Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer ALL questions in the attached. Assume that a preference share with a face value of 10 pays a 6% dividend annually. An a investor

Answer ALL questions in the attached.

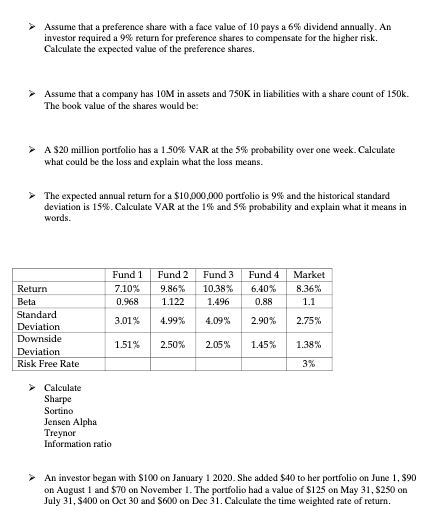

Assume that a preference share with a face value of 10 pays a 6% dividend annually. An a investor required a 9% return for preference shares to compensate for the higher risk. Calculate the expected value of the preference shares. Assume that a company has 10M in assets and 750K in liabilities with a share count of 150k. The book value of the shares would be: A $20 million portfolio has a 150% VAR at the 5% probability over one week. Calculate what could be the loss and explain what the loss means. The expected annual return for a $10.000.000 portfolio is 9% and the historical standard deviation is 15%. Calculate VAR at the 1% and 5% probability and explain what it means in words. Fund 1 7.10% 0.968 Fund 2 9.86% 1.122 Fund 3 10.38% 1.496 Fund 4 6.40% 0.88 Market 8.36% 1.1 3.01% 4.99% 4.09% 2.90% Return Beta Standard Deviation Downside Deviation Risk Free Rate 2.75% 1.51% 2.50% 2.05% 1.45% 1.38% 3% > Calculate Sharpe Sortino Jensen Alpha Treynor Information ratio An investor began with $100 on January 1 2020. She added $40 to her portfolio on June 1, 590 on August 1 and $70 on November 1. The portfolio had a value of $125 on May 31, S250 on July 31, $400 on Oct 30 and $600 on Dec 31. Calculate the time weighted rate of return. Assume that a preference share with a face value of 10 pays a 6% dividend annually. An a investor required a 9% return for preference shares to compensate for the higher risk. Calculate the expected value of the preference shares. Assume that a company has 10M in assets and 750K in liabilities with a share count of 150k. The book value of the shares would be: A $20 million portfolio has a 150% VAR at the 5% probability over one week. Calculate what could be the loss and explain what the loss means. The expected annual return for a $10.000.000 portfolio is 9% and the historical standard deviation is 15%. Calculate VAR at the 1% and 5% probability and explain what it means in words. Fund 1 7.10% 0.968 Fund 2 9.86% 1.122 Fund 3 10.38% 1.496 Fund 4 6.40% 0.88 Market 8.36% 1.1 3.01% 4.99% 4.09% 2.90% Return Beta Standard Deviation Downside Deviation Risk Free Rate 2.75% 1.51% 2.50% 2.05% 1.45% 1.38% 3% > Calculate Sharpe Sortino Jensen Alpha Treynor Information ratio An investor began with $100 on January 1 2020. She added $40 to her portfolio on June 1, 590 on August 1 and $70 on November 1. The portfolio had a value of $125 on May 31, S250 on July 31, $400 on Oct 30 and $600 on Dec 31. Calculate the time weighted rate of returnStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started