Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mia Carriers has determined that a new specialised delivery truck needs to be purchased. The truck will generate a positive net present value NPV

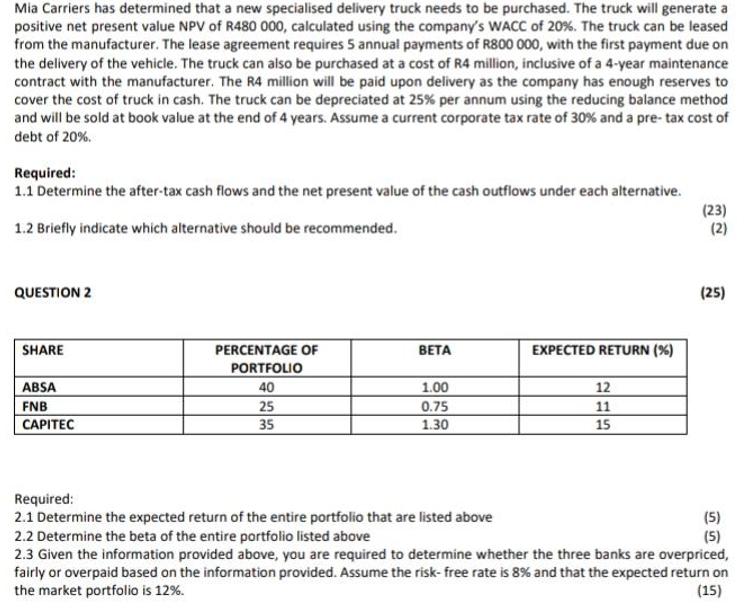

Mia Carriers has determined that a new specialised delivery truck needs to be purchased. The truck will generate a positive net present value NPV of R480 000, calculated using the company's WACC of 20%. The truck can be leased from the manufacturer. The lease agreement requires 5 annual payments of R800 000, with the first payment due on the delivery of the vehicle. The truck can also be purchased at a cost of R4 million, inclusive of a 4-year maintenance contract with the manufacturer. The R4 million will be paid upon delivery as the company has enough reserves to cover the cost of truck in cash. The truck can be depreciated at 25% per annum using the reducing balance method and will be sold at book value at the end of 4 years. Assume a current corporate tax rate of 30% and a pre- tax cost of debt of 20%. Required: 1.1 Determine the after-tax cash flows and the net present value of the cash outflows under each alternative. (23) (2) 1.2 Briefly indicate which alternative should be recommended. QUESTION 2 (25) SHARE PERCENTAGE OF EXPECTED RETURN (%) PORTFOLIO ABSA 40 1.00 12 FNB 25 35 0.75 11 CAPITEC 1.30 15 Required: 2.1 Determine the expected return of the entire portfolio that are listed above 2.2 Determine the beta of the entire portfolio listed above 2.3 Given the information provided above, you are required to determine whether the three banks are overpriced, fairly or overpaid based on the information provided. Assume the risk- free rate is 8% and that the expected return on the market portfolio is 12%. (5) (5) (15)

Step by Step Solution

★★★★★

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

2 Answer 8 Alternutive z lease leuse Rentul bo0 00 Peoun Poesent value of ushoutfiow 800000 soo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started