answer all please i will up !!

thank you so much !

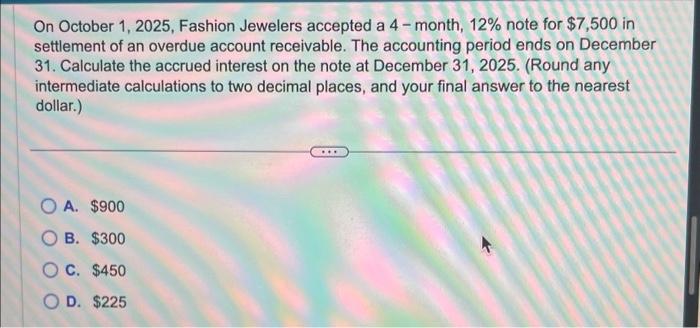

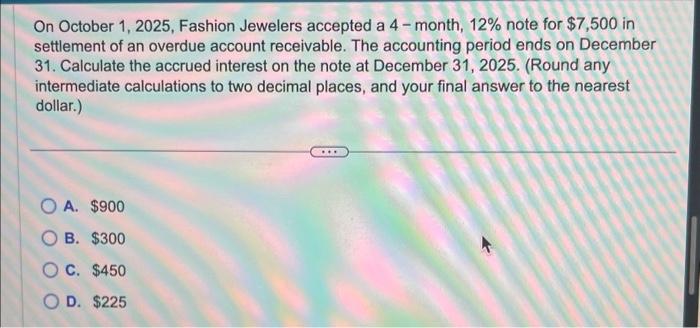

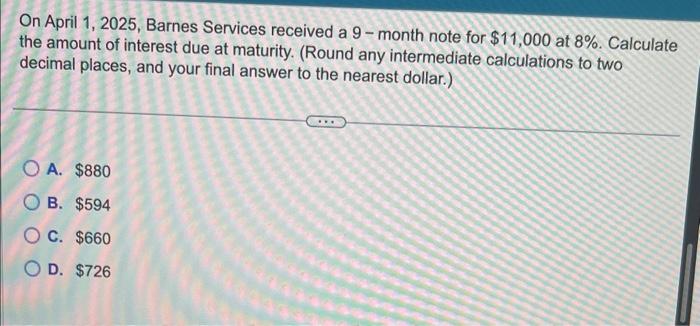

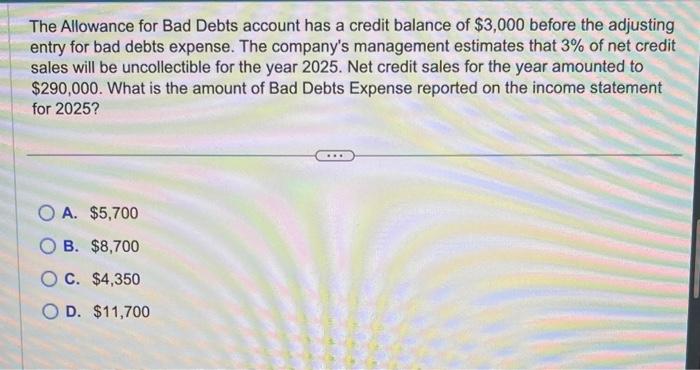

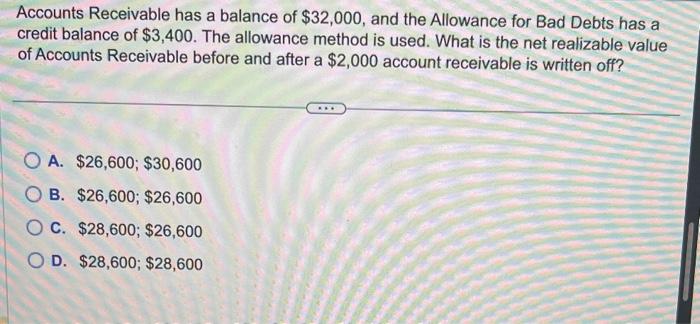

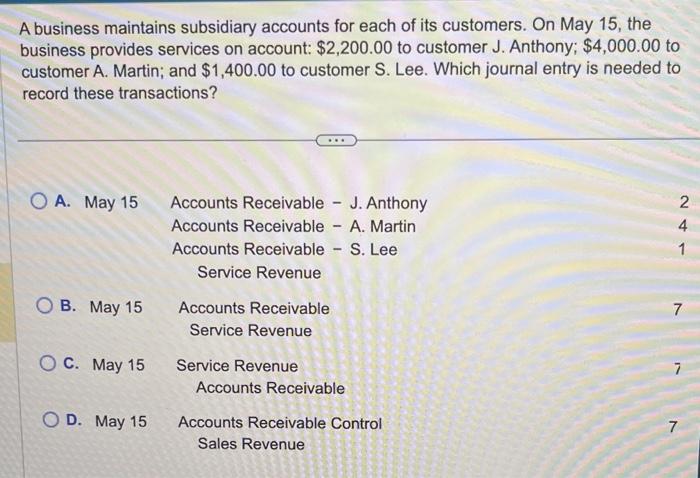

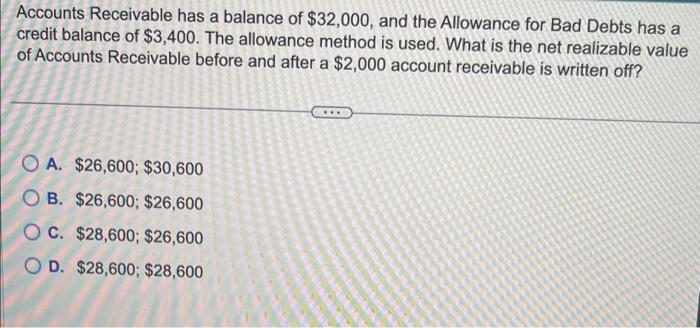

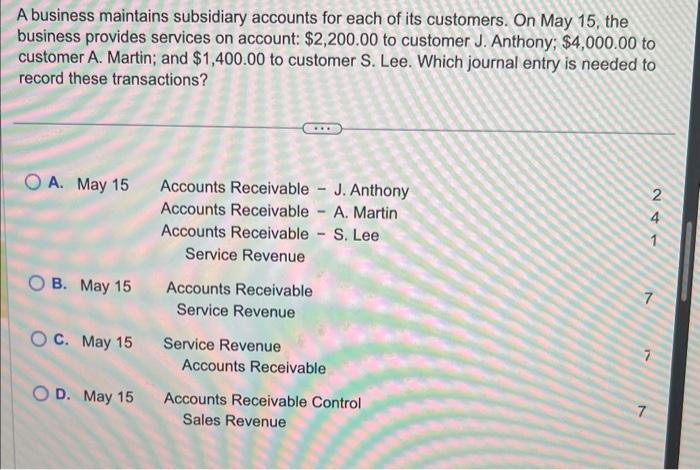

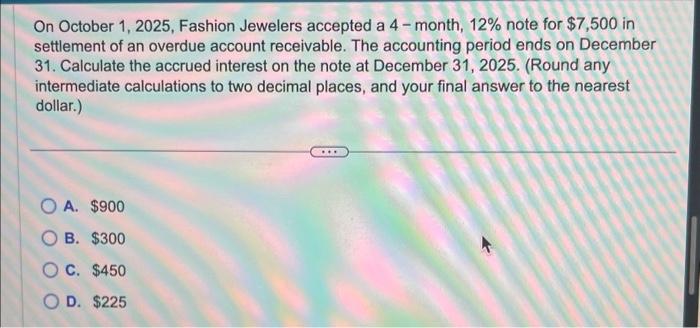

On October 1, 2025, Fashion Jewelers accepted a 4 - month, 12% note for $7,500 in settlement of an overdue account receivable. The accounting period ends on December 31. Calculate the accrued interest on the note at December 31, 2025. (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.) A. $900 B. $300 C. $450 D. $225 On April 1, 2025, Barnes Services received a 9 - month note for $11,000 at 8%. Calculate the amount of interest due at maturity. (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.) A. $880 B. $594 C. $660 D. $726 The Allowance for Bad Debts account has a credit balance of $3,000 before the adjusting entry for bad debts expense. The company's management estimates that 3% of net credit sales will be uncollectible for the year 2025. Net credit sales for the year amounted to $290,000. What is the amount of Bad Debts Expense reported on the income statement for 2025? A. $5,700 B. $8,700 C. $4,350 D. $11,700 Accounts Receivable has a balance of $32,000, and the Allowance for Bad Debts has a credit balance of $3,400. The allowance method is used. What is the net realizable value of Accounts Receivable before and after a $2,000 account receivable is written off? A. $26,600;$30,600 B. $26,600;$26,600 C. $28,600;$26,600 D. $28,600;$28,600 A business maintains subsidiary accounts for each of its customers. On May 15 , the business provides services on account: $2,200.00 to customer J. Anthony; $4,000.00 to customer A. Martin; and $1,400.00 to customer S. Lee. Which journal entry is needed to record these transactions? A. May 15 Accounts Receivable - J. Anthony Accounts Receivable - A. Martin Accounts Receivable - S. Lee Service Revenue B. May 15 Accounts Receivable 7 Service Revenue C. May 15 Service Revenue Accounts Receivable D. May 15 Accounts Receivable Control Sales Revenue Accounts Receivable has a balance of $32,000, and the Allowance for Bad Debts has a credit balance of $3,400. The allowance method is used. What is the net realizable value of Accounts Receivable before and after a $2,000 account receivable is written off? A. $26,600;$30,600 B. $26,600;$26,600 C. $28,600;$26,600 D. $28,600;$28,600 A business maintains subsidiary accounts for each of its customers. On May 15 , the business provides services on account: $2,200.00 to customer J. Anthony; $4,000.00 to customer A. Martin; and $1,400.00 to customer S. Lee. Which journal entry is needed to record these transactions? A. May 15 Accounts Receivable - J. Anthony Accounts Receivable - A. Martin Accounts Receivable - S. Lee Service Revenue B. May 15 Accounts Receivable 7 Service Revenue C. May 15 Service Revenue Accounts Receivable D. May 15 Accounts Receivable Control 7 Sales Revenue