Answered step by step

Verified Expert Solution

Question

1 Approved Answer

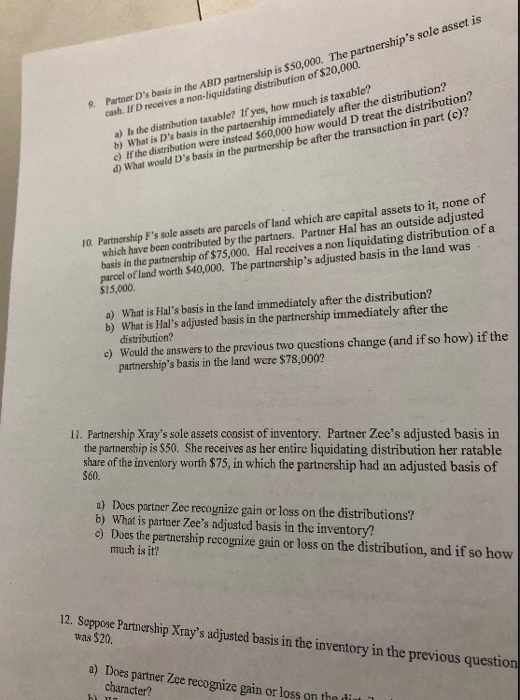

answer all please, 12 has the same parts as 11. 9. Partner D's basis in the ABD partnership is $50.000. The partnership's sole as cash.

answer all please, 12 has the same parts as 11.

9. Partner D's basis in the ABD partnership is $50.000. The partnership's sole as cash. I receives a non-liquidating distribution of $20,000 a) is the distribution taxable? If yes, how much is taxable? 1) What is D's basis in the partnership immediately after the distribution c) If the distribution were instead 560.000 how would D treat the distribution? d) What would D's basis in the partnership be after the transaction in part (c)? 10. Partnership F's sole assets are parcels of land which are capital assets to it, none of which have been contributed by the partners. Partner Hal has an outside adjusted basis in the partnership of $75,000. Hal receives a non liquidating distribution of a parcel of land worth $40,000. The partnership's adjusted basis in the land was $15,000 a) What is Hal's basis in the land immediately after the distribution? b) What is Hal's adjusted basis in the partnership immediately after the distribution? c) Would the answers to the previous two questions change (and if so how) if the partnership's basis in the land were $78,000? 11. Partnership Xray's sole assets consist of inventory. Partner Zee's adjusted basis in the partnership is $50. She receives as her entire liquidating distribution her ratable share of the inventory worth $75, in which the partnership had an adjusted basis of $60. a) Does partner Zee recognize gain or loss on the distributions? b) What is partner Zee's adjusted basis in the inventory c) Does the partnership recognize gain or loss on the distribution, and if so how much is it? 12. Suppose Partnership Xray's adjusted basis in the inventory in the previous question was $20. a) Does partner Zce recognize gain or loss on the dist character? b) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started