Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer all parts since its one question Please first analyze cash flows for Project L. Then calculate NPV and IRR, and make your capital budgeting

Answer all parts since its one question

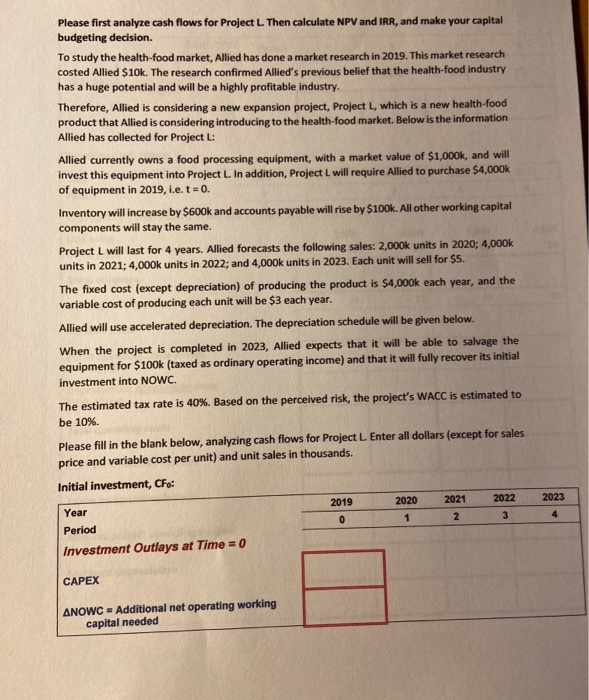

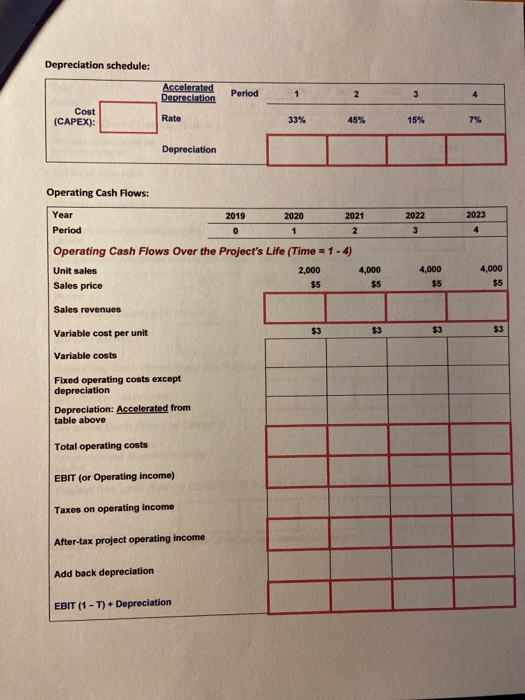

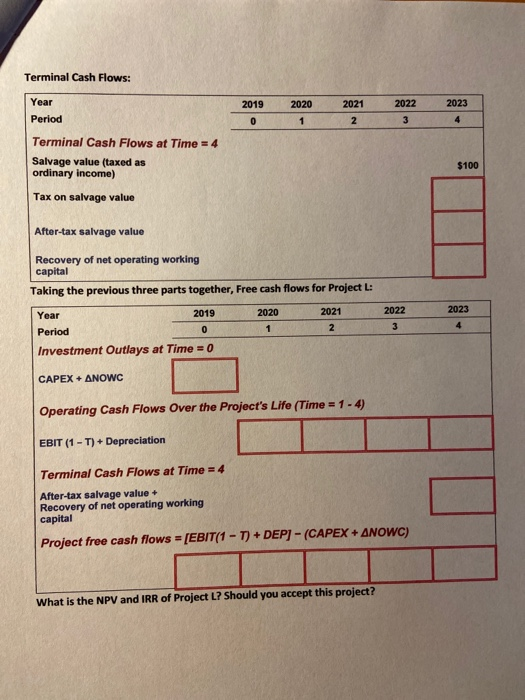

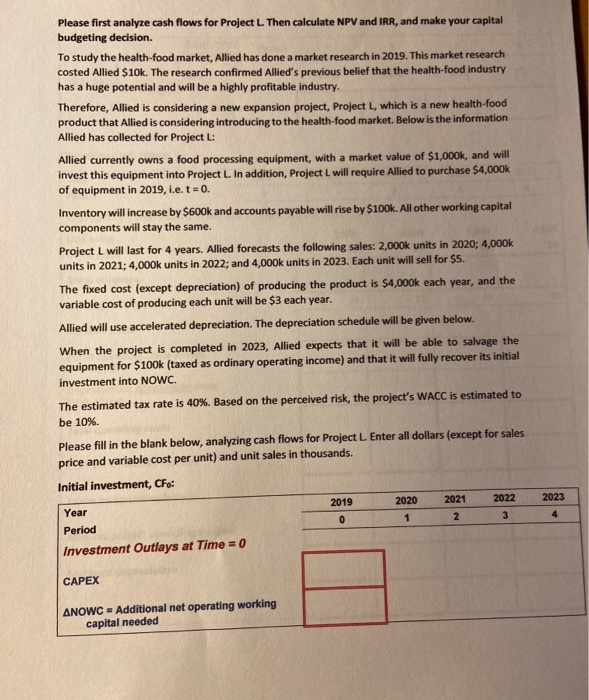

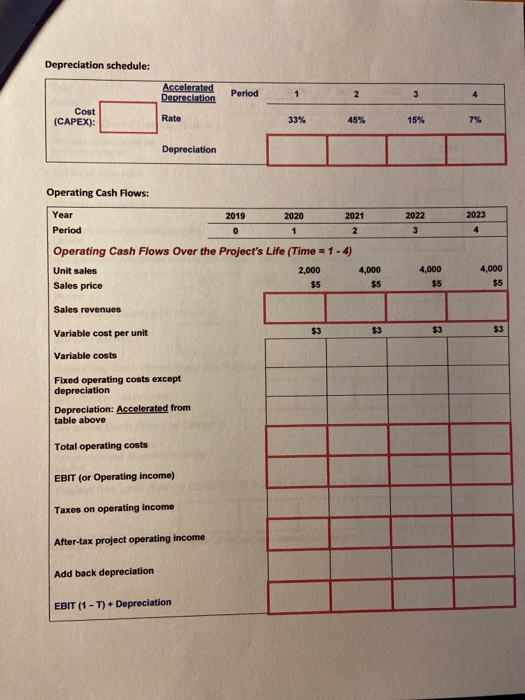

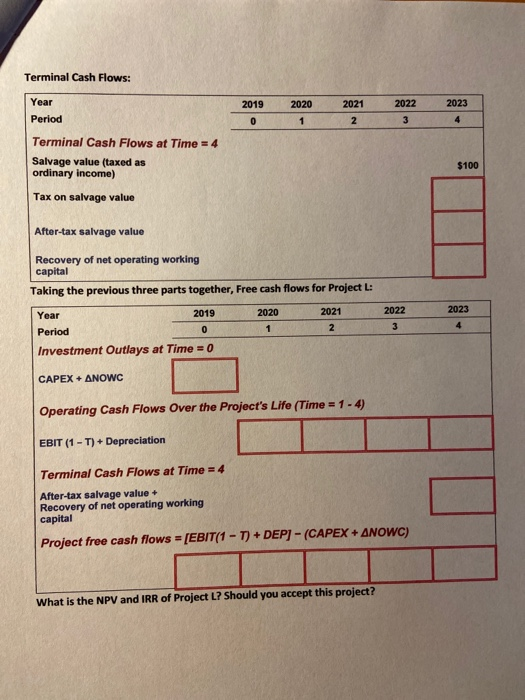

Please first analyze cash flows for Project L. Then calculate NPV and IRR, and make your capital budgeting decision. To study the health-food market, Allied has done a market research in 2019. This market research costed Allied $10k. The research confirmed Allied's previous belief that the health-food industry has a huge potential and will be a highly profitable industry. Therefore, Allied is considering a new expansion project, Project L, which is a new health-food product that Allied is considering introducing to the health-food market. Below is the information Allied has collected for Project L: Allied currently owns a food processing equipment, with a market value of $1,000k, and will invest this equipment into Project L. In addition, Project L will require Allied to purchase $4,000k of equipment in 2019, i.e. t = 0. Inventory will increase by $600k and accounts payable will rise by $100k. All other working capital components will stay the same. Project L will last for 4 years. Allied forecasts the following sales: 2,000k units in 2020; 4,000k units in 2021; 4,000k units in 2022; and 4,000k units in 2023. Each unit will sell for $5. The fixed cost (except depreciation) of producing the product is $4,000k each year, and the variable cost of producing each unit will be $3 each year. Allied will use accelerated depreciation. The depreciation schedule will be given below. When the project is completed in 2023, Allied expects that it will be able to salvage the equipment for $100k (taxed as ordinary operating income) and that it will fully recover its initial investment into NOWC. The estimated tax rate is 40 %. Based on the perceived risk, the project's WACC is estimated to be 10%. Please fill in the blank below, analyzing cash flows for Project L. Enter all dollars (except for sales price and variable cost per unit) and unit sales in thousands. Initial investment, CFo: 2019 2021 2023 2020 2022 Year 3 0 1 Period Investment Outlays at Time 0 CAPEX ANOWC Additional net operating working capital needed Depreciation schedule: Accelerated Depreciation Period 1 2 3 4 Cost Rate 33% 45% 15% 7% (CAPEX): Depreciation Operating Cash Flows: Year 2019 2022 2023 2021 2020 Period 4 1 2 3 0 Operating Cash Flows Over the Project's Life (Time 1-4) 4,000 4,000 4,000 Unit sales 2,000 $5 $5 $5 Sales price $5 Sales revenues $3 $3 $3 $3 Variable cost per unit Variable costs Fixed operating costs except depreciation Depreciation: Accelerated from table above Total operating costs EBIT (or Operating income) Taxes on operating income After-tax project operating income Add back depreciation EBIT (1-T)+ Depreciation Terminal Cash Flows: Year 2022 2023 2019 2020 2021 Period 4 0 1 2 Terminal Cash Flows at Time 4 Salvage value (taxed as ordinary income) $100 Tax on salvage value After-tax salvage value Recovery of net operating working capital Taking the previous three parts together, Free cash flows for Project L: 2023 2022 2020 2021 2019 Year 4 2 0 Period Investment Outlays at Time = 0 CAPEX ANOWC Operating Cash Flows Over the Project's Life (Time 1-4) EBIT (1-T)+ Depreciation Terminal Cash Flows at Time 4 After-tax salvage value + Recovery of net operating working capital Project free cash flows [EBIT(1-T) + DEP]-(CAPEX+ANOWC) What is the NPV and IRR of Project L? Should you accept this project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started