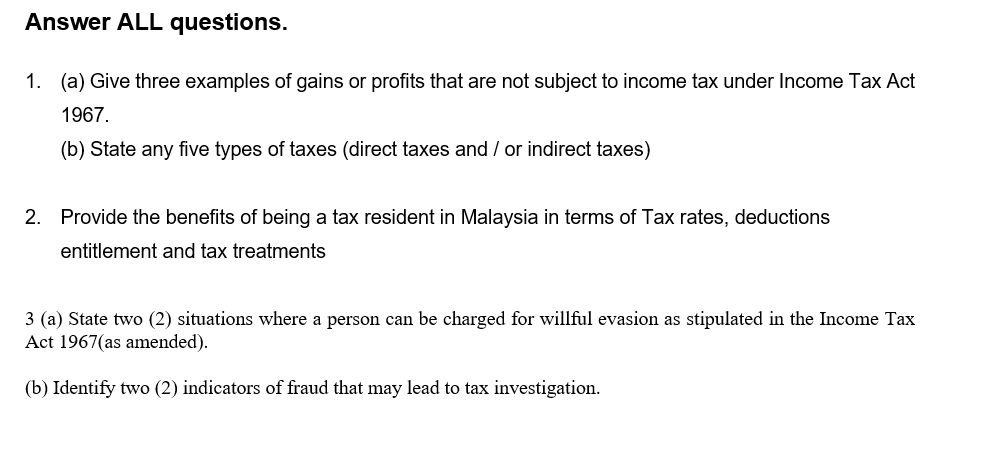

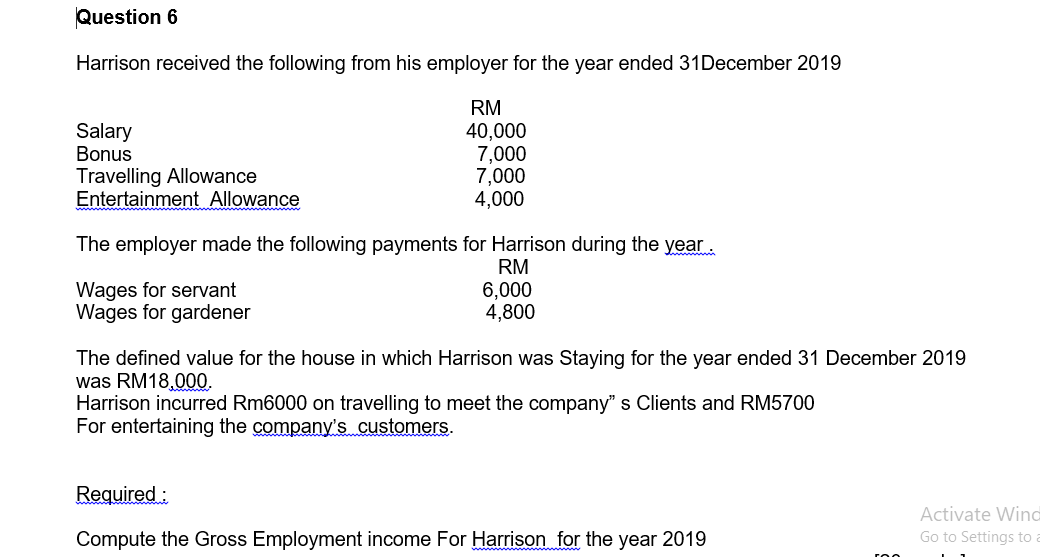

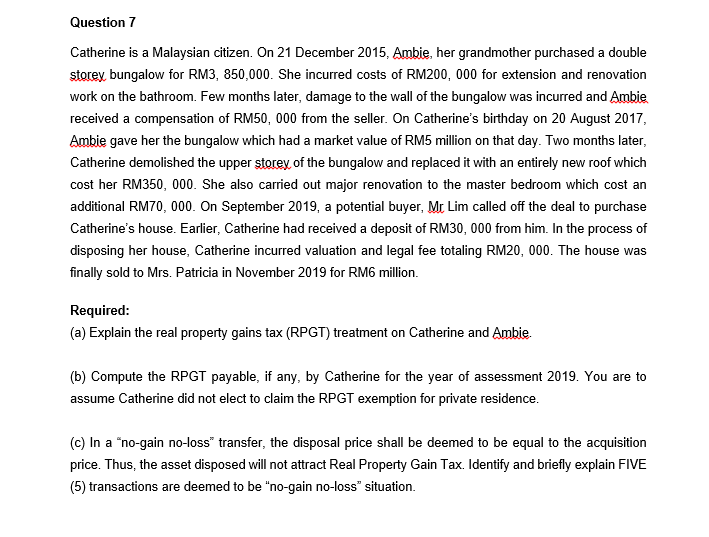

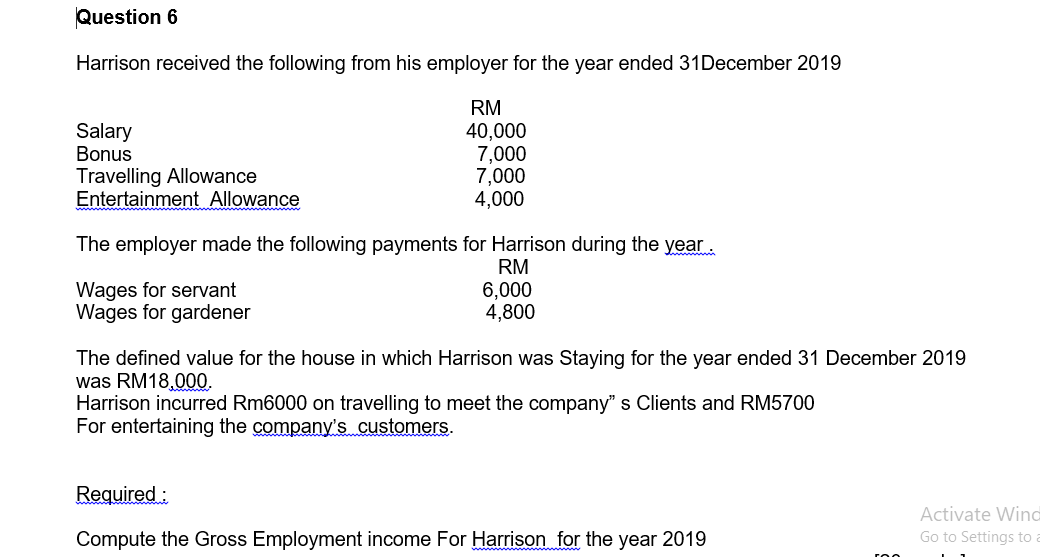

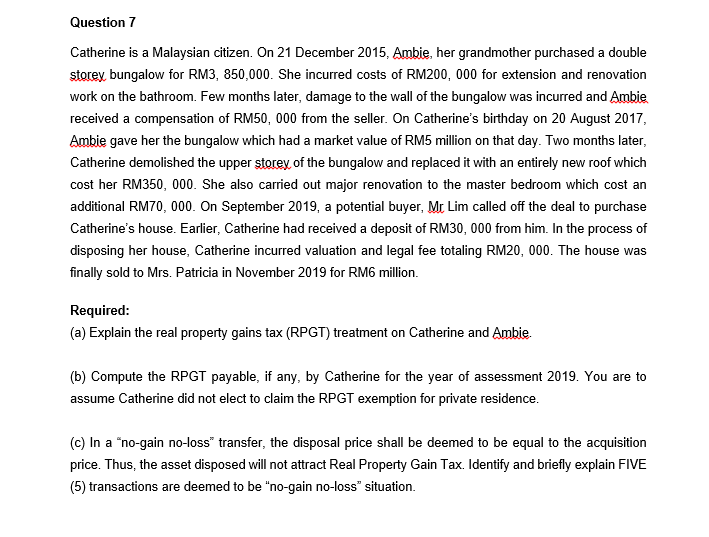

Answer ALL questions. 1. (a) Give three examples of gains or profits that are not subject to income tax under Income Tax Act 1967. (b) State any five types of taxes (direct taxes and / or indirect taxes) 2. Provide the benefits of being a tax resident in Malaysia in terms of Tax rates, deductions entitlement and tax treatments 3 (a) State two (2) situations where a person can be charged for willful evasion as stipulated in the Income Tax Act 1967(as amended). (b) Identify two (2) indicators of fraud that may lead to tax investigation. Question 6 Harrison received the following from his employer for the year ended 31December 2019 Salary Bonus Travelling Allowance Entertainment Allowance RM 40,000 7,000 7,000 4,000 The employer made the following payments for Harrison during the year RM Wages for servant 6,000 Wages for gardener 4,800 The defined value for the house in which Harrison was Staying for the year ended 31 December 2019 was RM18,000. Harrison incurred Rm6000 on travelling to meet the company" s Clients and RM5700 For entertaining the company's customers. Required: Activate Wing Go to Settings to Compute the Gross Employment income For Harrison for the year 2019 Question 7 Catherine is a Malaysian citizen. On 21 December 2015, Ambie, her grandmother purchased a double storey bungalow for RM3, 850,000. She incurred costs of RM200,000 for extension and renovation work on the bathroom. Few months later, damage to the wall of the bungalow was incurred and Ambie received a compensation of RM50,000 from the seller. On Catherine's birthday on 20 August 2017, Ambie gave her the bungalow which had a market value of RM5 million on that day. Two months later, Catherine demolished the upper storey of the bungalow and replaced it with an entirely new roof which cost her RM350, 000. She also carried out major renovation to the master bedroom which cost an additional RM70,000. On September 2019, a potential buyer, Mr Lim called off the deal to purchase Catherine's house. Earlier, Catherine had received a deposit of RM30,000 from him. In the process of disposing her house, Catherine incurred valuation and legal fee totaling RM20,000. The house was finally sold to Mrs. Patricia in November 2019 for RM6 million. Required: (a) Explain the real property gains tax (RPGT) treatment on Catherine and Ambie. (b) Compute the RPGT payable, if any, by Catherine for the year of assessment 2019. You are to assume Catherine did not elect to claim the RPGT exemption for private residence. (c) In a "no-gain no-loss transfer, the disposal price shall be deemed to be equal to the acquisition price. Thus, the asset disposed will not attract Real Property Gain Tax. Identify and briefly explain FIVE (5) transactions are deemed to be "no-gain no-loss" situation