Answered step by step

Verified Expert Solution

Question

1 Approved Answer

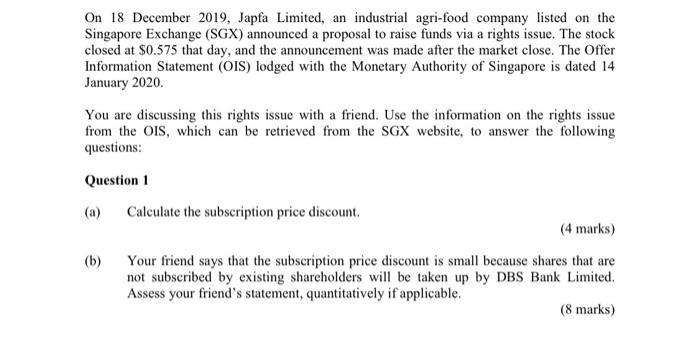

On 18 December 2019, Japfa Limited, an industrial agri-food company listed on the Singapore Exchange (SGX) announced a proposal to raise funds via a

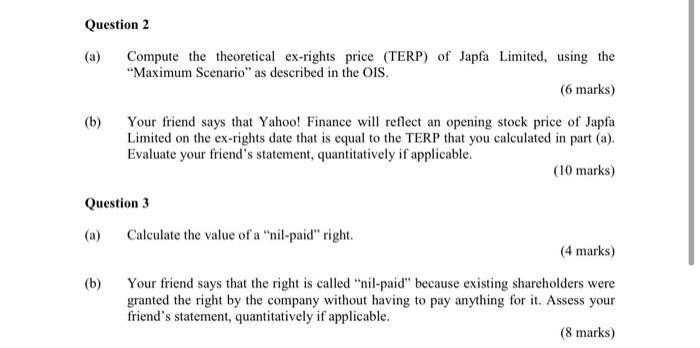

On 18 December 2019, Japfa Limited, an industrial agri-food company listed on the Singapore Exchange (SGX) announced a proposal to raise funds via a rights issue. The stock closed at $0.575 that day, and the announcement was made after the market close. The Offer Information Statement (OIS) lodged with the Monetary Authority of Singapore is dated 14 January 2020. You are discussing this rights issue with a friend. Use the information on the rights issue from the OIS, which can be retrieved from the SGX website, to answer the following questions: Question 1 (a) Calculate the subscription price discount. (b) (4 marks) Your friend says that the subscription price discount is small because shares that are not subscribed by existing shareholders will be taken up by DBS Bank Limited. Assess your friend's statement, quantitatively if applicable. (8 marks) Question 2 Compute the theoretical ex-rights price (TERP) of Japfa Limited, using the "Maximum Scenario" as described in the OIS. (6 marks) Your friend says that Yahoo! Finance will reflect an opening stock price of Japfa Limited on the ex-rights date that is equal to the TERP that you calculated in part (a). Evaluate your friend's statement, quantitatively if applicable. (10 marks) (a) (b) Question 3 (a) (b) Calculate the value of a "nil-paid" right. (4 marks) Your friend says that the right is called "nil-paid" because existing shareholders were granted the right by the company without having to pay anything for it. Assess your friend's statement, quantitatively if applicable. (8 marks) Question 4 (a) Suppose you invested $10,350 in Japfa's stock just before the market closed on the announcement date of the rights issue. Your friend says that markets are efficient and that you are protected even if you ignore the rights issue. Evaluate his proposed option relative to the options of buying the rights shares or trading the "nil-paid" rights, quantitatively if applicable. (20 marks) Your friend says that this rights issue does not allow you to sell the rights and that, in such a rights issue, you are essentially forced to invest more money in the stock, so exercising the rights and selling the rights are not value-equivalent options. Assess your friend's statement, quantitatively if applicable. (20 marks) Another friend joins the conversation. She says that, after 31 January 2020, which is expiration date for the rights shares, if you do not exercise the rights, the value associated with the rights vanishes into thin air. Assess this other friend's statement, quantitatively if applicable. (10 marks) (b) (c) Question 5 One friend says that this rights issue will cause Japfa's projects to be more attractive from an NPV standpoint, while the other insists that the capital raising exercise will cause Japfa's projects to be less attractive. Appraise their arguments. (10 marks)

Step by Step Solution

★★★★★

3.47 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

a The subscription price discount is calculated by subtracting the subscription price from the theoretical exrights price TERP The TERP is the market price of the stock adjusted for the rights issue T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started