Answered step by step

Verified Expert Solution

Question

1 Approved Answer

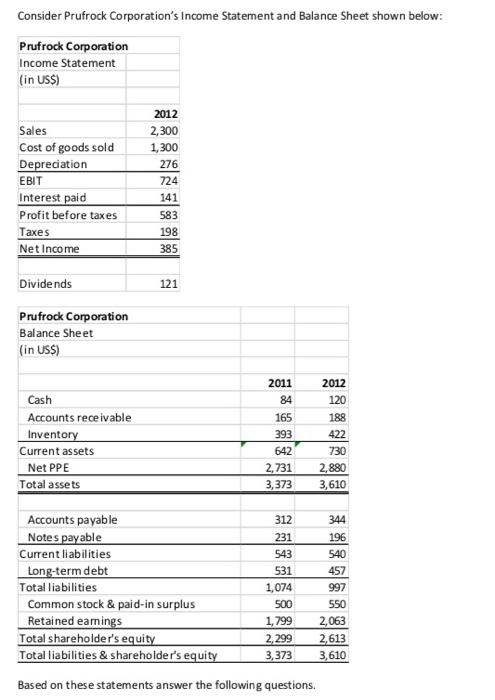

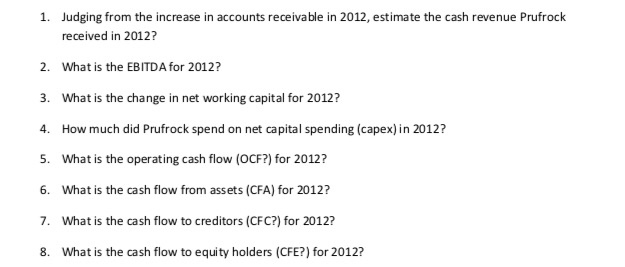

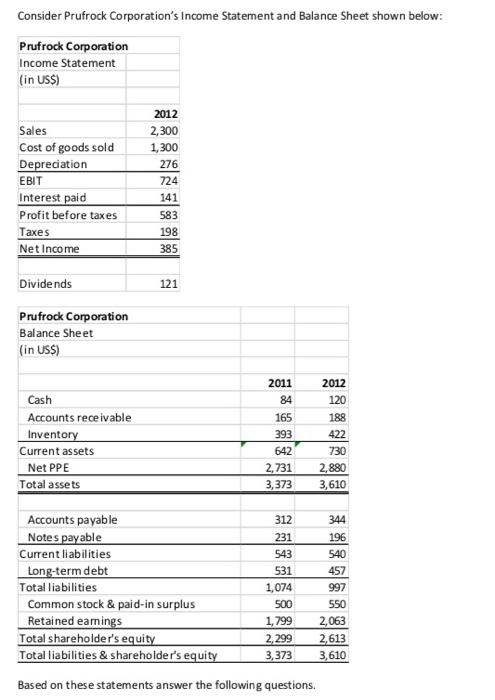

answer all questions and show the steps please. thank you! Consider Prufrock Corporation's Income Statement and Balance Sheet shown below: Prufrock Corporation Income Statement (in

answer all questions and show the steps please. thank you!

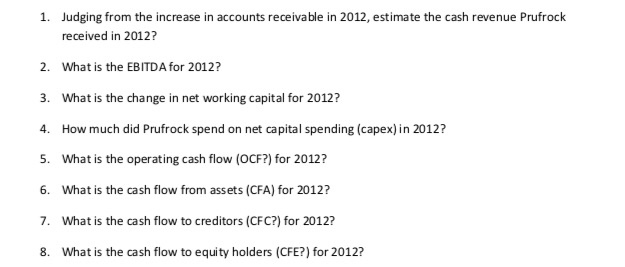

Consider Prufrock Corporation's Income Statement and Balance Sheet shown below: Prufrock Corporation Income Statement (in US$) Sales Cost of goods sold Depreciation EBIT Interest paid Profit before taxes Taxes Net Income 2012 2,300 1,300 276 724 141 583 385 Dividends Prufrock Corporation Balance Sheet (in US$) 2012 120 2011 84 165 393 189 Cash Accounts receivable Inventory Current assets Net PPE Total assets 642 2.731 3,373 3,610 312 344 196 231 543 Accounts payable Notes payable Current liabilities Long-term debt Total liabilities Common stock & paid-in surplus Retained eamings Total shareholder's equity Total liabilities & shareholder's equity 1.074 1.799 2299 2,613 3,373 3,610 Based on these statements answer the following questions. 1. Judging from the increase in accounts receivable in 2012, estimate the cash revenue Prufrock received in 2012? 2. What is the EBITDA for 2012? 3. What is the change in net working capital for 2012? 4. How much did Prufrock spend on net capital spending (capex) in 2012? 5. What is the operating cash flow (OCF?) for 2012? 6. What is the cash flow from assets (CFA) for 2012? 7. What is the cash flow to creditors (CFC?) for 2012? 8. What is the cash flow to equity holders (CFE?) for 2012

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started