Answer all questions and show work using hand formulas only. Do NOT answer the question if you cannot answer everything.

1.

2.

3.

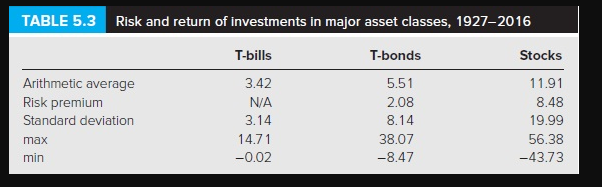

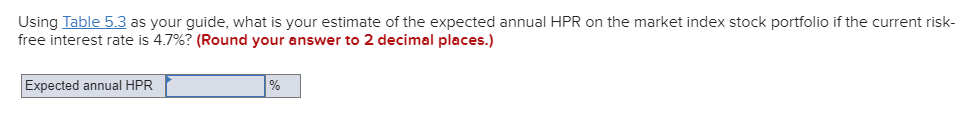

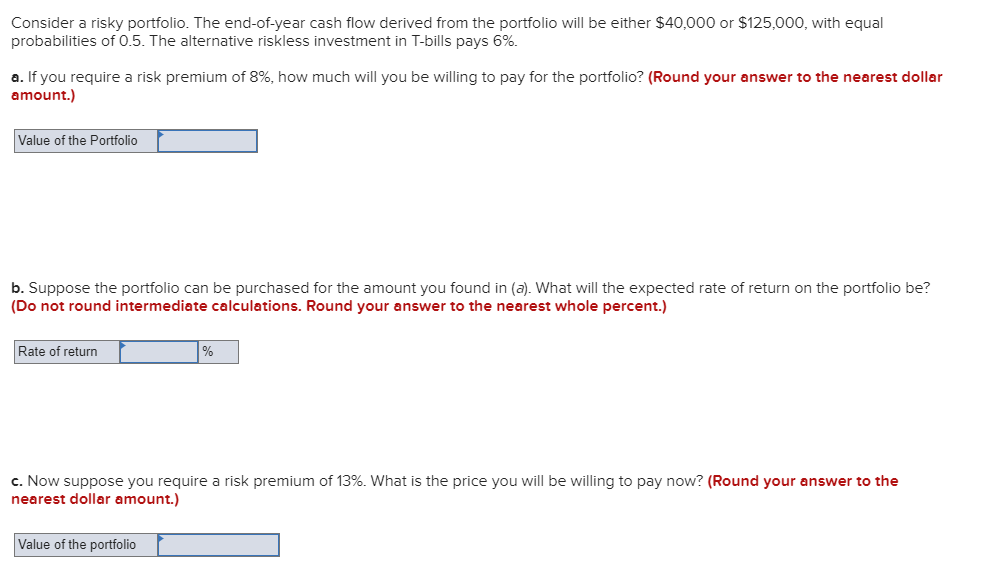

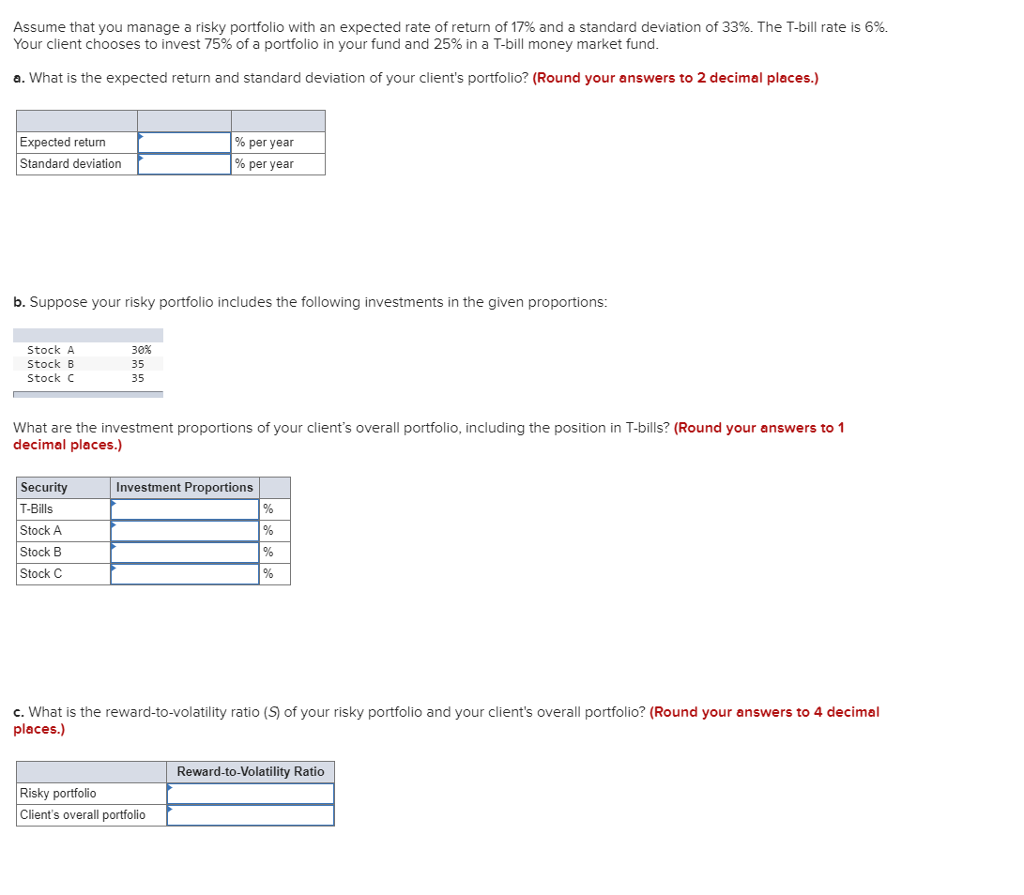

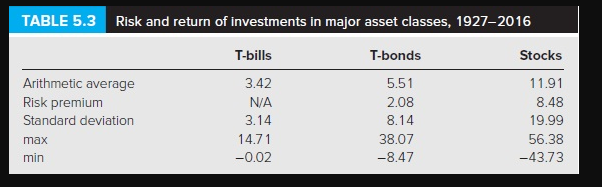

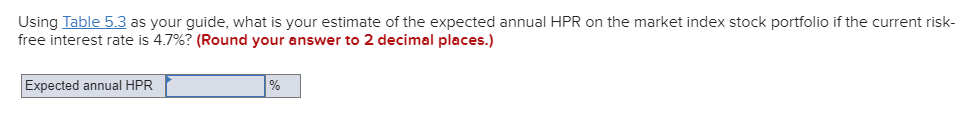

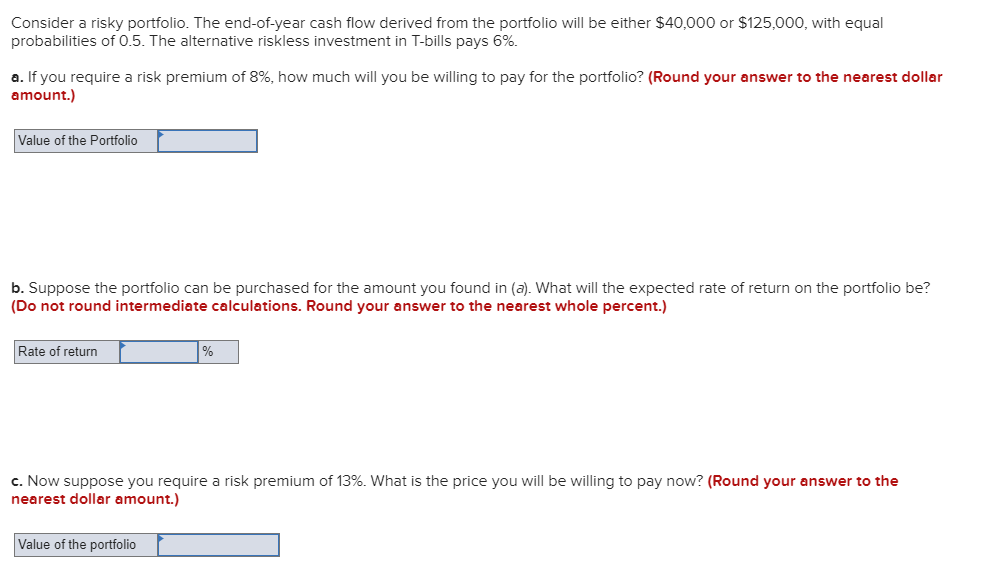

TABLE 5.3 Risk and return of investments in major asset classes, 1927-2016 T-bills T-bonds Stocks Arithmetic average Risk premium Standard deviation max min 3.42 N/A 3.14 14.71 -0.02 5.51 2.08 8.14 38.07 -8.47 11.91 8.48 19.99 56.38 -43.73 Using Table 5.3 as your guide, what is your estimate of the expected annual HPR on the market index stock portfolio if the current risk- free interest rate is 4.7%? (Round your answer to 2 decimal places.) Expected annual HPR Consider a risky portfolio. The end-of-year cash flow derived from the portfolio will be either $40,000 or $125,000, with equal probabilities of 0.5. The alternative riskless investment in T-bills pays 696. a. If you require a risk premium of 8%, how much will you be willing to pay for the portfolio? (Round your answer to the nearest dollar amount.) Value of the Portfolio b. Suppose the portfolio can be purchased for the amount you found in (a). What will the expected rate of return on the portfolio be? (Do not round intermediate calculations. Round your answer to the nearest whole percent.) Rate of return C. Now suppose you require a risk premium of 13%, what is the price you will be willing to pay now? (Round your answer to the nearest dollar amount.) Value of the portfolio Assume that you manage a risky portfolio with an expected rate of return of 17% and a standard deviation of 33%. The T-bill rate is 6%. Your client chooses to invest 75% of a portfolio in your fund and 25% in a T-bill money market fund a. What is the expected return and standard deviation of your client's portfolio? (Round your answers to 2 decimal places.) Expected return Standard deviation % per year % per year b. Suppose your risky portfolio includes the following investments in the given proportions: Stock A Stock B Stock C 30% 35 35 What are the investment proportions of your client's overall portfolio, including the position in T-bills? (Round your answers to 1 decimal places.) Security T-Bills Stock A Stock B Stock C Investment Proportions c. What is the reward-to-volatility ratio (S of your risky portfolio and your client's overall portfolio? (Round your answers to 4 decimal places.) Reward-to-Volatility Ratio Risky portfolio Client's overall portfolio