Answered step by step

Verified Expert Solution

Question

1 Approved Answer

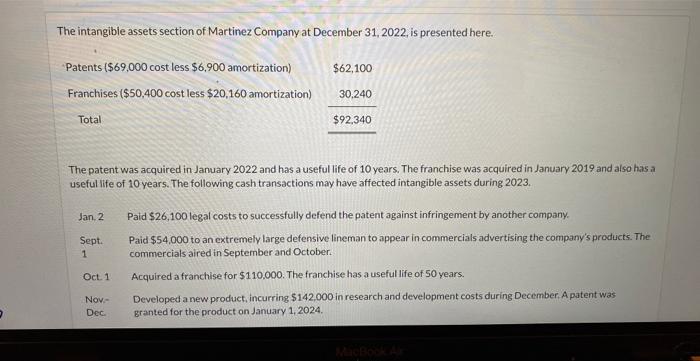

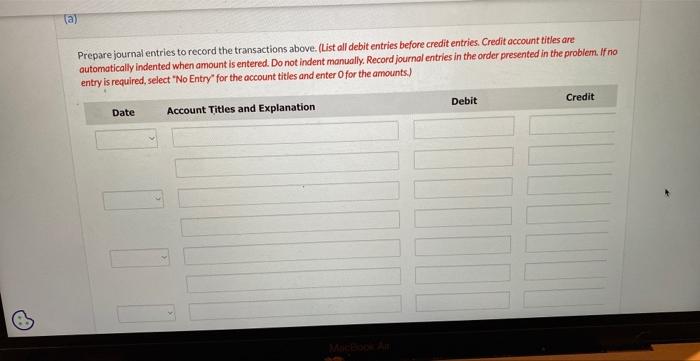

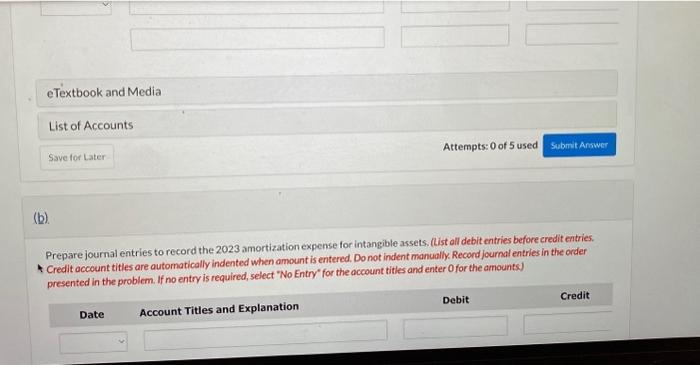

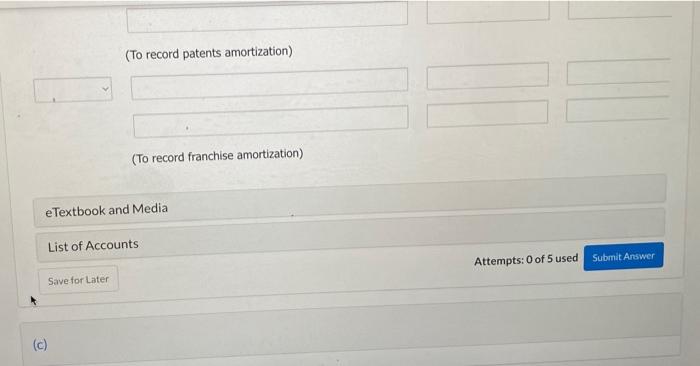

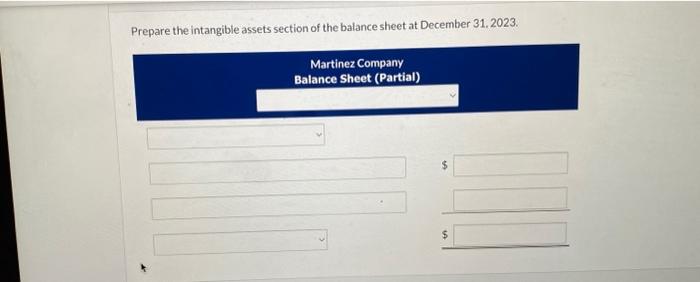

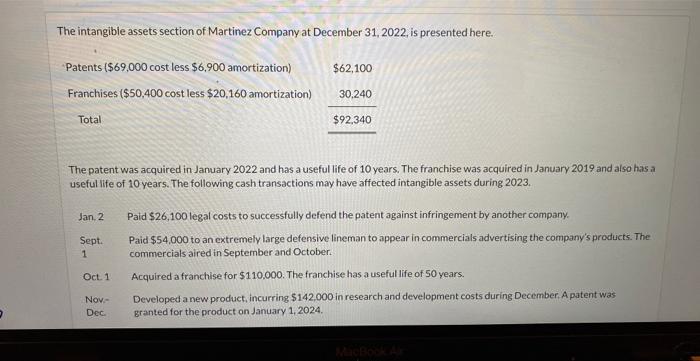

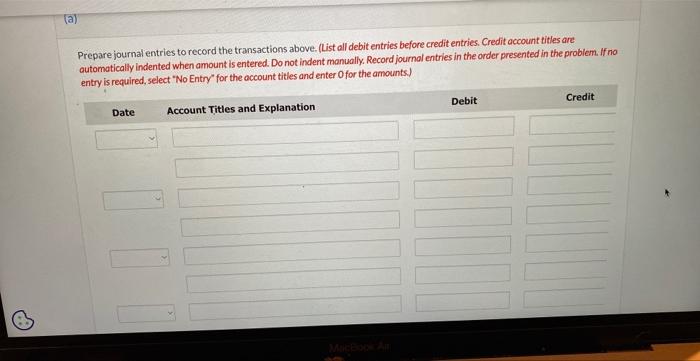

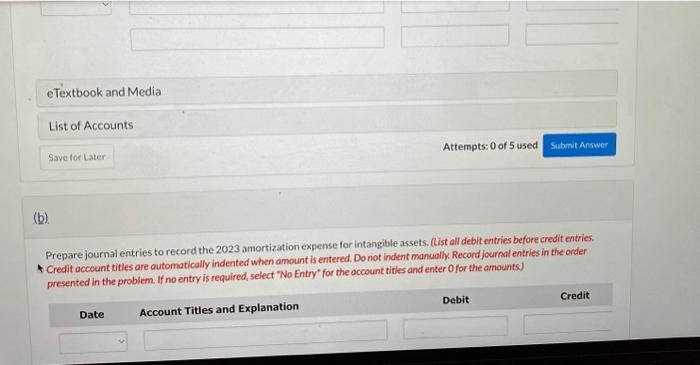

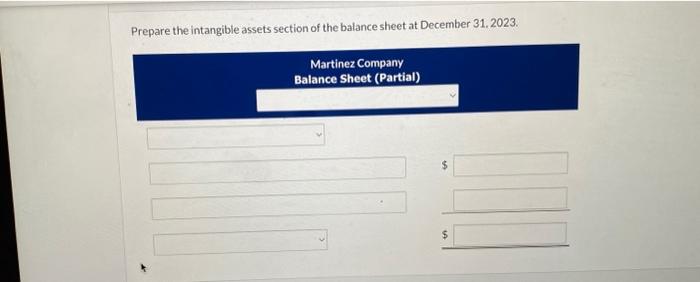

answer all please The intangible assets section of Martinez Company at December 31, 2022, is presented here. The patent was acquired in January 2022 and

answer all please

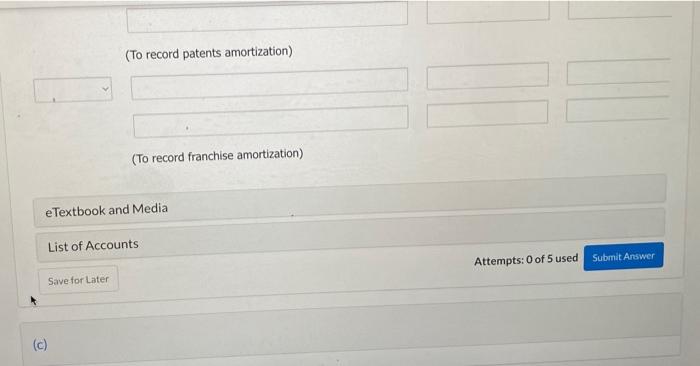

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started