Answered step by step

Verified Expert Solution

Question

1 Approved Answer

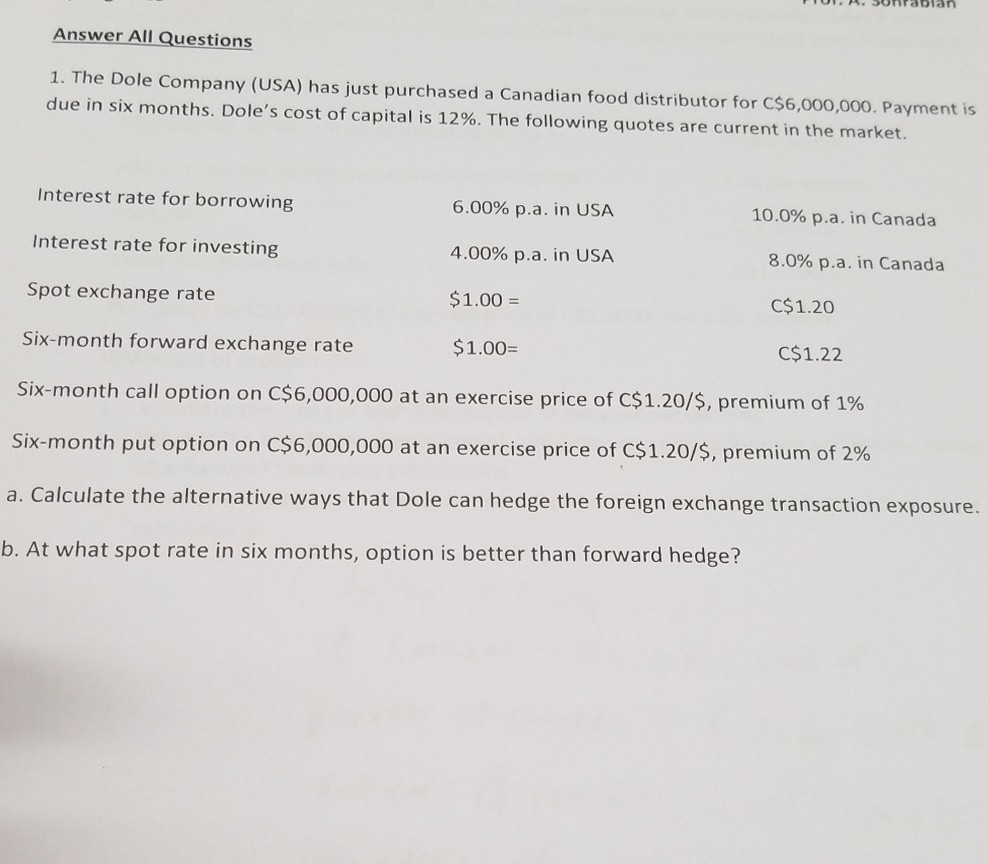

Answer All Questions 1. The Dole Company (USA) has just purchased a Canadian food distributor for C$6,000,000. Payment is due in six months. Dole's cost

Answer All Questions 1. The Dole Company (USA) has just purchased a Canadian food distributor for C$6,000,000. Payment is due in six months. Dole's cost of capital is 12%. The following quotes are current in the market. Interest rate for borrowing Interest rate for investing Spot exchange rate Six-month forward exchange rate Six-month call option on C$6,000,000 at an exercise price of C$1.20/$, premium of 1% 6.00% pa. in USA 4.00% p.a. in USA $1.00 $1.00- 10.0% pa. in Canada 8.0% pa. in Canada C$1.20 C$1.22 Six-month put option on C$6,000,000 at an exercise price of C$1.20/$, premium of 2% a. Calculate the alternative ways that Dole can hedge the foreign exchange transaction exposure. b. At what spot rate in six months, option is better than forward hedge

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started