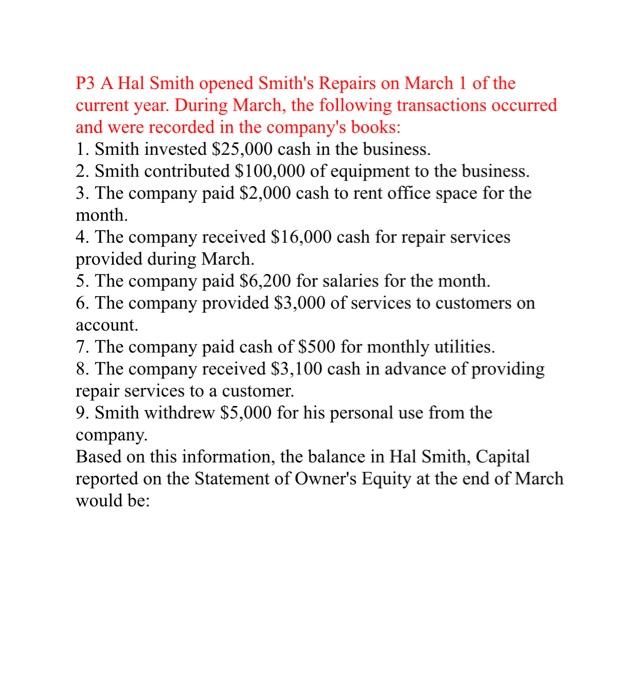

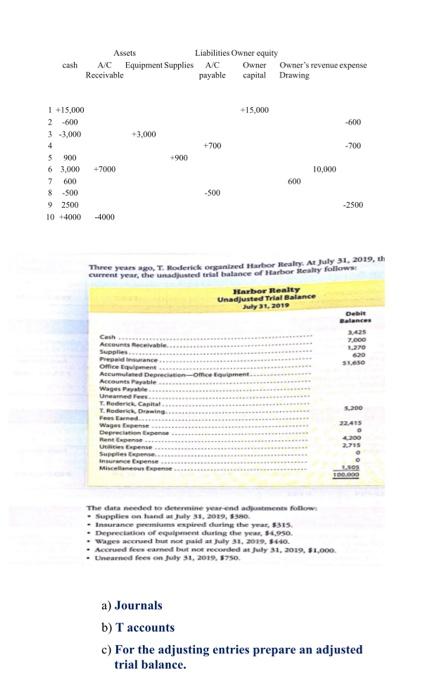

ANSWER ALL QUESTIONS 10 MARKS PI-IA On April 1, Julie Spengel established Spengel's Travel Agency, The following transactions were completed during the month. 1. Invested $15,000 cash to start the agency. 2. Paid $600 cash for April office rent. 3. Purchased equipment for $3,000 cash. 4. Incurred S700 of advertising costs in the Chicago Tribune, on account 5. Paid $900 cash for office supplies. 6. Performed services worth $10,000: $3,000 cash is received from customers, and the balance of $7,000 is billed to customers on account 7. Withdrew $600 cash for personal use. 8. Paid Chicago Tribune $500 of the amount due in transaction 9. Paid employees' salaries $2,500. 10. Received $4,000 in cash from customers who have previously been billed in transaction P-2 Selected transactions for Fabulous Flora Company are listed below. 1. Made cash investment to start business. 2. Purchased equipment on account. 3. Paid salaries. 4. Billed customers for services performed. 5. Received cash from customers billed in (4). 6. Withdrew cash for owner's personal use. 7. Incurred advertising expense on account. 8. Purchased additional equipment for cash. 9. Received cash from customers when service was performed ANS EXAMPLE Assets Liabilities Owners Equity Cash() NC OC(+) P3 A Hal Smith opened Smith's Repairs on March 1 of the current year. During March, the following transactions occurred and were recorded in the company's books: 1. Smith invested $25,000 cash in the business. 2. Smith contributed $100,000 of equipment to the business. 3. The company paid $2,000 cash to rent office space for the month. 4. The company received $16,000 cash for repair services provided during March. 5. The company paid $6,200 for salaries for the month. 6. The company provided $3,000 of services to customers on account. 7. The company paid cash of $500 for monthly utilities. 8. The company received $3,100 cash in advance of providing repair services to a customer. 9. Smith withdrew $5,000 for his personal use from the company. Based on this information, the balance in Hal Smith, Capital reported on the Statement of Owner's Equity at the end of March would be: cash Assets Liabilities Owner equity A/C Equipment Supplies AC Owner Owner's revenue expense Receivable payable capital Drawing -15.000 -600 +3.000 +700 -200 -900 1 +15,000 2 600 3 -3,000 4 5 900 63.000 7 600 8500 92500 10 4000 -7000 10.000 600 500 -2500 -4000 Three years. T. Micked Harbor HealryAt July 31, 2019, th current year, the unadhunted to balance of Harbor sesley Follow Harbor Realty Unadjusted Trial Balance July 1, 2019 De 2.00 620 SO Cash Acable Prada oment Amated Deprecate-omment Accounts Payable Megas Payalae Une The Capital Toring Feed Wagens Depreciation pense Rent Upen Supplies une pense 2. 3.10 The data needed to determine arendamment follow Supplies on hand July 31, 2009, 5380 Insurance premium expired during the year, IS, Depreciation of equipment during the w, 34.950. We ardhur me dat July 21, 2019. 10. Accrued fees came but not recorded at July 31, 2019, $1,000 earned fees on July 31, 2019.750 a) Journals b) T accounts c) For the adjusting entries prepare an adjusted trial balance. ANSWER ALL QUESTIONS 10 MARKS PI-IA On April 1, Julie Spengel established Spengel's Travel Agency, The following transactions were completed during the month. 1. Invested $15,000 cash to start the agency. 2. Paid $600 cash for April office rent. 3. Purchased equipment for $3,000 cash. 4. Incurred S700 of advertising costs in the Chicago Tribune, on account 5. Paid $900 cash for office supplies. 6. Performed services worth $10,000: $3,000 cash is received from customers, and the balance of $7,000 is billed to customers on account 7. Withdrew $600 cash for personal use. 8. Paid Chicago Tribune $500 of the amount due in transaction 9. Paid employees' salaries $2,500. 10. Received $4,000 in cash from customers who have previously been billed in transaction P-2 Selected transactions for Fabulous Flora Company are listed below. 1. Made cash investment to start business. 2. Purchased equipment on account. 3. Paid salaries. 4. Billed customers for services performed. 5. Received cash from customers billed in (4). 6. Withdrew cash for owner's personal use. 7. Incurred advertising expense on account. 8. Purchased additional equipment for cash. 9. Received cash from customers when service was performed ANS EXAMPLE Assets Liabilities Owners Equity Cash() NC OC(+)