Answered step by step

Verified Expert Solution

Question

1 Approved Answer

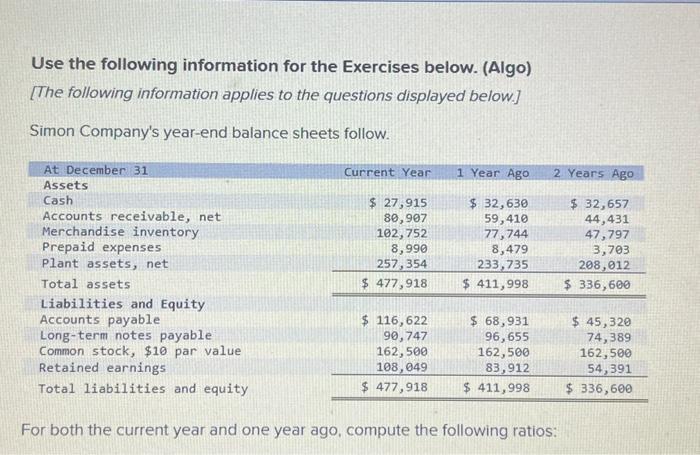

answer all parts show formulas. will thumbs up Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed

answer all parts show formulas. will thumbs up

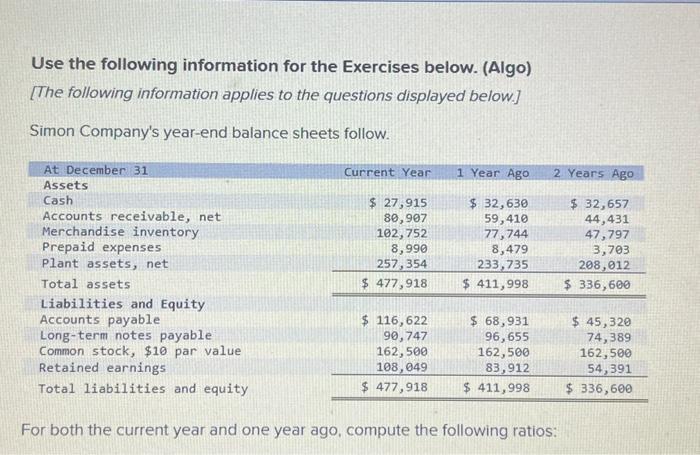

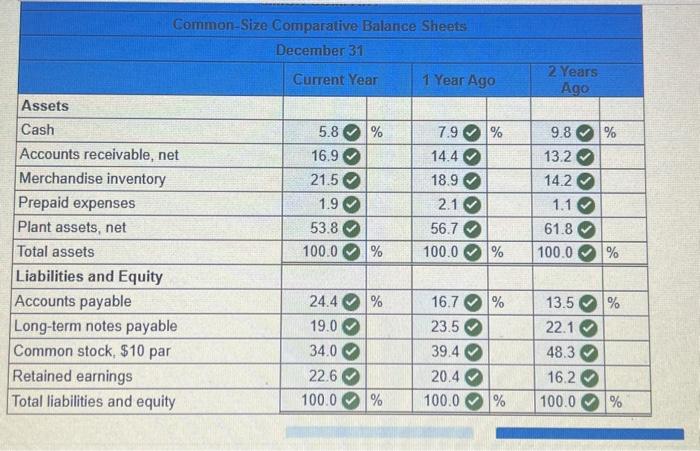

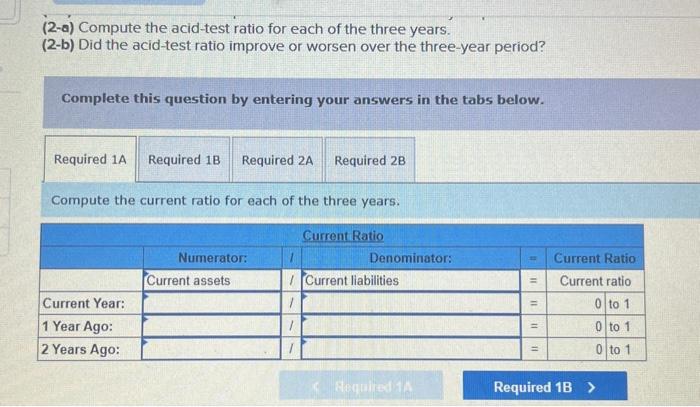

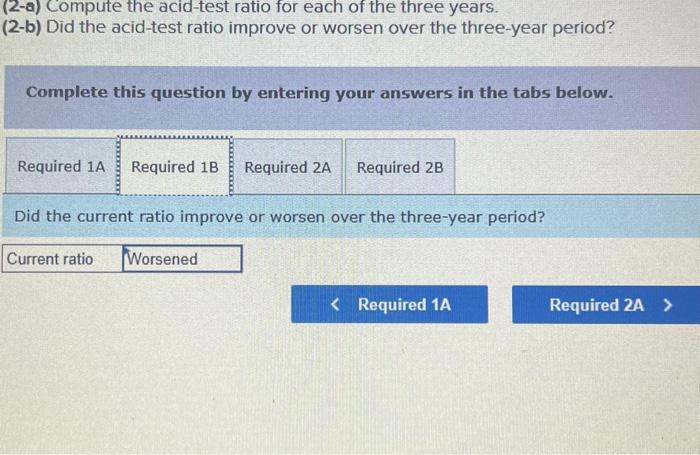

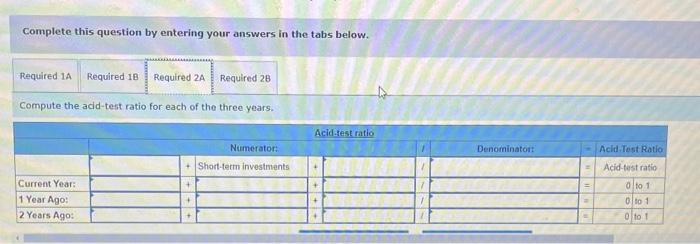

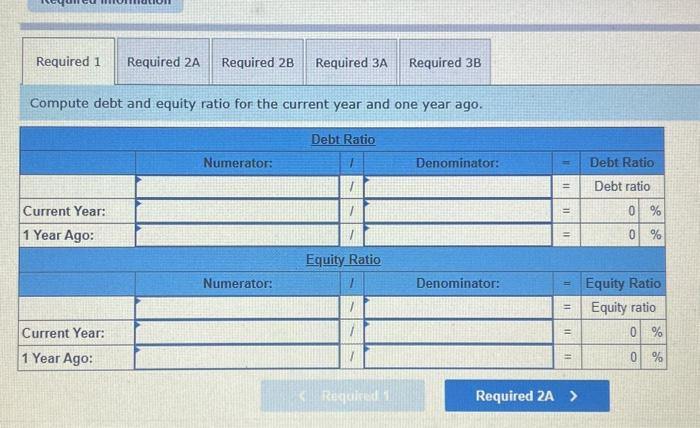

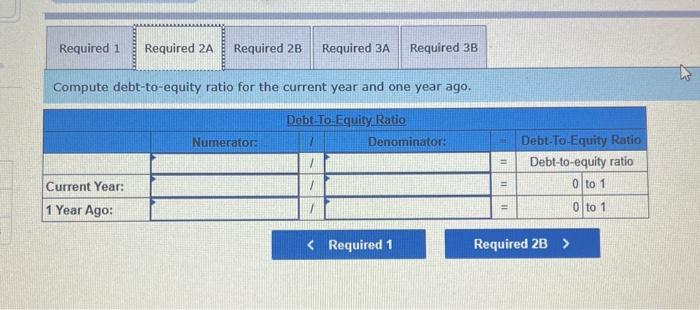

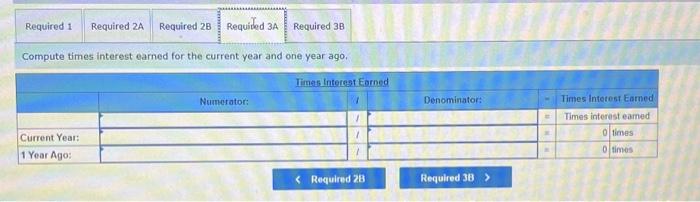

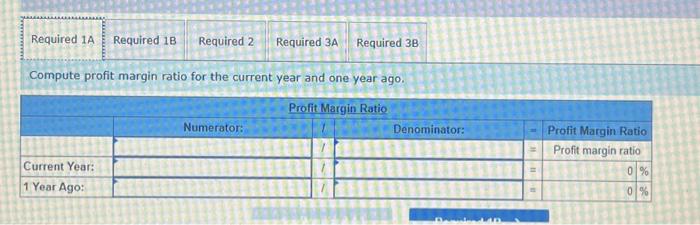

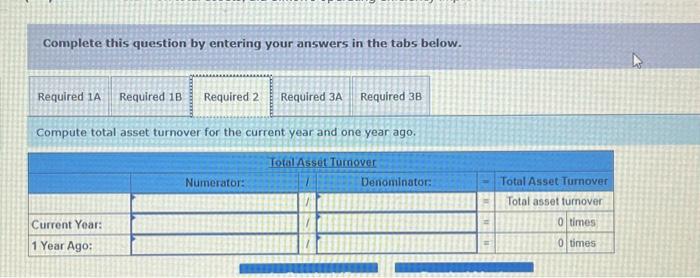

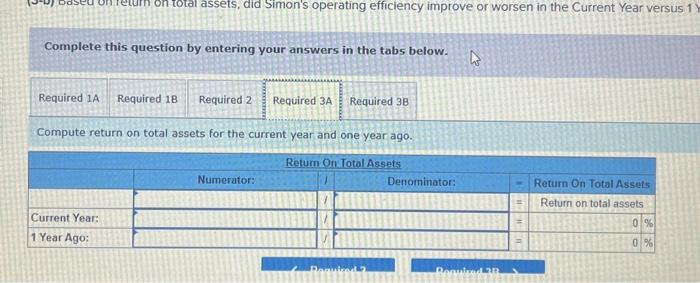

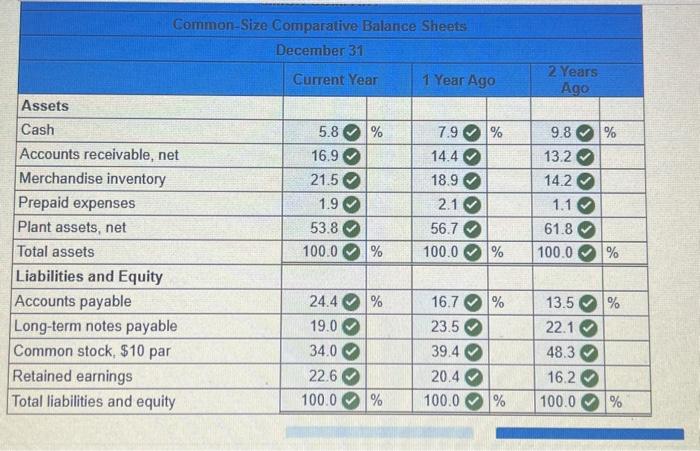

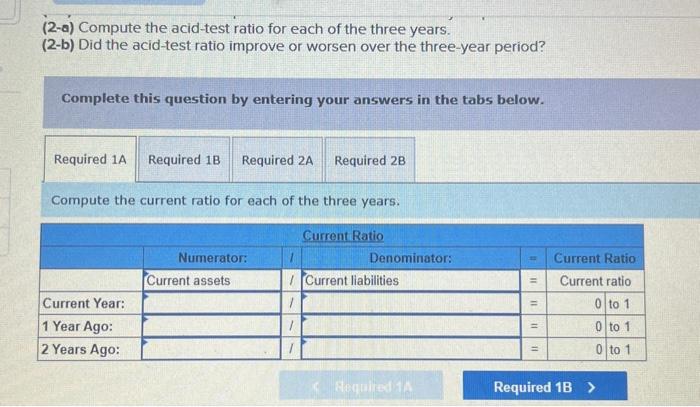

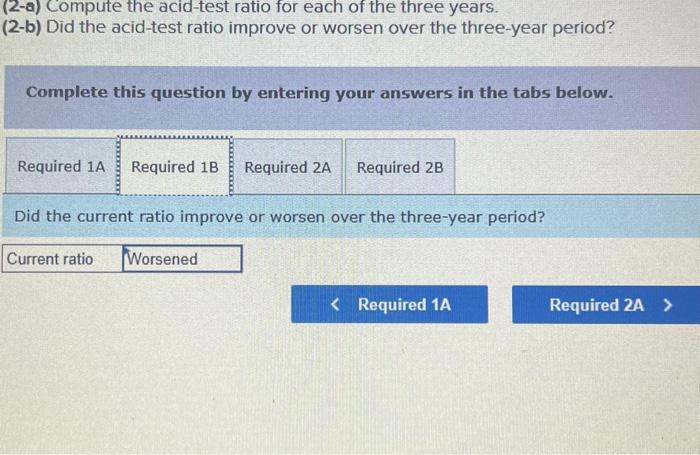

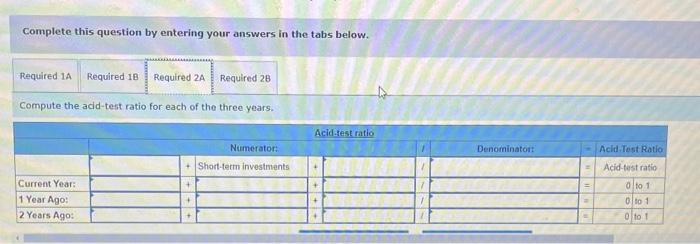

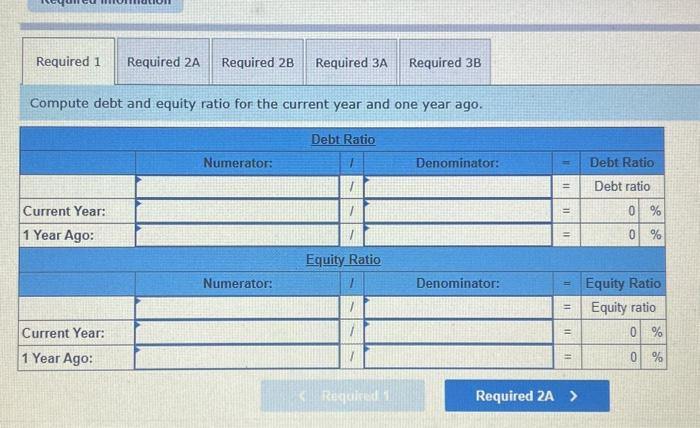

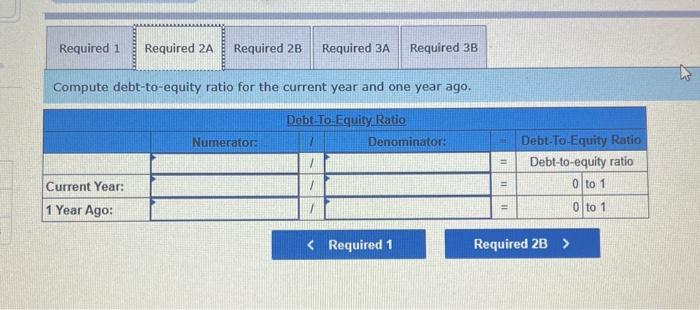

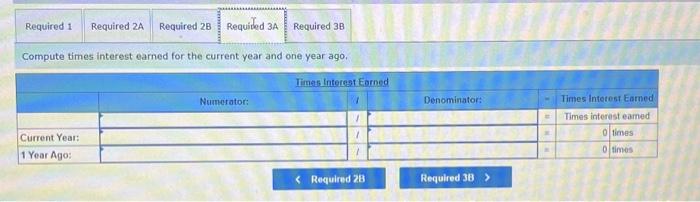

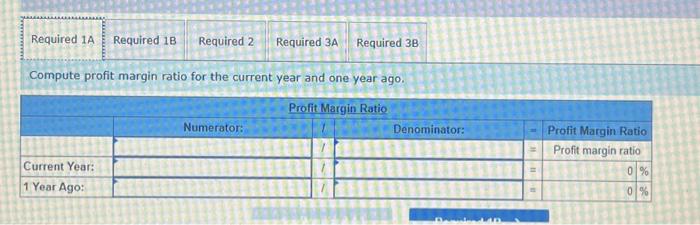

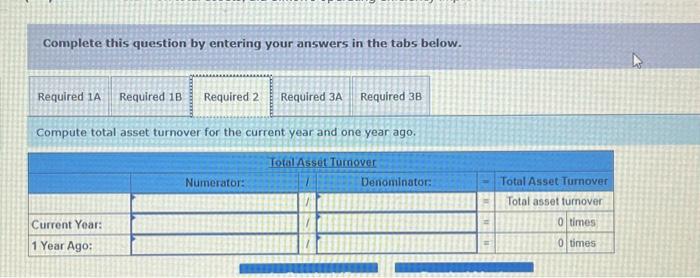

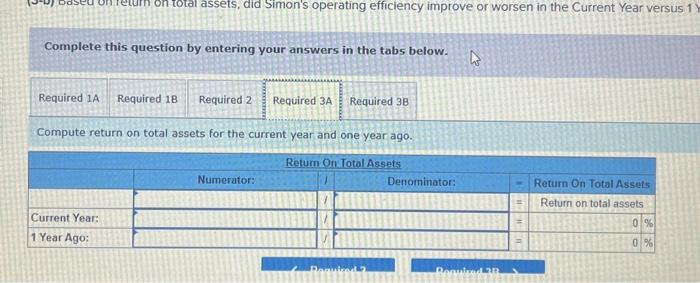

Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. For both the current year and one year ago, compute the following ratios: Common-Size Comparative Balance Sheets. (2-a) Compute the acid-test ratio for each of the three years. (2-b) Did the acid-test ratio improve or worsen over the three-year period? Complete this question by entering your answers in the tabs below. Compute the current ratio for each of the three years. (2-a) Compute the acid-test ratio for each of the three years. (2-b) Did the acid-test ratio improve or worsen over the three-year period? Complete this question by entering your answers in the tabs below. Did the current ratio improve or worsen over the three-year period? Complete this question by entering your answers in the tabs below. Compute the add-test ratio for each of the three years. Compute debt and equity ratio for the current year and one year ago. Compute debt-to-equity ratio for the current year and one year ago. Compute times interest earned for the current year and one year ago. Compute profit margin ratio for the current year and one year ago. Complete this question by entering your answers in the tabs below. Compute total asset turnover for the current year and one year ago. Complete this question by entering your answers in the tabs below. Compute return on total assets for the current year and one year ago. Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. For both the current year and one year ago, compute the following ratios: Common-Size Comparative Balance Sheets. (2-a) Compute the acid-test ratio for each of the three years. (2-b) Did the acid-test ratio improve or worsen over the three-year period? Complete this question by entering your answers in the tabs below. Compute the current ratio for each of the three years. (2-a) Compute the acid-test ratio for each of the three years. (2-b) Did the acid-test ratio improve or worsen over the three-year period? Complete this question by entering your answers in the tabs below. Did the current ratio improve or worsen over the three-year period? Complete this question by entering your answers in the tabs below. Compute the add-test ratio for each of the three years. Compute debt and equity ratio for the current year and one year ago. Compute debt-to-equity ratio for the current year and one year ago. Compute times interest earned for the current year and one year ago. Compute profit margin ratio for the current year and one year ago. Complete this question by entering your answers in the tabs below. Compute total asset turnover for the current year and one year ago. Complete this question by entering your answers in the tabs below. Compute return on total assets for the current year and one year ago

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started