompanies, not all of which are heavy industrial companies d. 100 companies with large cap market value In the Kent, LLC example above, assume that the company bought the office building using 70% mortgage debt at an interest rate of 4.00% over 240 months. 35. What would be the monthly debt service on the oflice building? a. $11.665 b. $9.544 c. $6,890 d. $1,877 36. What would be the nel cash flows atter debt service in year 3 ? a. $105,470 b. $80.019 c. $100.018 d. $2,980,000 37. What would be the balance of the loan at the end of Year 5 ? a. $1.240.000 b. $1.376,320 c. $1,290,300 d. $1,577,033 38. What would be the total cash flows in Year.5, taking into consideration the cash flows, annual debt service, sale price and the balance on the loan at the EOY 5 ? a. $1.662,985 b. $1,937,607 c. $1,722,986 d. $1.915.172 39. What is the leveraged IRR of the project? a. 32.15% b. 24.58% c. 21.48% d. 22.85% 40. Using the company's hurdle rate (discount rate) for leveraged projects of 11.00%, what is the leveraged NPV of the project? $467,694$893,210$591,450$953,37

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started