Answer all problems below, attach your workings please

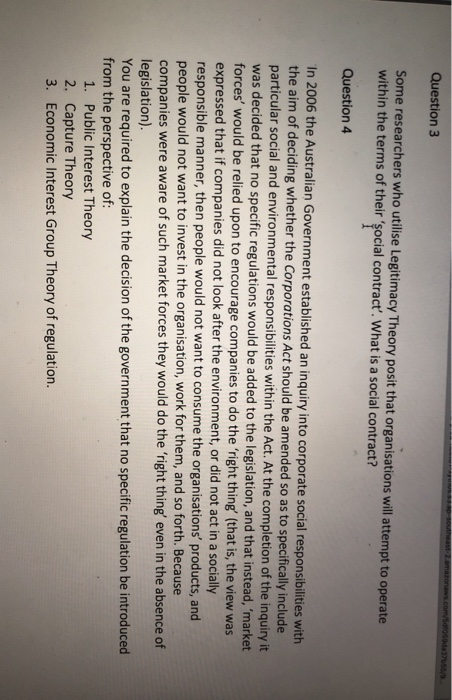

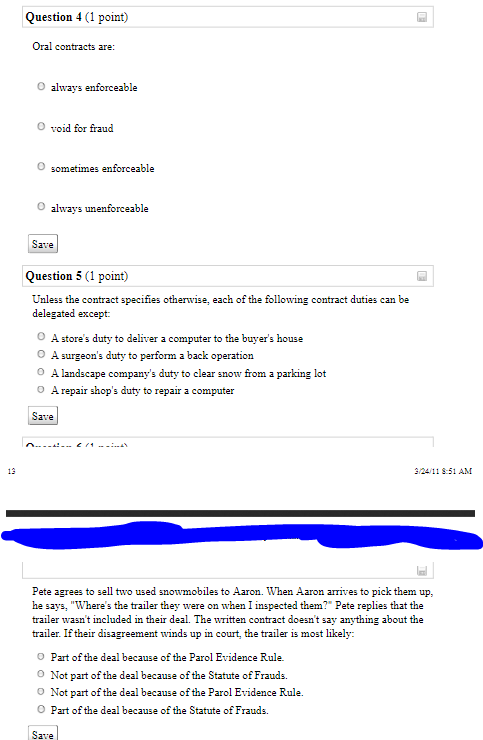

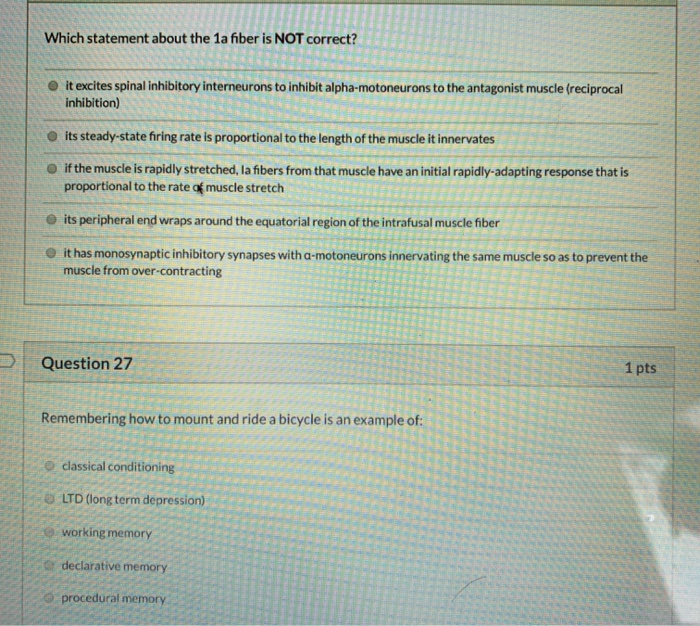

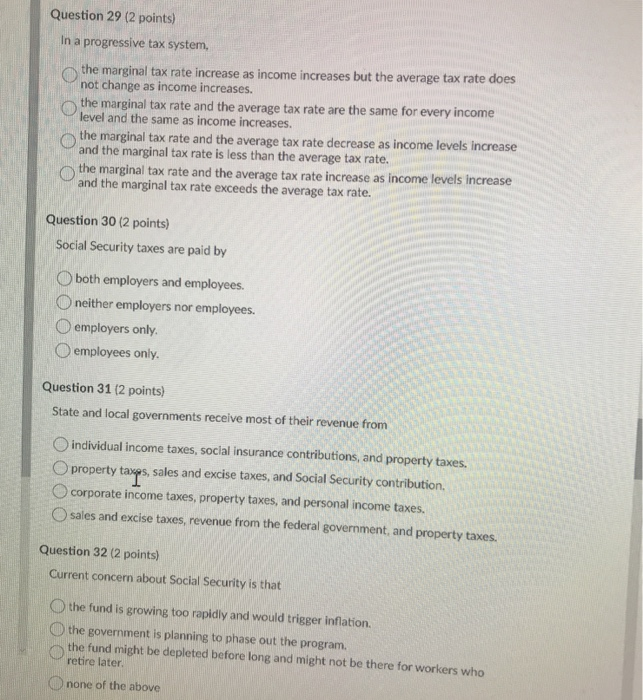

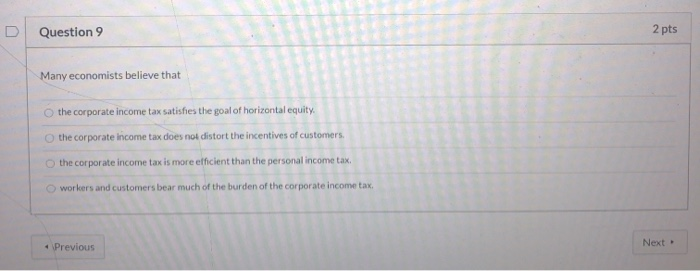

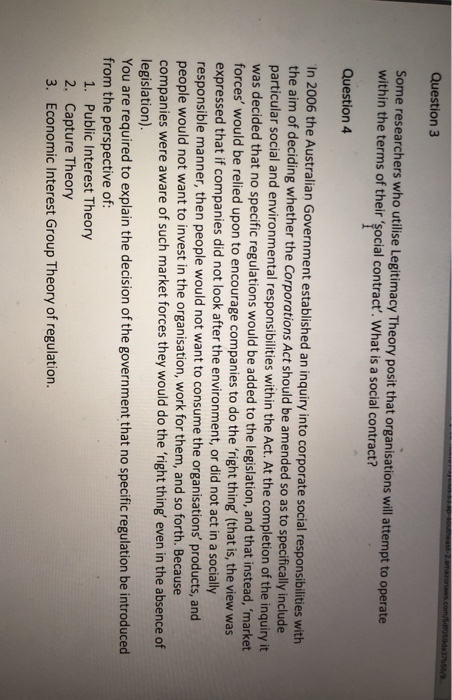

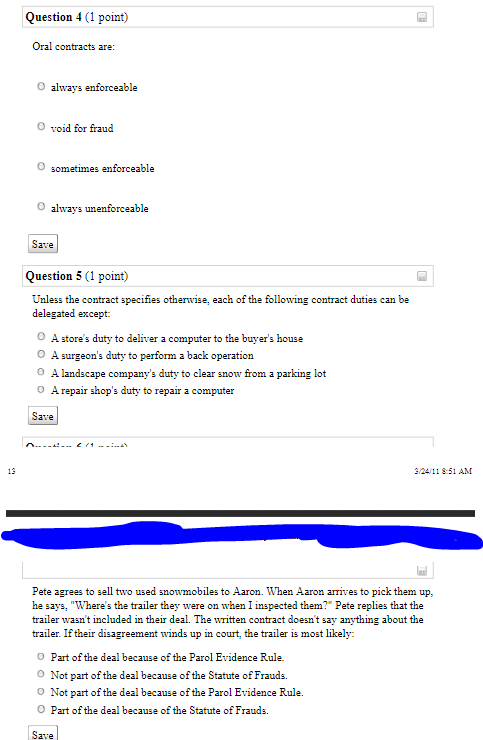

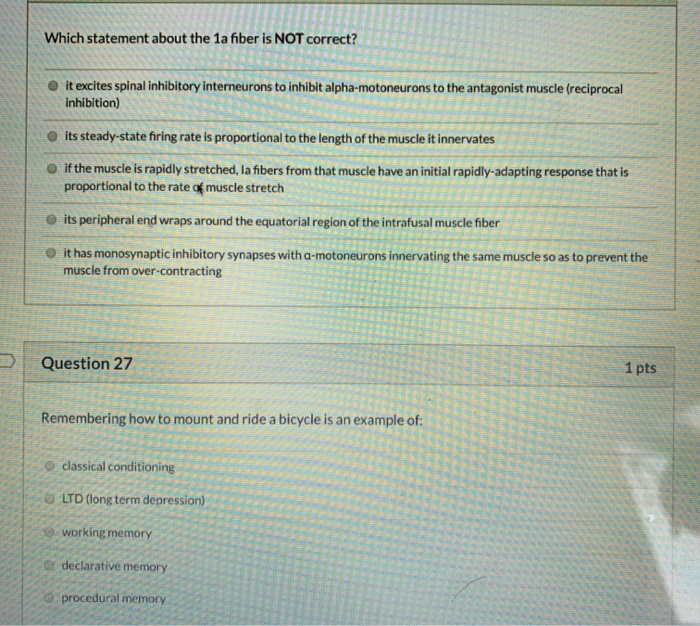

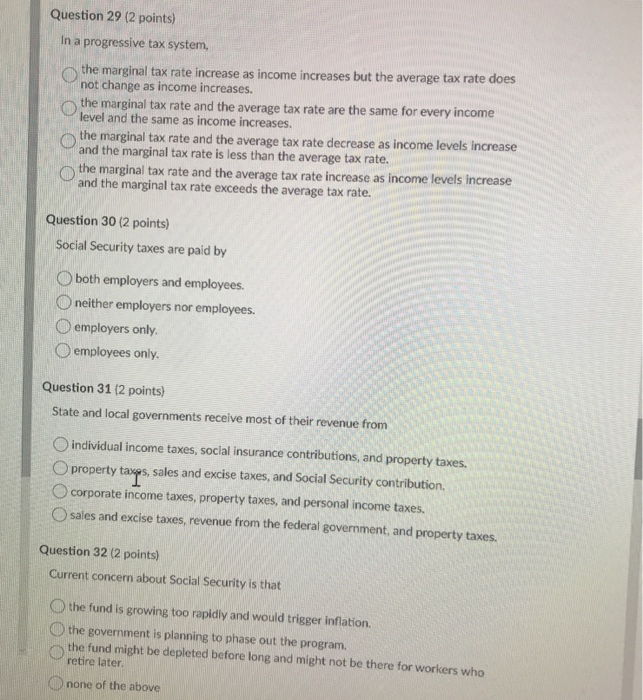

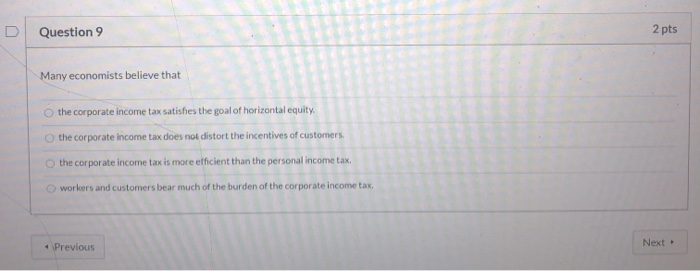

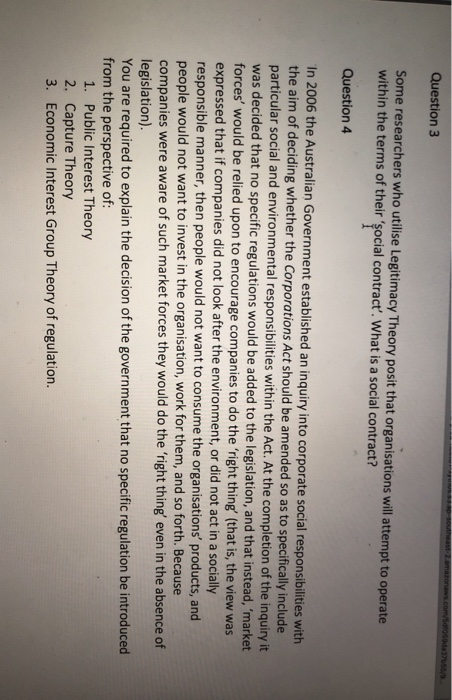

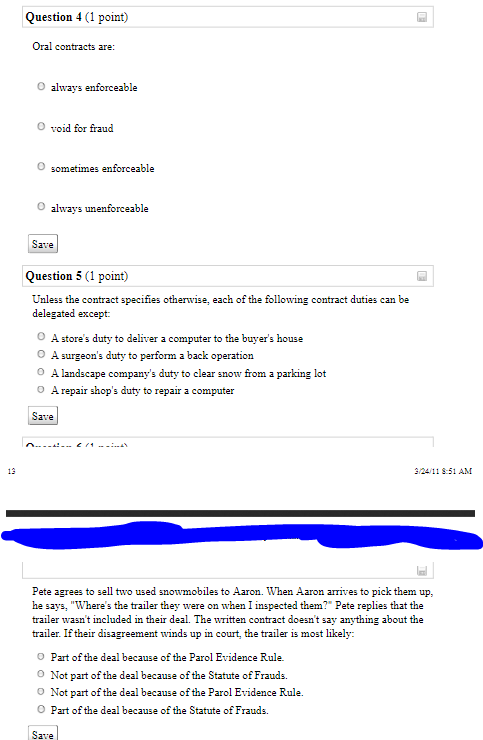

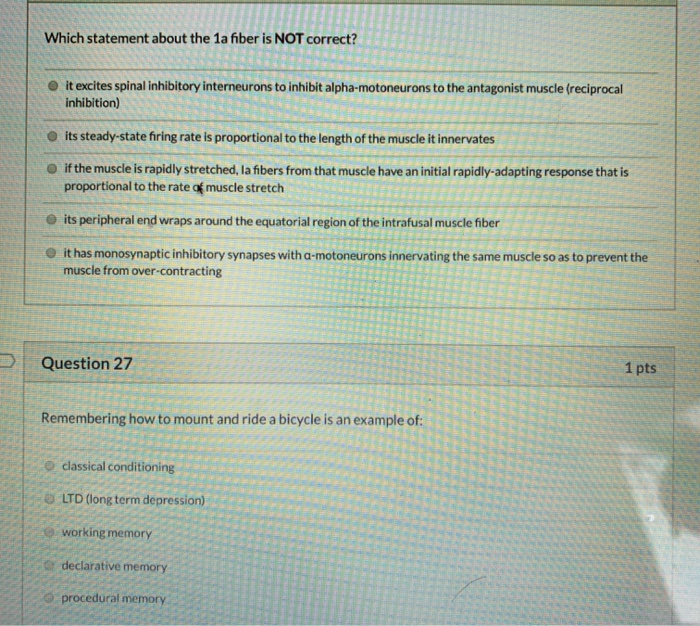

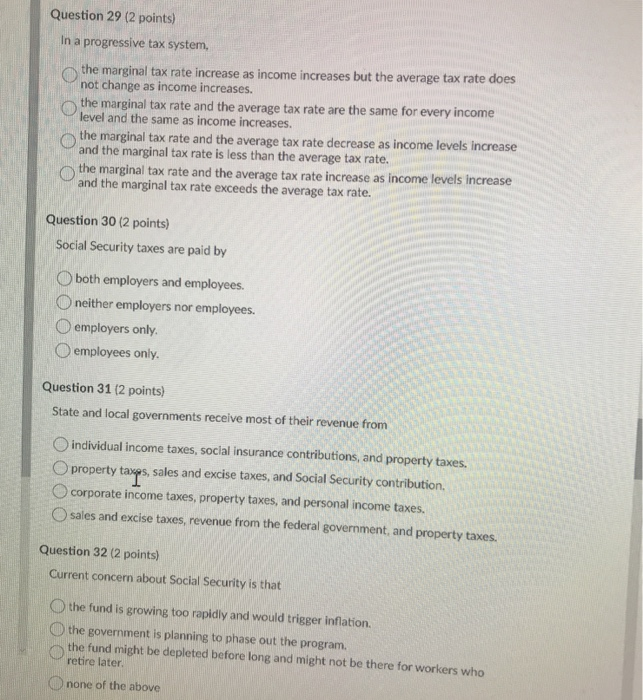

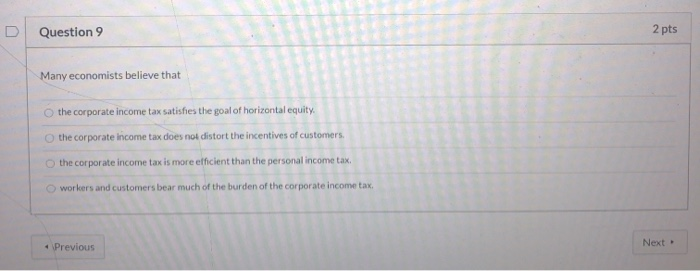

Question 3 Some researchers who utilise Legitimacy Theory posit that organisations will attempt to operate within the terms of their 'social contract". What is a social contract? Question 4 In 2006 the Australian Government established an inquiry into corporate social responsibilities with the aim of deciding whether the Corporations Act should be amended so as to specifically include particular social and environmental responsibilities within the Act. At the completion of the inquiry it was decided that no specific regulations would be added to the legislation, and that instead, 'market forces' would be relied upon to encourage companies to do the 'right thing' (that is, the view was expressed that if companies did not look after the environment, or did not act in a socially responsible manner, then people would not want to consume the organisations' products, and people would not want to invest in the organisation, work for them, and so forth. Because companies were aware of such market forces they would do the 'right thing' even in the absence of legislation). You are required to explain the decision of the government that no specific regulation be introduced from the perspective of: 1. Public Interest Theory 2. Capture Theory 3. Economic Interest Group Theory of regulation.Question 4 (1 point) Oral contracts are: O always enforceable O void for fraud sometimes enforceable O always unenforceable Save Question 5 (1 point) Unless the contract specifies otherwise, each of the following contract duties can be delegated except: O A store's duty to deliver a computer to the buyer's house O A surgeon's duty to perform a back operation O A landscape company's duty to clear snow from a parking lot O A repair shop's duty to repair a computer Save 13 3/24/11 8:51 AM Pete agrees to sell two used snowmobiles to Aaron. When Aaron arrives to pick them up, he says, "Where's the trailer they were on when I inspected them?" Pete replies that the trailer wasn't included in their deal. The written contract doesn't say anything about the trailer. If their disagreement winds up in court, the trailer is most likely: D Part of the deal because of the Parol Evidence Rule. O Not part of the deal because of the Statute of Frauds. O Not part of the deal because of the Parol Evidence Rule. O Part of the deal because of the Statute of Frauds. SaveWhich statement about the la fiber is NOT correct? O it excites spinal inhibitory interneurons to inhibit alpha-motoneurons to the antagonist muscle (reciprocal inhibition) O its steady-state firing rate is proportional to the length of the muscle it innervates O if the muscle is rapidly stretched, la fibers from that muscle have an initial rapidly-adapting response that is proportional to the rate of muscle stretch its peripheral end wraps around the equatorial region of the intrafusal muscle fiber it has monosynaptic inhibitory synapses with a-motoneurons innervating the same muscle so as to prevent the muscle from over-contracting Question 27 1 pts Remembering how to mount and ride a bicycle is an example of: classical conditioning LTD (long term depression) working memory declarative memory procedural memoryQuestion 29 (2 points) In a progressive tax system, the marginal tax rate increase as income increases but the average tax rate does not change as income increases. the marginal tax rate and the average tax rate are the same for every income level and the same as income increases. D the marginal tax rate and the average tax rate decrease as income levels Increase and the marginal tax rate is less than the average tax rate. O the marginal tax rate and the average tax rate increase as income levels increase and the marginal tax rate exceeds the average tax rate. Question 30 (2 points) Social Security taxes are paid by (both employers and employees. neither employers nor employees. Oemployers only. Oemployees only. Question 31 (2 points) State and local governments receive most of their revenue from individual income taxes, social insurance contributions, and property taxes. property taxes, sales and excise taxes, and Social Security contribution. corporate income taxes, property taxes, and personal income taxes. sales and excise taxes, revenue from the federal government, and property taxes. Question 32 (2 points) Current concern about Social Security is that () the fund is growing too rapidly and would trigger inflation. D)the government is planning to phase out the program. the fund might be depleted before long and might not be there for workers who retire later. () none of the aboveD Question 9 2 pts Many economists believe that O the corporate income tax satisfies the goal of horizontal equity. O the corporate income tax does not distort the incentives of customers. O the corporate income tax is more efficient than the personal income tax. O workers and customers bear much of the burden of the corporate income tax. Previous Next