Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer all please need it asap, ill gove thumbs up thank you What is the penaity for substantial undenstatemert of bas fiblity? occurs when tapayer

answer all please need it asap, ill gove thumbs up thank you

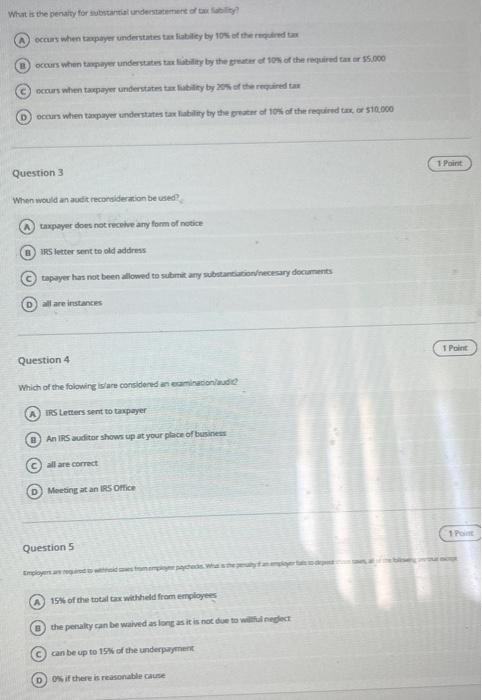

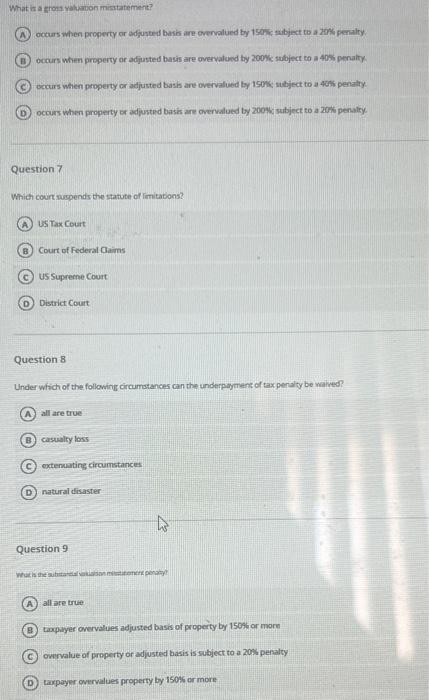

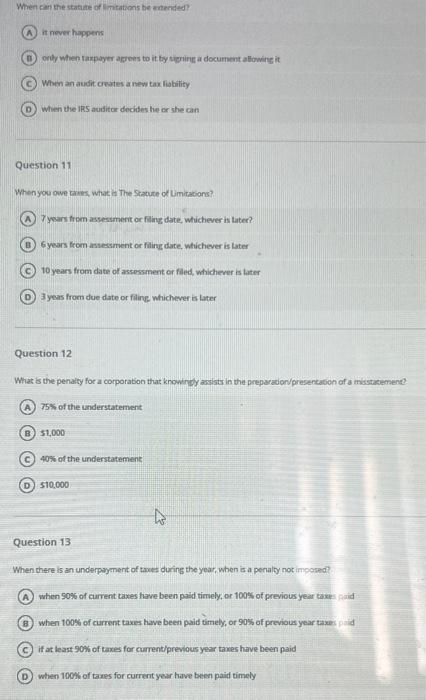

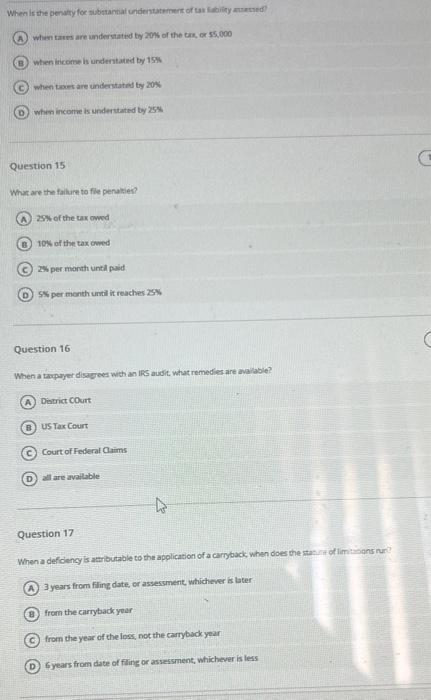

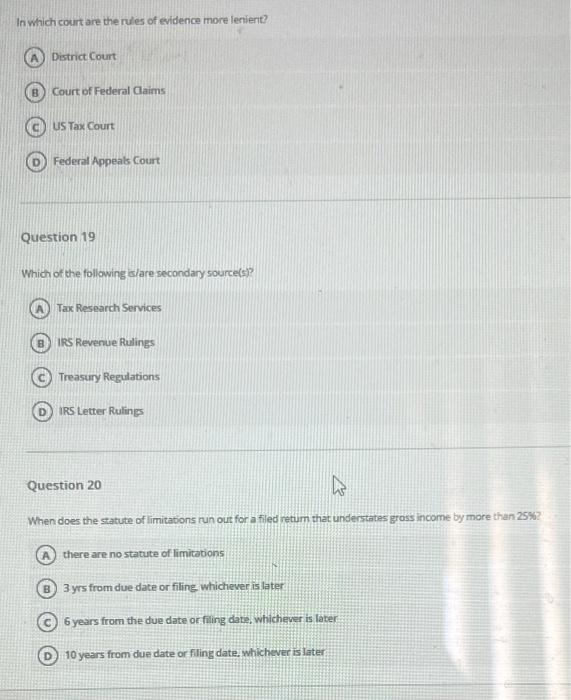

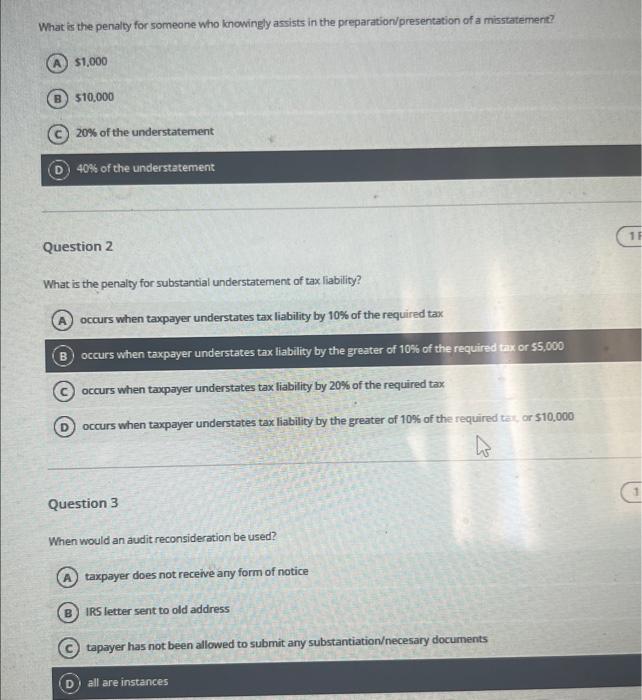

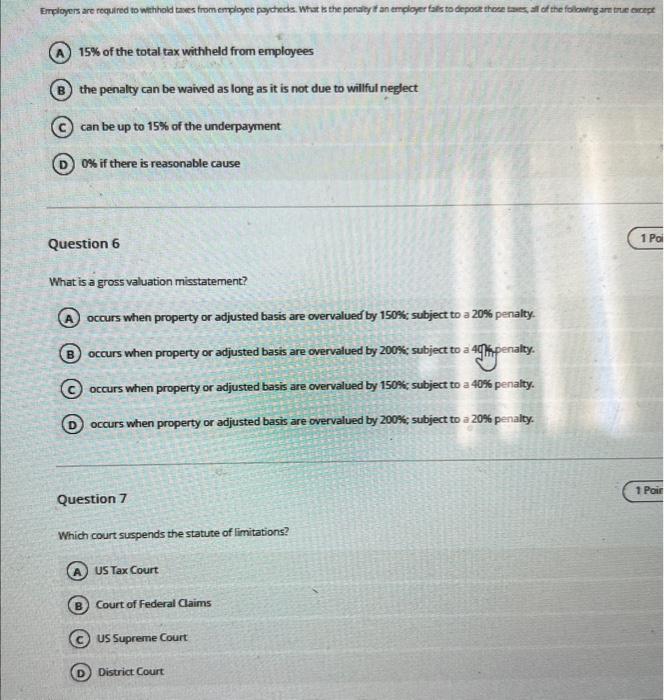

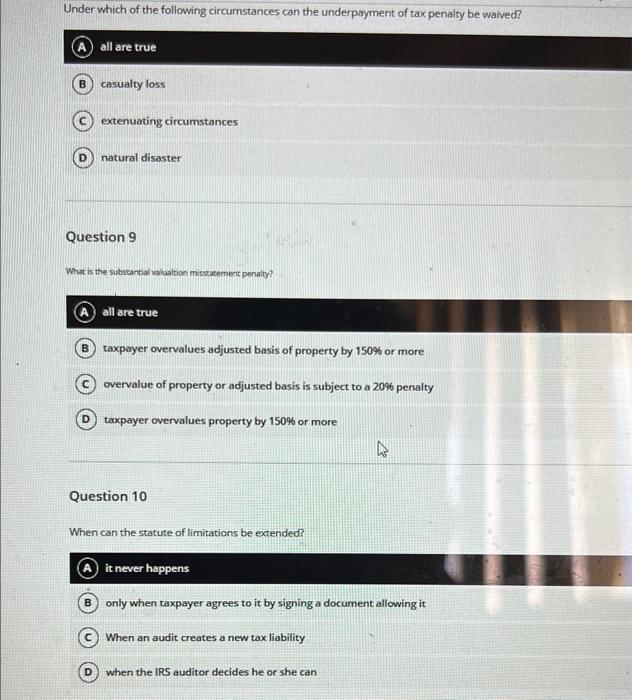

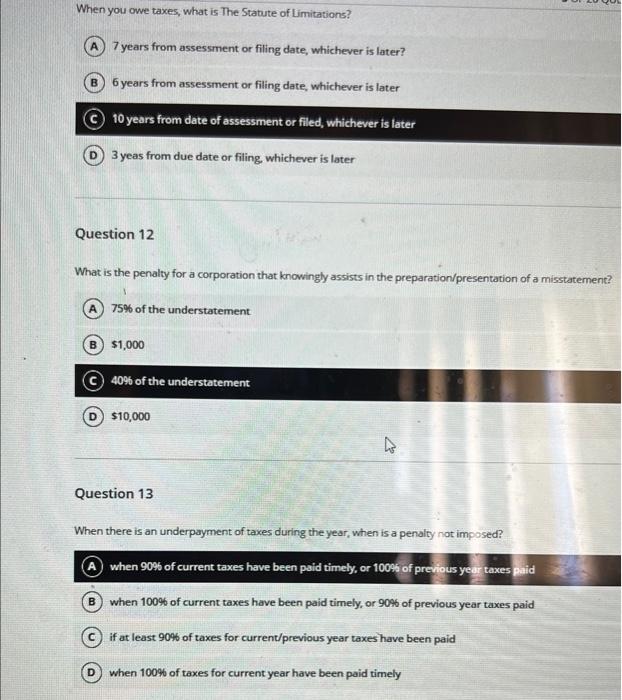

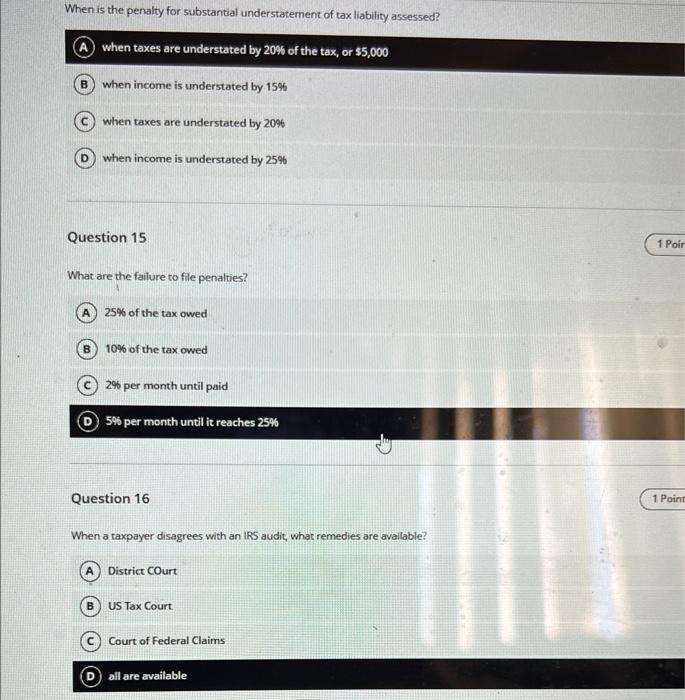

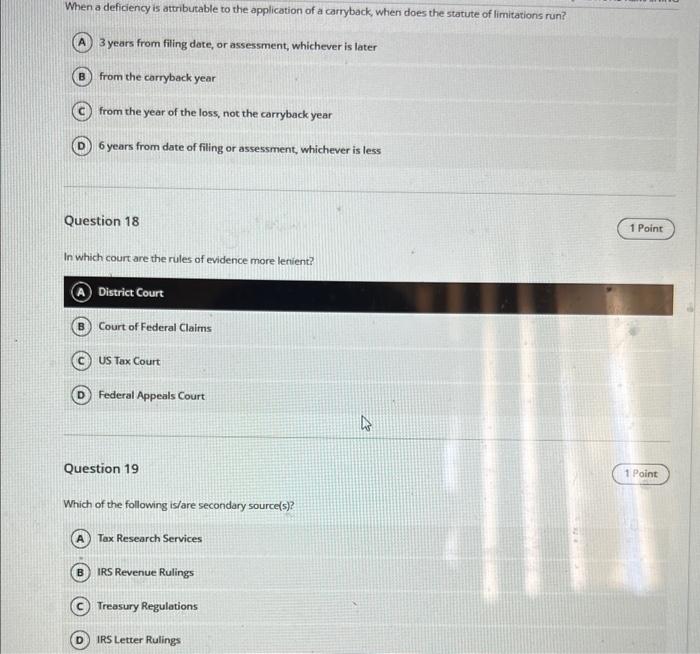

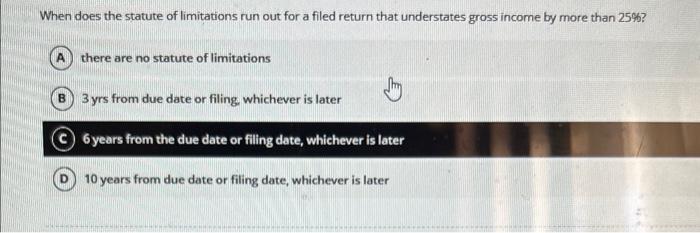

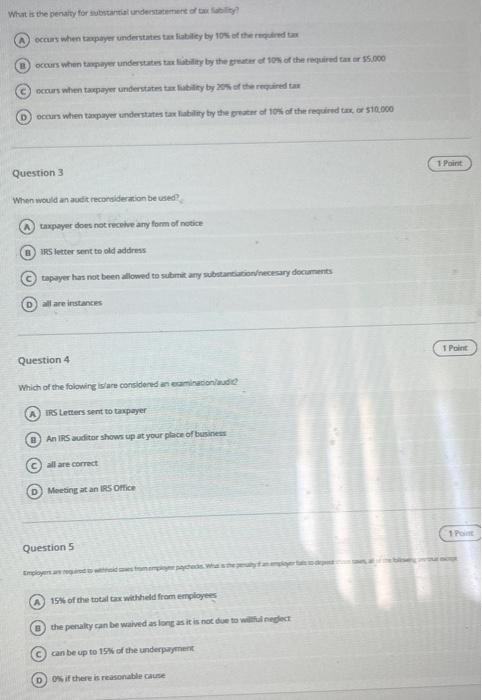

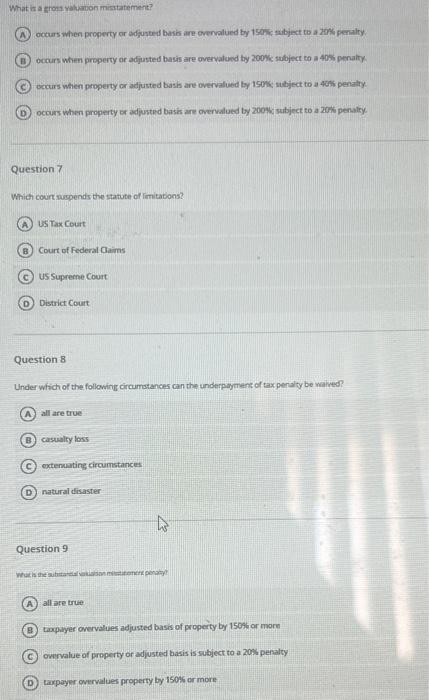

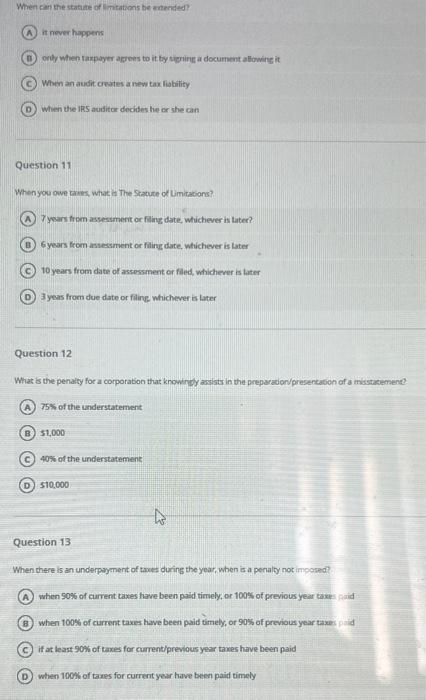

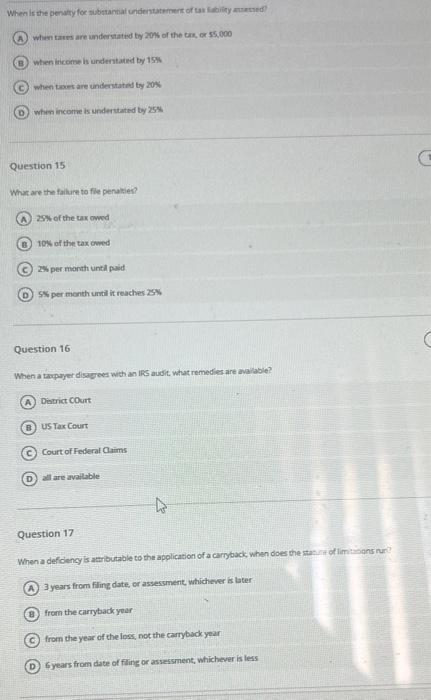

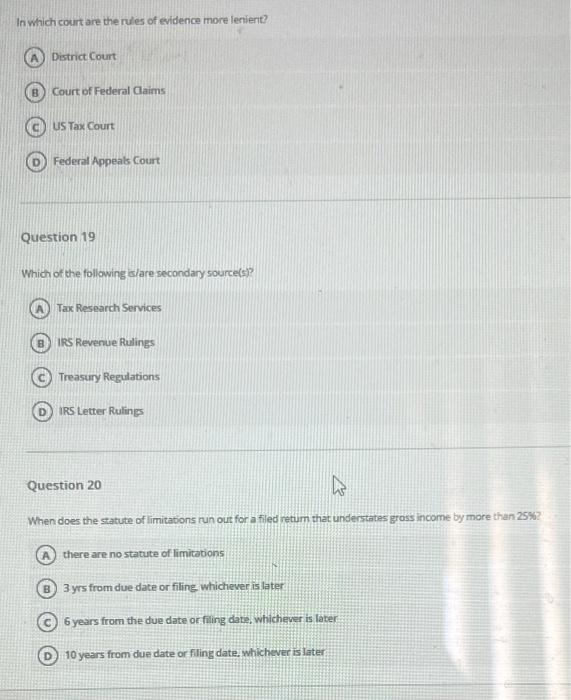

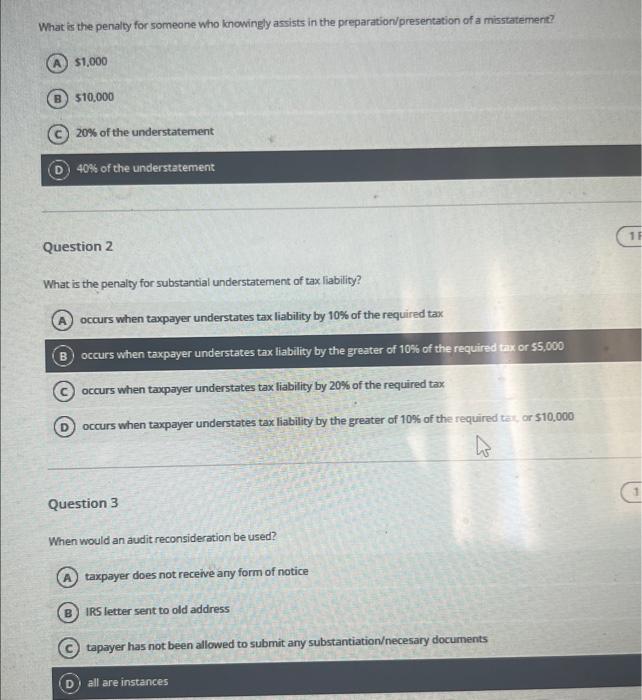

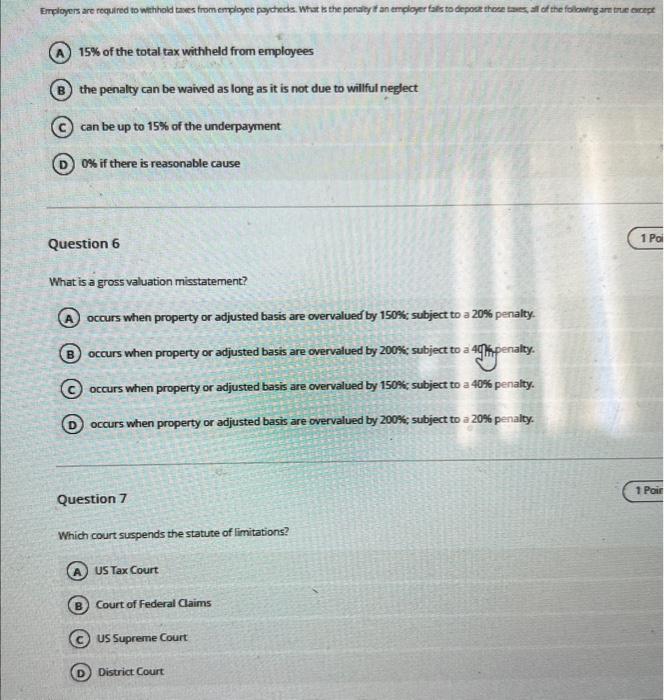

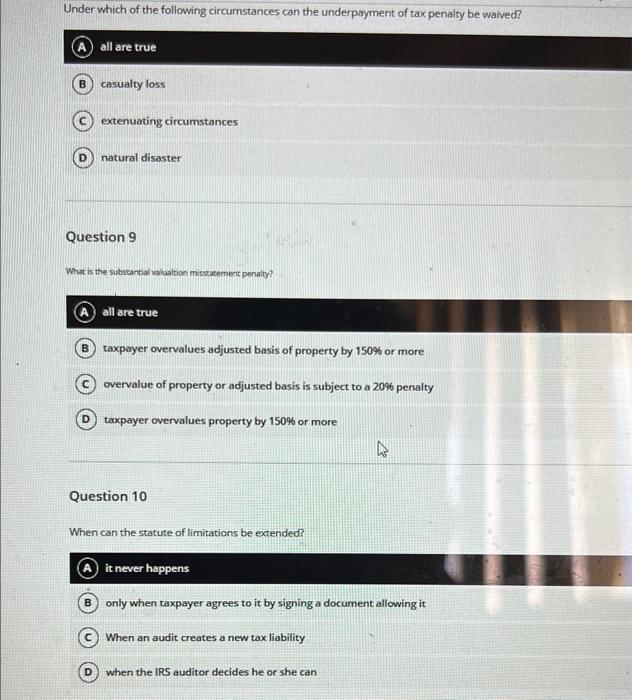

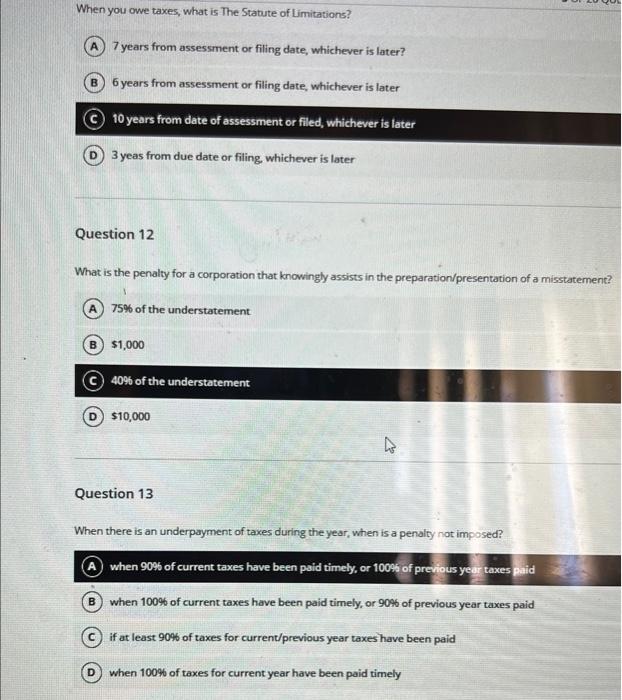

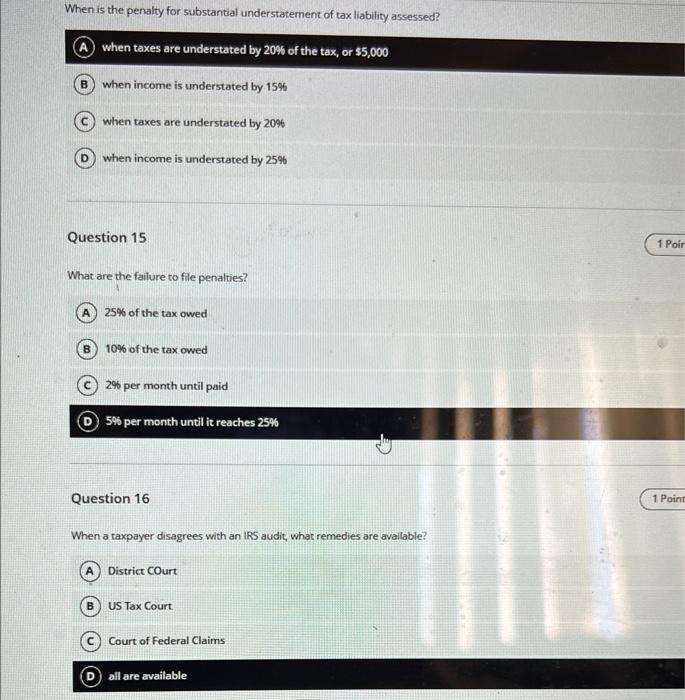

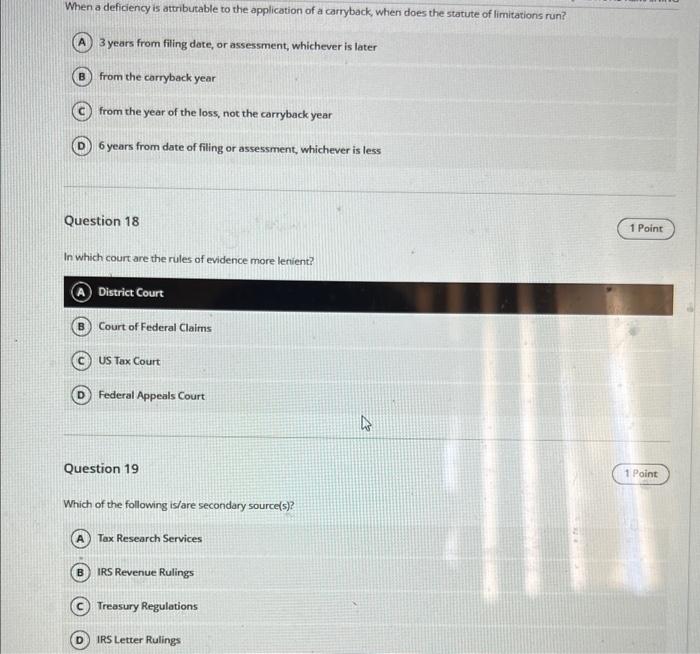

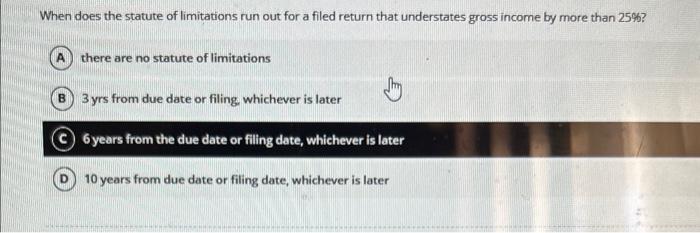

What is the penaity for substantial undenstatemert of bas fiblity? occurs when tapayer understates tax fiablicy by 104 of the riquind tax occurs when tamplyer understates tax lisibility by the greater of 104 of the required tar ar 35,000 ecruars when taxpayer understaten tax lighiliny by 85 of the requined tax occurs when taxplyer undentates tax lability ty the gearer of tow of the requird tax, or 510000 Question 3 When would an audit recordide crion be used? raxpeyer does not recohe any form of notice WiF5 letter sent to old address tapayer has not been allowed to sutmit any subetariousionecesary docianents Question 4 Which of the folowing istare considened as eaminacionlavie int tetters sent to taypayer An IFS raditor shows up at your plece of business all are correct Moeting at an liss Oifice Question 5 15\% of the treal tax whthhedd fram errployes the penally can be waived as lone as it is not due to willil nedect Can be up to 15% of the underpagmere Os it there is reasonable cause occurs when property cr adjusted basis are ovenolued by 199 co abject to a Zrif penalty. occurs when preperty or adiusted basis are overvalued by 2000k subject to a 409 penalty. Dcours whien property or adjusted basin are overvalued by 1505 si subject to a 435 penaly. occurs when property or adiusted basis are chervalued by 2001 wi subject to a 20 ti penalty. Question 7. Which court wuspends the statute of limitabons? UsTax Court Court of Federal Gains us Supreme Court District Court Question 8 Under which of the following circumbances can the underpaymers of tax peraly be waines? all are true casualty loss extenwating circumstances: natural clisaster Question 9 allare true tompinger onervalues adjusted basis of property by 1509 or morn owrvalue of property or adjusted basis is subject to a 200 penalty taxpayer overvalues property by isoth or more When carn the statiare of mirations be atrended? it nover happens Grly when laxpayer agroes to it ty siering a document allowing it When an audit crates ar rew tax fiability When the IRS auditar docides he or she can Question 11 When you owe trues, what \& The Prature of timitations? 7 yoars frcen assessment or filing date, whicheyer is later? Gyears from assesmuent or filing date, whichever is later 10 years from date of assessment or filed, whicherer is hater 3 yeas from due date or faire whichever a later Question 12 What is the penalty for a corporation that knowinty awsists in the pneparation/presencation of a thisstacenene? 75% of the understatement 51, 000 40% of the understatement 510,000 Question 13 When there is an underpayment of twxes during the year, when is a peralty not inposed? when 50% of current taxes have been paid timely, or 100% of previovs year waxes piud when 100% of current taxes have been paid timely, or 90% of previous year taxes paid if at least 90 in of taxes for cument/previous year taves have been paid When 1DOA of taxes for current year have been paid timely when tares are undersiated ty 201 of the cia, 0555,000 when inicome is underitated ty 19M when taxis are understates ty 20% when incone is undertated by 26% Question 15 Whar are the falure to file penakies? 25k of the tax cond 105 of the tax coned 2\% per manth until paid 5\$ per month until it reaches 25\% Question 16 When a twpyyer disagees with an IfS audit, what remedies are available? District Court US Tax Court Court of Federal Qaims all are avatlable. Question 17 When a deficiency is atribumbie to the application of a caryback, when does the stannit of lim iasians rur? 3 years from filing date, or assessment, whichever 8 later from the carrybadk year: from the year of the ioss, not the carryback year: 6years from date of fling or assessment, whichever is less In which court are the rules of Evidence more lenient? District Court. Court of Federal Claims USTax Court Federal Appeals Court Question 19 Whid of the following ivlare secondary source(si? Tax Research Services lis Revenue Rulings. Treasury Regulations IRS Letter Rulings Question 20 When does the statute of limitations run out for a fied retum that understates gross income by more than 25% ? there are no statute of limitations 3 yrs from due date or filing. Whichever is later: 6 years from the due date or faling date, whichever is laber 10 years from due date or filing date. whichever is Jater: What is the penalty for someone who knowingly assists in the preparation/presentation of a misstatement?? 51,000 510.000 20% of the understatement 400 of the understatement Question 2 What is the penaity for substantial understatement of tax liability? occurs when taxpayer understates tax liability by 10% of the required tax occurs when taxpayer understates tax liability by the greater of 10% of the required mix or 55,000 occurs when taxpayer understates tax liability by 20% of the required tax occurs when taxpayer understates tax liability by the greater of 10% of the required ten, or $10,000 Question 3 When would an audit reconsideration be used? taxpayer does not receive any form of notice IRS letter sent to old address tapayer has not been allowed to submit any substantiationecesary documents 15% of the total tax withheld from employees the penalty can be waived as long as it is not due to willul neglect can be up to 15% of the underpayment 0% if there is reasonable cause Question 6 What is a gross valuation misstatement? occurs when property or adjusted basis are overvalued by 150%; subject to a 20% penalty. occurs when property or adjusted basis are overvalued by 200s; subject to a 40 ingenalty. occurs when property or adjusted basis are overvalued by 150%; subject to a 40% penalty. occurs when property or adjusted basis are overvalued by 200%; subject to a 20% penalty. Question 7 Which court suspends the statute of limitations? USTax Court Court of Federal Claims US Supreme Court District Court Under which of the following circurnstances can the underpayment of tax penalty be waived? all are true casualty loss extenuating circumstances natural disaster Question 9 What is the subscantial valualion misstieement penaty? all are true taxpayer overvalues adjusted basis of property by 150% or more overvalue of property or adjusted basis is subject to a 20% penalty taxpayer overvalues property by 150% or more Question 10 When can the statute of limitations be extended? it never happens only when taxpayer agrees to it by signing a document allowing it When an audit creates a new tax liability when the IRS auditor decides he or she can When you owe taxes, what is The Statute of Limitations? 7 years from assessment or filing date, whichever is later? 6 years from assessment or filing date, whichever is later 10 years from date of assessment or filed, whichever is later D) 3 yeas from due date or filing, whichever is later Question 12 What is the penalty for a corporation that knowingly assists in the preparation/presentation of a misstatement? 75% of the understatement $1,000 40% of the understatement $10,000 Question 13 When there is an underpayment of taxes during the year, when is a penalty not imposed? when 9096 of current taxes have been paid timely, or 10095 of previous year taxes paid when 100% of current taxes have been paid timely, or 90% of previous year taxes paid if at least 90% of taxes for current/previous year taxes have been paid when 100% of taxes for current year have been paid timely When is the penalty for substantial understatement of tax liability assessed? when taxes are understated by 20% of the tax, or $5,000 when income is understated by 15% when taxes are understated by 20% when income is understated by 25% Question 15 What are the failure to file penalties? 25% of the tax owed 10% of the tax owed 296 per month until paid 5% per month until it reaches 25% Question 16 When a taxpayer disagrees with an IRS audit, what remedies are available? District COurt US Tax Court Court of Federal Claims When a deficiency is attributable to the application of a carryback, when does the statute of limitations run?? 3 years from filing dete, or assessment, whichever is later from the carryback year from the year of the loss, not the carryback year 6 years from date of filing or assessment, whichever is less Question 18 In which court are the rules of evidence more lenient? District Court Court of Federal Claims US Tax Court Federal Appeals Court Question 19 Which of the following is/are secondary source(s)? Tax Research Services IRS Revenue Rulings Treasury Regulations IRS Letter Rulings When does the statute of limitations run out for a filed return that understates gross income by more than 25% ? there are no statute of limitations 3 yrs from due date or filing, whichever is later 6 years from the due date or filing date, whichever is later 10 years from due date or filing date, whichever is later

What is the penaity for substantial undenstatemert of bas fiblity? occurs when tapayer understates tax fiablicy by 104 of the riquind tax occurs when tamplyer understates tax lisibility by the greater of 104 of the required tar ar 35,000 ecruars when taxpayer understaten tax lighiliny by 85 of the requined tax occurs when taxplyer undentates tax lability ty the gearer of tow of the requird tax, or 510000 Question 3 When would an audit recordide crion be used? raxpeyer does not recohe any form of notice WiF5 letter sent to old address tapayer has not been allowed to sutmit any subetariousionecesary docianents Question 4 Which of the folowing istare considened as eaminacionlavie int tetters sent to taypayer An IFS raditor shows up at your plece of business all are correct Moeting at an liss Oifice Question 5 15\% of the treal tax whthhedd fram errployes the penally can be waived as lone as it is not due to willil nedect Can be up to 15% of the underpagmere Os it there is reasonable cause occurs when property cr adjusted basis are ovenolued by 199 co abject to a Zrif penalty. occurs when preperty or adiusted basis are overvalued by 2000k subject to a 409 penalty. Dcours whien property or adjusted basin are overvalued by 1505 si subject to a 435 penaly. occurs when property or adiusted basis are chervalued by 2001 wi subject to a 20 ti penalty. Question 7. Which court wuspends the statute of limitabons? UsTax Court Court of Federal Gains us Supreme Court District Court Question 8 Under which of the following circumbances can the underpaymers of tax peraly be waines? all are true casualty loss extenwating circumstances: natural clisaster Question 9 allare true tompinger onervalues adjusted basis of property by 1509 or morn owrvalue of property or adjusted basis is subject to a 200 penalty taxpayer overvalues property by isoth or more When carn the statiare of mirations be atrended? it nover happens Grly when laxpayer agroes to it ty siering a document allowing it When an audit crates ar rew tax fiability When the IRS auditar docides he or she can Question 11 When you owe trues, what \& The Prature of timitations? 7 yoars frcen assessment or filing date, whicheyer is later? Gyears from assesmuent or filing date, whichever is later 10 years from date of assessment or filed, whicherer is hater 3 yeas from due date or faire whichever a later Question 12 What is the penalty for a corporation that knowinty awsists in the pneparation/presencation of a thisstacenene? 75% of the understatement 51, 000 40% of the understatement 510,000 Question 13 When there is an underpayment of twxes during the year, when is a peralty not inposed? when 50% of current taxes have been paid timely, or 100% of previovs year waxes piud when 100% of current taxes have been paid timely, or 90% of previous year taxes paid if at least 90 in of taxes for cument/previous year taves have been paid When 1DOA of taxes for current year have been paid timely when tares are undersiated ty 201 of the cia, 0555,000 when inicome is underitated ty 19M when taxis are understates ty 20% when incone is undertated by 26% Question 15 Whar are the falure to file penakies? 25k of the tax cond 105 of the tax coned 2\% per manth until paid 5\$ per month until it reaches 25\% Question 16 When a twpyyer disagees with an IfS audit, what remedies are available? District Court US Tax Court Court of Federal Qaims all are avatlable. Question 17 When a deficiency is atribumbie to the application of a caryback, when does the stannit of lim iasians rur? 3 years from filing date, or assessment, whichever 8 later from the carrybadk year: from the year of the ioss, not the carryback year: 6years from date of fling or assessment, whichever is less In which court are the rules of Evidence more lenient? District Court. Court of Federal Claims USTax Court Federal Appeals Court Question 19 Whid of the following ivlare secondary source(si? Tax Research Services lis Revenue Rulings. Treasury Regulations IRS Letter Rulings Question 20 When does the statute of limitations run out for a fied retum that understates gross income by more than 25% ? there are no statute of limitations 3 yrs from due date or filing. Whichever is later: 6 years from the due date or faling date, whichever is laber 10 years from due date or filing date. whichever is Jater: What is the penalty for someone who knowingly assists in the preparation/presentation of a misstatement?? 51,000 510.000 20% of the understatement 400 of the understatement Question 2 What is the penaity for substantial understatement of tax liability? occurs when taxpayer understates tax liability by 10% of the required tax occurs when taxpayer understates tax liability by the greater of 10% of the required mix or 55,000 occurs when taxpayer understates tax liability by 20% of the required tax occurs when taxpayer understates tax liability by the greater of 10% of the required ten, or $10,000 Question 3 When would an audit reconsideration be used? taxpayer does not receive any form of notice IRS letter sent to old address tapayer has not been allowed to submit any substantiationecesary documents 15% of the total tax withheld from employees the penalty can be waived as long as it is not due to willul neglect can be up to 15% of the underpayment 0% if there is reasonable cause Question 6 What is a gross valuation misstatement? occurs when property or adjusted basis are overvalued by 150%; subject to a 20% penalty. occurs when property or adjusted basis are overvalued by 200s; subject to a 40 ingenalty. occurs when property or adjusted basis are overvalued by 150%; subject to a 40% penalty. occurs when property or adjusted basis are overvalued by 200%; subject to a 20% penalty. Question 7 Which court suspends the statute of limitations? USTax Court Court of Federal Claims US Supreme Court District Court Under which of the following circurnstances can the underpayment of tax penalty be waived? all are true casualty loss extenuating circumstances natural disaster Question 9 What is the subscantial valualion misstieement penaty? all are true taxpayer overvalues adjusted basis of property by 150% or more overvalue of property or adjusted basis is subject to a 20% penalty taxpayer overvalues property by 150% or more Question 10 When can the statute of limitations be extended? it never happens only when taxpayer agrees to it by signing a document allowing it When an audit creates a new tax liability when the IRS auditor decides he or she can When you owe taxes, what is The Statute of Limitations? 7 years from assessment or filing date, whichever is later? 6 years from assessment or filing date, whichever is later 10 years from date of assessment or filed, whichever is later D) 3 yeas from due date or filing, whichever is later Question 12 What is the penalty for a corporation that knowingly assists in the preparation/presentation of a misstatement? 75% of the understatement $1,000 40% of the understatement $10,000 Question 13 When there is an underpayment of taxes during the year, when is a penalty not imposed? when 9096 of current taxes have been paid timely, or 10095 of previous year taxes paid when 100% of current taxes have been paid timely, or 90% of previous year taxes paid if at least 90% of taxes for current/previous year taxes have been paid when 100% of taxes for current year have been paid timely When is the penalty for substantial understatement of tax liability assessed? when taxes are understated by 20% of the tax, or $5,000 when income is understated by 15% when taxes are understated by 20% when income is understated by 25% Question 15 What are the failure to file penalties? 25% of the tax owed 10% of the tax owed 296 per month until paid 5% per month until it reaches 25% Question 16 When a taxpayer disagrees with an IRS audit, what remedies are available? District COurt US Tax Court Court of Federal Claims When a deficiency is attributable to the application of a carryback, when does the statute of limitations run?? 3 years from filing dete, or assessment, whichever is later from the carryback year from the year of the loss, not the carryback year 6 years from date of filing or assessment, whichever is less Question 18 In which court are the rules of evidence more lenient? District Court Court of Federal Claims US Tax Court Federal Appeals Court Question 19 Which of the following is/are secondary source(s)? Tax Research Services IRS Revenue Rulings Treasury Regulations IRS Letter Rulings When does the statute of limitations run out for a filed return that understates gross income by more than 25% ? there are no statute of limitations 3 yrs from due date or filing, whichever is later 6 years from the due date or filing date, whichever is later 10 years from due date or filing date, whichever is later

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started