Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer all questions 32) Carbon Inc. reports the following information for April: 32) AlphaBeta 3,000 units 750 units $600 480 Unit sold Sale price per

answer all questions

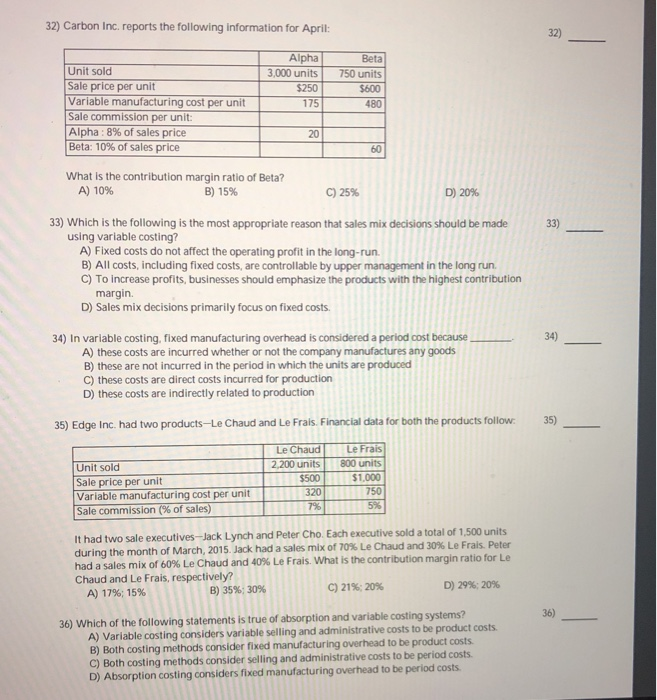

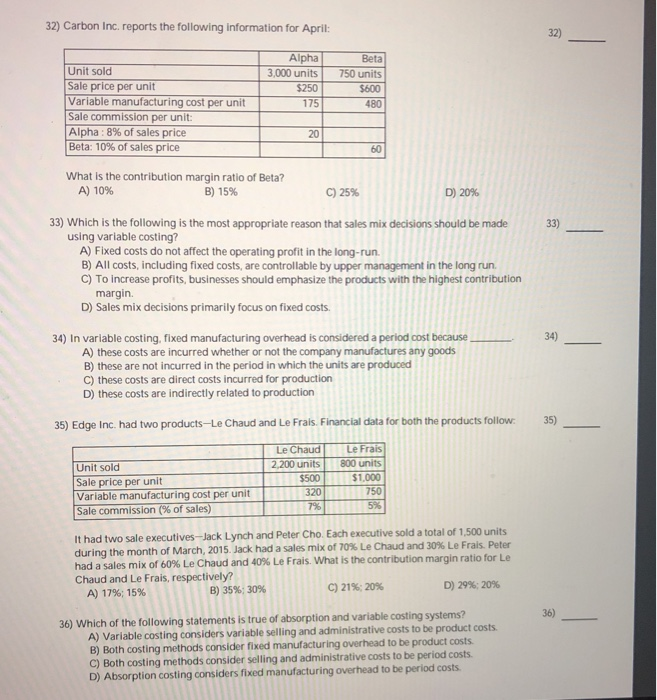

32) Carbon Inc. reports the following information for April: 32) AlphaBeta 3,000 units 750 units $600 480 Unit sold Sale price per unit Variable manufacturing cost per unit Sale commission per unit: Alpha : 8% of sales price | Beta 10% of sales price $250 175 20 60 What is the contribution margin ratio of Beta? A) 10% B) 15% C) 25% D)20% 33) Which is the following is the most appropriate reason that sales mix decisions should be made 33) using variable costing? A) Fixed costs do not affect the operating profit in the long-run B) All costs, including fixed costs, are controllable by upper management in the long run C) To increase profits, businesses should emphasize the products with the highest contribution margin. D) Sales mix decisions primarily focus on fixed costs 34) 34) In variable costing, fixed manufacturing overhead is considered a period cost because A) these costs are incurred whether or not the company manufactures any goods B) these are not incurred in the period in which the units are produced C) these costs are direct costs incurred for production D) these costs are indirectly related to production 35) Edge Inc. had two products-Le Chaud and Le Frais Financial data for both the products follow: 35) Le Frais Le Chaud 2,200 units 800 units $1,000 Unit sold Sale price per unit Variable manufacturing cost per unit Sale commission (% of sales) $500 It had two sale executives-Jack Lynch and Peter Cho. Each executive sold a total of 1,500 units during the month of March, 2015 Jack had a sales mix of 70% Le Chaud and 30% Le Frais Peter had a sales mix of 60% Le Chaud and 40% Le Frais, what is the contribution margin ratio for Le Chaud and Le Frais, respectively? D)29%: 20% C)21%: 20% B) 35%: 30% A) 1796; 15% 36) 36) Which of the following statements is true of absorption and variable costing systems? A) Variable costing considers variable selling and administrative costs to be product costs B) Both costing methods consider fixed manufacturing overhead to be product costs C) Both costing methods consider selling and administrative costs to be period costs. D) Absorption costing considers fixed manufacturing overhead to be period costs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started