Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer all please :) ill thumbs up QUESTION 7 If the expectations theory of the term structure of interest rates is correct, and if the

answer all please :) ill thumbs up

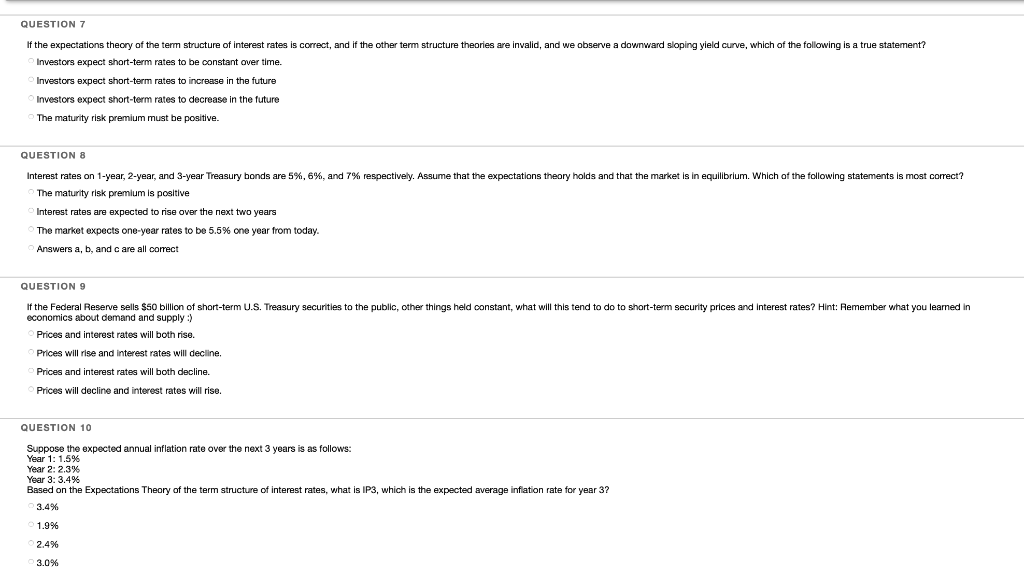

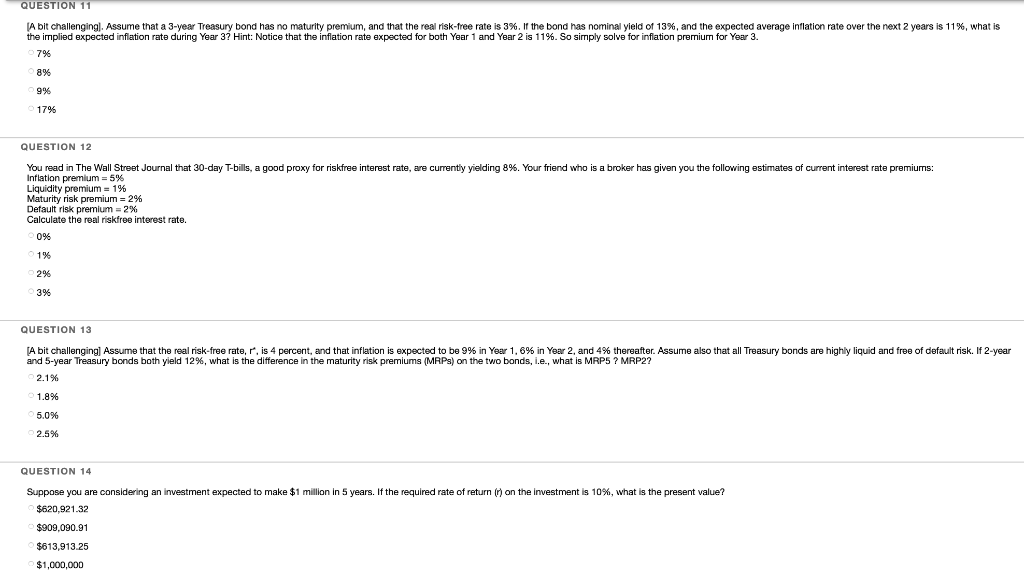

QUESTION 7 If the expectations theory of the term structure of interest rates is correct, and if the other term structure theories are invalid, and we observe a downward sloping yield curve, which of the following is a true statement? Investors expect short-term rates to be constant over time. Investors expect short-term rates to increase in the future Investors expect short-term rates to decrease in the future The maturity risk premium must be positive. QUESTION 8 Interest rates on 1-year, 2-year, and 3-year Treasury bonds are 5%, 6%, and 7% respectively. Assume that the expectations theory holds and that the market is in equilibrium. Which of the following statements is most correct? The maturity risk premium is positive Interest rates are expected to rise over the next two years The market expects one-year rates to be 5.5% one year from today. Answers a, b, and c are all correct QUESTION 9 If the Federal Reserve sells $50 billion of short-term U.S. Treasury securities to the public, other things held constant, what will this tend to do to short-term security prices and Interest rates? Hint: Remember what you learned in economics about demand and supply :) Prices and interest rates will both rise. Prices will rise and interest rates will decline, Prices and interest rates will both decline. Prices will decline and interest rates will rise. QUESTION 10 Suppose the expected annual inflation rate over the next 3 years is as follows: Year 1: 1.5% Year 2: 2.3% Year 3: 3.4% Based on the Expectations Theory of the term structure of interest rates, what is IP3, which is the expected average inflation rate for year 3? 3.4% 1.9% 2.4% 3.0% QUESTION 11 A bit challenging]. Assume that a 3-year Treasury bond has no maturity premium, and that the real risk-free rate is 3%. If the bond has nominal yield of 13%, and the expected average inflation rate over the next 2 years is 11%, what is the implied expected inflation rate during Year 32 Hint: Notice that the inflation rate expected for both Year 1 and Year 2 is 11%. So simply solve for inflation premium for Year 3. 7% 8% 9% 17% QUESTION 12 You read in The Wall Street Journal that 30-day T-bills, a good proxy for riskfree interest rate, are currently yielding 8%. Your friend who is a broker has given you the following estimates of current interest rate premiums: Inflation premium = 5% Liquidity premium = 1% Maturity risk premium = 2% Default risk premium = 2% Calculate the real riskfree interest rate. 0% 1% 2% QUESTION 13 (A bit challenging] Assume that the real risk-free rate, r, is 4 percent, and that inflation is expected to be 9% in Year 1.6% in Year 2, and 4% thereafter. Assume also that all Treasury bonds are highly liquid and free of default risk. If 2-year and 5-year Treasury bonds both yield 12%, what is the difference in the maturity risk premiums ( MRPs) on the two bonds. e. what is MRP5 7 MRP2? 2.1% 1.8% 5.0% 2.5% QUESTION 14 Suppose you are considering an investment expected to make $1 million in 5 years. If the required rate of return in on the investment is 10%, what is the present value? $620,921.32 $909,090.91 $613,913.25 $1,000,000 QUESTION 7 If the expectations theory of the term structure of interest rates is correct, and if the other term structure theories are invalid, and we observe a downward sloping yield curve, which of the following is a true statement? Investors expect short-term rates to be constant over time. Investors expect short-term rates to increase in the future Investors expect short-term rates to decrease in the future The maturity risk premium must be positive. QUESTION 8 Interest rates on 1-year, 2-year, and 3-year Treasury bonds are 5%, 6%, and 7% respectively. Assume that the expectations theory holds and that the market is in equilibrium. Which of the following statements is most correct? The maturity risk premium is positive Interest rates are expected to rise over the next two years The market expects one-year rates to be 5.5% one year from today. Answers a, b, and c are all correct QUESTION 9 If the Federal Reserve sells $50 billion of short-term U.S. Treasury securities to the public, other things held constant, what will this tend to do to short-term security prices and Interest rates? Hint: Remember what you learned in economics about demand and supply :) Prices and interest rates will both rise. Prices will rise and interest rates will decline, Prices and interest rates will both decline. Prices will decline and interest rates will rise. QUESTION 10 Suppose the expected annual inflation rate over the next 3 years is as follows: Year 1: 1.5% Year 2: 2.3% Year 3: 3.4% Based on the Expectations Theory of the term structure of interest rates, what is IP3, which is the expected average inflation rate for year 3? 3.4% 1.9% 2.4% 3.0% QUESTION 11 A bit challenging]. Assume that a 3-year Treasury bond has no maturity premium, and that the real risk-free rate is 3%. If the bond has nominal yield of 13%, and the expected average inflation rate over the next 2 years is 11%, what is the implied expected inflation rate during Year 32 Hint: Notice that the inflation rate expected for both Year 1 and Year 2 is 11%. So simply solve for inflation premium for Year 3. 7% 8% 9% 17% QUESTION 12 You read in The Wall Street Journal that 30-day T-bills, a good proxy for riskfree interest rate, are currently yielding 8%. Your friend who is a broker has given you the following estimates of current interest rate premiums: Inflation premium = 5% Liquidity premium = 1% Maturity risk premium = 2% Default risk premium = 2% Calculate the real riskfree interest rate. 0% 1% 2% QUESTION 13 (A bit challenging] Assume that the real risk-free rate, r, is 4 percent, and that inflation is expected to be 9% in Year 1.6% in Year 2, and 4% thereafter. Assume also that all Treasury bonds are highly liquid and free of default risk. If 2-year and 5-year Treasury bonds both yield 12%, what is the difference in the maturity risk premiums ( MRPs) on the two bonds. e. what is MRP5 7 MRP2? 2.1% 1.8% 5.0% 2.5% QUESTION 14 Suppose you are considering an investment expected to make $1 million in 5 years. If the required rate of return in on the investment is 10%, what is the present value? $620,921.32 $909,090.91 $613,913.25 $1,000,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started