Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer all parts. Thanks 1. Calculate the Gross and Net (or Operating) Profit made by Battle Electrical Ltd in each accounting year. (5 marks) 2.

Answer all parts. Thanks

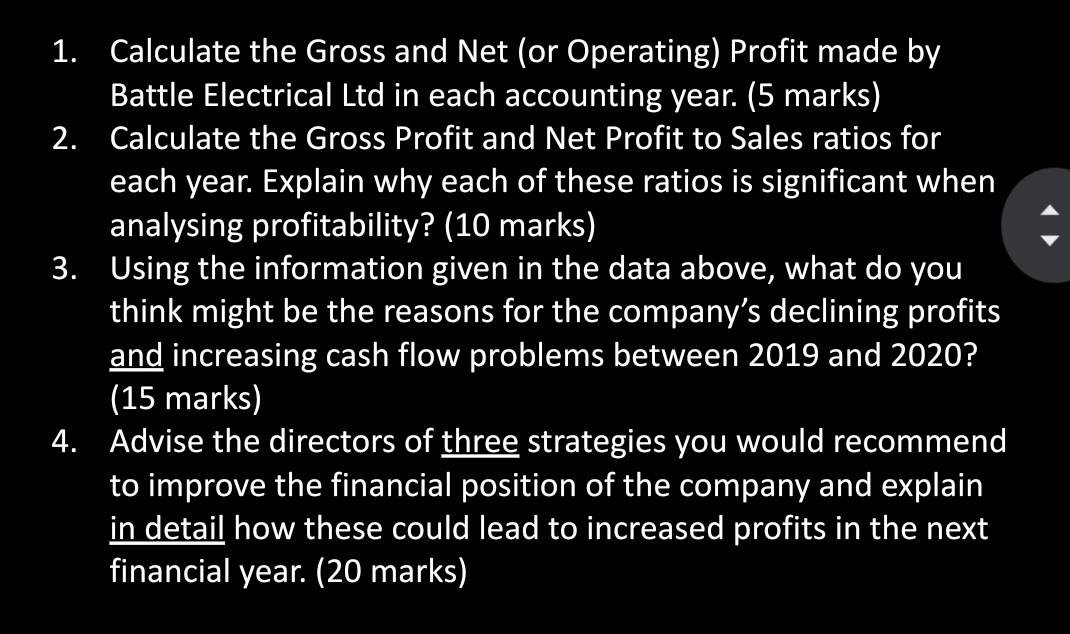

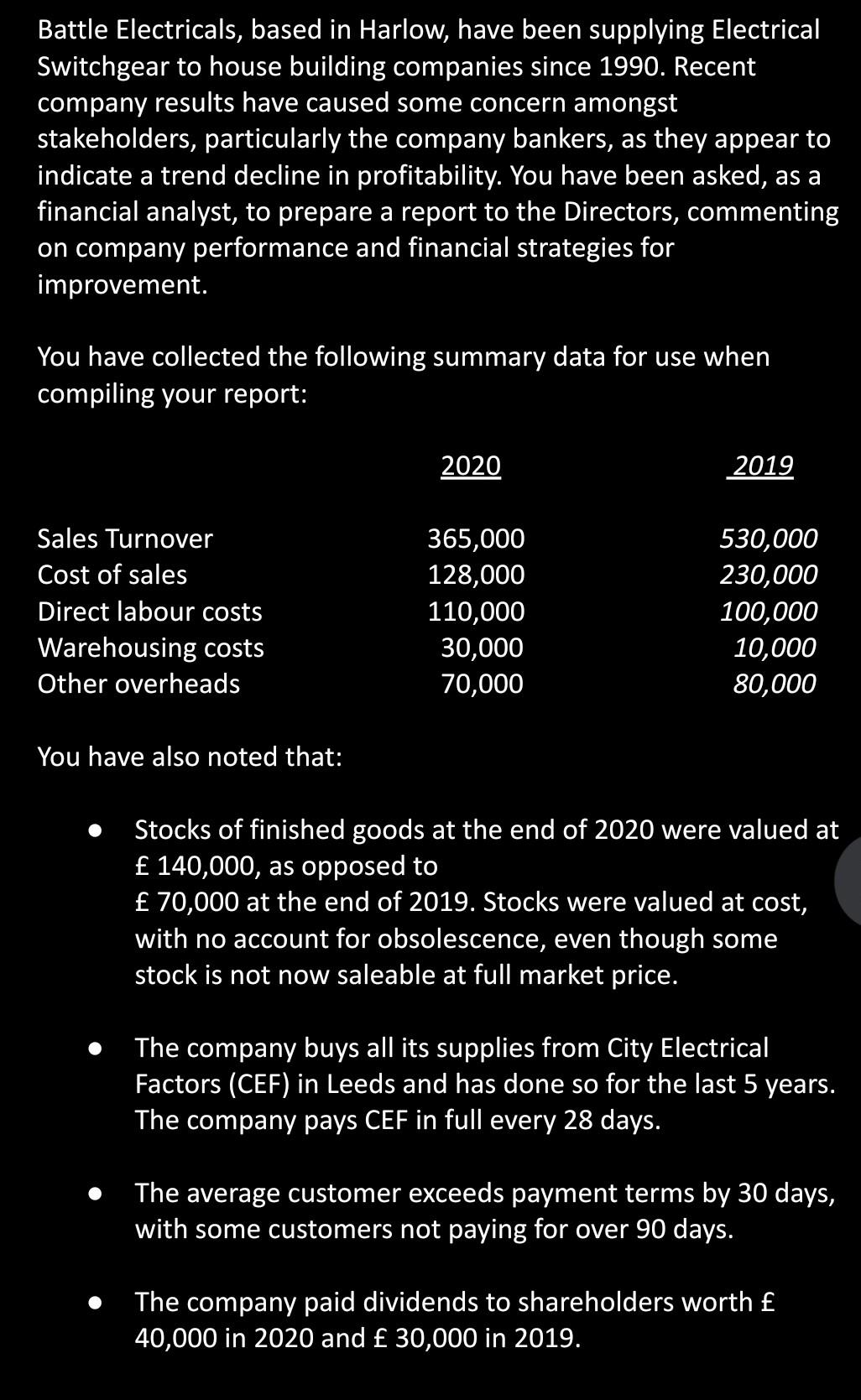

1. Calculate the Gross and Net (or Operating) Profit made by Battle Electrical Ltd in each accounting year. (5 marks) 2. Calculate the Gross Profit and Net Profit to Sales ratios for each year. Explain why each of these ratios is significant when analysing profitability? (10 marks) 3. Using the information given in the data above, what do you think might be the reasons for the company's declining profits and increasing cash flow problems between 2019 and 2020? (15 marks) 4. Advise the directors of three strategies you would recommend to improve the financial position of the company and explain in detail how these could lead to increased profits in the next financial year. (20 marks) Battle Electricals, based in Harlow, have been supplying Electrical Switchgear to house building companies since 1990. Recent company results have caused some concern amongst stakeholders, particularly the company bankers, as they appear to indicate a trend decline in profitability. You have been asked, as a financial analyst, to prepare a report to the Directors, commenting on company performance and financial strategies for improvement. You have collected the following summary data for use when compiling your report: 2020 2019 Sales Turnover Cost of sales Direct labour costs Warehousing costs Other overheads 365,000 128,000 110,000 30,000 70,000 530,000 230,000 100,000 10,000 80,000 You have also noted that: Stocks of finished goods at the end of 2020 were valued at 140,000, as opposed to 70,000 at the end of 2019. Stocks were valued at cost, with no account for obsolescence, even though some stock is not now saleable at full market price. The company buys all its supplies from City Electrical Factors (CEF) in Leeds and has done so for the last 5 years. The company pays CEF in full every 28 days. The average customer exceeds payment terms by 30 days, with some customers not paying for over 90 days. The company paid dividends to shareholders worth 40,000 in 2020 and 30,000 in 2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started